North America Data Center Cooling Market Size, Share & Industry Analysis, By Data Center Type (Large Scale, Medium Scale, and Small Scale), By Solution (Air Conditioning, Chilling Units, Liquid Cooling, Control Systems, and Others (Pumping Units, Humidifiers, etc.)), By Industry (BFSI, IT and Telecom, Manufacturing, Retail, Healthcare, Energy and Utilities, and Others (Government and Defense, Education, etc.)), and Regional Forecast, 2024 – 2032

KEY MARKET INSIGHTS

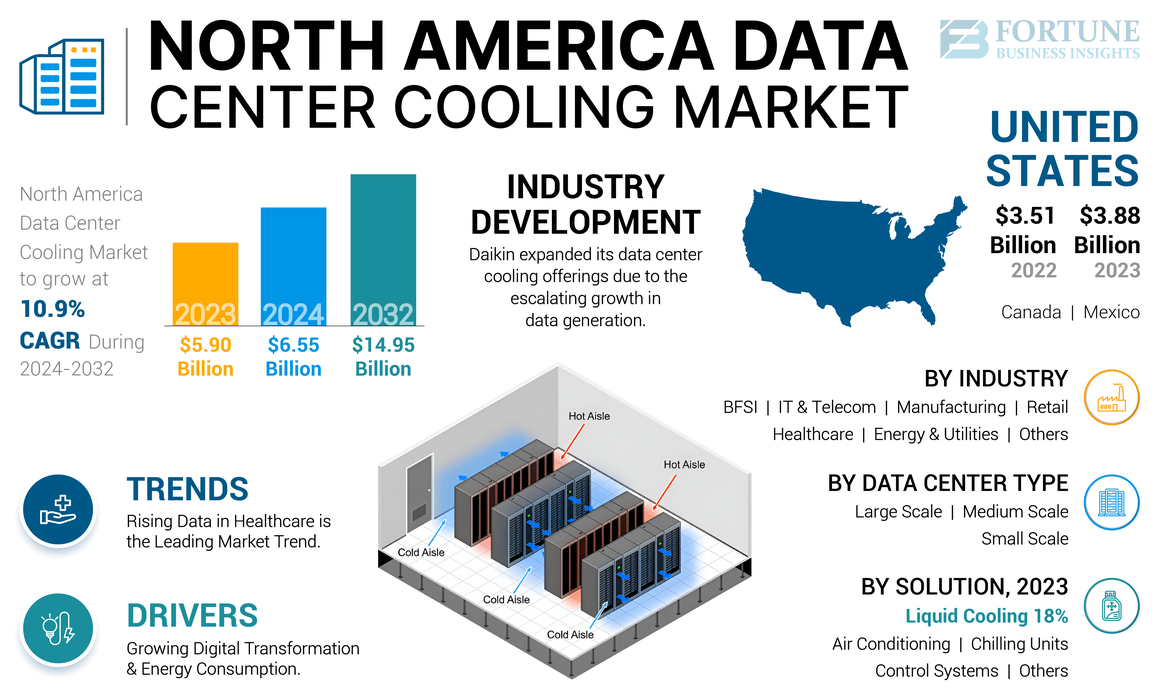

The North America data center cooling market size was valued at USD 5.90 billion in 2023. The market is projected to grow from USD 6.55 billion in 2024 to USD 14.95 billion by 2032, exhibiting a CAGR of 10.9% during the forecast period.

The North America data center cooling industry is witnessing substantial growth due to the rising demand for efficient and advanced cooling solutions. As the number of data centers increases, operators face the challenge of managing higher heat loads generated by modern computing technologies. The growing adoption of cloud services, big data, and artificial intelligence is driving the market growth, as cooling systems play a crucial role in maintaining optimal performance and preventing equipment overheating. This surge in infrastructure investment has significantly boosted the market share of advanced solutions such as liquid cooling and AI-powered cooling systems.

