Point-of-Use Water Treatment Systems Market Size, Share & Industry Analysis, By Product Type (Under the Counter Filters, Countertop Filters, Pitcher Filters, Faucet-mounted Filters, and Others), By Category (RO Filters, UV Filters, Gravity Filters, and Others), By Application (Residential and Light Commercial), By Distribution Channel (Offline Stores and Online Stores), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

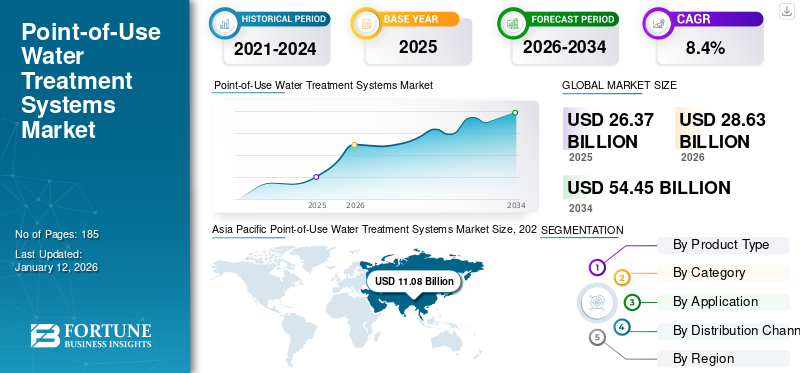

The global point-of-use water treatment systems market size was valued at USD 26.37 billion in 2025. The market is projected to grow from USD 28.63 billion in 2026 to USD 54.45 billion by 2034, exhibiting a CAGR of 8.4% during the forecast period. Asia Pacific dominated the point-of-use water treatment systems market with a market share of 42% in 2025. Moreover, the U.S. point-of-use water treatment systems market is projected to reach USD 7.55 billion by 2032, driven by growing concerns over drinking water quality and household filtration solutions.

Point-of-Use (POU) water treatment systems are installed at residential and non-residential places where water is utilized for various purposes. These systems are mounted at a sole water connection, typically under the counter of kitchens, bathroom showers, faucets, and other locations. Due to the less volume treatment, these systems are considered an ideal solution for the last stage of water purification in light commercial buildings or at home. The combination of these treatment systems and point-of-entry water treatment systems offers complete purification, from removing harmful contaminants to water softening.

The outbreak of the COVID-19 pandemic resulted in an unprecedented economic and operational impact on the global point-of-use water treatment systems industry. However, the water treatment industry falls under essential services, and the overall economic impact is slightly less than other manufacturing industries. To avoid the spread of coronavirus, governments across developed and developing economies imposed partial or complete lockdowns. The sudden lockdown resulted in supply chain disruptions across the ecosystem. The Water and Wastewater Equipment Manufacturers Association (WWEMA) surveyed the impact of COVID-19 on its member companies. More than 90% of manufacturers reported the impact on their orders, while most reported delays in orders and even predicted no sales growth during the second quarter of 2020.

Global Point-of-Use Water Treatment Systems Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 26.37 billion

- 2026 Market Size: USD 28.63 billion

- 2034 Forecast Market Size: USD 54.45 billion

- CAGR: 8.4% from 2026–2034

Market Share:

- Asia Pacific dominated the point-of-use water treatment systems market with a 42% share in 2025, driven by rapid urbanization, growing health awareness, and high adoption in countries such as China, Japan, and India.

- By product type, countertop filters are expected to retain the largest market share in 2025 due to their compact design, ease of use, and effective filtration using activated carbon or ceramic media.

Key Country Highlights:

- United States: The U.S. market is projected to reach USD 7.55 billion by 2032, supported by growing concerns over drinking water quality, aging infrastructure, and consumer preference for under-the-counter and smart filtration systems.

- India: Expected to register the highest growth in Asia Pacific, fueled by urbanization, increasing water contamination awareness, and government water safety initiatives.

- China: The largest consumer in Asia Pacific, with strong demand for smart and compact purification systems to combat industrial pollution.

- Germany: Leads the European market, driven by rising household water usage and demand for efficient, low-maintenance filtration units.

