Outdoor Heating Market Size, Share & Industry Analysis, By Product Type (Freestanding, Tabletop, Wall mounted, and Hanging), By Fuel Type (Electric, Gas / Propane, and Others (Wood)), By Application (Catering and hospitality, Commercial and industrial space heating, Residential Outdoors, and Indoor Agriculture/Livestock Brooder), and Regional Forecast, 2026-2034

Outdoor Heating Market Size

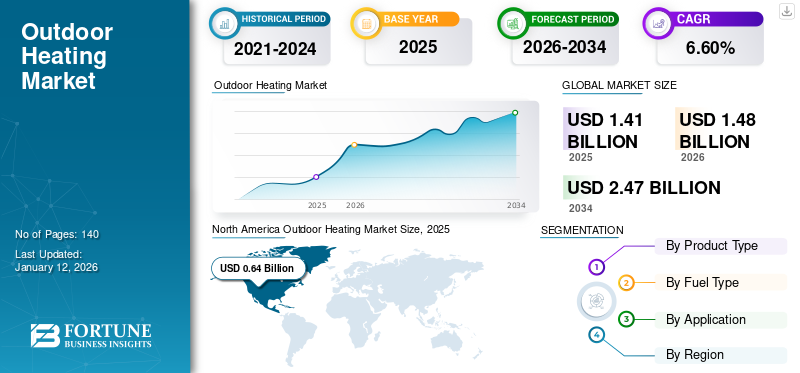

The global outdoor heating market size was valued at USD 1.41 billion in 2025 and is projected to grow from USD 1.48 billion in 2026 to USD 2.47 billion by 2034, exhibiting a CAGR of 6.60% during the forecast period. North America dominated the global market with a share of 45.70% in 2025. The outdoor heating market in the U.S. is projected to grow significantly, reaching an estimated value of USD 232.8 million by 2032, driven by the upsurge in outdoor entertaining activities.

Outdoor heaters are purpose-built devices designed to emit heat into the surrounding area where individuals congregate. This emitted heat is then absorbed by nearby objects and people, effectively increasing the ambient temperature. Types of outdoor heating appliances encompass gas-powered patio heaters, as well as electric lamps utilizing ceramic or quartz elements, and fire pits. These heaters come in a variety of styles, such as wall-mounted, hanging, or tabletop configurations, catering to diverse outdoor settings and preferences.

The COVID-19 pandemic prompted many businesses to limit indoor dining, leading to a surge in outdoor dining. To accommodate customers during colder months, businesses began using outdoor heating bulbs, resulting in positive impact on the market. This trend extended beyond restaurants, with individuals also opting for outdoor heating for their homes. In October 2022, commercial facilities and hospitality providers drove increased demand for outdoor heating units, aiming to expand outdoor capacities to offset reduced indoor capacities due to safety protocols. The demand for alfresco dining continued to rise post-pandemic, with operators investing in outdoor setups. This balanced supply and demand scenario is expected to drive market growth in the forecast period.

Outdoor Heating Market Trends

Growing Preference for Eco-Friendly Outdoor Heaters Drives Market Expansion

Electric outdoor heaters provide efficient warmth during cold weather and offer environmental benefits. This cost-effective alternative to gas heaters quickly heats up spaces with minimal resource consumption, making it an ideal choice for eco-conscious individuals looking to reduce pollution levels.

According to the U.S. Department of Energy (DOE), American consumers spend approximately USD 1 billion on electricity every minute. In response, consumers are transitioning to highly efficient appliances such as electric patio heaters to reduce electricity usage. In 2021, the Green America Organization reported that U.S. consumers saved over USD 12 billion in utility bills and contributed to greenhouse gas emissions reduction by adopting energy-efficient devices.

The versatility in size, shape, portability, and mounting options of electric patio heaters appealing to customers across commercial, industrial, and residential sectors. These features contribute to the ongoing expansion of the global market.

Outdoor Heating Market Growth Factors

Increasing Demand For Outdoor Heaters at Commercial Spaces to Bolster Market Growth

The market growth is being fueled by the increasing demand for outdoor heating appliances from commercial restaurants, hotels, bars, and other establishments. According to a survey conducted by the National Restaurant Association, approximately half of restaurants worldwide are planning to implement outdoor dining setups using patio outdoor heaters, reflecting rising consumer preference for outdoor dining after the COVID-19 pandemic. This surge in demand for outdoor heaters by several restaurants aims to provide a warm environment for customers. In addittion, in the U.S., more than half the nation’s full-services restaurants have planned to adopt outdoor dining with proper installation of tents and patio outdoor heaters.

Rising post-pandemic sales in restaurants, coupled with a surge in consumer spending on outdoor dining globally have propelled market growth. The restaurants and food services industry is the fastest adopter of outdoor heating appliances post-pandemic, with several restaurant owners planning to adopt these appliances to enhance customer experience. Rising restaurant and food service industry aids the market growth.

