Orthodontic Braces Market Size, Share & Industry Analysis, By Placement (Buccal Braces and Lingual Braces), By Design (Non-ligating Braces and Self-ligating Braces), By Material (Titanium, Ceramic, Stainless Steel, and Others), By Component (Bracket, Bands & Buccal Tubes, Archwire, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

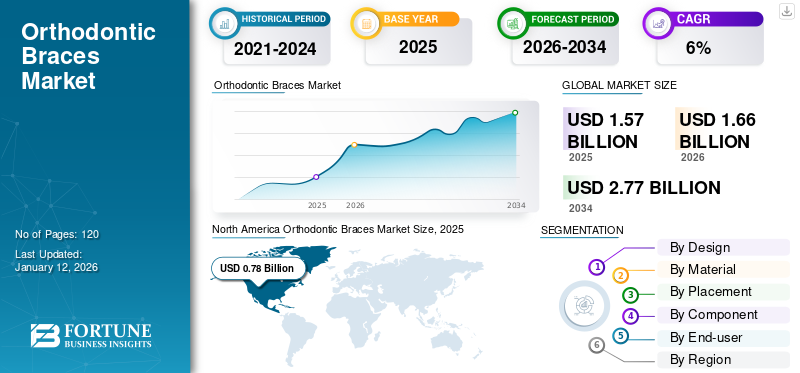

The global orthodontic braces market size was valued at USD 1.57 billion in 2025. The market is projected to grow from USD 1.66 billion in 2026 to USD 2.77 billion by 2034, exhibiting a CAGR of 6.61% during the forecast period. North America dominated the orthodontic braces market with a market share of 50% in 2025.

Orthodontics braces or dental braces are a combination of brackets, archwires, and bands that are utilized to align crooked teeth, cross-bite, tooth malocclusion, and other jaw-related problems. These braces apply gentle pressure and continuous force to reposition the misaligned teeth into their optimal alignment over time gradually. These orthodontics braces are available in various materials such as stainless steel, ceramic, titanium, and others in buccal and lingual placements.

The global orthodontics market is projected to grow primarily due to the rising prevalence of bite problems, malocclusion, and crooked teeth, globally. These conditions increase the chances of medically necessary orthodontic procedures, including orthodontic braces.

Additionally, the technological advancements and increasing number of product launches are further expected to propel market growth. Moreover, the rise in the demand for orthodontic procedures is further expected to drive market growth during the forecast period.

The market witnessed a decrease in revenue in 2020 due to the adverse impact of the COVID-19 pandemic globally. This was largely due to the closure of many dental offices and the prioritization of only urgent orthodontic cases to control the viral spread. Additionally, the travel restrictions further impacted the orthodontic braces market negatively.

- For instance, according to the Agency for Healthcare Research and Quality report, the pandemic led to the closure of 198,000 active dentists and dental specialties in the U.S., which negatively impacted the market in 2020.

However, in 2021, there was a notable rebound in the market due to the reopening of dental practices, a rise in tele-dentistry, and a surge in the adoption of digital tools. This increased the implementation of orthodontic products, including braces, in 2021 and led to significant growth, which is anticipated to continue in the years ahead.

Global Orthodontic Braces Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.57 billion

- 2026 Market Size: USD 1.66 billion

- 2034 Forecast Market Size: USD 2.77 billion

- CAGR: 6.61% from 2026–2034

Market Share:

- Region: North America dominated the market with a 50% share in 2025, driven by the presence of major players, the wider availability of technologically and aesthetically advanced braces, and a high preference for teeth alignment procedures among the general population.

- By Placement: The buccal braces segment held the largest market share. The effectiveness and reliability of these braces, which are placed on the front side of the teeth, are key factors for their high adoption and market dominance.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific market, growth is driven by the emerging adoption of advanced technologies for dental treatment and an increasing number of multispecialty hospitals and dental clinics providing orthodontic services.

- United States: The market is fueled by a very large patient base, with over 9.0 million individuals receiving orthodontic treatment annually. Growth is also supported by the adoption of new technologies, including 3D-printed ceramic braces and AI-powered treatment planning.

- China: The market is expanding due to the rising adoption of advanced dental technologies, a growing number of dental clinics, and strategic initiatives by global players to promote digital dentistry and increase product supply in the region.

- Europe: As the second-largest market, growth is supported by the presence of advanced healthcare facilities, a greater emphasis on dental care, and the availability of innovative dental products, which increases the adoption of orthodontic braces.

Orthodontic Braces Market Trends

Increasing Usage of Digital Tools to Boost Market Growth

In recent years, the digital transformation of the dental industry has become a key focus area. There has been a rise in the adoption of technologies, such as machine learning, artificial intelligence tools, and 3D printing tools in dental braces manufacturing. These advanced technologies can improve the accuracy of diagnostics, treatment planning, and personalized treatment approaches for patients requiring dental braces by analyzing large amounts of data and patterns.

