Optical Sensors Market Size, Share & Industry Analysis, By Type (Extrinsic Sensor and Intrinsic Sensor), By Application (Distance Measurement, Light Detection, and 3D Mapping), By Sensor Type (Ambient Light Sensor, Proximity Sensor, Fiber Optical Sensor, Image Sensors, and Others), By End-user (Healthcare, Consumer Electronics, Energy & Utility, Aerospace & Defense, Automotive & Transportation, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

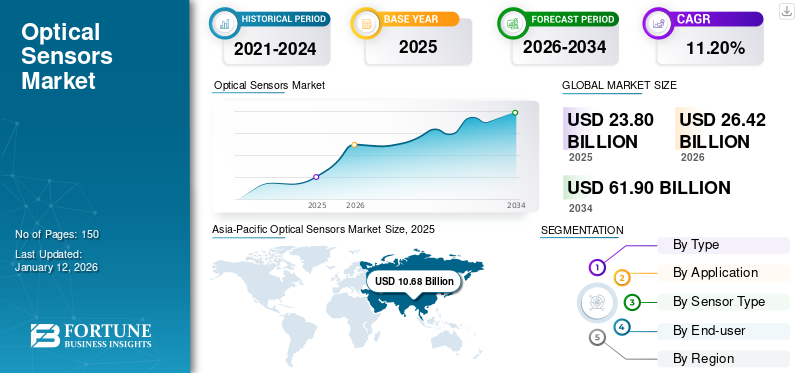

The global optical sensors market size was valued at USD 23.8 billion in 2025. The market is projected to grow from USD 26.42 billion in 2026 to USD 61.9 billion by 2034, exhibiting a CAGR of 11.20% during the forecast period. Asia Pacific dominated the global market with a share of 44.90% in 2025.

An optical sensor, also known as a photoelectric sensor, converts light rays into an electronic signal. These sensors help measure the intensity of incoming light and convert it into a readable form using a built-in meter, depending on the type of sensor. Typically, it is an integral part of a larger system that includes a light source, a sensor, and the measuring device itself.

In general, optical sensors include gratings, optical measuring devices, encoders, optical fibers, and other devices. Thus, all these devices help each other to enable the operation of the optical sensor and accurately measure various data normally. For instance,

- An optical smoke alarm is also called a photo-electric smoke alarm, which is mostly used in bedrooms, lounges, hallways, and others. This smoke alarm answers very fast to visibly smoldering fires.

In addition, the COVID-19 pandemic increased the use of smartphones as companies adopted a work-from-home culture. Due to the pandemic, educational institutions also started offering online classes, which boosted the growth of the market. Moreover, China and India have been heavily affected by the pandemic. Therefore, there were many opportunities for growth in these countries' markets.

Generative AI Impact

Enhancement of Sensor Performance through Generative AI to Drive Market Growth

Generative AI can be used to simulate and model the behavior of these sensors under various conditions, enabling the design of more efficient and effective sensors. AI can assist in discovering and optimizing materials with superior optical properties, enhancing sensor performance. Moreover, AI improves the quality of data captured by optical sensors by reducing noise and enhancing signal clarity. In addition, it can enable real-time processing and analysis of data from optical sensors, making them more responsive and useful in dynamic environments.

Optical Sensors Market Trends

Rise in Adoption of 3D Sensing Technology in Photoelectric Sensors to Impel Market Growth

The 3D sensing technology is extensively being used in smartphones for facial recognition, Augmented Reality (AR), and Virtual Reality (VR) applications. Companies such as Apple have integrated 3D sensing into their devices to enhance security features and user experiences. In addition, in the automotive sector, 3D enhancements are crucial for Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. These sensors help in lane departure warnings, collision avoidance systems, and parking assistance by providing accurate depth perception and object detection. Hence, this factor is poised to stimulate the global optical sensors market growth.

Download Free sample to learn more about this report.

Optical Sensors Market Growth Factors

Growing Demand for Optical Sensors in Consumer Electronics to Boost Market Growth

The market is growing rapidly, mainly due to the increasing demand for consumer electronics. Everyday devices such as tablets, smartphones, and smartwatches have become indispensable in people's daily lives, and optical sensors are an integral part of these devices. They offer features such as automatic screen brightness adjustment based on ambient lighting conditions, secure fingerprint recognition, and advanced camera features. Consumers' desire for more versatile, safer, and advanced electronic devices is a major catalyst for the expansion of this market. In addition, the growing demand for feature-rich consumer electronics is a key driver for the growth of the sensors market, which is driving continuous technological advancements and expanding industry opportunities.