RESTRAINING FACTORS

Rising Environmental Concerns and High Operational Costs of Electric Outdoor Heaters May Hinder Market Growth

The proliferation of gas-powered outdoor heaters, reliant on fossil fuels such as coal, propane, and natural gas, significant contributes to environmental degradation. These heaters emit substantial amounts of CO2 and other pollutants, including nitrogen oxides and sulfur dioxide, raising alarms about their environmental impact and potentially impeding the growth of the market.

For instance, a study by the Propane Education and Research Council revealed that a standard propane patio heater with a 3,000 Watt capacity emits approximately 42 kg of CO2 while heating a 9 square meter patio for 8 hours nightly. This is equivalent to the emissions from driving an average car 104 miles in the U.S. Moreover, propane-based outdoor heaters emit 5.76 kg of CO2 per gallon, as highlighted in a report by the Sustainable Princeton Organization.

Additionally, gas-powered patio heaters contribute to nighttime warming of the environment, releasing CO2 rapidly during operation. According to a Phys.org report, such heaters emit around 108 MJ of energy and approximately 3 kg of CO2 in just a couple of hours of usage, exacerbating global warming and environmental concerns.

These findings underscore the urgent need for more sustainable alternatives in the sector to mitigate carbon emissions and address environmental challenges. This approach will foster market growth aligned with eco-friendly practices.

Download Free sample to learn more about this report.

Outdoor Heating Market Segmentation Analysis

By Product Type Analysis

Freestanding Segment to Dominate Owing to Due to Its Portability

By product type, the market is divided into freestanding, tabletop, wall-mounted, and hanging.

The freestanding segment possessed the highest market share in 2026, accounting for 60.81% of the total market share, driven by its ease of portability. These heaters can be effortlessly moved to areas requiring heat, emitting infrared waves directly to surfaces and individuals without obstruction from wind or breeze.

Tabletop heaters are witnessing a moderate increase in demand. Compact and typically attached to patio tables, they offer both propane and electric variants, boasting portability as a key advantage.

Additionally, wall-mounted and hanging heaters are experiencing steady growth. Attached to walls, they optimize floor space, making them ideal for compact patios or enhancing available space for guests and furniture on larger patios.

By Application Analysis

Catering and Hospitality Segment to Lead Owing to Surge in Extended Outdoor Dining Seasons

Based on application, the market is divided into catering & hospitality, commercial & industrial space heating, residential outdoor, and indoor agriculture/livestock brooder.

The catering & hospitality sector held the highest market share in 2026, accounting for 58.11% of the total market share, driven by the growing use of outdoor spaces in cafés and bars. Outdoor heaters play a pivotal role in ensuring guest comfort and extending outdoor dining seasons, offering features such as instant heat, light, cooling, speakers, and bluetooth control.

The commercial & industrial space heating segment is forecasted to experience significant expansion. Incorporating heating solutions in these spaces enhances operational efficiency and provides comfort for employees, particularly in warehouse environments.

In residential outdoor settings, the demand for outdoor heaters is on the rise, as they offer temperature control and serve as decorative elements, prolonging outdoor leisure time.

Moreover, the indoor agriculture/livestock brooder segment is expected to grow steadily due to the adoption of heaters in greenhouse farming and animal enclosures, facilitating optimal conditions for crop growth and ensuring animal welfare.

The trend toward alfresco dining is driving demand for outdoor heating solutions across various sectors, signaling notable progress for the catering and hospitality industry and beyond.

By Fuel Type Analysis

The Fastest Growth of Electric Outdoor Heaters in Market Due to Lower Production Costs

By fuel type, the market is segmented into electric, gas/propane, and others (wood).

Electric heaters are poised for the fastest growth during the forecast period, attributed primarily to their lower production costs. Moreover, the minimal expenses associated with maintaining and preserving electric heaters are driving increased customer demand.

Meanwhile, the gas/propane segment held the highest market share in 2026, accounting for 54.05% of the total market share and is to sustain a moderate growth trajectory during the forecast period, due to its widespread availability, convenience, and cost-effectiveness compared to other fuel types. Nevertheless, propane-based products are expected to capture a substantial market share by 2032, owing partly to the diverse range of offerings within this category. This diversity contributes to the segment's dominance in the market landscape.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Based on geography, the market is categorized into Europe, North America, the Asia Pacific, South America, and the Middle East & Africa.

