PCB Design Software Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Application (Computer & Consumer Electronics, Telecommunication Equipment, Medical Devices, Industrial Equipment, Automotive Components, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

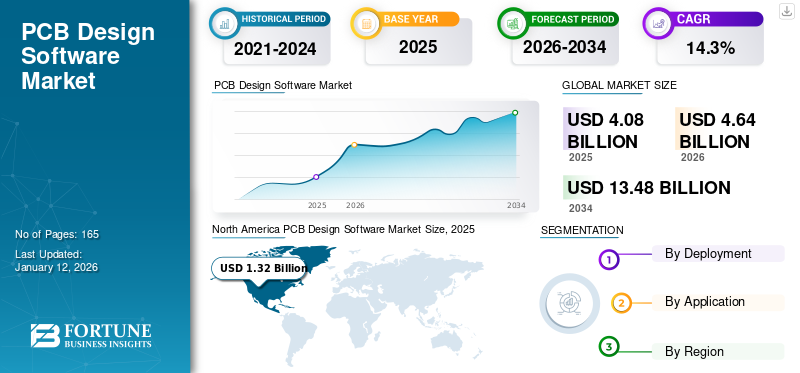

The global PCB design software market size was valued at USD 4.08 billion in 2025 and is projected to grow from USD 4.64 billion in 2026 to USD 13.48 billion by 2034, exhibiting a CAGR of 14.3% during the forecast period. North America dominated the global market with a share of 32.4% in 2025.

Printed Circuit Board (PCB) design software facilitates the integration of mechanical support and electronic components in real form by designing electronic circuits. The PCB design method assists electrical engineers in designing layouts for printed circuit boards. It uses the layout software for combining component routing and placement to describe electrical connections on a manufactured circuit board and validate circuit graphic designs. PCB design software is frequently incorporated into other design software systems, such as machine and product design software and all-purpose CAD software.

Moreover, PCB design software is combined with other related software, such as Product Lifecycle Management (PLM), which assists engineers in better understanding the designs and layouts of PCBs. Integrating embedded intelligence such as the Internet of Things (IoT) and Artificial Intelligence (AI) in PCB design software drives the market by creating opportunities in sectors such as automotive, electronics, medical, communication systems, and others.

The COVID-19 pandemic severely impacted PCB manufacturing companies due to imposed lockdowns globally. The semiconductor industry was affected during the pandemic due to less demand for electronic devices and minimum manufacturing processes hindering the PCB design software market growth for short-term. Further, due to the increased use of PCB boards in the medical & healthcare sector, the demand for PCB boards rose due to the extensive use of medical equipment during the pandemic. Organizations deployed cloud-based solutions to ensure business continuity during the crisis. For instance,

- In December 2022, German startup Celus announced the design flow for circuit design and PCB development with the help of Artificial Intelligence (AI) and Machine Learning (ML), aiming to revolutionize the electronics industry.

The surge in the adoption of cloud services for digitalization amid the COVID-19 pandemic increased the demand for software.

IMPACT OF GENERATIVE AI

Transforming PCB Designing with the Help of Generative AI Drives Market Growth

In the semiconductor and electronics industry, 2023 has witnessed significant advancements in the adoption and expansion of generative AI. According to the reports, Cadence Design Systems has introduced artificial intelligence (AI) on its flagship chip design suite. It allows designers to build minor and comparatively fast processors with less power consumption, resulting in cost savings. Cadence Allegro X AI automates PCB placement and routing for small to medium-size designs, reducing both physical layout and analysis time.

PCB Design Software Market Trends

Integration of Product Lifecycle Management (PLM) over PCB Design Software to Act as a Key Trend

Product Lifecycle Management (PLM) software manages the information and processes across global supply chains at every stage of a product or service lifecycle. It includes data from items, products, parts, requirements, documents, quality workflows, and engineering change orders.

Integrating PLM software in circuit design creates a top-down design with better visibility in the electronics and semiconductor sectors. Product lifecycle management in PCB design creates continuous innovation in the circuits' designs with new components as new technology becomes available. PLM software in PCB design functions by documenting design data, facilitating quick access for manufacturing.

