North America Endoscopic Surgical Stapler Market Size, Share & Industry Analysis, By Type (Powered and Manual), By Product (Linear Stapler, Linear Cutter Stapler, Circular Stapler, and Curved Stapler), By Usage (Disposable and Reusable), By Application (Gynecology Surgery, Thoracic Surgery, Colorectal Surgery, Bariatric Surgery, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

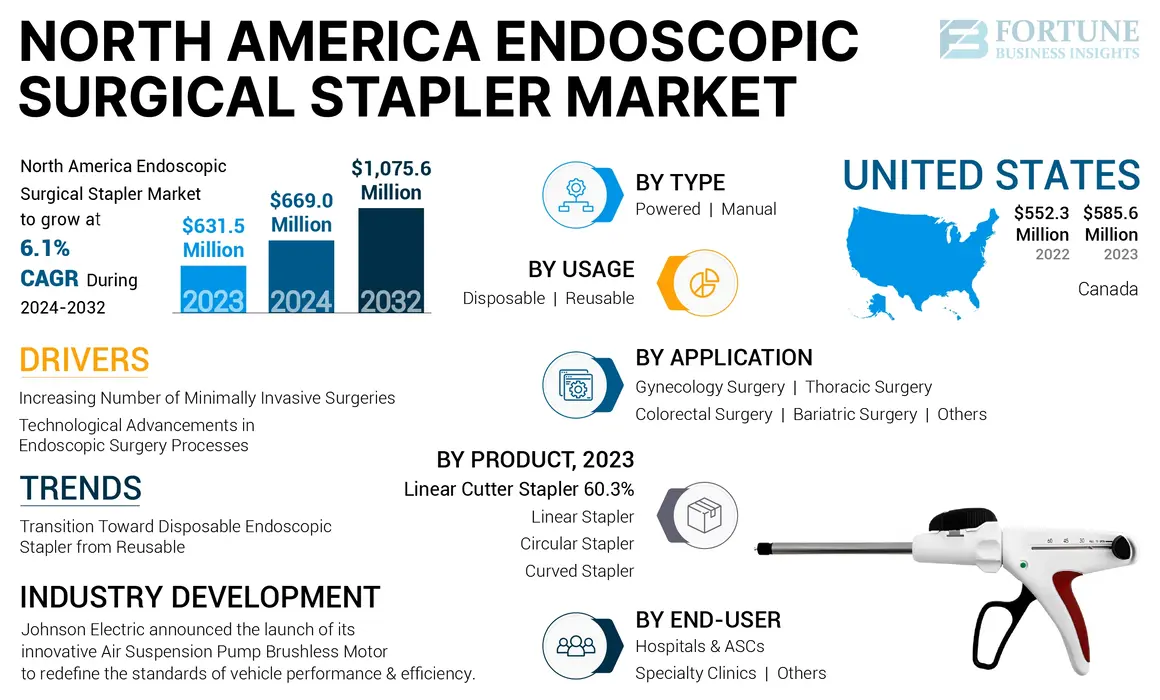

The North America endoscopic surgical stapler market size was valued at USD 631.5 million in 2023. The market is projected to grow from USD 669.0 million in 2024 to USD 1,075.6 million by 2032, exhibiting a CAGR of 6.1% during the forecast period.

Endoscopic surgical staplers are medical devices used to apply staples during surgical procedures. These devices are designed to close incisions or wounds within the body, facilitating faster healing and reducing the risk of complications associated with traditional suturing methods. These devices could be used for removing part of an organ, cutting through and sealing organs & tissues, and creating connections between structures. This market includes surgical staplers, such as linear, linear cutter, curved, and circular, that are intended for laparoscopic procedures and minimally invasive procedures.

The North America endoscopic surgical stapler market is expected to grow significantly during the forecast period. The increasing number of chronic diseases, such as cancer, result in a higher number of surgical procedures that are conducted laparoscopically. Additionally, technological advancements in these staplers to offer efficient products are expected to increase the demand in North America.

- For instance, the American Society for Metabolic and Bariatric Surgery (ASMBS) reported 160,609 sleeve gastrectomy procedures in 2022, which was 5.1% higher than the previous year. Similarly, 57,689 cholecystectomies were performed in Canada.

The COVID-19 pandemic had a substantial negative effect on the North America endoscopic surgical stapler market in 2020 due to several factors. The postponement of elective surgeries and the redirection of healthcare resources significantly reduced the usage of surgical staplers. Additionally, supply chain disruptions impacted product availability, further decreasing utilization of these devices, which ultimately led to a decline in revenue. In 2021, the market experienced a rebound in product sales due to the increased number of surgeries. The growing prevalence of chronic diseases and the corresponding rise in related surgical procedures, along with technological advancement in endoscopic staplers, are anticipated to drive product demand during the forecast period.

