Physical Security Market Size, Share & Industry Analysis, By Component (Hardware, Software, and Services), By End-user (Residential and Commercial/Industrial), By Type (Video Surveillance Systems, Biometrics & Access Control Systems, Intrusion Detection and Prevention Systems, Fire Detection Systems, Physical Security Information Management (PSIM), and Others), By Vertical (BFSI, Government, Healthcare, Manufacturing, Retail, Transportation & Logistics, Energy & Utilities, and Others), and Regional Forecast, 2026 – 2034

Physical Security Market Current & Forecast Market Size

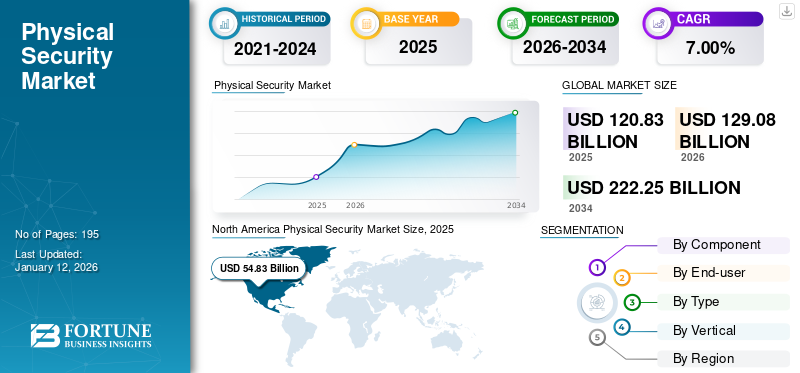

The global physical security market size was valued at USD 120.83 billion in 2025. The market is projected to grow from USD 129.08 billion in 2026 to USD 222.25 billion by 2034, exhibiting a CAGR of 7.00% during the forecast period.

Physical security involves protecting people, property, and physical assets from theft, damage, unauthorized entry, or destruction. The objective of physical security is to maintain a defined level of safety for a location by preventing unauthorized access by individuals, vehicles, and cargo, identifying and delaying intruders, and preventing emergencies and sabotage.

The growth of the physical security market is expected to be driven by the rise in malicious activities and security breaches targeting physical systems, increased spending to protect organization’s critical assets, and adoption of cloud-based data storage solutions. The 'World Security Report 2023' indicates that 46% of businesses surveyed reported an uptick in their security budgets, attributed to higher operational expenses, a fluctuating economic environment, and growing concerns about domestic security. Moreover, increasing demand for physical security systems in data centers to secure hardware assets and equipment is accelerating market growth.

Physical Security Market Overview

Market Size:

- 2025: USD 120.83 billion

- 2026: USD 129.08 billion

- 2034 Forecast: USD 222.25 billion

- CAGR (2026–2034): 7.2%

Market Share:

- North America holds a significant share, attributed to advanced infrastructure and heightened security concerns.

- Asia Pacific is experiencing rapid growth due to increased urbanization and infrastructure development.

Key Industry Trends:

- Adoption of AI-powered surveillance and access control systems.

- Integration of IoT devices for real-time monitoring and threat detection.

- Shift towards cloud-based security solutions for enhanced scalability and management.

Driving Factors:

- Rising concerns over physical threats and unauthorized access.

- Government regulations mandating stringent security measures.

- Technological advancements enabling more effective and efficient security systems.

The COVID-19 pandemic had a mixed impact on the market. Strict health and safety protocols enforced by governments worldwide significantly increased the demand for contactless access control and temperature screening solutions. Conversely, the pandemic led to substantial supply chain disruptions, especially in manufacturing, impacting the availability of physical security products. After the pandemic, growing awareness of the necessity for strong security systems, advancements in technology, and beneficial regulatory modifications are anticipated to boost market growth.

IMPACT OF GENERATIVE AI

Advancements of AI and Surging Data Center Demand Security to Fuel Market Growth

AI advancements are driving an unprecedented surge in demand for data centers, which serve as the backbone of the digital world. This growth has significantly raised the concerns and need for robust physical security solutions. As data centers grow in size and value, they become more attractive targets for cybercriminals and physical attacks. Thus, partnering with experienced security solution providers has become a crucial need for the generative AI industry.