RESTRAINING FACTORS

High Cost of Products May Restrain Market Growth

The prices of raw materials used in the manufacturing of these sensors have increased recently. The high cost of optical detectors may be a limiting factor for the market growth. The prices of raw materials are constantly rising or fluctuating due to factors such as supply chain, transportation and logistics, and other factors that also affect the price of the product. Gaps between image quality, high cost, and product acceptability due to lack of awareness are limiting the growth of the market.

Optical Sensors Market Segmentation Analysis

By Type Analysis

Adoption of Extrinsic Sensors in Various Applications to Propel Segment Growth

By type, the market is segregated into extrinsic sensor and intrinsic sensor.

The extrinsic sensor segment held the largest global optical sensors market share in 2024. These sensors often provide higher sensitivity and accuracy compared to intrinsic sensors, making them suitable for precise measurements in various applications. In addition, they can be used in a wide range of environments, including harsh conditions where intrinsic sensors might fail. They are often more flexible in terms of design and deployment. Therefore, this factor accelerates the growth of the market.

On the other hand, the intrinsic sensor segment is slated to witness the highest CAGR during the forecast period. These sensors are capable of detecting minute changes in the environment, providing high sensitivity and precision in measurements. They can be miniaturized, allowing for their use in applications where space is limited. They can also be easily integrated with fiber optic cables, allowing for long-distance sensing and data transmission without significant signal loss. Thus, these factors boost the growth of the global optical sensors market.

By Application Analysis

Widespread Adoption of 3D Mapping in Several Applications to Fuel Segment Growth

By application, the market is divided into distance measurement, light detection, and 3D mapping.

The 3D mapping segment leads the market by accounting for the maximum share of 46.55% in 2026. This mapping provides detailed and accurate measurements of objects and environments, allowing for precise analysis and assessment. It provides depth information, which is crucial for applications such as robotics, autonomous vehicles, and augmented reality.

On the contrary, the distance measurement segment is anticipated to expand at the highest CAGR during the forecast period. These sensors can measure distances rapidly, enabling real-time data collection and analysis, which is crucial for dynamic environments and applications. They can also measure distances without physical contact, reducing the risk of damaging objects or surfaces and allowing measurements in hazardous or inaccessible areas.

By Sensor Type Analysis

Rising Uptake of Ambient Light Sensors in Optical Displays to Drive Segment Expansion

With respect to sensor type, the market is segregated into ambient light sensor, proximity sensor, fiber optical sensor, image sensors, and others.

The ambient light sensor segment dominates with the maximum market shareof 32.32% in 2026. By detecting ambient light levels, these sensors can adjust the brightness of displays, lighting systems, and screens, leading to significant energy savings. They also help optimize the brightness of displays based on surrounding light conditions, improving visibility and reducing eye strain for users. In addition, in portable devices such as smartphones and laptops, these sensors help manage power consumption by adjusting screen brightness, thereby extending battery life.

Furthermore, the image sensors segment is expected to grow at the highest CAGR during the forecast period. These sensors provide high-resolution images, capturing detailed information that is crucial for applications such as photography, videography, and medical imaging. They can be used in a wide range of applications, including smartphones, digital cameras, security systems, industrial inspection, and autonomous vehicles. Furthermore, these sensors also provide accurate color reproduction, which is important for applications in photography, film production, and medical diagnostics.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Adoption of Consumer Electronics to Foster Segment Expansion

On the basis of end-user, the market is categorized into healthcare, consumer electronics, energy & utility, aerospace & defense, automotive & transportation, and others.

The consumer electronics segment held the largest market share of 26.08% in 2026. Consumer electronics technologies have advanced user interfaces, including touchscreens and gesture controls, which can be integrated into optical sensors to enhance usability and user interaction. The demand for smaller, more portable consumer electronics has driven the development of miniaturized components, which can be applied to optical sensors to create compact, efficient designs suitable for a variety of applications.

Moreover, the healthcare segment is anticipated to grow at the highest CAGR during the forecast period. These sensors provide real-time data, enabling immediate analysis and timely interventions, which is crucial for critical care and chronic disease management. In addition, they offer high precision and accuracy in measurements, ensuring reliable data for diagnostic and therapeutic purposes.

REGIONAL INSIGHTS

Regionally, the global optical sensors market is segregated into five major regions: South America, North America, Europe, Asia Pacific, and the Middle East & Africa. They are further divided into nations.

Asia-Pacific Optical Sensors Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominates the market by capturing the largest market share, and is expected to continue its dominance during the forecast period. Growth in automobile sales and technological advancements in consumer electronics in Asia Pacific are expected to boost the growth of the market. Demand for smartphones, tablets, computers, and smartwatches is growing in the region. In addition, some industries in China where sensors are used are agriculture, manufacturing, data centers, meteorology, Heating, Ventilation, and Air Conditioning (HVAC). The Japan market is projected to reach USD 3.39 billion by 2026, the China market is projected to reach USD 3.45 billion by 2026, and the India market is projected to reach USD 1.49 billion by 2026.

