Optical Lens Market Size, Share & Industry Analysis, By Type (Converging and Diverging), By Application (AR/VR/Headsets or Mounted Display, Camera, Automotive, Smartphones, Medical Surgery, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

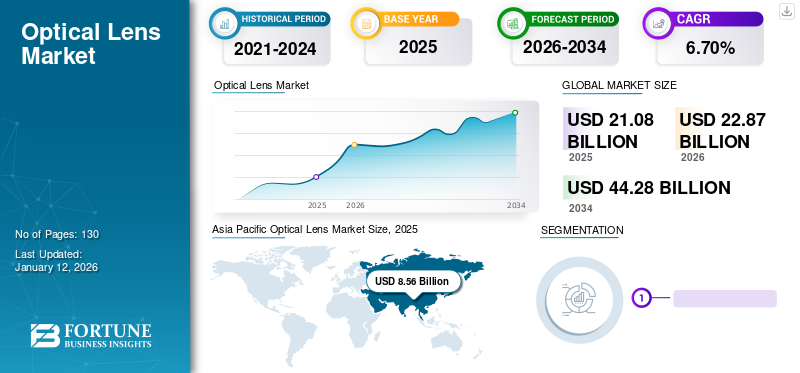

The global optical lens market size was valued at USD 21.08 billion in 2025. The market is projected to grow from USD 22.87 billion in 2026 to USD 44.28 billion by 2034, exhibiting a CAGR of 6.70% during the forecast period. Asia Pacific dominated the global optical lens market with a share of 40.10% in 2025.

An optical lens is a transparent optical component with one or more curved surfaces that pass or transmit light. It can be utilized either uncoated or with an anti-reflective coating for a wide range of applications such as correction of optical aberrations, magnification, image projection, and image focusing. These optical components are usually made of transparent glass and polymers, acrylics, and minerals. Optical lenses are the prime component in smartphones and consumer electronics that enhances the picture quality of the captured or downloaded images. Increasing disposable income in developing countries, rapid technological advancements and the rise in e-commerce platforms are key factors contributing to the rising demand for various consumer electronics products worldwide. According to the International Telecommunication Union (ITU), globally, 73% of the population aged 10 and over owned a mobile phone in 2022. Optical lens aids in capturing high-quality images and videos using a smartphone.

Many smartphone manufacturers collaborate with lens manufacturers to meet the rising demand for smartphones offering image quality similar to DSLR and stay ahead of the competition. For instance,

- In February 2023, Xiaomi, a consumer electronics and smart manufacturing company, entered into a long-term partnership with Leica Camera AG, a manufacturer of cameras and sport optics. The objective of the partnership is to bring a high level of quality to smartphone photography using Leica’s imaging capabilities.

The COVID-19 outbreak severely impacted the optical lens industry. During the initial period of the outbreak, many optical stores and clinics worldwide were temporarily closed or operated with limited capacity, owing to social distancing and lockdown measures. This reduced demand for prescription glasses and contact lenses, resulting in lower sales and revenue for this market.

However, as the global economy showed signs of a steady recovery in 2021, the optical lens industry started to recover. Post COVID-19, vehicle purchases have had a massive uptick, offering safety features such as Advanced Driver Assistance Systems (ADAS). These systems highly rely on high-quality lenses, leading to an increased demand for automotive lenses that support these features.

Optical Lens Market Trends

Rising Adoption of Machine Vision across Various Industries to Fuel Market Growth

Machine vision is a rapidly evolving technology that enables robots and other machines to see and understand their surroundings. The technology uses one or more video cameras and image processing software to boost production speed and yield, automate production, and improve the quality of end products. Lenses play a vital role in machine vision systems by capturing and focusing light onto image sensors, allowing the analysis of visual data. Additionally, AI integration into the machine vision technology has enabled the adoption of robots that can easily communicate with humans by accurately judging the position based on live images detected by the camera’s optical lens. Furthermore, it encourages human to interact and command orders to robots through voice interaction or voice commands.

Download Free sample to learn more about this report.

Optical Lens Market Growth Factors

Increasing Demand for Various Consumer Electronics Products Fuel Market Growth

There is a growing demand from consumers for various imaging lenses such as ultra-wide-angle, macro lenses, and telephoto for better photography experience. Interchangeable lenses are a crucial part of digital cameras. Technological innovations in lens manufacturing have improved lens performance, image quality, and optical capabilities. These advancements are expected to surge the demand for optical lenses in digital camera applications. Moreover, the rising demand for lenses in AR and Virtual Reality (VR) headsets is a major optical lens market trend. Camera enabled televisions are the latest technology integration with low optical lenses manufacturing cost which makes it possible for a group of people to interact live very clearly from a long distance. Such advancements in technology increase the adoption of consumer electronics and drive the demand for optical lens in the long term. Additionally, several leading players in the market are launching advanced lenses for digital cameras.