PHYSICAL SECURITY MARKET TRENDS

Digital Transformation to Handle Potential Threat and Risk is the New Trend

The physical security market is experiencing several key developments that are shaping its future trajectory. One of the most notable future trends is the move toward integrated and converged security solutions. As organizations face an increasingly complex threat landscape, they are opting for solutions that combine physical security with cloud-based security measures. Organizations today operate as complex ecosystems where the synchronization of people, processes, and technologies significantly improves business performance. To improve efficiencies and break down constraints, a change in the system is necessary.

Thus, digital transformation plays a crucial role by enabling dynamic identity management for early detection and identification of threats. Furthermore, robust threat-handling software solutions have empowered businesses to deliver unified physical security solutions to their customers.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Increasing Demand for Robust Asset Security Solutions is Driving Profitable Growth

A multitude of factors drive the global physical security market share, each contributing to the increasing demand for asset security solutions across various industries. One of the primary drivers of market growth is the escalating concerns over crime, vandalism, and breaches in secured premises.

Additionally, growing urbanization and the rise in prioritizing security measures in both the public and private sectors to safeguard assets, infrastructure, and personnel are driving investment in physical security technologies. Governments, corporations, and other organizations are adopting security solutions such as access control, surveillance systems, intrusion detection, and advanced alarm systems to mitigate risks.

- For instance, in April 2024, Nice, a gate automation and access management solution, announced the launch of the 661 garage door opener integrated with the Nice GO Mobile App. The product launch aims to expand the company’s door and access portfolio with the smart garage operator.

Market Restraints

Security Concerns Related to Credential and User Convenience Hinder Market Growth

In any organization, physical security serves as the most important and critical layer of security programs, protecting people, physical property, and assets from malicious intent. While these security technologies are used by the majority of organizations, they are commonly overlooked and can become weak in detecting and responding to threats.

The market's top concerns and technological challenges revolve around balancing security with user convenience. Protecting against security threats and vulnerability remains a top priority. In contrast, the complexity of using the access control equipment due to the inconvenience of ID revoke is a major concern.

Market Opportunities

Increasing Demand for Remote Access Solutions to Create Ample Opportunities for market Players

Market players have the opportunity to develop mobile access and physical control solutions tailored to the unique needs of specific industries. For instance, government and military organizations focus mainly on integrating real-time perimeter physical security solutions that can be remotely monitored through secure IP networks.

Another significant market opportunity lies in providing data center physical security solutions with an increasing focus on safeguarding people, physical equipment, and assets from breaches. These advancements in the product help achieve maximum profitability while minimizing training and operational expenses. Additionally, the demand for home access systems, future-proof technologies, and industrial-compliant solutions is expected to drive further physical security market growth.

SEGMENTATION ANALYSIS

By Component

Exceptional Capabilities of Hardware Elements for Managing Security Boosted its Demand

Based on component, the market is segmented into hardware, software, and services.

In terms of share, the hardware segment dominated the market in 2026 with a valuation of 40.50%. The hardware elements are vital for managing security in both public and private organizations, leading to high demand in the market. The integration of these devices with advanced software solutions is becoming increasingly important as organizations seek to enhance their security infrastructure.

The services segment is anticipated to register the highest CAGR during the forecast period fueled by increasing security concerns, urban development, technological innovations, and regulatory pressures. This trend underscores the importance of comprehensive security strategies in safeguarding against evolving threats.

By End-user

Prioritization of Safety with Customized Solutions Boosted Commercial/Industrial Segment Growth

Based on end-user, the market is segmented into residential and commercial/industrial.

In terms of share, the commercial/industrial dominated the market in 2024 and is set to reach the valuation of 67.24% in 2026, as organizations increasingly prioritize safety amid evolving threats. These sectors’ complex security needs drive the demand for customized solutions that integrate various security components into a unified system.

The residential segment is anticipated to register the highest CAGR of 8.48% during the forecast period (2025-2032), driven by the expansion of urban areas and the growing demand for effective residential security solutions. Higher population densities in urban regions often correlate with higher crime rates, prompting residents to seek enhanced security measures.

By Type

Growing Concerns about Safety and Security Pushed Video Surveillance Systems Segment Growth

Based on type, the market is segmented into video surveillance systems, biometrics & access control systems, intrusion detection and prevention systems, fire detection systems, Physical Security Information Management (PSIM), and others.

In terms of share, the video surveillance systems dominated the market in 2024 and is anticipated to capture a share valued at 37.89% in 2026. Video surveillance systems consist of analog cameras, axis network cameras, video encoders, monitors, and storage devices. The rise of technologies such as UHD, alongside falling equipment prices, has resulted in a greater uptake of video surveillance systems aimed at improving remote monitoring and physical security. Growing concerns about safety and security, along with strict regulatory requirements, are key factors contributing to the expansion of this segment.