North America

North America is anticipated to witness the highest CAGR during the study period, driven by the widespread adoption of electric vehicles, smartphones, and various smart home applications. In addition, integration with popular social media platforms such as smart cameras, Augmented Reality (AR) face filters, and real-time marketing applications increases the growth of live commerce events. The U.S. market is facing a quick surge due to the growing demand for advanced safety systems and vehicle technology. The increasing consumer preference for road safety and growing government concern to curtail road accidents are the main reasons for implementing optical sensors in ADAS and blind spot detection. The U.S. government announced initiatives such as FMVSS (Federal Motor Vehicle Safety Standard) to decrease road accidents, increasing the growth opportunities for sensors in the U.S. market. The U.S. market is projected to reach USD 4.46 billion by 2026.

Europe

Europe is slated to depict steady expansion over the study period. The region has a strong demand for the product due to increasing automation, digitalization, and the adoption of IoT technologies across various industries. This demand stimulates market growth and encourages technological advancements. Moreover, investments in infrastructure development across Europe, including energy, transportation, and telecommunication sectors, drive the adoption of optical sensors for monitoring and control applications. The UK market is projected to reach USD 0.95 billion by 2026, while the Germany market is projected to reach USD 1.16 billion by 2026.

South America & Middle East & Africa

Similarly, South America is witnessing significant market growth due to its crucial role in environmental monitoring initiatives across the region, including monitoring air and water quality, biodiversity conservation, and climate change research.

The Middle East & Africa (MEA) is predicted to grow in the coming years owing to improved investment and government funding for digitization.

KEY INDUSTRY PLAYERS

Market Players to Leverage Merger & Acquisition Strategies to Expand Their Operations

Major companies in the industry are engaged in active expansion of their global presence by introducing specialized solutions tailored to particular sectors. They are strategically forming partnerships and acquiring local businesses to establish a robust foothold in various regions. These companies are concentrating on creating effective marketing strategies and developing new solutions to maintain and grow their market share. Thus, the rising demand for optical sensors is poised to generate profitable opportunities for companies.

List of Top Optical Sensors Companies:

- ROHM Co., Ltd. (Japan)

- TE Connectivity (Switzerland)

- Hamamatsu Photonics (Japan)

- Analog Devices, Inc. (U.S.)

- Texas Instruments (U.S.)

- STMicroelectronics (Switzerland)

- Vishay Intertechnology, Inc. (U.S.)

- Broadcom (U.S.)

- Leuze Electronics Pvt. Ltd. (India)

- Alphasense (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Viavi Solutions, Inc. acquired Broadcom by expanding the RAN Intelligent Controller (RIC) to generate a digital twin for valuation and performance benchmarking for applications. The platform allows one to capture data once and emulate it with numerous other applications, decreasing the overhead of repeatedly processing, capturing, and transmitting data.

- January 2024: Hamamatsu Photonics introduced CMOS linear image sensors, improving precision in the VUV range. These sensors deliver improved sensitivity and functionality, setting innovative standards in imaging technology.

- October 2023: Hamamatsu Photonics launched a UV-sensitive mini spectrometer microchip model that offers high sensitivity, fingertip size, and low cost. These structures help reduce the size of eco-friendly measurement devices.

- August 2023: Leuze launched a new cost-effective photoelectric sensor that is easy to align and suitable for most commercial production and manufacturing environments. These sensors are available, have the transmitting and receiving electronics in the same device, and do not require a reflector (scattering sensor).

- July 2023: STMicroelectronics introduced its latest FlightSense multi-zone range sensor with a camera-like field of view. Expanding the field of view gives users even more flexibility while maintaining accuracy, resolution, and simplicity.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Sensor Type

By End-user

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 61.9 billion by 2034.

In 2026, the market was valued at USD 26.42 billion.

The market is projected to grow at a CAGR of 11.20% during the forecast period.

By end-user, the consumer electronics segment captured the largest share in 2024.

The growing demand for the product in consumer electronics is the key factor driving market growth.

ROHM Co., Ltd., TE Connectivity, Hamamatsu Photonics, Analog Devices, Inc., Texas Instruments, STMicroelectronics, Vishay Intertechnology, Inc., Broadcom, Leuze Electronics Pvt. Ltd., and Alphasense are the top players in the market.

Asia Pacific dominated the global market with a share of 44.90% in 2025.

By application, the distance measurement segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us