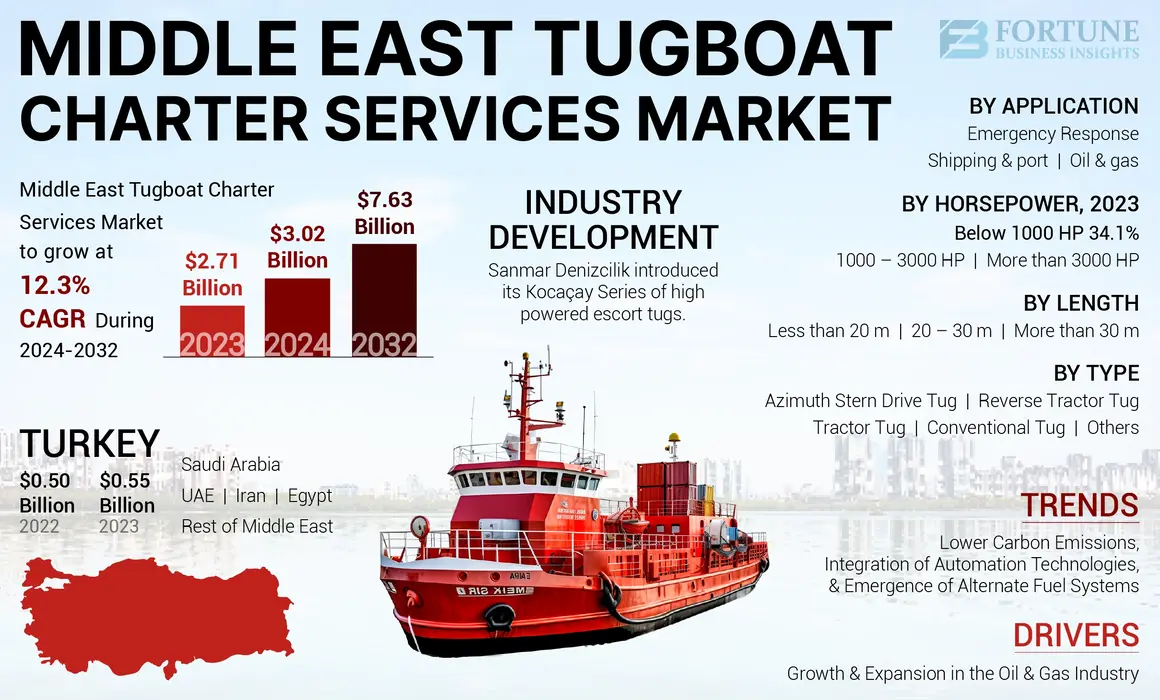

Middle East Tugboat Charter Services Market Size, Share & Industry Analysis, By Horsepower (Below 1000 HP, 1000 – 3000 HP, and More than 3000 HP), By Length (Less than 20 m, 20 – 30 m, and More than 30 m), By Application (Shipping & Port, Emergency Response, and Oil & Gas), By Type (Conventional Tug, Tractor Tug, Azimuth Stern Drive Tug, Reverse Tractor Tug, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

The Middle East tugboat charter services market size was valued at USD 2.71 billion in 2023. The market is projected to grow from USD 3.02 billion in 2024 to USD 7.63 billion by 2032, exhibiting a CAGR of 12.3% during the forecast period.

Tugboat charter services refer to a range of maritime operations that involve the use and rental of tugboats to help with the movement and handling of vessels within coastal areas and ports. Tugboats are specialized vessels designed to push or pull other ships. Pilotage, towage, mooring, and support services are the primary functions. Primarily due to the region's strategic maritime routes, such as the Strait of Hormoz and the Suez Canal, which handle significant global shipping traffic, tugboat charter services are increasingly important in the Middle East.

The market is set for growth, driven by sustainability initiatives, technological advancements, growth in the oil & gas industry, and increasing demand for charter services of tugboats for growing construction projects and expansion in maritime trade in the region. Key players in the market include GAC Ras Al Khaimah, Astro Offshore, and Sea Horse Middle East Marine Services LLC, among others, which compete in the pricing and service provision in the market growth.

Market Dynamics

Market Drivers

Growth And Expansion in the Oil & Gas Industry to Lead to a Substantial Growth in the Market

The Middle East's growing oil and gas sector is highly propelling the demand for tugboat charter services propelling an interactive relationship between the sectors. When exploration and production expand, especially offshore, then more intense utilization of special marine support services becomes increasingly important. Therefore, tugboats are quite indispensable, especially when it comes to maneuvering drilling rigs and supplying vessels with proper navigation in busy maritime environments.

High demand for tugboat charter services is further augmented by the fact that this region is one of the global oil export hubs with numerous port infrastructure investments geared toward handling bigger and more ships at higher frequencies. This expansion can be attributed to rising maritime trade, driven by the needs of countries, such as Iran and Saudi Arabia, which continuously increase their energy demands.

