Milk Mineral Concentrate Market Size, Share & COVID-19 Impact Analysis, By Calcium Content (Less than 20%, 20% to 25%, and 26% to 30%), By Granularity (Standard Powder and Micronized Powder), By Application (Functional Foods, Infant Formula, Sports Nutrition, Beverages, Dietary Supplements, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

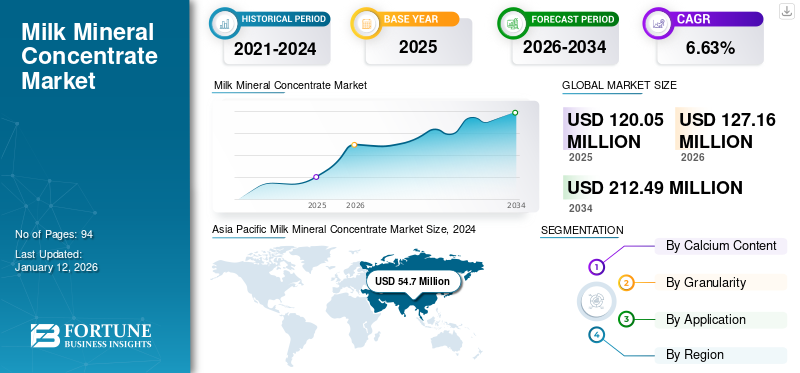

The milk mineral concentrate market size was valued at USD 120.1 million in 2025. The market is projected to grow from USD 127.16 million in 2026 to USD 212.49 million by 2034, exhibiting a CAGR of 6.63% during 2026-2034. Asia Pacific dominated the global market with a share of 48.23% in 2025.

Based on our analysis, the global milk mineral concentrate market exhibited a higher growth of 5.5% in 2020 as compared to 2019. Milk mineral concentrates are obtained by filtering whey, a byproduct obtained in cheese production. The whey is fractionated by several isolation techniques, dried, and then ground into fine powders. These are rich in calcium, potassium, sodium, and other essential minerals and are used to provide nutrition by adding them to infant formulas, nutritional foods, beverages, and so on.

The rising prevalence of bone-related disorders, such as osteoporosis and osteopenia, among the population is a significant factor propelling the demand for the calcium-rich foods and beverages. Calcium deficiency is increasing globally due to several factors such as insufficient calcium intake, medications that decrease calcium absorption, autoimmune disorders, and several other factors.

- For instance, according to an article published by Bone Health and Osteoporosis Foundation (BHOF) in 2021, it is estimated that around 10 million Americans have osteoporosis, and around 44 million are at high risk for its development due to low bone mass.

The paradigm shift toward nutritional foods and supplements owing to increasing awareness about health and wellness among the population globally is leading to an increased demand for these foods and beverages. This is resulting in increasing application of milk calcium in various food products and beverages for nutritional purposes.

- For instance, according to a 2021 report published by Mintel, one in five consumers buy functional foods and drinks for their anti-inflammatory benefits and metabolic health.

Additionally, the rising focus of government authorities on fortification of food products, infant formulas, and other products in countries such as China is increasing the awareness and consumption of such products. These initiatives and focus are projected to fuel the global market. Similar initiatives have also facilitated the growth of the Milk Protein Concentrates (MPC) market.

- For instance, in February 2021, the National Health Commission of the People’s Republic of China and the State Administration for Market Regulation issued the Standard GB 10765 - 2021 (the National Food Safety - Infant Formula), which will be implemented in February 2023.

Moreover, the increasing research and development activities by the market players widening the application areas of the concentrates to cater the unmet needs of the population are anticipated to fuel the global milk mineral concentrate market growth.

Global Milk Mineral Concentrate Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 120.1 million

- 2026 Market Size: USD 127.16 million

- 2034 Forecast Market Size: USD 212.49 million

- CAGR: 6.63% from 2026–2034

Market Share:

- Region: Asia Pacific dominated the market with a 48.23% share in 2025. This leadership is driven by the rising prevalence of calcium deficiency disorders, particularly among infants and the geriatric population, and increasing initiatives by government authorities to establish and update regulations for fortified food products like infant formulas.

