North America Load Bank Market Size, Share & COVID-19 Impact Analysis, By Current (AC and DC), By Site (Portable and Stationary), By Type (Resistive, Reactive, and Combined), and By End-User (Power Generation, Data Centers, Oil & Gas, and Others), and Regional Forecast, 2025-2032

North America Load Bank Market Size

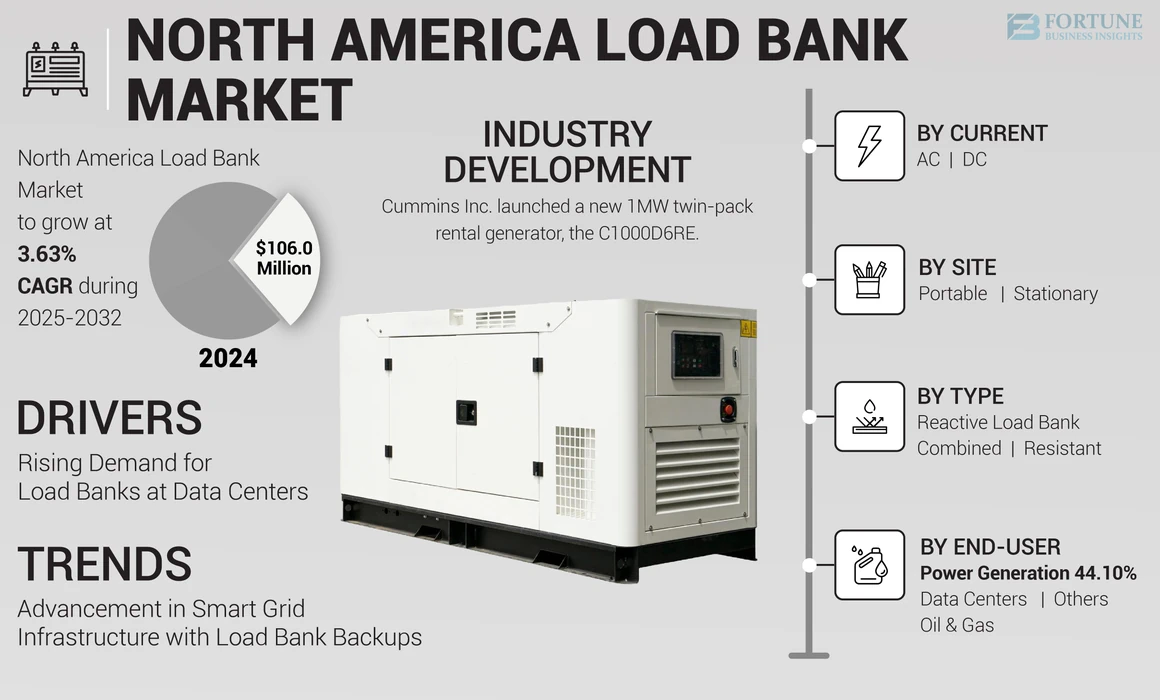

The North America load bank market size was worth USD 106.0 million in 2024 and is projected to grow at a CAGR of 3.63% during the forecast period.

The load bank is the equipment used to simulate an electrical load to test an electric power source. It is used for testing and maintenance purposes to assess the capacity and reliability of the power source under dissimilar load conditions.

Load bank systems are heavily used in various applications to simulate power load. The rising demand for backup power systems in multiple sectors, including energy, power plant, oil & gas, is driving the market. Load banks play a major role in assessing the energy efficiency of backup power systems, which will boost the market over the forecast timeframe.

The U.S. holds a dominant market share in the North America load bank market. The increase in the number of manufacturing and industrial units has boosted demand for load banks. Canada has been attracting investment in data center infrastructure, driven by factors such as favorable climate conditions, reliable power supply, and political stability. As data centers continue to expand in Canada, the need for load banks is likely to grow for testing and maintaining backup power systems.

The COVID-19 pandemic impacted nearly every country across the globe. Lockdown measures significantly reduced electricity demand in industry, affecting the power mix in turn. Decreased demand has raised the share of renewables in electricity supply, as their output is largely unaffected by demand. Demand fell for all other sources of electricity, including coal, gas and nuclear power.