- For instance, in June 2022, SIGMA Corporation announced a new lens, SIGMA 16-28mm F2.8 DG DN. These lenses have a robust and lightweight body and are especially useful for landscape, wedding, and travel photography.

RESTRAINING FACTORS

Glass Shortage to Hamper the Market Growth

Glass is an important material for numerous industries, including optics & optoelectronics, electronics, energy, biomedicine, information & communication, aerospace, and agriculture. The demand for glass has soared in the last decade due to the growth of these sectors. Various factors, such as labor shortages, energy costs, and supply chain issues, have severely affected the glass material’s production, transportation, and availability. Moreover, the shortage of raw materials, such as high-quality sand and soda ash, used in glass production is expected to hamper the market growth.

Optical Lens Market Segmentation Analysis

By Type Analysis

Robust Demand from a Wide Range of Industries to Fuel the Demand for Converging Lenses

Based on type, the market is divided into converging and diverging. The converging segment is expected to hold the maximum market with a share of 60.34% in 2026. Converging lenses are used across numerous industries, including automotive, electronics, healthcare, and telecommunications. The increasing demand for these lenses in applications such as microscopy, medical imaging, Virtual Reality (VR), Augmented Reality (AR), and autonomous vehicles is propelling market growth. Furthermore, continuous R&D activities in optics and lens technologies propel advancements in converging lenses. The investments made by companies and research institutions result in the development of advanced lens materials, designs, and fabrication techniques, further driving market growth.

Diverging segment is expected to show the fastest CAGR during the forecast period, owing to continued advancements in these lenses. Improvements in lens coatings, materials, and manufacturing processes are expected to produce higher-performing diverging lenses in the coming years.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Demand for Optical Lenses from Smartphone Manufacturers Drives Growth

Based on application, the market is segmented into AR/VR/headsets or mounted display, camera, automotive, smartphones, medical surgery, and others.

The smartphones segment is anticipated to dominate the market during the forecast period, accounting for a 30.27% share in 2026. The growing popularity of social media platforms, such as Snapchat, Instagram, and Facebook, resulted in increased interest in photography and videography. In the last decade, social media users almost tripled, from 970 million in 2010 to 4.48 billion in July 2021. Nowadays, people use smartphones to capture personal memories and share photos and videos on social media. This, in turn, has increased the demand for better camera performance, including improved lenses, to share visually appealing content.

In addition, the AR/VR/headsets or mounted display segment is expected to show the fastest CAGR during the forecast period as these technologies are rapidly gaining popularity globally. The demand for lenses in Augmented Reality (AR) and VR headsets is growing significantly as these technologies are gaining popularity worldwide. As the AR/VR headset demand continues to rise, the requirement for lenses that offer improved optics and customized solutions for different applications is expected to grow during the forecast period.

- For instance, in March 2022, Radiant Vision Systems, LLC announced an XRE lens solution with electronic focus for near-eye display testing. This solution comes with high-resolution ProMetric imaging colorimeters, photometers, and TT-ARVR Software to offer a fully automated visual inspection solution for XR display testing in R&D and production.

REGIONAL INSIGHTS

Geographically, the market is fragmented into five major regions, North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

Asia Pacific

Asia Pacific Optical Lens Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to account for the largest market share during the forecast period, with a market size of USD 8.56 billion in 2025 on account of the presence of major players such as Tamron Co., Ltd., Sunny Optical Technology (Group) Company Limited, Canon Inc., FUJIFILM Corporation, SONY ELECTRONICS INC., Nikon Corporation, thereby rising demand for consumer electronics products and increasing automotive production. Several countries in the Asia Pacific region, such as Japan, China, South Korea, Taiwan, and India, play an important role in the development of the optical lens industry. China and Japan have emerged as major manufacturing hubs for optical lenses due to the presence of the largest and well-known lens manufacturers in these nations. The Japan market is projected to reach USD 1.8 billion by 2026, the China market is projected to reach USD 4.26 billion by 2026, and the India market is projected to reach USD 1.12 billion by 2026.

North America

The market in North America is driven by the increasing prevalence of vision disorders, the rising popularity of AR/VR headsets, and the rising integration of Advanced Driver Assistance Systems (ADAS) in vehicles. ADAS demand is anticipated to grow rapidly in this region due to regulatory and consumer interest in safety systems that protect drivers and decrease accidents. Lenses and cameras play a crucial role in ADAS, acting as one of the main sensory inputs for decision-making and perception systems. The U.S. market is projected to reach USD 4 billion by 2026.

South America

In South America, significant growth in various end-user industries such as healthcare, consumer electronics, and automotive is anticipated to augment the market growth. The increasing population and disposable income in this region have contributed to the expansion of the consumer electronics industry. This, in turn, is expected to augment the demand for optical lenses during the forecast period.