Additionally, the AI-powered software can assist in designing customized braces that are more comfortable and efficient, further driving the demand for these products. Additionally, the focus of dental service providers on incorporating 3D printing technologies to improve patient outcomes is being witnessed globally.

- For instance, in March 2023, Smile Health Orthodontics (SHO) initiated the offerings of 3D printed LightForce ceramic braces and 3D printed clear aligners, and other treatment solutions. Moreover, there is an increase in the funding initiatives for 3D printing that is being witnessed across the market.

- For instance, in August 2023, LightForce Orthodontics received a USD 80.0 million funding series from the Ally Bridge Group to expand its business for 3D printed braces by utilizing AI models. Such growth in the investments and initiatives for AI-based and 3D printing technologies is expected to be a major factor that drives the global orthodontic braces market growth.

Download Free sample to learn more about this report.

Orthodontic Braces Market Growth Factors

High Prevalence of Malocclusion Increases the Adoption of Dental Braces

Malocclusion involves the misalignment of the teeth or the improper jaw positioning. Orthodontic solutions, including braces, are commonly utilized to correct malocclusion. These offer the application of gentle pressure on the teeth to correct the alignment.

Dental malocclusion is described as a variation in the shape, which often has no significance with other medical conditions. However, it is a cosmetic issue, and untreated malocclusion can negatively impact the quality of life. The market for orthodontic braces is growing due to the increasing number of individuals with malocclusion globally, particularly amongst those with genetic disorders, including osteogenesis imperfecta. This condition weakens the bones and alters the shape of the teeth, further driving the demand for treatment. Such an increase in the demand for such treatments, will lead to an increase in the adoption of braces.

- A stat from Medicina in May 2021, osteogenesis imperfecta refers to a rare genetic condition, affecting approximately 1 in 15,000 to 20,000 births. Such prevalence of these conditions is expected to increase the adoption of orthodontic braces in the near future.

Increasing Adoption of Lingual and Ceramic Braces to Propel Market Expansion

Lingual braces are placed on the inside of the teeth, making them virtually invisible. Similarly, ceramic braces use tooth-colored or clear brackets that blend in with the natural teeth. The growing preference for discreet orthodontic treatments, especially amongst adults, is driving the demand for these aesthetic options.

Additionally, several prominent companies are investing in research and development activities to create more comfortable, efficient, and aesthetically pleasing braces. The continuous improvements in the lingual and ceramic braces, such as an improved design, make them more appealing to the patients. Such advanced product launches and the growing demand for orthodontic treatment are anticipated to drive the adoption of lingual and ceramic braces.

Moreover, the emerging availability of customized lingual and ceramic braces is attracting a wider range of patients due to their aesthetics and better treatment outcomes, which is expected to boost the orthodontic braces market growth.

RESTRAINING FACTORS

Surge in the Expenses and Potential Adverse Effects of Treatment to Limit Market Growth

The global market is growing globally due to the increasing need for dental treatments to address issues, such as dental malocclusion. However, the high costs and lengthy treatment durations associated with these procedures are projected to constrain the market expansion during the forecast period.

- For instance, according to SMILE2IMPRESS SL., the average cost of braces treatment in the U.S. is estimated to be USD 3,000 to USD 7,000 for non-ligating metal braces, USD 4,000 to USD 7,500, and USD 8,000 to USD 13,000 for the lingual braces.

Additionally, these prolonged treatments have been linked to various negative consequences, such as increased incidence of dental cavities, decalcification, gingival irritation, temporomandibular disorders, and root resorption. Moreover, the long-term adverse effects, such as allergic reactions and other complications, further impede market growth. These limitations associated with orthodontic braces are anticipated to limit the global market growth.

Orthodontic Braces Market Segmentation Analysis

By Placement Analysis

Buccal Braces Segment Dominated the Market Due to its High Adoption in 2024

By placement, the market is divided into buccal braces and lingual braces.

The buccal braces segment accounted for the largest share of 89.55% in the market in 2026. The buccal brackets include all the braces that are placed on the front side of the teeth. The effectiveness and reliability of these braces are expected to be key factors for its dominance in the market. Moreover, the introduction of ceramic brackets in the self-ligation options is anticipated to drive the segment growth further.

The lingual braces are expected to grow at a high CAGR during the forecast period. The discreet option of these braces increases, and the growing demand for these braces among adults is expected to increase the adoption of these braces in the near future.

To know how our report can help streamline your business, Speak to Analyst

By Design Analysis

High Adoption of Non-ligating Braces Due to Greater Cost-effectiveness Boost Segmental Dominance

Based on design, the market is segmented into the non-ligating braces and self-ligating braces.