North America Endoscopic Surgical Stapler Market Trends

Transition Toward Disposable Endoscopic Stapler from Reusable

There has been a notable shift from reusable endoscopic staplers to disposable staplers, primarily as disposable surgical staplers significantly lower the risk of surgical site infections (SSIs) compared to their reusable counterparts, which require sterilization between uses. The increased focus on infection control within healthcare settings has led to an increasing preference for disposable endoscopic staplers. Furthermore, the rising number of approvals and launches of disposable products in North America is expected to accelerate market growth over the forecast period.

- For instance, in January 2023, Victor Medical Instruments Co., Ltd. received U.S. FDA 510(k) clearance for the disposable endoscopic cutter stapler and cartridge. This approval significantly bolstered the use of disposables in the North America endoscopic surgical stapler market.

Download Free sample to learn more about this report.

North America Endoscopic Surgical Stapler Market Growth Factors

Increasing Number of Minimally Invasive Surgeries to Aid Market Growth

The rising prevalence of chronic conditions and genetic disorders, including obesity, cancer, and gastrointestinal diseases, has driven growth in surgical procedures, such as colorectal, thoracic, gynecological, and bariatric surgeries across North America. Additionally, there is a notable shift toward minimally invasive surgical techniques due to their benefits, such as reduced recovery times, less postoperative pain, and shorter hospital stays. Advancements in surgical technology, including robotic-assisted and laparoscopic procedures, enable this trend. The rising demand for minimally invasive surgeries directly increases the demand for endoscopic staplers, which are essential tools for these interventions.

- For instance, the American Society for Metabolic and Bariatric Surgery (ASMBS) estimated that 62,097 Roux-en-Y gastric bypass (RYGB) surgeries were performed in the U.S. in 2022. This growing number of minimally invasive procedures is expected to increase the demand for these staplers in North America.

Technological Advancements in Endoscopic Surgery Processes to Foster Market Growth

The growing adoption of endoscopic surgical staplers is driving market players to invest in research and development to introduce technologically advanced products that cater to the rising demand. The development of robotic staplers, powered surgical staplers, and staplers with real-time feedback is revolutionizing the field of endoscopic surgery by increasing precision, efficiency, and control during procedures. These staplers offer enhanced maneuverability and stability in tight spaces and staplers, monitor tissue thickness, and provide recommendations for optimal staple size, minimizing the risk of complications such as leaks and bleeding.

- For instance, in May 2024, Johnson & Johnson Services, Inc. launched the ECHELON LINEAR Cutter in the U.S. market. It comprises 3D-Stapling Technology and Gripping Surface Technology (GST) to enable greater staple line security, reducing risks and supporting patient outcomes.

These innovative products are making endoscopic surgeries safer, faster, and more effective, ultimately leading to better patient outcomes and driving the North America endoscopic surgical stapler market growth.

RESTRAINING FACTORS

Adverse Events of Endoscopic Surgical Staplers to Limit the Adoption

Endoscopic surgical staplers are essential tools in various surgical procedures, including the resection of organ parts, cutting and sealing tissues, and establishing connections between anatomical structures. Their significance is higher in minimally invasive surgeries, where they facilitate efficient and precise tissue handling with minimal incisions. However, despite their advantages, staple line leaks continue to pose a significant challenge, often leading to serious complications and increased mortality rates. These leaks can occur due to improper staple formation or inadequate tissue compression, resulting in fluid leakage that may necessitate additional interventions. Furthermore, reports of misfiring and device malfunctions raise concerns about the reliability of these instruments, potentially compromising patient safety. According to the 2019 data published by KFF Health News, more than 110,000 surgical stapler malfunctions and adverse events were reported between 2011 and 2018. The growing number of adverse events increases product recalls, and it can hamper its adoption rate, further limiting the growth of the market.

North America Endoscopic Surgical Stapler Market Segmentation Analysis

By Type Analysis

Powered Segment Dominated the Market due to Lesser Staple Line Leaks

Based on type, the market is segmented into powered and manual.

The powered segment dominated the market in 2023. The segment growth is attributed to the rising utilization of powered staplers as they offer improved stability and precision, reduced trauma to adjacent tissue, and reduced bleeding.