North America Load Bank Market Trends

Advancement in Smart Grid Infrastructure with Load Bank Backups Is the New Trend

Smart grids are electricity networks that use sensors and software to better match the supply and demand of electricity in real-time to multiple applications while having control over it. Load banks help check and authenticate the performance of various components within the smart grid, such as switchgear, transformers, and power generation systems. For instance, the U.S. Department of Energy (DOE) announced a USD 13 billion funds initiative to support the expansion and improvement of the U.S. electric grid in which load banks will play an important role.

North America Load Bank Market Growth Factors

Rising Demand for Load Banks at Data Centers is Driving Market Growth

Data centers are one of the most important markets for load bank testing. The widespread electrical infrastructure and requirement for constant and dependable power mean load banks are of vital significance. It is utilized during commissioning and most modern data centers' maintenance, expansion, and component replacement. During the commissioning stage of a data center, several vital components should be checked by load banks, including UPS systems, backup diesel generators, bus tracks, HVAC systems, and others. In addition, most data centers have a backup to provide power if the grid fails. Scheduled maintenance is important for guaranteeing downtime in data centers. Due to this, load testing is an effective process for checking and verifying all parts in a circuit.

RESTRAINING FACTORS

Presence of Alternative Technologies is Hindering Market Growth

One of the primary factors hindering the market growth is the availability of alternative products and technologies. Technologies, such as simulation software and virtual load testing tools, electronic load simulators, and electric power converters, are some alternatives widely used in commercial and industrial applications.

North America Load Bank Market Segmentation Analysis

By Current Analysis

Based on current, the market is segmented into AC and DC.

The AC segment held a larger North America load bank market share in 2024 owing to one of the most common current types used applicably and long-standing in various industries. AC load banks are broadly utilized for testing transformers and generators. Load bank DC current is particularly essential for assessing the efficiency, stability, and power quality of renewable energy systems, including photovoltaic (PV) arrays, batteries, and DC microgrids. The exponential growth of data centers, driven by cloud computing and the digital transformation of businesses, has created a demand for load banks with both AC and DC capabilities.

The DC segment is estimated to be the fastest growing during the forecast period.

- On May 10, 2023, Crestchic Loadbanks will participate and present resistive-only load banks, large multi-megawatt DC load banks, in the upcoming Data Central World Frankfurt 2023. Crestchic aims to connect with industry leaders and showcase their commitment to providing reliable load-testing solutions for businesses worldwide in an event hosting more than 10,000 attendees.

By Site Analysis

Based on the site, the market is segmented into portable and stationary.

The portable segment held a larger share in 2024 owing to several advantages, such as flexibility and mobility. In addition, it can be easily transported and used in various locations.

Stationary load banks are typically larger, more powerful, and permanently installed at specific locations, such as industrial facilities, power plants, data centers, and testing laboratories.

- March 2023: Nexus Capital Management, a Los Angeles-based private equity firm, announced the acquisition of Aviation Ground Equipment Corp. (AGEC), a privately held, Veteran-owned aviation ground support equipment manufacturer. Additionally, AGEC manufactures aviation ground support equipment, including Land-Based and Shipboard Portable Ground Power Units (GPUs) and Portable Universal Load Banks (ULBs).

By Type Analysis

Based on type, the market is segmented into resistive, reactive, and combined.

The combined segment held a larger share in 2024 as it offers a high grade of versatility and can simulate a wide range of loads, including inductive, resistive, and capacitive. This makes it appropriate for testing power sources and equipment, such as turbines, generators, batteries, and UPS systems.

Resistive load banks are widely used for testing and validating power systems, including electrical distribution systems. They provide a purely resistive load and allow for comprehensive testing of the power system's performance, capacity, and stability.

- In May 2023, Avtron Power Solutions announced that the 9800 medium voltage load bank had received UL-listed status and became the first medium voltage solution to achieve this level of certification. The 9800 offers resistive load testing up to 3000kW at 4160 to 13,800VAC. The unit consists of a step-down transformer and a low-voltage load bank connected to a transportable skid.