The COVID-19 pandemic accelerated digital transformation across various industries, leading to an increased reliance on data centers. As a result, the increasing demand for data center cooling solutions became more pronounced, as data center operators faced higher workloads due to the rapid growth of online services and remote work. While supply chain disruptions temporarily impacted the deployment of new cooling systems, the overall market experienced positive growth during the pandemic, driven by the rising demand for robust and efficient cooling infrastructure.

IMPACT OF GENERATIVE AI

Generative AI Increases Data Center Energy Demands Driving Need for Advanced Cooling Solutions

The rise of generative AI is transforming the market by significantly increasing data processing needs and energy consumption. With AI models requiring high computational power, data centers are generating more heat, creating a greater demand for efficient cooling systems.

According to a report by the Lawrence Berkeley National Laboratory, AI-driven cooling optimization can reduce data center energy consumption by up to 40%, demonstrating its potential to improve energy efficiency and lower operational costs.

Generative AI also enhances predictive maintenance by continuously monitoring cooling systems and adjusting operations in real-time to avoid overheating and failures, thereby extending the lifespan of cooling infrastructure and reducing downtime.

Furthermore, AI-based systems can optimize airflow patterns, further reducing the cooling burden. As data center infrastructure grows to support AI applications, data center cooling market share is expected to expand significantly. Government policies promoting sustainable energy usage are also expected to drive advancements in energy-efficient cooling solutions, ensuring a balance between AI-driven growth and environmental sustainability.

North America Data Center Cooling Market Trends

Rising Data in Healthcare Drives Demand for Data Center Cooling Solutions and Increases Storage Needs

Earlier, healthcare data came from hospital records and authorized personnel within healthcare systems, with only authorized staff allowed access to software and tools within secure networks for record-keeping. However, in recent times data is collected from multiple sources, such as hospitals, doctors, patients, and medical histories. Patients upload their data to applications and hospital portals, while hospitals save the history of each patient.

Earlier medical data such as CT scans, X-ray scans, and medical reports were saved in files and are now uploaded on servers, creating a huge demand for data storage. Also, there are many tools and equipment in healthcare that generate a high amount of images and diagnostic data.

Government initiatives have boosted the adoption of Electronic Medical Records/Electronic Health Records (EHR/HMR), contributing to the growth of digital healthcare data. Electronic Medical Records (EMR), revenue cycle, digital imaging, and billing software are building massive data sets from the healthcare industry.

Along with this, IoT applications in healthcare are increasing data generation as they monitor patients, manage control stations, and monitor patient rooms, with data saved on the cloud for future reference. With the help of historical data, the IoT measures the drug intake and schedules system. This has created a need for leasing data centers to store crucial information related to hospital and patient records. With the rise of data centers, the North America data center cooling market growth is poised to accelerate, driven by the growing demand for various cooling solutions to support the increasing healthcare data storage needs.

Download Free sample to learn more about this report.

North America Data Center Cooling Market Growth Factors

Growing Digital Transformation and Energy Consumption Increases Demand for Efficient Data Center Cooling Solutions

The North America data center cooling market is driven by the rapid expansion of cloud computing, big data analytics, Artificial Intelligence (AI), and the Internet of Things (IoT). As businesses increasingly adopt digital platforms, the volume of data generated and stored is surging, resulting in higher processing power requirements and increased heat generation within data centers. To maintain optimal performance and prevent overheating, advanced cooling systems are essential. Furthermore, hyperscale data centers, which are becoming the backbone of modern computing infrastructure, require scalable and energy-efficient cooling solutions to handle vast computing loads.

Technologies such as liquid cooling, free cooling, and AI-powered cooling management systems are gaining popularity due to their ability to optimize energy usage and reduce operational costs. The Environmental Protection Agency (EPA) has highlighted the importance of energy-efficient cooling as part of its broader data center energy conservation initiatives, further accelerating the adoption of innovative cooling technologies across the region. Additionally, rising electricity costs and the need for uninterrupted service in data centers are pushing operators to prioritize cooling system upgrades to enhance reliability and reduce downtime.

As data centers expand in size and number to meet the growing demand for cloud services, the need for cooling solutions that support scalability and efficiency is becoming crucial, driving continuous investments in this market.