- For instance, a study published in Diseases of the Esophagus in October 2022 reported that the use of powered circular staplers contributed to an 80% risk reduction of anastomotic leakage after esophageal resection compared to manual circular staplers.

These advantages associated with powered staplers are driving the segment's growth.

The manual segment is anticipated to expand at a substantial CAGR during the projection period. The segment growth is attributed to its reliability during procedures and ease of use in various surgical settings. Low-cost of these products is an additional factor that drives the market growth in the near future. Moreover, the rising number of bariatric surgeries using manual staplers is anticipated to drive the segment growth.

By Product Analysis

Linear Cutter Staplers Led the Market Due to Their Wide Availability

Based on product, the market can be segmented into linear stapler, linear cutter stapler, circular stapler, and curved stapler.

The linear cutter stapler segment accounted for the largest share of the North America market in 2023 and is expected to expand at a substantial CAGR during the forecast period. This growth is attributed to the wide availability of these products and continuous innovation and new product launches in North America. Additionally, linear cutter staplers are used in a wide number of surgeries in the region. Furthermore, rising collaboration between players is expected to launch advanced products, thereby aiding the segment growth.

The circular segment is expected to grow at a higher CAGR during 2024-2032. The segment growth can be attributed to the significant rise in colorectal surgeries. These single-use staplers are used in anastomosis, and the rise in the same is expected to increase the demand for circular staplers. Additionally, the launch of the powered circular stapler is expected to increase the demand as these decrease the anastomosis leaks. For instance, in September 2019, Johnson & Johnson Services, Inc. launched the first powered circular stapler, the ECHELON CIRCULAR Powered Stapler. This launch is increasing the demand for powered circular staplers.

To know how our report can help streamline your business, Speak to Analyst

By Usage Analysis

Reusable Segment Dominated with Its Increased Usage in Bariatric Surgeries

The market, by usage, is classified into disposable and reusable.

The reusable segment dominated the market in 2023. This trend is largely driven by the increasing preference for reusable staplers in bariatric surgeries across North America. Reusable staplers offer advantages, such as reduced waste generation and more efficient resource utilization compared to disposable alternatives. Additionally, advancements in the stapler reloads, such as reinforcement to reduce leakage, are the factors expected to drive the segment growth during the forecast period.

The disposable segment is anticipated to grow at a higher CAGR over the forecast period. The comparable safety and efficacy of disposable staplers with reusable staplers in the region drives the segment growth. Additionally, increased regulatory approval of these products is expected to boost the segment growth further.

- For instance, in January 2023, Victor Medical Instruments Co., Ltd. received U.S. FDA 510(k) clearance for the disposable endoscopic cutter stapler and cartridge. Such approvals could increase these product usages.

By Application Analysis

Colorectal Surgery Segment Dominated due to Higher Prevalence of Colorectal Cancer

Based on application, the market can be divided into gynecology surgery, thoracic surgery, colorectal surgery, bariatric surgery, and others.

The colorectal surgery segment accounted for a major market share in 2023, driven by the increasing prevalence of colorectal cancer. For instance, the American Cancer Society estimated 153,020 new cases of colorectal cancer (CRC) in 2023 in the U.S. This growing burden of colorectal cancer, coupled with the need for effective surgical interventions, is expected to be a key factor in driving the demand for these staplers in colorectal procedures. Advancements in minimally invasive surgical techniques, such as laparoscopic and robotic-assisted surgeries, have further contributed to the adoption of specialized endoscopic stapling devices designed for precise tissue management and anastomosis.

The bariatric surgery segment is expected to witness a higher CAGR during the forecast period. The rising prevalence of obesity and related chronic health conditions significantly drives the growth of bariatric surgery in North America. Additionally, advancements in this technology increase the demand for minimally invasive techniques, such as sleeve gastrectomy and Roux-en-Y gastric bypass and the demand for these staplers is expected to increase significantly.

By End-user Analysis

Hospitals & ASCs Segment Dominated due to Higher Procedural Volume in these Facilities

In terms of end-user, the market is classified into hospitals & ASCs, specialty clinics, and others.

The hospitals and ASCs segment represented the largest share of the market in 2023 and is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. This growth is driven by several factors, including the expertise of these facilities, access to futuristic products, and the advancements in the hospitals resulting in the higher number of minimally invasive procedures in these facilities. Additionally, there is a rising preference for minimally invasive surgeries in ASCs, which is anticipated to drive demand for these devices further.

- For instance, according to the data published in the Ambulatory Surgery Center Association and ASCA Foundation journal, there are more than 5,900 Medicare-certified ASCs in 50 states of the U.S., with an estimated 22.5 million procedures every year. Such a large number of ASCs with insurance coverage leads to the increasing surgical volume and demand for these devices.