Non-ligating braces dominated the global orthodontic braces market share of 83.19% in 2025. Non-ligating braces are metal or ceramic braces that require ligatures, such as elastic bands, to hold the archwire to the bracket to achieve gentle pressure. The dominance of the segment is attributed to the wider availability of orthodontic braces and their cost-effectiveness compared to the self-ligating braces. Additionally, the increasing orthodontic visits and the high adoption of these braces among the teen population are expected to drive segmental growth.

- For instance, as per Burke & Redford Orthodontists, nearly 80% of the Americans wearing braces are children and teens between the age group of 9 and 14. Such a high proportion of teens wearing braces and the popularity of these non-ligating braces are expected to drive segmental growth.

On the other hand, the self-ligating braces are anticipated to grow at a higher CAGR during the projected period. These braces do not require elastic bands to connect the archwire and the brackets. These brackets create lesser friction between the wire and braces, enabling faster tooth alignment as these slide along the wire. Such advantages of self-ligating are expected to result in faster growth in the coming years.

By Material Analysis

Stainless Steel Braces Segment Dominated the Market Due to Its Wider Availability

Based on material, the market is classified into titanium, ceramic, stainless steel, and others.

In 2026, the stainless steel segment held the majority share of 59.94% the global market. The durability of the stainless steel material, coupled with the widespread availability of these products, is expected to drive the segment's growth. Increased accessibility to these products is also driving the adoption of stainless steel braces among patients seeking effective orthodontic solutions.

The ceramic segment is expected to grow at a faster CAGR during the forecast period. The rising prevalence of malocclusion and ceramic orthodontic braces are anticipated to boost segmental growth. Moreover, a growing preference for aesthetically pleasing brackets amongst adults is expected to drive segmental growth.

- For instance, in April 2019, Ormco (Envista Holding Corporation) launched the Symetri Clear ceramic twin brackets in the .018 slot option.

The titanium segment is expected to grow significantly in the forecast period due to advantages, such as the material’s stability that offers better torque for tooth movement. The others segment, which includes cobalt chromium, is expected to grow due to the affordability of these products.

By Component Analysis

High Demand for Self-ligating Braces to Boost Brackets Segment

Based on the component, the market is classified into bracket, bands & buccal tubes, archwire, and others.

The brackets segment accounted for the largest share of 70.76% in 2026. For a single procedure, few brackets are required, which leads to the dominance of the market and is expected to continue its dominance in the forecast period. Additionally, a growing emphasis on dental aesthetics and an increasing number of ceramic and self-ligating product launches are increasing the demand for the brackets.

The archwire segment held considerable revenue in 2024. Archwires need to be replaced every 6 to 8 weeks as they exert the necessary pressure on the teeth and brackets. These factors are increasing the consumption of these products throughout the procedures. Moreover, new product launches are expected to drive the market significantly during the forecast period. For instance, in January 2023, DynaFlex launched the infinity archwire to offer improved aesthetics for the orthodontic treatment.

The bands & buccal tube segments are expected to grow considerably due to the high prevalence of class II and III malocclusion. The others segment comprises products, such as the molar bands, and is expected to grow considerably due to the increasing prevalence of class 2 and 3 malocclusion, which requires additional pressure for the alignment.

By End-user Analysis

Solo Segment Dominated due to the Large Pool of Solo Practitioners Present Globally

Based on end-user, the market is classified into solo practices, DSO/group practices, and others.

Solo practices generated higher revenue in 2024 driven by the presence of a significant number of solo practitioners and the financial benefits that the practitioners receive through this model. In addition, the ownership of these practices, autonomy, and the ability to provide personalized services are the key factors expected to contribute to the growth of this segment during the projected period.

In the last few years, DSO/group practices have rapidly expanded, especially in developed nations. The increasing popularity of dentists choosing to work in the DSO setting and the decreased administrative responsibilities of being part of a group practice drive the segmental growth. Additionally, the rising number of new clinics, acquisitions, and partnerships in the dental industry are the other factors fueling this trend.

- For instance, SAGE DENTAL MANAGEMENT, LLC., opened 27 new practices from June 2023 to October 2023, across the U.S. Such an increase in the number of DSOs is expected to increase the orthodontics procedures adoption rate among the population.

The others segment comprises settings, such as hospitals and research institutes, which are expected to grow considerably. Also, the rising adoption of teledentistry and the growth in virtual technologies significantly drive segmental growth by improving patient outcomes, thereby increasing the adoption rate of orthodontic braces.

REGIONAL INSIGHTS

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Orthodontic Braces Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.78 billion in 2025 and USD 0.83 billion in 2026, and is expected to continue its dominance in the forecast period. The region’s dominance can be credited to the presence of the major players and the wider availability of technologically and aesthetically advanced orthodontic braces. Moreover, the increasing preference for teeth alignment procedures among the general population and innovative product launches are expected to support the region's market growth. The U.S. market is projected to reach USD 0.75 billion by 2026.

