Magnetic Separator Market Size, Share & Industry Analysis, By Product (Magnetic Drum Separator, Magnetic Roller Separator, Over band/Cross Belt Separator, Magnetic Pulley Separator, Eddy Current Separator, and Others), By Intensity (High-Intensity Magnetic Separator, Medium-Intensity Magnetic Separator, and Low-Intensity Magnetic Separator), By Industry (Mining and Recycling), and Regional Forecast, 2026-2034

MAGNETIC SEPARATOR MARKET CURRENT & FORECAST MARKET SIZE

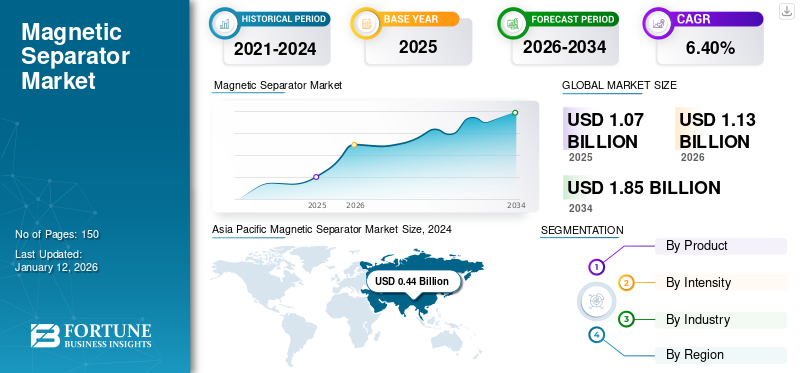

The global magnetic separator market size was valued at USD 1.07 billion in 2025 and is projected to grow from USD 1.13 billion in 2026 to USD 1.85 billion by 2034, exhibiting a CAGR of 6.40% during the forecast period. Asia Pacific dominated the magnetic separator market with a market share of 44.30% in 2025.

A magnetic separator is installed in conveyor belts across different industries to separate ferrous materials from nonferrous substances. The application is helpful for seamless segregation of metallic particles and nonmetallic substances. The ferrous products, such as nickel, cobalt, iron, and other metals, are separated from nonferrous materials, such as glass, plastic, silica sand, and other nonmetallic contaminants. These separators find their prominent applications in the mining and waste recycling industries. They minimize production costs and are also helpful in significantly reducing downtime and elevating production output to a considerable extent.

The COVID-19 pandemic comprehensively faded the evolution of the processing industry with a major decline in sales due to companies focusing on fewer expansion projects and weaker trades in global and regional markets.

The pandemic caused a tough health crisis and social & economic catastrophe, declining world capitalism. Low efforts and reduced foreign direct investments affected the industry and are expected to withstand it long-term.

- For instance, the UN Department of Economic and Social Affairs (DESA) stated that the global economy will possibly shrink by 1% in 2020, by the previously forecasted growth of 2.5%. These factors have increased the market volatility.

However, manufacturers' profits are low compared to the pre-pandemic. Also, mainstream processing equipment manufacturers have observed resurrecting sales due to business expansion, which has increased the industry's growth.

- For instance, in November 2021, Metso Outotec Corporation, a prominent industrial processing equipment manufacturer, announced its new manufacturing in Alwar, India. The company will be extending mobile crushing and screening units. This plan will boost production by 30% and expand the mobile track-mounted machines business by 15%.

EMERGING TRENDS & TECHNOLOGICAL ADVANCEMENTS IN MAGNETIC SEPARATOR MARKET

Advancements in Magnetic Separation to Leverage Opportunities Through the Recycling Sector

In the age of the digital era, (Industrial Internet of Things) IIoT-connected devices are the prime preference among users. Additionally, monitoring equipment and the need for preventive maintenance drive the demand for advanced electrical motors in industries and production lines.

However, the emergence of recycling scrap has changed the potential of the magnetic separation equipment landscape, where handlers and OEMs (Original Equipment Manufacturers) can easily monitor and extract the data of running equipment performance in production lines. It also allows users to monitor the equipment, increase machine productivity, and optimize the cost-productivity ratio.

Additionally, features, such as mobile app integration and easy monitoring of the recycling magnetic separation equipment at the user end that reduces time and operational costs, leverage long-term opportunities for players.

- For instance, in October 2021, Metso Outotec, a prominent processing equipment leader, introduced its new recycling magnetic separator equipped with data collection technology. The machine has index operating and production data collection technology that transfers relevant data from the recycling machine to the user through an application.

Thus, technological advancements and mobility solutions in the industry open new opportunities for leveraging to cater to the market. Also, it helps to improve the core OEM players to broaden and diversify their product offerings, propelling the magnetic separator market growth.

Download Free sample to learn more about this report.

GROWTH DRIVERS: WHAT’S FUELING THE MAGNETIC SEPARATOR MARKET EXPANSION?

Rising Adoption of Advancements for Operational Efficiency to Boost Market Expansion

Magnetic separators are essential processing equipment for the metal processing industry that diligently increases metal segregation and processing efficiency, whether in the mining industry or large manufacturing facilities. Also, with the growing industrial revolution and boosters, such as Industry 4.0, advanced automated processing equipment usage has increased significantly. Consumers demand equipment that offers more cost savings and efficient operations.