The specialty clinics segment held the second-largest market share in 2023 and is projected to grow at a substantial CAGR during the projection period. The development of powered surgical tools and the rising demand for bariatric surgeries in these facilities are anticipated to propel the demand for endoscopic surgical staplers for wound closure in specialty clinics.

COUNTRY INSIGHTS

U.S. Dominated due to Advancements in Medical Technologies

The market is studied across the U.S. and Canada.

In 2023, the U.S. dominated the North America market with USD 585.6 million in revenue. The dominance is attributed to the high adoption rate of innovative technologies, and higher surgical volumes are the primary factors leading to the country's market growth. Additionally, the presence of major players in the U.S. market, with advanced offerings and launches, is expected to propel the country’s growth.

- For instance, in June 2022, Johnson & Johnson Services, Inc. launched the ECHELON 3000 Stapler in the U.S. The device is a digitally enabled device that provides surgeons with simple, one-handed powered articulation.

Canada held a considerable share of the market. An increase in chronic diseases and the number of surgeries with growth in healthcare facilities are expected to increase the number of minimally invasive surgeries. This increase in minimally invasive procedures could contribute to drive the market growth.

KEY INDUSTRY PLAYERS

Johnson & Johnson Services, Inc. and Medtronic are the Leading Players due to the Continuous Innovation

The North America endoscopic surgical stapler industry is consolidated with a few key market players. In 2023, Johnson & Johnson Services, Inc. led the market, primarily due to a growing number of product launches aimed at expanding its stapler portfolio. Additionally, an increasing focus on obtaining regulatory approvals for new stapler products has significantly contributed to the company's expanding North America endoscopic surgical stapler market share.

Medtronic is a second key player in the market focused on research and development to develop and launch innovative surgical staplers in the region. Furthermore, increasing merger and acquisition activity among other industry players is expected to drive companies’ growth.

Companies such as Intuitive Surgical, B. Braun SE, and Teleflex Incorporated are focused on their expansion in North America through acquisitions and collaborations. Additionally, the rising technological advancement and R&D initiatives of these companies to launch quality products in the market are expected to increase their growth in the forecast period

LIST OF TOP NORTH AMERICA ENDOSCOPIC SURGICAL STAPLER COMPANIES:

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- B. Braun SE (Germany)

- Frankenman International Ltd. (China)

- Reach Surgical (China)

- Intuitive Surgical (U.S.)

- Ezisurg Medical Co., Ltd. (China)

- Lexington Medical (U.S.)

- Teleflex Incorporated (U.S.)

- Victor Medical Instruments Co., Ltd. (China)

- Purple Surgical (England)

- Waston Medical Corporation (China)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Johnson & Johnson Services, Inc. announced the U.S. launch of the ECHELON LINEAR Cutter. It comprises 3D-Stapling Technology and Gripping Surface Technology (GST) to enable greater staple line security, reducing risks and supporting patient outcomes.

- October 2022: Teleflex Incorporated completed the previously announced acquisition of Standard Bariatrics, Inc. This acquisition commercialized powered stapling technology for bariatric surgery.

- April 2022: Medtronic collaborated with GE Healthcare to meet the demand for care at ambulatory surgery centers (ASCs) and office labs (OBLs) with extensive product portfolios, including surgical products.

- June 2021: Intuitive Surgical launched the SureForm robotic-assisted surgical stapler, which features SmartFire technology—an integrated software system.

- October 2020: Purple Surgical launched the new and upgraded Purple Surgical Endoscopic Stapler, incorporating a more robust handle and advanced gripping technology.

REPORT COVERAGE

The North America endoscopic surgical stapler market report provides a detailed analysis of the industry. The report focuses on the segments such as by type, product, usage, application, end-user, and region. Additionally, the recovers key aspects such as technological advancements, key industry developments, such as mergers, acquisitions, and partnerships, and the impact of COVID-19 pandemic on the market. Besides this, the report also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.1% from 2024-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Product

|

|

|

By Usage

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 631.5 million in 2023 and is projected to reach USD 1,075.6 million by 2032.

Registering a CAGR of 6.1%, the market will exhibit steady growth during the forecast period.

In 2023, the market value stood at USD 585.6 million.

The linear cutter stapler segment dominated the market in 2023.

The increasing number of minimally invasive surgeries and technological advancements are the key factors driving the market.

Johnson & Johnson Services Inc. and Medtronic are the leading companies in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us