Medical Equipment Financing Market Size, Share, COVID-19 Impact & Industry Analysis, By Device Type (Diagnostic Equipment, Therapeutic Equipment, Patient Monitoring Equipment, and Others), By End User (Hospitals & Clinics, Laboratories and Diagnostic Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

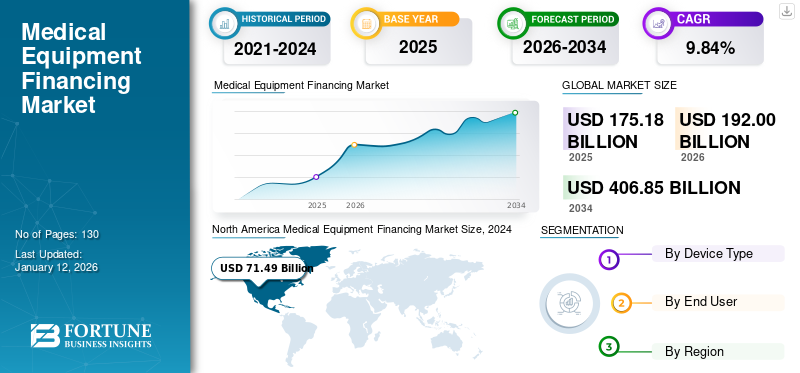

The global medical equipment financing market size was valued at USD 175.18 billion in 2025. The market is projected to grow from USD 192 billion in 2026 to USD 406.85 billion by 2034, exhibiting a CAGR of 9.84% during the forecast period. North America dominated the medical equipment financing market with a market share of 78.2% in 2025.

Continuous advancements in the medical technology industry have benefited and helped society in many ways. Best-in-class medical equipment have become a necessity for excellent healthcare services. However, affording such advanced systems involves high cost and proves difficult for the hospitals or medical practitioners to set-up this equipment through their funds. Hence, medical equipment financing comes into the picture to provide flexible loan models having lower monthly installments and rate of interest.

Owing to increasing demand for EHR/practice management services to diagnostic imaging and robotics technology, there is a leveraging opportunity for the finance companies in the medical industry. According to the Equipment Leasing and Finance Association, medical equipment financing represents approximately 4% of the business volume in the United States. Moreover, a pandemic crisis such as COVID-19 has recently created multiple opportunities in the medical equipment financing market worldwide. The rising demand for diagnostic kits, medical accessories such as gloves, masks, protective gear, and many more have initiated robust manufacturing in the medical industry. Thus, over the coming period, there is an immense market potential for medical equipment finance companies.

Global Medical Equipment Financing Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 175.18 billion

- 2026 Market Size: USD 192 billion

- 2034 Forecast Market Size: USD 406.85 billion

- CAGR: 9.84% from 2026–2034

Market Share:

- North America dominated the medical equipment financing market with a 78.2% share in 2025. This dominance is due to high financing rates for medical equipment, continuous innovation in medical devices, and substantial investments in healthcare infrastructure.

- By device type, diagnostic equipment held the largest market share in 2024, driven by rising demand for advanced diagnostic tests, innovations, and increased funding for diagnostic centers during and after the COVID-19 pandemic.

Key Country Highlights:

- Japan: Growing adoption of advanced medical technologies and financing solutions to support hospitals in upgrading critical equipment, especially in diagnostic and therapeutic sectors.

- United States: The largest market in North America, propelled by strong financing availability, medical technology innovation, and partnerships such as the Wells Fargo-Siemens Healthineers finance program to support healthcare providers.

- China: Rapid healthcare infrastructure development, government funding for hospital expansions, and increasing demand for advanced diagnostic and therapeutic equipment are driving growth in equipment financing.

- Europe: The market is expanding with investments in AI-based medical equipment financing and increasing awareness among healthcare providers. Strong healthcare infrastructure funding across Western and Eastern Europe supports growth.

MARKET TRENDS

Download Free sample to learn more about this report.

Higher Medical Equipment Finance Support from Banks to Propel Market Growth

After the signing of the Affordable Care Act in 2010, there has been a tremendous shift in the competitive landscape of the medical equipment financing industry. The industry has now changed its focus on the interest of financial decision-makers. This has created lucrative opportunities for several finance lenders in boosting their businesses. Equipment financing companies and banks play the role of a backbone in providing adequate finance. Amidst the COVID-19 crisis, setting up necessities in a short period requires a healthy financial stability. Currently, in such situations, the World Bank is taking quick action by providing finances in millions to help the countries with essential medical equipment such as ventilators, MRI scanners, and other therapeutic equipment. Such higher investments in the medical equipment industry are likely to add impetus to the market during the forecast period.