Another major factor that drives the adoption of magnetic separators in industrial processing units is the product's operational life and efficiency. End users demand products with minimal cost and can deliver high output with minimal maintenance.

Industries nowadays spend about 50-60% on the energy cost of electrical equipment, where maximum expenditure on operations misbalances the operational expense of the industry. This condition showcases a void in the product segment that needs to be filled by such efficient magnetic separators that incur minimal operational cost.

- For instance, in September 2022, Bunting, a prominent process technology manufacturer, showcased its broader portfolio of magnetic separators and metal detectors that offers high-strength magnetic products, such as Plate Magnet Housing (PHMS), Grate Magnet, Drawer Magnet (HFS), Plate Magnet and Bullet magnet that can remove fine tramps of iron from granules and powder.

Hence, technological advancements made by Original Equipment Manufacturers (OEM) are paving for adopting such efficient and mechanically adhered magnetic separation processing units in the industry that significantly boosting the demand & rising magnectic separator market growth.

WHAT ARE THE KEY CHALLENGES LIMITING MARKET GROWTH?

Low Profit Margins and Rising Part Costs are Hindering the Market Growth

Screening equipment is a critical part of the process line in industries that is directly equivalent to production. At the same time, the electromagnet is a critical part of the process line that consumes about 30-40% of the whole equipment.

Additionally, the material used for the electromagnets costs heavily for the magnetic separator manufacturer as the sourcing of raw material and shipping charges rise post-pandemic, decreasing profit margins.

Hence, heavy installation and part costs are the major constraints for manufacturers operating in the magnetic separation business, lowering revenues and profit margins.

Such key restraints and supply chain constraints are decreasing the companies' revenue and concurrently reducing profit margins on electromagnets, the prime components of magnetic separator equipment.

However, electromagnet manufacturers are shifting toward advanced electromagnet material that provides the equivalent efficiency to the other traditional magnets to gain better magnetic permeability and significantly lower cost.

In contrast, a rise in product purity concerns in industries, such as chemical, food, pharmaceutical, packaging, and other processing applications that demand stronger magnets in process lines generates revenues. It increases profit margins in the long term.

- For instance, in December 2021, Eriez, a prominent market leader in separation technology, introduced its newly advanced Xtreme Rare Earth+ and Rare Earth+ magnetic plates. These plates will be implemented in the company's deep reach, hump style, and round pipe magnetic separators.

Magnetic Separator Market Segmentation Analysis

By Product Analysis

Exceptional Safety in Operations and Ability to Execute Economic Operations to Boost the Performance of Magnetic Drum Separators

By product category, the market research scope contains six different types: magnetic drum separator, magnetic roller separator, over band/cross belt separator, magnetic pulley separator, eddy current separator, and others.

According to the market findings, the magnetic drum separator dominating the market and is expected to perform significantly in the global market. The obvious advantages, such as enhanced operational safety, easy and economical maintenance, and ability to work as a protecting equipment for grinders, crushers, and other equipment, make it a most sought-after product across the market. Moreover, the magnetic drum separator can be used for a wide variety of applications by integrating with gravity separators.

The over band/cross belt separator also holds a considerable market share and will register a decent growth rate throughout the forecast period. Simple and hassle-free installation with considerable ease, especially in retrofitting job sites, increases the procurement of cross-band separators. Also, the product, as mentioned above, helps to eliminate shutdown and unplanned downtime as the product does not require any electric supply for operation and requires minimal maintenance for optimum operation.

By Intensity Analysis

Increasing Application of High-intensity Magnetic Separators at Large Mining Sites is Expected to Establish a Strong Market Share

In the intensity segmentation, the market deals with the current market share and market share projections for high-intensity magnetic separator, medium-intensity magnetic separator, and low-intensity magnetic separator. High-intensity magnetic separators are further classified between wet HIMS and dry HIMS.

In 2026, the high-intensity magnetic separator segment is projected to lead the market with a 53.10% share, capaturing the majority of the share in the global market. The requirement of HIMs in mining sectors and large-scale waste recycling plants are critical factors that fuel the sales of these products. Also, continuous efforts by mine operators and recycling plants to increase their production capacity and elevate the level of efficacy in the operations increasing the demand for high intensity separators.

Morever, the medium-intensity magnetic separator is exhibiting the substantial growth during the forecast period. The innovative magnetic circuit it utilizes, produces a consistently strong magnetic field and gradient throughout its entire arc, both axially and radially. These characteristics makes it highly efficient in recovering and purifying low magnetic susceptibility iron ore.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Consistent Increment in Mining Operations to Establish Mining as a Leading Industry in the Market

By industry, the market is segmented into mining and recycling.

The mining segment is expected to account for 76.99% of the market in 2026 and will hold a noteworthy share of the global market along with major growth in CAGR. Increasing mining operations across different geographies and efforts to boost automation at these facilities are propelling the sales of the products for the mining industry. Waste recycling is projected to register a share of over 20% of the total market. The mining and mineral processing industries utilize magnetic separators to extract and separate valuable minerals from ore deposits. As global demand for minerals continues to grow, the demand for magnetic separators in these industries also increases.