In addition to this, several projects in the expansion of seaports of the region are under construction, offering another impetus for the industry. Operators also expand their fleets to meet these upsurge needs; for instance, Safeen Group recently upgraded its fleet with new tugboats in a bid to improve service offerings in various marine operations. However, significant challenges for operators in the region include high fuel costs and regulatory complexities. Still, the general prospects for tug service operations appear positive due to the relentless exploration of the Middle East's oil and gas resources toward supporting growth and building economic maritime capacity.

Market Restraints

High Operational Costs of Tugboat Charter Services to Hinder Market Growth

In the market, one of the prominent market restraints to the Middle East tugboat charter services market growth is the exorbitant cost of operations in tugboats that include repairing and maintaining the vessels as well as the hiring of crew members. For this particular market, these costs cover the price of fuel, which is higher than normal due to the region's unfriendly water environment and the salaries of the crew onboard, as well as maintenance costs of the tugboats, which are very high. Moreover, these costs are controllable considering a rise in the fuel prices making it hard for the service providers to manage and sustain the low costs of service. In addition, there are costs related to the implementation of various safety measures that further increase the operational costs and can discourage new players from entering while limiting the present operators in growing their services. Hence, the high operational costs can hamper the growth of the market and access to tugboat services, in particular the smaller players and clients with financial constraints.

Market Opportunities

Growing Construction Projects and Expansion in Maritime Trade in Asian and Middle East Regions to Offer Market Opportunities

The global maritime industry is witnessing growing demand for its services and offered products, owing to increasing the dependency on marine vessels due to expansion in trade and cargo shipments in various parts of the world. Many ports in the Asian, Indian, and Middle East regions are strongly investing in the expansion of existing and new port construction to modernize and accommodate larger container vessels and handle stronger cargo volumes.

The increasing demand for new ports is likely to develop demand for additional vessels to support the expansion of port operations. Tugboats are highly favorable for assisting, maneuvering, and berthing operations within the port basins, terminals, and harbors. Tugboats also play a crucial part during the port construction phase in delivering construction raw materials, equipment and various others. Furthermore, tugboats are also used for the installation of offshore structures, which comprise floating docks, navigational aids, and others.

Furthermore, the increasing involvement of tugboats in salvage and emergency operations is expected to drive market growth. Tugboats are highly reliable in mitigating sea fires, salvaging ships, and vessel assistance near-shore areas. Thus, as the maritime industry advances toward expanding operations and international trade, the tugboat market is expected to witness new market expansion opportunities.

Market Challenges

Regulatory Requirements and Upfront Cost Challenges the Market Development

Different jurisdictions within the region have varied international marine fuel regulations for licensing and operations, making compliance difficult for service providers operating across borders.

- Supply Chain and Equipment Delays: Shipbuilders are facing delays in acquiring critical components, such as engines and winches, increasing the lead time for new builds to up to 20 months.

- Workforce Shortages: A shortage of skilled workers in shipyards and among the operating crew adds complexity to maintaining and expanding fleets.

Middle East Tugboat Charter Services Market Trends

Lower Carbon Emissions, Integration of Automation Technologies, and Emergence of Alternate Fuel Systems are Major Trends

Sustainability: The maritime industry is highly focused on addressing the carbon emissions generated by the industry and is actively focused on integrating environment-friendly solutions and introducing technologies that offer higher fuel economy in the vessels. Furthermore, the strengthening of various ship regulations is further expected to drive growth in the adoption of hybrid and LNG propulsion-based tugboats.

Automation in Maritime: Tugboat operators are inclined toward opting for tug vessels integrated with digital and automation technology as it offers smooth and hassle-free operations for the operators in terms of maneuvering, berthing, and mooring. Introducing remote monitoring systems, autonomous boats, and dynamic positioning systems are some of the most preferred technologies opted by operators.

Alternate Fuel and Alternate Propulsion Systems: Industry players are highly focused on innovation and are introducing innovative fuel systems to reduce the dependency on traditional diesel-powered tugboats. In addition to LPG, the increasing awareness toward alternate fuels is leading to technological innovations in the propulsion system with respect to hydrogen fuel cells, battery electric propulsion, and biofuels are some of the emerging trends in the tugboat industry with respect to propulsion systems.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic sent shockwaves through numerous industries, affecting supply-demand dynamics. However, the boat industry remained resilient while displaying strong growth in 2020. As people were working in flexible times, they shifted toward outdoor activities. During the start of the pandemic, few industry players were predicting turbulent times. However, actual market conditions left them in shock. Due to high demand, manufacturers and many dealerships were struggling to maintain inventory. The penetration of first-time buyers increased significantly during 2020 owing to demographic shifts. The COVID-19 pandemic compelled people to spend more time with families and friends, thereby leading to a rise in activities.