MARKET DRIVERS

Technological Innovations in Medical Equipment’s will Attract More Businesses, to Aid Higher Market Potential

Over the past few years, there has been a tremendous growth in the medical equipment industry. Rapid technological advancements combined with AI technology has leveraged the medical industry's potential. This is the major factor contributing to the demand and magnetizing doctors, physicians, and others towards the equipment financing market. The highly advanced & expensive equipment has made the hospitals, and diagnostic centers to opt for financing. Moreover, medical finance companies have equally provided flexible finance solutions to its customers. Also, upgradation of the existing equipment versions increases the cost factor, and ultimately becomes unaffordable by the physicians of the middle-income or lower-income countries. For instance, in 2024 Philips launched an advanced imaging system solution for magnetic resonance imaging (MRI) in India. The Ingenia Ambition MR is the latest in the MRI portfolio and is 50% faster. To purchase such MRI systems in India, physicians approach equipment finance companies thus leveraging the market potential. Such factors are likely to aid in expansion of the market in the forecast period.

MARKET RESTRAINT

Cautious Capital Expenditures by Businesses to Hinder Market Growth

As the economic growth of the equipment finance companies continues to move forward, they may still face many challenges. In the current scenario, although banks have higher capital and are looking for opportunities in the medical equipment industry, most businesses have become cautious about their capital expenditures. Businesses such as hospitals, clinics, and diagnostic centers are more inclined towards spending in the maintenance of their existing equipment rather than approaching for a new one. This has led towards a decline in the medical equipment financing market growth index over the past few years. Additionally, inflated equipment cost such as high cost of X-ray machines, MRI scans, CT-scans, ECG, Cardiology machines, and others., makes the end-users to rethink about their capital expenditures. Thus, the above-mentioned factors are likely to affect market negatively during the forecast period.

SEGMENTATION

By Device Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Number of Diagnostic Tests is Likely to Augment Diagnostic Equipment Segment Growth

Based on type, the market is segmented into diagnostic equipment, therapeutic equipment, patient-monitoring equipment, and others. Among these, the diagnostic equipment segment dominated the global market in terms of value and market share 43.88% in 2026. Owing to the increasing prevalence of infectious diseases and innovations in the diagnostic equipment, there is a growing trend towards setting up of more diagnostic centers. This, in turn, is responsible for rising finance towards diagnostic equipment. Moreover, to provide advance medical care to the patients, end-users tend to invest in advance diagnostic as well as therapeutic equipment such as dialysis machines, ventilators, and ICU equipment, etc. For instance, due to the COVID-19 crisis in 2024, there is an upsurging demand for ventilators and other diagnostic equipment such as X-ray machines, and MRI scans. This is likely to increase the market value of the diagnostic as well as the therapeutic segment in the coming months.

Furthermore, the demand for advance intensive care unit facilities by the patients have propelled hospitals to invest in upgrading their facilities. Patient-monitoring equipment such as ECG monitors, incubators, and EHR systems have become crucial for every end-user. Owing to the demand in ventilators and other equipment, the diagnostic equipment finance segment is anticipated to have the highest CAGR and emerge dominant in the forecast period.

By End User Analysis

Development of Diagnostic Kits to Facilitate the Laboratories & Diagnostic Centers Segment Growth

By end-user, the market is classified into hospitals & clinics, laboratories & diagnostic centers, and others. In 2024, the hospitals & clinics segment held the leading position in the market share contributing 54.92% globally in 2026. This dominance is attributed to factors such as higher investments in infrastructure management and growing demand for surgical procedures by the patient population at hospitals and clinics. The hospitals and clinics segment are witnessing significant growth due to the presence of well-established medical infrastructure and higher preference from the patient population. The newly launched medical systems are adopted and installed by the hospitals and clinics in a short duration due to the availability of adequate funds from finance companies. In addition, increasing number of patient admissions due to infectious diseases such as COVID-19, respiratory disease, cardiology disorders, and others are facilitating the need for therapeutic equipment thus creating varied opportunities for the finance companies.

On the other hand, laboratories & diagnostic centers segment is anticipated to showcase a faster growth during the forecast period owing to the development of diagnostic kits and appropriate equipment for patient healthcare. For instance, in the current pandemic emergency of COVID-19 worldwide, there has been a tremendous demand for diagnostic kits which are in development stage in diagnostic centers as well as the state-of-art laboratories. Equipment finance companies are moving a step forward in providing funds to carry out R&D to lower the pandemic risk worldwide.