RESTRAINING FACTORS

High Capital Investment and Operational Costs Limit Adoption of Advanced Cooling Technologies in Data Centers

One of the major restraining factors for the market is the high initial investment and operational costs associated with advanced cooling technologies. The implementation of energy-efficient systems such as liquid cooling, free cooling, and AI-powered cooling management requires significant capital expenditure. For small and medium-sized data centers, this can be a financial burden, limiting their ability to upgrade to more sustainable cooling solutions. Additionally, the complexity of installing and maintaining these systems requires specialized skills and infrastructure, further driving up costs.

Another challenge is the environmental impact of traditional cooling systems, which often rely on energy-intensive methods and refrigerants that contribute to greenhouse gas emissions. Although sustainable solutions are emerging, the transition from conventional to eco-friendly cooling remains slow due to technological limitations and high costs. Regulatory compliance with energy efficiency standards also adds pressure, as data centers need to balance performance with sustainability without significantly increasing operational expenses.

North America Data Center Cooling Market Segmentation Analysis

By Data Center Type Analysis

Medium Scale Data Centers Dominate Market Due To Their Cost-Effectiveness

Based on data center type, the market is divided into large scale, medium scale, and small scale.

Medium scale data centers, which hold the highest market share, are widely used by enterprises that require efficient cooling but lack the vast infrastructure of large-scale facilities. They balance cost and performance, making them a key segment in the cooling market as they upgrade their systems to more energy-efficient solutions to keep up with increasing workloads.

Large-scale data centers are expected to witness the highest growth rate due to the rising adoption of cloud services, big data analytics, and AI applications, which demand massive data storage and processing capabilities. These facilities invest heavily in advanced cooling solutions to handle the high heat generated by their extensive IT infrastructure, driving growth in this segment.

Small-scale data centers, while accounting for a smaller share, continue to grow steadily, particularly among SMEs. Their cooling requirements are comparatively lower, but they still invest in cost-effective solutions to optimize performance and reduce operational expenses.

By Solution Analysis

Air Conditioning is the Leading Solution Due to its Reliability and Widespread Usage

Based on solution, the market is divided into air conditioning, chilling units, liquid cooling, control systems, and others (pumping units, humidifiers, etc.).

Air conditioning systems hold the highest market share due to their widespread use in both medium and large-scale data centers, providing reliable cooling solutions that are relatively easy to install and maintain. Their dominance is driven by their adaptability to different data center sizes and their cost-effectiveness for traditional cooling needs.

Chilling units are commonly used in large-scale data centers requiring more powerful cooling capabilities to manage high-density server loads. Meanwhile, liquid cooling systems are expected to witness the highest growth rate.

The rapid adoption of liquid cooling is driven by its superior energy efficiency and ability to handle the increasing heat output of advanced computing equipment, especially in hyperscale data centers. Control systems play a crucial role in optimizing cooling performance by automating temperature regulation and airflow management. Additionally, other solutions, including free cooling and hybrid systems, are gaining traction as data centers seek to reduce operational costs and minimize environmental impact.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

IT and Telecom Segment Holds Prominent Position Due to Continuous Expansion of Cloud Computing

Based on industry, the market is divided into BFSI, IT and telecom, manufacturing, retail, healthcare, energy and utilities, and others (government and defense, education, etc.).

The IT and telecom sector holds the highest North America data center cooling market share, driven by its massive data storage and processing needs. The continuous expansion of cloud computing, AI, and big data applications in this sector increases the demand for cooling solutions that can support 24/7 operations with minimal downtime.

The retail industry is expected to experience the highest growth rate, largely due to the rapid rise of e-commerce and digital transactions, which require data centers to manage large volumes of customer data securely. As retail companies expand their online presence, the demand for efficient cooling systems to support data storage grows significantly.

The BFSI, manufacturing, healthcare, and energy sectors also contribute to the market, though at varying growth rates, as they modernize their IT infrastructure to meet regulatory and operational demands, driving cooling solution investments.

COUNTRY INSIGHTS

The U.S. holds the highest market share in the data center cooling market, fueled by its large number of hyperscale and enterprise data centers. The presence of major cloud service providers, tech giants, and colocation facilities in the U.S. significantly boosts the demand for advanced cooling solutions, as these facilities require efficient systems to manage high heat loads generated by extensive computing operations.