- For instance, according to the article published in BMC Oral Health in May 2021, over 9.0 million individuals in the U.S. receive orthodontic treatment every year. Such a large number of orthodontic procedures and technological advancements are expected to boost the market growth in the region further.

Europe held a substantial market share in 2024 and is expected to experience significant market growth in the coming years. This growth can be attributed to the presence of advanced healthcare facilities, a greater emphasis on dental care, and the availability of innovative dental products, which increases the adoption of orthodontic braces. The UK market is projected to reach USD 0.06 billion by 2026, while the Germany market is projected to reach USD 0.08 billion by 2026.

Asia Pacific is projected to witness the fastest CAGR throughout the forecast period. This can be majorly attributed to the emerging adoption of advanced technologies for dental treatment, the growing number of multispecialty hospitals & dental clinics, and increasing product supplies in China, India, Japan, and Australia. Additionally, the strategic initiatives by the global players to promote digital dentistry are expected to drive the region’s market growth. The Japan market is projected to reach USD 0.05 billion by 2026, the China market is projected to reach USD 0.09 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

Latin America and the Middle East & Africa are anticipated to observe moderate growth over the analysis period. The rising collaborations of major players to expand their geographical presence in these regions and the increase in the number of people opting for aesthetic procedures are expected to drive growth in these regions. Moreover, increased awareness about orthodontic braces in these regions is expected to drive the market.

KEY INDUSTRY PLAYERS

Ormco (Envista Holding Corporation) Dominated in 2024 with Advanced Product Portfolio

The Ormco (Envista Holding Corporation) dominated the market in 2024. The company’s strong and wide range of product portfolio, including ceramic, self-ligating braces, and metal braces, has been fueling its dominance in the market. Additionally, a focus on advanced product launches is expected to drive the market in the coming years. Moreover, the company’s focus on digital and customized brackets is expected to drive the company’s growth further.

Companies, including 3M and Henry Schein, Inc. held significant revenue in 2024. These players’ initiatives, such as strategic collaborations and geographical expansion, are expected to drive its growth.

Other players, such as DB Orthodontics Limited, American Orthodontics, LightForce Orthodontics, are focusing on digital technologies and 3D printing technologies to enhance the outcome of their products, which is expected to propel these companies’ growth in the forecast period.

LIST OF TOP ORTHODONTIC BRACES COMPANIES:

- Henry Schein, Inc. (U.S.)

- Ormco (Envista Holding Corporation) (U.S.)

- 3M (U.S.)

- DB Orthodontics Limited (U.S.)

- American Orthodontics (U.S.)

- TP Orthodontics, Inc. (U.S.)

- G&H Orthodontics (U.S.)

- DynaFlex (U.S.)

- LightForce Orthodontics (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2023: Orthodontic Details collaborated with DynaFlex, G&H Orthodontics, 3M, Reliance Orthodontic Products, and other suppliers to adopt their products and solutions.

- January 2023: OrthoNu launched tweakz for braces and aligners, a new category of products designed specifically to meet the needs of orthodontic patients.

- August 2021: Sage Dental partnered with Institut Straumann AG to utilize AI in remote orthodontic treatment monitoring and digital intraoral scanning for orthodontic usage.

- February 2021: Ultradent Products Inc. collaborated with American Orthodontics to distribute Ultradent’s Opal Orthodontics branded products, increasing overall company revenue.

- May 2019: LightForce Orthodontics introduced a fully-customized, 3D-printed bracket system. The system is produced for individual patients using 3D printing technology.

REPORT COVERAGE

The report provides an in-depth analysis of the market. It focuses on market segments, such as design, material, type, product, end-user, and region. Besides, it offers the market forecast in relation to the current market dynamics, the impact of COVID-19 pandemic, and the latest market statistics. Additionally, the report provides values of market shares for different segments and factors driving market growth. The report also provides the competitive landscape of the market at global level. Furthermore, the report provides the key insights on technological advancements, prevalence of malocclusion, and key industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.61% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Design

|

|

By Material

|

|

|

By Placement

|

|

|

By Component

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to grow from USD 1.66 billion in 2026 to USD 2.77 billion by 2034.

The market will exhibit a CAGR of 6.61% during the forecast period of 2026-2034.

Currently, the buccal segment is leading the market in terms of placement.

The high prevalence of malocclusion increases the adoption of dental braces, and a significant rise in the adoption of lingual and ceramic braces boosts market growth.

Henry Schein, Inc., Ormco (Envista Holding Corporation), and 3M (U.S.) are some of the key players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us