REGIONAL ANALYSIS

North America Medical Equipment Financing Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The medical equipment financing market size in North America emerged dominant and stood at USD 71.49 billion in 2024. The primary factor responsible for this dominance is the highest finance rate for medical equipment in the region. Continuous medical device innovations and investments in the medical infrastructures have aided to the dominance of this region. The U.S. market is projected to reach USD 80.44 billion by 2026.

Europe

Additionally, Europe accounts for the second position in the market owing to the rising adoption of artificial intelligence technology based medical equipment financing and growing healthcare infrastructural investments. Besides this, increased awareness among the healthcare personnel and physicians about the finance industry has propelled more customers towards the equipment finance market. Also, healthy economic growth in several parts of Eastern Europe is likely to push the market higher during the forecast period. The UK market is projected to reach USD 8.35 billion by 2026, while the Germany market is projected to reach USD 11.45 billion by 2026.

Asia Pacific

On the other hand, Asia Pacific is anticipated to witness a faster growth owing to the emergence of the finance industry in the region and setting-up of hospitals and state-of-art laboratories and diagnostic centers in its emerging countries. Fund allocations by various governments for the medical industry will also contribute to this market growth. For example, recently during the budget announcement for 2020 in India, the finance minister Nirmala Sitharaman has allotted USD 9.09 billion to the healthcare sector. The main objective of the allocation was to set-up a greater number of hospitals throughout the country. Such investments are likely to increase the market size in the forecast period. The Japan market is projected to reach USD 11.36 billion by 2026, the China market is projected to reach USD 10.27 billion by 2026, and the India market is projected to reach USD 4.65 billion by 2026.

Latin America and Middle East & Africa

Furthermore, Latin America and Middle East & Africa markets are likely to witness considerable growth owing to lower awareness and poor understanding among the population about the financing guidelines & structure.

KEY INDUSTRY PLAYERS

Emergence of Several Equipment Finance Players has led to a Fragmented Market

This market witnesses the presence of many players. Vendors such as National Funding, Hero FinCorp among others have successfully established their position through various acquisitions, affordable financial solutions, and excellent customer-provider relationships. These industry players have a well-built portfolio for the medical practitioners having varied loan options and low monthly installments. They finance medical equipment such as CT/MRI scans, ultrasound systems, dental chairs, X-ray machines, pharmaceutical equipment, and many more. The varied array of their portfolio has led hospitals, diagnostic centers to acquire reliable loans from these finance companies. Moreover, provision for customized loan options and availability of financing for advanced technologies has brought up more customers to the companies thus attracting high market revenue in the near future.

LIST OF KEY COMPANIES PROFILED:

- Hero FinCorp

- National Funding

- Blue Bridge Financial, LLC.

- First American Equipment Finance

- TIAA Bank

- HDFC Bank Ltd

- SMC Finance

- Other Prominent Players

KEY INDUSTRY DEVELOPMENTS:

- July 2021 - IFC and MIGA (Multilateral Investment Guarantee Agency) launched the Trade Finance Guarantee initiative, which will support trade flows of critical goods, including food and medical equipment, in low-income countries to recover them from the impacts of the pandemic.

- May 2021 - G.E. Healthcare and NSIA Banque Cote d'Ivoire announced a partnership with IFC's Africa Medical Equipment Facility to strengthen the healthcare industry and support medical equipment financing across Africa.

- April 2021 - IMAGEENS raised USD 1.45 Mn in seed financing in collaboration with Anaxago. This is anticipated to strengthen the company’s team with key R&D talents to scale the deployment of its software solutions.

- June 2020 - Wells Fargo & Company announced the launch of a medical equipment finance program with Siemens Healthineers to provide wide-ranging financing options for hospitals and health systems across the U.S. Wells Fargo would supply lease and loan products to Siemens Healthineers to support the sales process.

REPORT COVERAGE

The global medical equipment financing market report provides a detailed analysis of the market and focuses on key aspects such as leading key players, financing types, and leading applications of the types. Besides this, the report offers insights into the market, current market trends, and highlights the key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over the recent years. It further highlights some of the growth-stimulating factors and restraints, helping the reader to gain an in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Device Type

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size is projected to reach USD 406.85 billion by 2034.

In 2025, the market value stood at USD 175.18 billion.

Growing at a CAGR of 9.84%, the market will exhibit a steady growth in the forecast period (2026-2034).

Diagnostic equipment segment is expected to be leading the market during the forecast period.

High cost of medical equipment’s that require more funds for adoption is the key factor driving the market in 2024.

The key players in the market are Hero FinCorp, National Funding, Blue Bridge Financial, LLC, and others.

North America held the dominant market share in 2025.

Emergence of technologically advanced equipment, growing capital investments, and demand for state-of-art facilities at the hospitals and specialty clinics are the factors responsible to drive the adoption of medical equipment.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us