Canada is witnessing steady growth as data center investments rise, particularly in regions with cooler climates where companies can leverage free cooling technologies to lower energy costs. The country is also benefiting from increased demand for data storage driven by privacy regulations and cloud adoption.

Mexico, while holding a smaller share, is experiencing growth as businesses and tech firms expand their IT infrastructure. The growing e-commerce and manufacturing sectors in Mexico are also driving demand for data centers, thereby increasing the need for efficient cooling solutions to support operations in warmer climates.

KEY INDUSTRY PLAYERS

Leading Industry Players Drive Market Growth With Energy-Efficient and Innovative Cooling Solutions

The North America data center cooling market is dominated by key players such as Vertiv Group Corp, Schneider Electric, and STULZ GmbH, known for their cutting-edge cooling technologies and energy-efficient solutions. These companies offer a wide range of products, including air conditioning, liquid cooling, and advanced control systems, addressing the cooling needs of hyperscale, colocation, and enterprise data centers. Additionally, these industry leaders focus on innovation and sustainability while reducing operational costs by integrating AI-driven cooling optimization and liquid cooling technologies. This strategic focus positions them to meet the growing demand for greener and more efficient solutions.

List of Top North America Data Center Cooling Companies:

- Asetek Inc. (Denmark)

- Daikin Industries, Ltd. (Japan)

- Danfoss (Denmark)

- Johnson Controls (Ireland)

- Madison Air (U.S.)

- Mitsubishi Electric Corporation (Japan)

- MODINE MANUFACTURING COMPANY (U.S.)

- Schneider Electric (France)

- STULZ GmbH (Germany)

- Thermal Care (U.S.)

- Vertiv Group Corp. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Daikin expanded its data center cooling offerings owing to the burgeoning growth in data generation. According to industry forecasts, the data center market is expected to grow at 10% annually, with an estimated USD 49 billion investment in new facilities by the decade's end, driven by AI and cloud computing, boosting demand for advanced cooling solutions.

- October 2023: Thermal Works unveiled its advanced waterless cooling system for the rapidly evolving data center industry. This effective modular design aims to renovate traditional data center operations by minimizing energy consumption and eliminating water usage in cooling. The company started delivering its integrated cooling system to clients.

- October 2023: Thermal Care announced the update of their chiller product portfolio with EPA-approved low Global Warming Potential (GWP) refrigerants R-513A and R-454B. This proactive step aligned with impending legislation aims at phasing out high-GWP refrigerants linked to climate change. Governments worldwide are implementing regulations to transition away from refrigerants such as R-134a and R-410A, commonly used in chillers, due to their significant contribution to global warming.

- September 2023: Johnson Controls unveiled Cooling as a Service (CaaS), a revolutionary capital-free solution that covers the entire cooling lifecycle, from upgrades to ongoing maintenance, transforming the cooling industry.

- June 2023: The Modine’s Rockbridge facility (Virginia) announced the commissioning of a cutting-edge 5MW testing laboratory, enhancing the capabilities of Airedale by Modine to cater to the evolving needs of data center customers. This expansion addressed the growing demand within the data center industry for verified, sustainable cooling solutions. The established laboratory is equipped to conduct comprehensive testing of air conditioning equipment, with water-cooled chillers up to 5MW and air-cooled chillers up to 2.1MW.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 10.9% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Data Center Type

By Solution

By Industry

By Country

|

Frequently Asked Questions

The market is projected to reach USD 14.95 billion by 2032.

In 2023, the market was valued at USD 5.90 billion.

The market is projected to grow at a CAGR of 10.9% during the forecast period.

The medium scale data center type leads the market.

Growing digital transformation and energy consumption are key factors driving efficient data center cooling solutions.

Schneider Electric, Johnson Controls, Daikin Industries, Ltd., Vertiv Group Corp., and Danfoss are prominent players in the market.

The U.S. holds the highest market share.

By industry, IT and telecom captures the highest market share.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us