- By Application: The Infant Formula segment held the largest market share. The dominance is attributed to the increasing awareness of mineral deficiencies among infants and children in emerging countries, leading to a higher demand for fortified infant formulas to ensure proper growth and development.

Key Country Highlights:

- Japan: As part of the dominant Asia Pacific market, growth is driven by increasing consumption of infant formulas and a growing awareness among the population regarding the importance of fortified nutritional products for both children and the elderly.

- United States: The market is fueled by a high prevalence of inadequate calcium intake, with around 40% of the population, especially women and older children, not meeting recommended levels. This drives the demand for calcium-fortified foods and dietary supplements to address conditions like osteoporosis, which affects an estimated 10 million Americans.

- China: Growth is strongly supported by government initiatives, such as the National Food Safety Standard for Infant Formula, which promotes the fortification of products. The country also faces a significant challenge with its aging population, as the number of people with osteoporosis is projected to increase from 60 million to over 120 million by 2050.

- Europe: The market is driven by a high burden of bone-related disorders. In 2019, an estimated 25.5 million women and 6.5 million men in the European Union had osteoporosis, creating a substantial demand for calcium-rich functional foods and supplements to support bone health.

COVID-19 IMPACT

Higher Price of Raw Materials and Products amid COVID-19 Pandemic Augmented the Market

The COVID-19 impact on the milk mineral concentrate market growth was positive during the forecast period. The demand for milk and other dairy products increased during the COVID-19 pandemic. The procurement of raw materials and ingredients by the producers of milk mineral concentrates was slightly hampered due to slight disruptions in the supply chain and logistics.

The higher demand for milk and dairy products among the population, coupled with lower production of milk and other products, resulted in higher raw materials prices. These factors led to decreased sales volume of products with higher ASP, thereby generating higher revenues. The market players witnessed growth in revenue generated during 2020.

- For instance, Arla Foods Ingredients Group P/S generated a revenue of USD 12,671.4 million in 2020 compared to USD 12,532.1 million in 2019. The increase was due to the increased demand for specialized ingredients across the globe and higher prices of the materials sold.

The restrictions on import and export and shortage of laborers resulted in slight logistics disruptions among the key players in the market. However, the companies implemented various strategies to recover their operations in a short time.

- In 2021, FrieslandCampina DOMO completed its three-year Supply Chain Unlock optimization program with an aim to focus on improving its supply chain for cost savings, cash flow improvements, and optimization of the production network.

Thus, the overall COVID-19 impact on the pandemic was positive on the global market, with slight disruptions in the supply chain due to lower production of milk and other dairy products. The increased ASP of the products positively impacted the revenues generated by the major players operating in the market. Additionally, the increasing number of launches and approvals of products by the key players contributed to the growth of the market in 2021.

LATEST TRENDS

Download Free sample to learn more about this report.

Shifting Consumer Preference to Transform Consumption of Fortified Products

The rising health consciousness and the disorders owing to lack of nutrient intake among the population are leading to increasing adoption of dietary supplements, fortified beverages, and foods globally.

- According to a 2021 survey published by the U.S. Department of Agriculture’s Supplemental Nutrition Assistance Program (SNAP) survey, around two-thirds of Americans are now prioritizing eating food with fortified minerals and other nutrients owing to the rising prevalence of deficiency disorders.

Similarly, the rising initiatives of governments to update the guidelines and adhere to the quality of the products manufactured by the market players are increasing the research and activities of these players to develop and launch products with a wider range of applications such as gut health, and immunity, among others.

Therefore, consumer preference shifting toward more nutritious food products is expected to fuel the demand for milk mineral concentrate production for calcium fortification of various food products and beverages.

DRIVING FACTORS

Growing Prevalence of Bone-related Disorders Especially among Geriatric Population to Fuel Market Growth

The global prevalence of disorders such as osteoporosis, osteopenia, and other mineral deficiency disorders is rising among the population. With the growing geriatric population, the prevalence is also increasing.