North America Outdoor Heating Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America commanded the highest market share, with the market size valued at USD 0.64 billion in 2025 and increasing to USD 0.68 billion in 2026, propelled by burgeoning commercial and residential construction endeavors in the U.S. and Canada, where these heaters find extensive application. Andrew Rigie, Executive Director of the New York City Hospitality Alliance, reports a staggering 10,500 eating and drinking establishments in New York City alone offering outdoor dining options. This growing trend toward al fresco dining, coupled with proactive initiatives by dining establishments, stands to bolster the demand for outdoor heating units across North America. The US market is projected to reach USD 0.55 billion by 2026.

The U.S. is poised to experience significant growth in the foreseeable future, with projections indicating substantial market revenue generation and dominance within the North American market. This growth is attributed to the strong presence of key market players in the U.S., which greatly contributes to market performance. Additionally, the ongoing expansion of hospitality and catering infrastructures, including the construction of hotels, bars, pubs, and restaurants, coupled with the increasing popularity of outdoor dining concepts, further drives the demand for outdoor heaters in the country. The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.05 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

In South Asia, especially across the Indian subcontinent, the need for outdoor heating devices remains low for over ten months annually due to the prevalent tropical climate. However, the presence of robust manufacturing facilities in China, South Korea, and Japan positions the Asia Pacific region as a pivotal player in the global market, poised to expand its Asia Pacific outdoor heating market share further. The Japan market is projected to reach USD 0.02 billion by 2026, the China market is projected to reach USD 0.08 billion by 2026, and the India market is projected to reach USD 0.01 billion by 2026.

Across Europe, a promising growth trajectory is evident in the global market, fueled by the increasing installation of outdoor heaters in various public settings such as cafes, restaurants, breweries, and rooftop hotels. However, recent regulations in France, targeting the prohibition of outdoor heaters regardless of their power source to combat pollution, are poised to restrain outdoor heating market growth within the region.

The Middle East & Africa and South America are projected to have the least promising development prospects in the forecast period. The expansive desert landscapes in these regions, coupled with the sweltering climates of Gulf countries, could curtail product sales across the Middle East & Africa.

Key Industry Players

Key Players Focus on Product Diversity to Target Diverse Range of Consumers

Major manufacturers in the market prioritize creating diverse product lines integrated with advanced technologies to attract more customers using outdoor heating systems across various applications. Many consumers seek heating solutions that meet critical needs while operating with optimal efficiency. Companies form strategic partnerships and collaborations with other industry players, suppliers, or retailers to enhance their distribution networks, expand market reach, and leverage complementary strengths in product development and marketing.

List of Top Outdoor Heating Companies:

- Infratech (U.S.)

- Lava Heat Italia (U.S.)

- Bromic (U.S.)

- Calcana (Canada)

- Ambience (U.S)

- Fire Sense (U.S.)

- Schwank (patioSchwank) (U.S.)

- AZ Patio Heaters (U.S.)

- Napoleon (Canada)

- Dayva (U.S.)

- Lynx Grills (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Heatsail introduced TWIG, its newest outdoor heating solution, featuring a harmonious fusion of stylish design, space saving form factor, and practicality, tailored for both residential and commercial environments.

- July 2023: Haloo launched the Outdoor Rotating Electric Patio Heater, crafted to enhance any outdoor setting with its modern style and high-grade construction. This heater seamlessly blends functionality and robustness, boasting an IP54 rating for protection against water and dust.

- October 2022: Nexgrill, a distinguished purveyor of outdoor lifestyle equipment, announced the arrival of its latest assortment of patio heaters. This strategic expansion of their product line aimed to fortify Nexgrill's market presence and offer enhanced comfort to outdoor enthusiasts.

- October 2022: Solo Stove, the visionary force behind smokeless fire pits, unveiled its towering patio heater. Enveloping a generous 10-foot radius with comforting warmth, this engineering marvel promises a consistent burn time of 3 hours, epitomizing the pinnacle of outdoor heating innovation.

- February 2021: Dometic announced a landmark agreement to acquire Twin Eagles, a move poised to catalyze its expansion in the vibrant North American market. With Twin Eagles as a strategic asset, Dometic positioned itself for accelerated growth and innovation in the realm of outdoor lifestyle products.

REPORT COVERAGE

The research report offers an in-depth analysis of the industry and focuses on key factors such as leading companies, product type, installation, and leading applications of the product. Besides, the report provides insights into the market trends and highlights key industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Fuel Type

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 2.47 billion by 2034.

In 2025, the market was valued at USD 1.41 billion.

The market is projected to grow at a CAGR of 6.60% during the forecast period.

The catering & hospitality segment is expected to lead the market.

Surge in outdoor entertainment activities is a key factor driveing market expansion.

Infratech, Lava Heat Italia, BROMIC, Calcana, Ambience, Fire Sense, Schwank (patioSchwank), AZ Patio Heaters, Napoleon, Dayva, and Lynx Grills. are the top players in the market.

North America holds the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us