It ensures stable documentation over time, making it easy to track design revisions and begin new product manufacturing. PLM software offers engineers a complete idea in terms of simulation regarding how the product will perform in different conditions.

Thus, the factors above are expected to be a trend in the forecast period.

Download Free sample to learn more about this report.

PCB Design Software Market Growth Factors

Increasing Need to Minimize Errors and Product Development to Drive Market Growth

The PCB design software market in the electronics industry is increasingly being developed to create circuit board designs to save time and reduce errors during product development. This software can improve the production rate and enable scalable integration for complex circuit designs. Moreover, as technology advances, there is a trend toward reducing the size of PCB boards, compelling major players to focus on developing advanced PCBs for competitive advantages.

Moreover, the adoption of design software gives engineers flexibility to simulate current design, allowing them to identify and address issues in real-time. This software offers access to auto-placement, auto-routing, and auto-tuning, making the PCB fabrication a relatively seamless affair.

Cost analysis is a major factor for engineers, and with the help of design software, engineers can estimate the total cost while designing a circuit. This benefits better planning and aids in decision-making on the quality of materials used and the price of several components. Therefore, the design of PCB software is experiencing increased adoption owing to its wide-ranging applications in medical, consumer electronics, automotive, and military industries.

Thus, the factors mentioned above act as driving forces for the market's growth.

RESTRAINING FACTORS

Availability of Open-source Software is Expected to Hamper the PCB Design Software Market

Professionals are more reliant on open-source software as the software is available on the internet for free. In addition, the availability of pirated copies poses risk due to vulnerabilities in components and third-party vendors. The escalating threat from third-party risk jeopardizes the security of enterprise applications. For instance,

- November 2021- According to an industry expert’s survey of 530 security decision-makers, 33% of breaches come from a third-party service or software. Another 35% of external attacks exploit vulnerabilities, leading to data exploitation through various sources.

Thus, the availability of open-source software restricts the key player business and market growth for PCB design software.

PCB Design Software Market Segmentation Analysis

By Deployment Analysis

Collaborative Efficiency in PCB Design to Fuel Cloud Segment’s growth

Based on deployment, the market is bifurcated into cloud and on-premises.

Cloud software is expected to grow significantly during the forecast period. Cloud computing is changing the approach to PCB design. In 2026, the Cloud segment is projected to lead the market with a 78.59% share. The adoption of cloud-based solutions in this software is continually advancing as companies focus on increasing productivity and shortening design cycles, thus allowing engineers to work from anywhere. This approach aids design teams in reducing miscommunication, redesign iterations, and time to market. For instance,

- In May 2020, Altium Ltd. launched Altium 365, the first cloud platform for Printed Circuit Board (PCB) design. The cloud software aimed to simplify collaborations for PCB designers, manufacturers, and part suppliers throughout the design-to-production process.

Further, on-premises deployment in this software market accounted for the highest market revenue share in recent years. This demand is due to enhanced data security and a greater rate of software implementation among start-ups and small and medium-sized businesses.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Computer & Consumer Electronics Segment to Lead owing to Diverse Applications

On the basis of applications, the market is fragmented into computer & consumer electronics, telecommunication equipment, medical devices, industrial equipment, automotive components, and others (aerospace & defense and safety and security equipment).

Computer & consumer electronics segment is estimated to grow with a CAGR of 15.3% during the forecast period due to daily-use consumer electronics & computer products incorporating PCBs, significantly increasing the demand for PCBs. The diverse applications in consumer electronics, influenced by size, shape, and function, drive extensive PCB design development. The Computer & Consumer Electronics segment is forecast to represent 39.48% of total market share in 2026.

Further, telecommunication equipment is the second leading segment among others in terms of market share owing to increasing development of new technologies and availability of a huge amount of data coupled with high investments and expansion of telco infrastructure, are expected to boost the segment’s growth in the coming years.

REGIONAL INSIGHTS

Regionally, the market is studied across North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

North America PCB Design Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.32 billion in 2025 and USD 1.48 billion in 2026. North America holds the majority of the share driven by the presence of leading companies in the U.S. due to early tech-driven innovations and a rising preference for high-speed analogue circuits across multiple industries. The U.S. market is projected to reach USD 1.17 billion by 2026.