The COVID-19 pandemic had a profound impact on tugboat charter services in the Middle East, characterized by supply chain disruptions, port closures, economic uncertainty, labor shortages, and a gradual recovery in demand post-pandemic. As the region navigates through these challenges, the long-term outlook appears more favorable, particularly with renewed investments in the oil and gas sector driving demand for tugboat charter services.

Segmentation Analysis

By Horsepower

1000-3000 HP Segment Dominated the Market Due to Its Efficiency With Well-balanced Power Consumption

On the basis of horsepower, the market has been divided into Below 1000 HP, 1000 – 3000 HP, and More than 3000 HP.

The 1000-3000 HP segment accounted for the largest market size in 2023 and it is expected to grow at the highest CAGR over the forecast period. They are the medium horsepower tugboats and are very efficient towing units with well-balanced power consumption and hull design optimized for both open waters and restricted channels, which enhances bollard pull - a widely accepted measure of tow capacity. They are also put together with sophisticated control systems to minimize capsizing during the exercise of operations. This adaptability in operation makes them suitable for a broad range of activities besides towage itself, which includes ice management and emergency responses.

The below 1000 HP segment accounted for a significant market size in 2023 and is expected to grow at a stable CAGR for the forecast period. Compared to high horsepower tugboats, low horsepower tugboats have the most economical construction and low operating costs. The simplicity of their construction contributes to low maintenance expenses, making them a viable choice for operators who need reliable vessels without the cost of more expensive larger tugs.

To know how our report can help streamline your business, Speak to Analyst

By Length

20-30 M Tugboats Dominated the Market Due to Their Adoption in Several Coastal and inland Operations

Based on the length, the market has included less than 20 m, 20 – 30 m, and more than 30 m.

The 20-30 m segment accounted for the largest market size in 2023 and it is expected to grow at the highest CAGR in the forecast period. For instance, azimuth thrusters may be a technology that can prove appropriate to improve further the maneuverability and efficiency of medium tugs. Ship-to-ship operations are becoming increasingly complex with a growth in trade level. Medium tugboats provide a wide range of operations as harbor assist, offshore, and towing operations are undertaken. Their balance between power and size makes them useful for several coastal and inland operations. The growing world trade requires sturdy harbor operations. Harbor assistance to the larger ship needs at busy ports makes them irreplaceable with expanding shipping activities.

The more than 30 m segment accounted for a substantial market size in 2023 and it is expected to grow at a significant CAGR over the forecast period. As the size of container tankers and ships increases, there is a need for powerful tugboats to assist the large vessels at docking and undocking. High horsepower is inevitable if proper operation of vessels in complex maritime conditions is required. Large tugs would be necessary for supply work and transfers of vessels related to the development of offshore oil and gas fields.

By Application

Growth in Number of Ports and Increasing Maritime Trade and Services Boosted Shipping & Port Segment Expansion

Based on the application, the market has included shipping & port, emergency response, and oil & gas.

The shipping & port segment accounted for the largest market size in 2023 and is expected to grow at the highest CAGR in the forthcoming years. A number of port development projects are currently underway all over the world to accommodate ever-growing shipping traffic. These projects need more tugboat services, including safe navigation assistance to vessels. For instance, a series of massive investments in ports, such as APM Terminals Poti are for capacity building as well as efficiency.

The oil & gas segment accounted for a significant market size in 2023. With the increasing exploration and production of oil and gas in deeper waters, there is a need for specialized tugboat services in supply operations and vessel transfers. Tugboats are also used to support drilling activities while enabling safe navigation and transportation of equipment to offshore platforms.

Another influx in the area is that of offshore renewable energy projects, particularly wind farms, which heightens the demands placed upon tugboats as heavy equipment and materials will be transported toward the destination platforms.

By Type

Conventional Tugboats Led the Market Due to Their Higher Reliability and Easy Availability

Based on the type, the market has included conventional tug, tractor tug, azimuth stern drive tug, reverse tractor tug, and others.

Conventional tug accounted for the dominating market size in 2023. The segment is expected to maintain its dominance over the forecast period as well. Conventional tugboats feature one of the oldest tugboat designs and have been proven reliable for the application of towage. Furthermore, the higher reliability and easy availability of these types of tugboats further contribute to the greater market share of this segment.

The azimuth stern drive tug market is expected to grow at the highest CAGR over the forecast period. Higher directional stability in speed, along with lower maintenance costs of these types of tugboats, propel segment growth.

Tractor tugs and reverse tugs are also expected to grow in terms of value during the forecast period owing to various hulling and escorting maritime applications.

Middle East Tugboat Charter Services Market Country Outlook

Based on the country, the market gets studied across Turkey, Saudi Arabia, Iran, UAE, Egypt, and Rest of Middle East.