Europe

In Europe, the rising sales of electric vehicles with ADAS features and the presence of major vehicle manufacturers are expected to drive market growth. Moreover, the demand for digital cameras and smartphones is anticipated to grow owing to increased tourism in this region. Germany is expected to maintain its leadership position due to a solid structure for the R&D of advanced technologies. The UK market is projected to reach USD 0.63 billion by 2026, while the Germany market is projected to reach USD 1.01 billion by 2026.

Middle East & Africa

Growing population, rapid urbanization, and economic development drive market growth in the Middle East & Africa (MEA). The region has an increasing demand for consumer electronics and vision correction solutions.

KEY INDUSTRY PLAYERS

Key Players Focus on Strengthening their Market Position with Continuous Developments

The global market is consolidated by leading players such as Tamron Co., Ltd., Sunny Optical Technology (Group) Company Limited, Canon Inc., FUJIFILM Corporation, SONY ELECTRONICS INC., and Nikon Corporation. These companies are expanding their operations by adopting strategies such as acquisitions, collaborations, mergers, partnerships, and product launches. For instance,

- In June 2022, SONY ELECTRONICS INC., a consumer electronics product manufacturer, unveiled three new E-mount lenses in India for their interchangeable mirrorless camera. These lenses include versatile G lens E 15mm F1.4 G (model SEL15F14G), Sony power zoom G lens E PZ 10-20mm F4 G (model SELP1020G), and the ultrawide prime E 11mm F1.8 (model SEL11F18).

- For instance, In May 2022, Tamron Co., Ltd., an optics manufacturer company, launched compact φ29mm machine-vision lenses, compatible with models MA23F12V (focal length 12mm), MA23F16V (16mm), and MA23F50V (50mm) to meet the increasing demand for megapixel cameras required in substrate mounting equipment, test equipment, production equipment, and various engineering machines for inspection purposes.

List of Top Optical Lens Companies:

- Sunny Optical Technology (Group) Company Limited (China)

- Tamron Co., Ltd. (Japan)

- Canon Inc. (Japan)

- Largan Precision Co., Ltd. (Taiwan)

- FUJIFILM Corporation (Japan)

- Nikon Corporation (Japan)

- Genius Electronic Optical (Taiwan)

- ZEISS International (Germany)

- SONY ELECTRONICS INC. (Japan)

- SIGMA CORPORATION (Japan)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Nikon Corporation, a prominent optical technology leader has announced the new smart telescopes ODYSSEY and ODYSSEY Pro. The telescopes are jointly develop by Nikon and Unistellar SAS. The telescope is equipped with autonomous field detection technology with a Nikon designed optical tube for better picture quality.

- June 2023: Nikon Corporation, an optical instrument manufacturer company, plans to expand its Japan-based optics factory to increase the production capacity for lenses in cameras, microscopes, and semiconductor exposure equipment. The facility is anticipated to cost approximately USD 224 million, with operation starting in 2026.

- June 2023: Nikon Corporation, a manufacturer of optical instruments, introduced NIKKOR Z 70-180mm f/2.8, a compact and light telephoto zoom lens for the Nikon Z mount system. This telephoto zoom lens covers a wide range of focal lengths with a constant fast maximum aperture of f/2.8.

- June 2023: Zeiss, a prominent manufacturer of optical lenses has announced the collaboration with Apple for co-operatively developing precision optics for the Apple Vision Pro for the people who cannot enjoy Vision Pro and have vision correction problem.

- April 2023: SIGMA Corporation, a producer and distributor of digital cameras, interchangeable lenses, and photographic accessories, announced the launch of interchangeable lenses for the Nikon Z mount system.

REPORT COVERAGE

The report offers qualitative and quantitative insights into the market and a detailed analysis of the size & growth rate for all possible segments in the market. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The report also offers key insights, such as implementing automation in specific market segments, recent industry developments such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro and micro-economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 - 2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 6.70% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is estimated to be worth USD 44.28 billion by 2034.

In 2025, the market value stood at USD 21.08 billion.

The market is projected to grow at a CAGR of 6.70% during the forecast period (2026–2034).

Smartphones segment is expected to dominate the market in 2026.

Increasing focus on healthcare and medical imaging technologies coupled with strong demand for consumer electronics to augment the market growth.

Some of the top players in the market are Tamron Co, Ltd., FujiFilm Corporation, Sunny Optical Technology (Group) Company Limited, Canon Inc., Nikon Corporation, Largan Precision Co., Ltd., and others.

Asia Pacific dominated the global optical lens market with a share of 40.10% in 2025.

By application, AR/VR/headsets or mounted display segment is expected to show the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us