With an increasing focus on recycling and sustainability, industries such as mining, waste management, and recycling are adopting magnetic separators to efficiently separate ferrous materials from non-ferrous materials, thereby improving the quality and quantity of recyclable materials.

REGIONAL MARKET DYNAMICS AND GROWTH OPPORTUNITIES

The magnetic separator market is studied geographically across North America, Europe, Asia Pacific, South America, the Middle East & Africa.

Asia Pacific Magnetic Separator Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominating the market as it is abundant in mineral resources, such as coal, iron ore, copper, gold, and rare earth elements. Countries, such as Australia, China, and Indonesia are major producers of these minerals. Magnetic separators are essential in extracting and concentrating valuable minerals from ore deposits, making them indispensable tools in the region's mining operations. Many countries in Asia Pacific are investing heavily in infrastructure projects to support economic growth and urbanization. These projects require significant quantities of construction materials, such as aggregates, cement, and metals, driving the demand for mining activities which is increasing the magnetic separator market share in the region.

The Japan market is estimated to reach USD 0.02 billion by 2026, the China market is estimated to reach USD 0.30 billion by 2026, and the India market is estimated to reach USD 0.05 billion by 2026.

North America is home to technological innovation and the development of modern cutting-edge products, elevating the level of automation in the magnetic separator industry. Ongoing research in the technology, such as the development and introduction of new high intensity magnetic separators integrated with the automation features, is a crucial factor contributing to consistent market growth. The U.S. market is estimated to reach USD 0.08 billion by 2026.

European countries are at the forefront of environmental sustainability initiatives, driving the adoption of technologies that enable efficient waste management and resource recovery. Magnetic separators help industries comply with environmental regulations by removing ferrous contaminants from waste streams, thereby improving the quality of recycled materials and reducing environmental impact. The U.K. market is estimated to reach USD 0.03 billion by 2026, while the Germany market is estimated to reach USD 0.06 billion by 2026.

The GCC will spearhead the region in terms of market share and growth projections in the market of the Middle East & Africa region, owing to an enhanced level of automation in waste recycling operations. Also, as this region continues to invest in sectors, such as sustainable recycling and increased efforts to boost mining, there is an increased need for reliable solutions to ensure the efficiency and safety of these processes.

Compared to regions, including North America and Europe, South America has relatively lower levels of industrialization in certain areas. This limited industrialization may result in lower demand for magnetic separators, particularly in sectors, such as mining and recycling, where these devices are commonly used.

Key Industry Players

Emergence of Industry Participants across Different Geographic Locations is anticipated to Fuel Market Competition

The market is highly fragmented as there are numerous well-known brands globally, along with many regional players operating across their domestic market. They are also trying to operate effectively in the international markets. Eriez Manufacturing Co., Noritake Co. Ltd, Metso Corporation, and Bunting Magnetics are the prominent players in the magnetic separator market, with a presence across multiple geographies across the globe. Additionally, these players supply equipment based on custom requirements, enabling them to create application-specific magnetic separators. As a result, manufacturers have significant opportunities to enhance their business with the production of innovative products.

List of Top Magnetic Separator Companies:

- Metso Corporation (Finland)

- NORITAKE CO., LIMITED (Japan)

- Permanent Magnets Ltd (India)

- Nippon Magnetics, Inc. (Japan)

- Douglas Manufacturing Co., Inc. (Rulmeca Group) (U.S.)

- Eriez Manufacturing Co. (U.S.)

- Bunting (U.S.)

- Sesotec GmbH (Germany)

- STEINERT GmbH (Germany)

- Multotec (Pty) Ltd. (South Africa)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Eriez, a global leader in separation technology, has showcased its high-intensity magnetic filters featuring high-intensity magnetic matrix-type separators at Ceramitec 2024.

- December 2023: Steinert Global commissioned Metales Bolueta, a family-owned aluminum metal company Gatika project that handles 4000 tons of metal a month. It’s a complete metal processing turnkey project.

- November 2023: Eriez achieved a recycling milestone with the sales of 50 Shred1 Ballistic Separator. Steel Dynamic Inc. is the buyer of its 50th machine for its operation.

- October 2023: ICL Boulby, a material processing entity, announced the upgradation of its air-cooled magnetic separator to Bunting Redditch-designed Electromax Overband Magnet.

- September 2023: Bunting Magnet launched its new manual clean drawer filter magnet that features easily retrofitted into existing FF filters.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

By Intensity

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 1,62 billion by 2034.

In 2025, the market was valued at USD 1.07 billion.

The market is projected to grow at a CAGR of 6.40% during the forecast period.

The magnetic drum separator segment is estimated to be the market leader.

Increased adoption of separators to elevate operational efficiency.

Eriez Manufacturing, Metso Outec, Bunting Magnetics, NORITAKE CO., LIMITED are the top players in the market.

Asia Pacific generated the maximum revenue in 2025.

The mining industry is expected to attain a highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us