The intrusion detection and prevention systems segment is anticipated to register the highest CAGR of 8.48% during the forecast period (2025-2032), driven by increasing security threats and the need for robust cybersecurity solutions. These systems are crucial for organizations aiming to safeguard their assets from a variety of threats. As technology evolves, these systems will continue to play a pivotal role in maintaining secure environments across various sectors.

By Vertical

Government Segment Dominated the Market Due to Amplified Focus of Government on Public Safety

Based on vertical, the market is categorized into BFSI, government, healthcare, manufacturing, retail, transportation & logistics, energy & utilities, and others.

In terms of share, in 2024, the government segment dominated the market and is set to reach a market value of 20.46% in 2025, due to a heightened focus on the security of public utilities and places. These trends are backed by rising government expenditures on national security and public safety programs, driven by worldwide threats such as terrorism and cyberattacks.

The retail segment is expected to record the highest CAGR of 8.83% during the forecast period (2025-2032), due to retailers constantly facing significant risks from shoplifting and other theft-related incidents, prompting investments in advanced security measures. Moreover, retailers are increasingly required to comply with regulations concerning asset protection and customer safety is further driving demand for comprehensive security solutions.

To know how our report can help streamline your business, Speak to Analyst

PHYSICAL SECURITY MARKET REGIONAL OUTLOOK

North America

North America Physical Security Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held a major market share in 2025 with a valuation of USD 54.83 billion and USD 58.26 billion in 2026. The growth of the regional market is influenced by factors such as robust economic expansion, regulatory changes, and increased investments by small and medium-sized enterprises in physical security solutions. Additionally, numerous public facilities and transport systems, including airports, seaports, railways, and bus stations, are prioritizing the protection of their infrastructure with multiple security layers. For instance, in January 2022, Allied Universal, a security provider based in the U.S., purchased Norred & Associates Inc., a security firm to offer a comprehensive range of security services to transportation hubs, including bus stations, railways, and airports such as investigation, security consulting, manned guarding, and pre-employment screening.

The U.S. holds the largest share within North America due to an increasing focus on safety and security across various sectors. With ongoing technological innovations and rising awareness of potential threats, businesses are likely to continue investing in advanced physical security solutions. The U.S. market is set to reach USD 45.38 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

South America

South America is expected to hit USD 5.52 billion in 2025. The physical security market in South America is evolving rapidly due to various factors such as increasing urbanization, economic growth, and the rising demand for safety solutions across residential, commercial, and industrial sectors.

Europe

Europe is the third largest market, projected to be valued at USD 18.46 billion in 2026. This region is an evolving sector that encompasses a wide range of technologies and services designed to protect people, property, and assets. The U.K. market is expanding and is set to be valued at USD 2.99 billion in 2026. This market includes both traditional security methods (such as access control and surveillance systems) and newer, tech-driven solutions (such as biometric identification and AI-powered security systems). Germany is expected to reach USD 2.94 billion in 2026, while France is estimated to be valued at USD 2.91 billion in the same year.

Middle East & Africa

The Middle East & Africa is projected to experience significant growth in the market during the forecast period. This growth is expected to be driven by a combination of external threats, technological innovations, and regulatory pressures that demand enhanced security measures across various sectors. The GCC market is predicted to reach a value of USD 1.10 billion in 2025.

Asia Pacific

Asia Pacific is estimated to grow at the CAGR of 9.93% during the forecast period (2025-2032) and is expected to be valued at USD 42.45 billion in 2026. In the region, ensuring physical security has become as essential for businesses as protecting against cyber threats, shielding them from various hazards such as vandalism, theft, burglary, and environmental disasters, including fires and floods. The rising need for robust safety measures is propelling the uptake of physical security systems. Furthermore, the heightened investment in smart city projects and the declining costs of IP cameras have fueled the demand for physical security systems aimed at safeguarding citizens. India is set to be worth USD 4.1 billion in 2026, while Japan is poised to be worth USD 4.82 billion in the same year.

China is the largest market in the Asia Pacific region, driven by governmental investments, smart city initiatives, and large-scale infrastructure projects. China is anticipated to capture a market share valued at USD 18.11 billion in 2026.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players to Use Merger & Acquisition, Partnership, and Product Development Strategies to Expand Business Reach

Major players operating in the market are providing advanced security devices by offering enhanced security features in their product portfolio. These companies are focusing on signing acquisition agreements with small and local firms to increase their business operations. Moreover, partnerships, mergers & acquisitions, and key investments will also boost the demand for the market.