- For instance, according to a 2021 population-based study published by the Journal of Orthopedic Surgery and Research, the overall prevalence of osteoporosis in older men and women in the world is around 35.3%.

- Similarly, according to a 2018 article published by the Asian Federation of Osteoporosis, the number of osteoporotic hip fractures is estimated to increase from 1.2 million in 2018 to 2.6 million in 2050 in Asian countries.

The rising number of children and adults with calcium deficiency is rising globally due to several reasons, such as insufficient calcium intake in the diet, underlying medical conditions such as autoimmune disorders, and medications lowering calcium absorption in individuals.

- For instance, according to an article published by the Oregon State University in 2020, around 40% of the U.S. population, especially older children, adolescents, and women, have inadequate calcium intake levels.

Thus, calcium deficiency among the population is increasing the prevalence of bone-related disease, creating an unmet need for treatment. These factors are leading to an increased demand for calcium-fortified foods and dietary supplements to fulfill the recommended dietary intake of calcium and other minerals.

Also, the increasing awareness among the population regarding health and interest in leading a healthy lifestyle is resulting in increased consumption of calcium-fortified food products and beverages.

To fulfill the need for micronutrients and minerals, an increasing number of individuals are opting for functional foods such as supplements in the form of powder, syrup, or tablets in their daily diet to significantly reduce the chances of developing health complications. This is considered to be one of the major attributes favorable that drive the market.

Increasing Applications of Milk Minerals in Nutrition and Food Sectors to Accelerate Market Growth

Milk mineral concentrates are used to manufacture baked goods, beverages, and other nutritional products to meet the deficiency of calcium intake among the population across the globe.

Continuous efforts of the major market players to research and develop new products with a wider range of applications to meet the population's demand is another factor contributing to the growth of the milk mineral concentrate market.

- In October 2021, Arla Foods Ingredients Group P/S opened a new Innovation Center to develop new solutions with a wide range of specialized dairy ingredients to meet the fast-growing demands of children, athletes, and other consumers.

The increasing focus on improving the calcium intake in infants owing to its advantages such as growth and development, physical activity, and defense against infections is leading to an increased demand for infant formula among the population in both developed and emerging regions.

Thus, the increasing research and development activities of the market players to increase the application areas of the mineral concentrates in the foods, beverages, and nutrition sectors are expected to augment the market growth during the forecast period.

RESTRAINING FACTORS

Growing Inclination of Consumers toward Vegan Food to Hamper Market Growth

The rising consumer inclination toward a healthy lifestyle is shifting the demand and preference between plant-based or vegan products from conventionally processed meat products which are also restraining the demand for dairy products.

The preference shift toward the consumption of vegan food among the population in developed and emerging countries is increasing due to many factors. According to a 2021 report published by article published by the Guardian, there is around a 40% increase in the number of vegans in the U.K. and the total number is around 1.5 million.

Additionally, plant-based alternatives are now considered nutritious and superior choice of milk, resulting in decreasing consumption of dairy milk and products in developed countries such as the U.S., the U.K., and others.

All these factors, when coupled with ethical and environmental reasons, the preference for vegan food among the population is leading to an increased demand for plant-based products. This is also resulting in a higher number of mergers and acquisitions among plant-based food companies.

- In November 2021, Royal DSM entered into an agreement with Vestkorn Milling, a Norwegian plant-based protein ingredients manufacturer, owing to the rising demand for vegan and vegetarian food products. Similarly, in April 2021, JBS S/A, one of the largest Brazilian meat processing companies, entered into an agreement to acquire Vivera, a European plant-based food company.

Therefore, the rising health-conscious population across the regions and increasing demand for vegan food products are some factors limiting the demand for dairy-based products and beverages. These factors are anticipated to restrain the growth of the global market during the forecast period.

SEGMENTATION

By Calcium Content Analysis

20% to 25% Segment to Experience Dynamic Growth during Forecast Period Owing to Rising Focus on Fitness and Wellbeing

On the basis of calcium content, the market is segmented into less than 20%, 20% to 25%, and 26% to 30%.