By End-user Analysis

Based on end-user, the market is segmented into power generation, data centers, oil & gas, and others.

The power generation segment held a larger share in 2024 owing to the increasing demand for electricity and power generation facilities in the U.S. The role of the power generation sector is vital in any economy. North America is one of the world's major economies, and the power generation sector needs to be solid, so the role of the load bank is vital. Load banks simulate the electrical loads during operation, allowing for thorough system validation, performance testing, and optimization. Data centers consume substantial amounts of electricity and require efficient cooling systems to operate reliably.

To know how our report can help streamline your business, Speak to Analyst

Key Industry Players

In terms of the competitive landscape, the market represents the presence of established and emerging companies. Schneider Electric is expected to account for a significant market share due to its wide product portfolio and strong brand value. Furthermore, the company is also focused on enhancing its sales, distribution, and marketing channels through partnerships with local associates to fortify its product reach across the U.S.

Cummins Inc. is one of the well-established brands in the U.S. Its diesel generator products are readily integrated into different applications and industries, such as oil & gas, defense, healthcare, commercial, marine, mining, data centers, and telecom, along with many others.

Other companies with a substantial existence in the U.S. market include Crestchic Limited, Hubbell Incorporated, and Eagle Eye Power Solutions.

LIST OF TOP NORTH AMERICA LOAD BANK COMPANIES:

- Cummins Inc. (U.S.)

- Mosebach Manufacturing Company (U.S.)

- Schneider Electric (France)

- Crestchic Limited (U.K.)

- The Vanjen Group, LLC (U.S)

- Eagle Eye Power Solutions, LLC (U.S.)

- Power House Manufacturing Inc. (U.S.)

- Hubbell Incorporated (U.S.)

- Avtron Power Solutions (U.S.)

- Cannon Load Banks Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: Veteran Power Solutions, an Arkansas-based generator maintenance business in Texas, has appointed Crestchic as their main load bank supplier. This will help the company save costs, ensure timely delivery, and improve customer service.

- May 2023: Crestchic provided formal load bank training to one of the most elite naval forces in the world post the arrival of its 3000 kVA, 3-phase load bank with NOVA control hardware and Orion user interface. Load banks were tested for resistance above 550 megaohms at 500V and placed in a 10ft ISO container.

- June 2022: Cummins Inc. launched a new 1MW twin-pack rental generator, the C1000D6RE, which offers a competitive rental power solution for various applications throughout North America. Manufactured by Cummins, a company synonymous with technology, reliability, and service since 1919, the new C1000D6RE model will be built in Fridley, Minnesota. This product ensures greater reliability for rugged portable power applications and others. The generator’s container is capable of withstanding extreme weather conditions.

- September 2022: Eagle Eye Power Solution has expanded and moved its headquarters to Mequon, Wisconsin, complete with an onsite battery learning lab as part of Eagle Eye University headquarters. Eagle Eye also added a services headquarters in 2021, Eagle Eye Services, located in Grain Valley, MO.

- October 2022: Schneider Electric reinforced PowerLogic PFC Platform to North American Markets. PowerLogic PFC, the low voltage power factor correction solution from Schneider Electric, strengthens its best-in-class low voltage capacitor bank with robust, IoT-based communication abilities to offer another element within the EcoStruxure Power architecture. These new proficiencies provide opportunities for today’s energy management and power systems applications.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as an overview of technological advancements, the trends of the market, and pricing analysis. Additionally, it includes an overview of the market, new product launches, and key industry developments such as mergers, partnerships, and acquisitions. Besides this, the report also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2030 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.63% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Current

|

|

By Site

|

|

|

By Type

|

|

|

By End-User

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 106.0 million in 2024.

The market is expected to exhibit a CAGR of 3.63% during the forecast period (2025-2032).

By current, the AC segment leads the market by holding a considerable share of the market.

Cummins Inc., Schneider Electric, and Hubbell Incorporated are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us