Major Players in the Physical Security Market

To know how our report can help streamline your business, Speak to Analyst

Key players are focusing on product portfolio expansion and technological updates, acquisitions and partnerships, and research & development activities to proliferate the demand for physical security solutions.

List of Physical Security Companies Studied:

- Honeywell International Inc. (U.S.)

- Axis Communications AB (Sweden)

- Bosch Sicherheitssysteme GmbH (Germany)

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- Dahua Technology Co., Ltd (China)

- Johnson Controls (Ireland)

- Cisco Systems, Inc. (U.S.)

- SECOM CO., LTD. (Japan)

- ADT (U.S.)

- Genetec Inc. (Canada)

- Anixter International, Inc. (U.S.)

- Allied Universal Security Services LLC (U.S.)

- Senstar Corporation (Canada)

- NordLayer (U.S.)

- Evolv Technology (U.S.)

- Cloudvue (U.S.)

- Ava Security (U.K.)

- Acura (Japan)

- Verkada Inc. (U.S.)

- SEAtS Software (Ireland)

..and more

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Genetec expanded its Security Center SaaS platform with the launch of Operations Center, a work management solution tailored for physical security operations. This new offering aims to streamline workflows and improve collaboration among security teams by providing tools that facilitate incident management and reporting. The introduction of Operations Center reflects Genetec's commitment to enhancing operational efficiency within the physical security sector.

- June 2024: Honeywell completed the acquisition of Carrier's global access solutions business, a move expected to enhance its portfolio in building technologies. The acquisition aligns with Honeywell's strategy to expand its offerings in access control and building management systems. Following this acquisition, Honeywell updated its outlook for 2024, indicating anticipated growth driven by enhanced product capabilities and market reach.

- May 2024: Genetec announced powerful new tools designed to help law enforcement agencies securely share vehicle data and accelerate investigations. These tools aim to improve collaboration between agencies while ensuring compliance with privacy regulations. By facilitating efficient data sharing, Genetec seeks to enhance investigative capabilities and support law enforcement efforts in maintaining public safety.

- May 2024: Hikvision unveiled its second-generation professional access control solutions that offer an upgraded experience in access management. The new system incorporates advanced features designed to enhance user convenience and security while simplifying management processes. This development reflects Hikvision's commitment to providing innovative solutions that address the evolving needs of access control in various environments.

- August 2022: Honeywell introduced new fire detection and alarm systems designed to improve occupant safety across various building types. These systems incorporate advanced technologies aimed at enhancing early warning capabilities during emergencies. By focusing on occupant safety, Honeywell seeks to provide effective solutions that address contemporary fire safety challenges within buildings.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The physical security industry presents a dynamic landscape filled with opportunities driven by technological advancements and increasing safety concerns. Investors seeking to enter this market should focus on sectors such as smart city initiatives, integrated security solutions, and PSIM technologies while also considering challenges related to costs and privacy issues. Global governments are making significant investments in different security solutions to enhance public infrastructure security.

For instance,

- In September 2023, Indian railways entered into a Memorandum of Understanding (MoU) with Railtel Corporation to install 6,122 CCTV cameras at 364 central railway stations. Of these, 3,652 cameras would incorporate a face recognition system to improve the security framework.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, and leading verticals of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, End-user, Type, Vertical, and Region |

|

Segmentation |

By Component

By End-user

By Type

By Vertical

By Region

|

|

Companies Profiled in the Report |

Honeywell International Inc. (U.S.), Axis Communications AB (Sweden), Bosch Sicherheitssysteme GmbH (Germany), Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd (China), Johnson Controls (Ireland), Cisco Systems, Inc. (U.S.), SECOM CO., LTD. (Japan), ADT (U.S.), and Genetec Inc. (Canada) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 222.25 billion by 2034.

In 2025, the market was valued at USD 120.83 billion.

The market is projected to record a CAGR of 7.00% during the forecast period.

The video surveillance systems segment led the market in 2025.

Increasing demand for robust asset security solution is a key factor driving market growth.

Honeywell International Inc., Axis Communications AB, Bosch Sicherheitssysteme GmbH, Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd, Johnson Controls, Cisco Systems, Inc., SECOM CO., LTD., ADT, and Genetec Inc. are the top players in the market.

North America held the major market share in 2025.

By vertical, the retail segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us