The introduction of superior products with higher calcium content is expected to lower the market share of less than 20% segment by the end of the forecast period. The 20% to 25% segment dominated the milk mineral concentrate market with a share of 63.47% in 2026 owing to the increasing number of people with mineral deficiencies and growing awareness of the conditions and available treatment options. The market players, including Glanbia PLC., Arla Foods Ingredients Group P/S, and others are focusing on increasing the content of essential minerals, including calcium, on meeting the demand for mineral concentrates. These factors are anticipated to fuel the segmental growth during the forecast period.

The increasing demand for fortified food products, infant formulas, nutritional drinks, and others is increasing the efforts of the market players to offer milk mineral concentrate with higher calcium content. This is anticipated to fuel the 26% to 30% segment growth during the forecast period.

By Granularity Analysis

Micronized Powder to Hold Largest Market Share Attributable to Easy Solubility Property and Higher Number of Applications

On the basis of granularity, the milk mineral concentrate market is segmented into standard powder and micronized powder

The micronized powder segment held the maximum share in the market with a share of 77.78% in 2026. The segment is expected to grow at a higher CAGR during the forecast period. The increasing applications of fortified calcium in low viscous products, such as milk, juices, and other nutritional beverages, are leading to an increased demand for micronized milk mineral concentrate in the market.

Additionally, the growing challenges of providing fortified products with high calcium content and good taste are leading to increased use of micronized mineral concentrate to fortify infant formulas, nutritional drinks, and beverages.

The standard powder segment is usually used to fortify dairy products, biscuits, and other functional foods due to its easy handling and less solubility requirement. The increasing demand for these products among the population is anticipated to propel the segmental growth in the market during the forecast period.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Infant Formula Segment to Dominate Owing to Increasing Demand for Infant Formulas among Regions

On the basis of application, the market is segmented into infant formula, functional food, beverages, sports nutrition, dietary supplements, and others.

The infant formula segment dominated the market with a share of 38.52% in 2026 and is expected to register a significant CAGR during the forecast period. The increasing awareness of mineral deficiencies among infants and children in emerging countries such as China, Japan, and others is resulting in a higher demand for infant formulas among the population.

Also, the increasing number of clinical trials to develop and launch infant formulas with added nutritious molecules to address the compromised nutrition level along with increasing regulatory framework is another significant factor attributable to the segment's growth.

- For instance, in April 2021, a regulatory framework for Human Milk Fortifiers (HMF), infant foods added to human milk to increase its nutritional value, was finalized as part of the 2019 Agri-food and Aquaculture Regulatory Review roadmap.

Similarly, growing awareness of healthy lifestyles and nutrient intake among the population, especially among the people involved in sports activities, is a factor surging the demand for sports nutrition foods & beverages and dietary supplements in the market.

- According to a 2022 article published by ACP Journal, research studies show that taking dietary supplements may improve cognition in older adults. The studies suggest that there was about 60% slowing of cognitive decline with three years of dietary supplementation.

These above-mentioned factors and the increasing per capita healthcare expenditure are leading to increased consumption of fortified food products and beverages globally.

REGIONAL INSIGHTS

Asia Pacific Milk Mineral Concentrate Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia pacific dominated the market with a valuation of USD 57.9 billion in 2025 and USD 61.52 billion in 2026 and is projected to register a significant CAGR during the forecast period. The region dominated due to factors such as the rising prevalence of calcium deficiency disorders among the population, especially in infants and the geriatric population.

- For instance, according to the 2018 report published by the Journal of Bone and Mineral Research, the proportion of the elderly population in China in 2018 was 15.5%, which is estimated to increase to 31.2% by 2050.

- It is also estimated that the population with osteoporosis in China will increase from 60 million in 2018 to over 120 million by 2050.

Furthermore, increasing initiatives by government bodies and authorities to establish and update new regulations for fortified food products, such as infant formulas, are anticipated to drive the market in the region.

Moreover, increasing consumption of infant formulas in countries, such as China, Japan, and others, is resulting in increasing efforts of the market players to launch products with continuous improvement in terms of mineral content, which is anticipated to drive the demand for infant formulas during the forecast period. In June 2021, Nestle China launched two of its stage-four infant formulas for children under the age three to six under the NAN range.