Governments are investing in semiconductor manufacturing companies to boost global competitiveness. The U.S. introduced the CHIP Act to revitalize its chip-making ecosystem across a wide range of technologies, ranging from current-generation chips to large-scale projects. Various semiconductor companies have announced multiple projects to increase manufacturing capacity in the U.S. and expand the domestic semiconductor value chain, leading to demand for PCB design software. During the estimated timeframe the U.S. is anticipated to capture significant market share.

Europe

Europe is anticipated to account for a noteworthy PCB design software market share due to significant investment and development in PCB manufacturing. The PCB market is increasing as companies are enhancing their services to offer improved experience. The companies also design and manufacture high-end PCB prototypes in various fields such as aviation, measurement technology, and medicine. The UK market is projected to reach USD 0.27 billion by 2026, while the Germany market is projected to reach USD 0.32 billion by 2026.

Asia Pacific

Asia Pacific is projected to grow exponentially due to significant manufacturing companies adopting PCB design software in developing countries such as India, South Korea, Japan, and China. China is enhancing the service by adding features such as 3D visualization, data management, and high-speed design capabilities to simplify the process of circuit design software. Furthermore, the growing functionality of smartphones and the rising number of electronic equipment in transportation is expected to support market growth. The Japan market is projected to reach USD 0.20 billion by 2026, the China market is projected to reach USD 0.60 billion by 2026, and the India market is projected to reach USD 0.12 billion by 2026.

The increasing demand for PCB training in Dubai has made it a popular technology hub in industries such as manufacturing due to its commercial benefits, including cost reduction and dependability, contributing to stagnant growth in the Middle East & Africa market.

South America is attaining steady popularity in the market due to a significant increase in the production of consumer electronics and the growing end-user penetration is anticipated to accelerate the market expansion in the region.

KEY INDUSTRY PLAYERS

Leading Companies Deploy Various Strategies to Increase Global Reach

Prominent industry leaders, which include Altium Limited, Autodesk Inc., NATIONAL INSTRUMENTS CORP., and others are executing diverse business strategies. Major global enterprises prioritize expanding their operations and market footprint through acquisitions and mergers. Their objective is to purchase smaller regional firms in order to enhance their market presence.

List of Top PCB Design Software Companies

- Autodesk Inc. (U.S.)

- ANSYS, Inc. (U.S.)

- Cadence Design Systems, Inc. (U.S.)

- Siemens (Germany)

- Zuken (Japan)

- Altium Limited (U.S.)

- NATIONAL INSTRUMENTS CORP. (U.S.)

- Labcenter Electronics (U.K.)

- Novarm Limited (Ukraine)

- KLA Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2022: Altium Designer introduced a 3D PCB layout tool that would combine electrical circuits with three-dimensional mechanical parts.

- June 2022: Siemens Digital Industries unveiled Siemens NX software, an advanced product engineering solution fostering enhanced collaboration, intelligent data capture, and electronic co-design. Siemens NX expanded its electronic design functionalities, introducing a seamless workflow tailored for both rigid PCB and rigid-flex designs.

- June 2022: Cadence Design Systems started adding artificial intelligence (AI) into its flagship set of chip design software to benefit chip designers in building better chips.

- January 2022: Altair, a technology company in computational intelligence and engineering, launched a software tool called Altair PollEx. This innovative software tool, designed for Altium users, empowers PCB designers to forecast and improve overall PCB performance and validate manufacturability.

- November 2020: Downstream announced new versions of PCB post-processing solutions BluePrint-PCB and CAM350 V. With these launches, both products would support the import and conception of CAD designs containing Rigid Flex, Flex, and Embedded component data in both 3D and 2D views.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.3% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 13.48 billion by 2034.

In 2025, the market was valued at USD 4.08 billion.

The market is projected to grow at a CAGR of 14.3% during the forecast period.

The computer & consumer electronics segment is expected to lead the market.

Increasing need to minimize errors and product development is the key factor driving market growth.

Autodesk Inc., ANSYS, Inc., Cadence Design Systems, Inc., Siemens, and Altium Limited are the top players in the market.

North America holds the major market share.

By application, telecommunication equipment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us