Turkey

Turkey accounted for the leading market share in 2023. Turkey's leadership in the tugboat charter service market in the Middle East can be attributed to several key factors. First, Turkey's strategic geographical position, bridging Europe and Asia, facilitates significant maritime traffic through the Bosporus Strait, one of the world’s busiest waterways. This advantageous location enhances the demand for tugboat services to assist with vessel navigation and docking in busy ports.

Second, Turkey has a well-developed maritime infrastructure, including modern ports, such as Istanbul, Izmir, and Mersin, which handle a large volume of cargo and shipping activities. This infrastructure is supported by a fleet of technologically advanced tugboats, enabling efficient and safe operations.

Saudi Arabia

The Saudi Arabian market is forecasted to achieve a higher growth rate in the coming years. Huge investments are made in the development and expansion of Saudi port infrastructures, the improvement of existing ones, and setting-up of new ports. An efficient number of vessels in service increases the tugboat services needed. This has increased charter services. The introduction of modern tugboats improves port performance since turnover turns out to be quick and not congested, which is important in absorbing surging cargo traffic.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players are Focusing on Long-term Partnerships to Cement Their Market Positions

The key players are actively looking for expansion of the business in the Middle East and Asian countries. Moreover, the companies are also engaging in the long term partnership to strengthen the business. In report, the data provided focuses specifically on the companies' engagement within the market and also provides the Middle East tugboat charter services market share.

List of Key Tugboat Charter Service Companies Profiled In The Report

- GAC Ras Al Khaimah (UAE)

- Astro Offshore (UAE)

- Sea Horse Middle East Marine Services LLC (UAE)

- Haven Shipping FZE (UAE)

- Mubarak Marine (UAE)

- Mannino Marine LLC (UAE)

- Dexter Offshore Ltd (UAE)

- Linden Shipping International LLC (UAE)

- Asaker Marine & Shipping Agency (UAE)

KEY INDUSTRY DEVELOPMENTS

- August 2024 - South African port operator, Transcend announced that the company is focusing on renewal of its existing tugboat and port vessel fleet to tackle increasing demand and port congestion due to the increasing frequency of marine vessels leading to port traffic and congestion issues. The operator announced it had invested USD 52 million to acquire 7 additional tugboats.

- April 2024 - Cheoy Lee Shipyards, based in Hong Kong, completed its 50th harbor tug to Robert Allan Ltd's exclusive RAmparts 3200-CL design in February 2024, and it's now docked at its home port. The Mongla Port Authority in Bangladesh manages both tugs Joymoni and Keel Komol, which were built in China. Following a decade of this design being refined, their completion was a milestone in RAmparts tug construction.

- April 2024 - Sanmar Denizcilik, a Turkish tugboat manufacturer and fleet operator, announced that the company recently introduced its Kocaçay Series of high-powered escort tugs. The new tugs feature a hull design that significantly improves towing and seakeeping performance.

- September 2023 - ADNOC Logistics & Services, the logistics and shipping arm of Abu Dhabi National Oil Company, under its subsidiary Zakher Marine International (ZMI) Holdings, received eight self-propelled jack-up barges (JUBs). This new addition has further entrenched ADNOC L&S as the owner and operator of one of the largest fleets of JUBs in the GCC region, raising the total to 39 owned and operated barges from 31 previously.

- June 2023 - Svitzer won a contract from mining group BHP to operate five tugboats escorting dry bulk carriers at one of the world's largest iron ore export ports at Port Hedland in Western Australia. The five hybrid propulsion tugboats will be chartered for five years from the AP Moller-Maersk subsidiary, with two further five-year periods of hiring being available.

- July 2021 - Singapore-based OSV owner Miclyn Express Offshore (MEO) secured a five-year contract for three fast crew boats in the Middle East. The charter vessels Express 94, Express 77, and Express 69 are contracted with a long-term customer to perform a long-term charter through 2026, with options to extend to 2028.

Report Coverage

The Middle East tugboat charter services report analyzes the market in-depth and highlights crucial aspects such as prominent companies, market segmentation, competitive landscape, tug type, and technology adoption. Besides this, the market research report provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 12.3% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Horsepower

By Length

By Application

By Type

By Country

|

Frequently Asked Questions

The market was valued at USD 2.71 billion in 2023 and is projected to reach USD 7.63 billion by 2032.

The market is projected to grow at a CAGR of 12.3% over the forecast period.

The conventional tug segment accounted for a major market share in 2023.

Growth and expansion in the oil & gas industry to lead to a substantial growth in the market

Mubarak Marine, GAC Ras Al Khaimah, Linden Shipping International LLC, and Dexter Offshore Ltd are some of the leading players in the market.

Turkey dominated the Middle East market in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us