The market in North America is expected to grow at a significant CAGR during the forecast period. Some of the major reasons attributing to the growth of the market in the region are increasing patient population suffering from micronutrient deficiency disorders in the U.S. and Canada.

The rising concerns regarding the health issues due to lower intake of essential nutrients and micronutrients, increasing awareness and diagnosis of mineral deficiency disorders among the population in the U.K., Germany, and others are some of the contributing factors to the growth of the market in Europe.

- According to the 2021 Scorecard for Osteoporosis in Europe (SCOPE) report, 25.5 million women and 6.5 million men were estimated to have osteoporosis in 2019 in the European Union.

Similarly, the improving healthcare infrastructure and healthcare access in the emerging countries in the regions, including Latin America, the Middle East & Africa, is expected to augment the market growth in the rest of the world during the forecast period.

KEY INDUSTRY PLAYERS

Glanbia PLC. Leads the Market with a Strong Portfolio of Nutritional and Functional Foods

The milk mineral concentrate market is consolidated with a few major players of milk mineral concentrate, including Glanbia PLC., FrieslandCampina DOMO, and ARMOR PROTÉINES, among other players holding the maximum share in the market.

The focus of the market players to cater to the rising demand for nutritional foods and beverages is increasing owing to the growing prevalence of mineral deficiency disorders globally. Additionally, the implementation of strategies by the key players to expand their product portfolio and geographical presence is another factor contributing to the market's growth.

Glanbia PLC., remained the market leader in terms of market share in 2021, owing to strong demand for premix micronutrients and functional foods.

- According to Glanbia PLC’s 2021 Annual Report, the Nutritional Solutions division generated a revenue of USD 1,044.5 in 2021, witnessing a growth of 17.5% as compared to the previous year.

Also, the increasing investments of the companies in research initiatives for developing various dairy ingredients are anticipated to drive market growth during the forecast period.

- For instance, in October 2021, Arla Foods Ingredients Group P/S opened a new Innovation Center with an aim to develop new solutions with a wide range of specialized dairy ingredients to meet the fast-growing demands of children, athletes, and other consumers.

The increasing approvals and launches of products with a wider range of applications, including sports drinks, infant formulas, dietary supplements, and other fortified products are anticipated to drive the global market growth during the forecast period.

LIST OF KEY COMPANIES PROFILED:

- FrieslandCampina DOMO (Netherlands)

- Glanbia PLC (Ireland)

- Arla Foods Ingredients Group P/S (Denmark)

- ARMOR PROTÉINES (France)

- Sachsenmilch Leppersdorf GmbH (Germany)

- Fonterra Co-Operative Group Limited (New Zealand)

- MILEI GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- June 2022 - Sachsenmilch Leppersdorf GmbH entered into an agreement with FrieslandCampina DOMO to take over five brands of dairy product range and three production facilities.

- March 2022 - Arla Foods Ingredients Group P/S launches two new products for early life nutrition with an aim to expand its organic offering to strengthen its position in the market in the organic sector.

- February 2021- FrieslandCampina DOMO announced a new partnership with Cayuga Milk Ingredients for the production of its Refit milk proteins MPI 90 and MPC 85 with an aim to increase its product portfolio.

REPORT COVERAGE

The global milk mineral concentrate market research report provides a detailed analysis and overview. It focuses on key aspects such as leading companies, calcium content, granularity, and application. Besides this, it offers insights into the market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Calcium Content

|

|

By Granularity

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 120.1 million in 2025 and is projected to reach USD 212.49 million by 2034.

In 2025, the market value stood at USD 57.9 million.

The market will exhibit steady growth at a CAGR of 6.63% during the forecast period (2026-2034).

By calcium content, the 20% to 25% segment will lead the market.

Rising prevalence of bone-related disorders, increasing diagnosis of the conditions such as osteoporosis and osteopenia, and increasing research & development activities by the major market players are the key drivers of the market.

FrieslandCampina DOMO, Glanbia PLC., Arla Foods Ingredients Group P/S, and ARMOR PROTEINES are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us