- South Africa: A key market in Africa due to rising healthcare spending, water awareness campaigns by WHO and UN, and growing preference for personal water filtration units.

Point-of-Use Water Treatment Systems Market Trends

Emergence of Smart Water Treatment Systems is a Significant Trend

The introduction of the Internet of Things has enabled smart water purification systems to emerge as a new technological trend in the water purification industry. These smart purifiers are strategically designed to replace conventional reverse osmosis and ultraviolet water purification systems. They are compact and convenient for use with smartphones. Water can be easily dispensed with just one click. Also, it notifies the user about the frequent replacement of filters before their expiry. Furthermore, users can set specific timing for filling one glass or bottle and track their daily water consumption to avoid excess usage. Asia Pacific witnessed a growth from USD 9.14 Billion in 2023 to USD 10.05 Billion in 2024.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Increasing Awareness about Water-borne Diseases to Fuel Market Growth

Water-borne diseases are caused due to infections by pathogens, such as protozoa, bacteria, viruses, algae, parasitic worms, and other metal contaminants. The consumption of pathogen & metal-contaminated water leads to diseases, such as typhoid, diarrhea, chlorella, malaria, campylobacteriosis, lead poisoning, and others. These diseases spread while drinking, showering, washing, or eating food contaminated by raw and untreated water. The WHO predicts around 1.5 million human deaths due to water-borne diseases per year. With the increasing awareness and availability of information on water-borne diseases & water pollution, people are becoming more concerned about their health and prefer clean treated water to prevent such serious diseases.

Moreover, water campaigns conducted by several environmental agencies are spreading awareness about the health benefits of drinking and using clean and safe drinking water in both developed and developing economies. Point-of-use water treatment systems can be effectively adopted to improve the quality of daily consumed water and prevent water-borne diseases. Hence, the increasing awareness about water-borne diseases is surging the demand for these systems across the globe.

MARKET OPPORTUNITIES

Technological Innovations to Create New Opportunities for the Emerging Companies

Despite the range of water filtration technologies on the market, P-o-U treatment systems are still viewed as reliable, mature options that deliver clean water at relatively low costs. Common methods also include flocculation & coagulation, which reduce turbidity and prevent microbial proliferation, alongside filtration and disinfection processes that deactivate harmful microorganisms, making water safe for domestic and drinking purposes.

At the same time, R&D efforts are driving innovations, with companies, such as Pentair, Brita, and A.O. Smith Corporation focusing on advancing P-o-U technology. Recently, these systems have seen substantial improvements, with capacitive deionization emerging as a promising alternative to conventional membrane separation. This approach offers lower operational costs, enhanced energy efficiency, and significantly reduces water rejection, making it an attractive option for efficient contaminant removal.

Market Restraints

High Production and Maintenance Costs of Filters to Limit Market Growth

Reverse osmosis filters and ultra-violet filters are expensive. A technically skilled workforce is required to achieve the optimal design and meet standard regulations, which increases the production cost of filters. The maintenance cost of point-of-use water treatment systems depends upon filters and the technology required. In general, RO water purification systems have higher maintenance costs than other systems. After three to six months, such treatment filters require replacement to maintain the water output quality. This increases the overall maintenance & operational cost of the system. Therefore, the high cost of filters restricts the use of point-of-use water treatment systems.

Market Challenges

Environmental Concerns Associated with Disposal of RO Waste Water and Used Filters to Challenge Market Growth

Environmental concerns related to the disposal of reverse osmosis waste water and used filters pose a challenge to the growth of the market. RO systems typically waste a large amount of water during the water filtration process. This wastage is seen as unsustainable, especially in regions facing water scarcity, such as Middle East & Africa. Additionally, used RO filters are difficult to recycle and contribute to landfill waste. These environmental impacts may deter environmentally conscious consumers and increase regulatory scrutiny, limiting the market growth.

SEGMENTATION ANALYSIS

By Product Type

Owing to Higher Adoption, the Countertop Filters Segment Dominated the Market

Based on product type, the market is segmented into countertop filters, under the counter filters, faucet-mounted filters, pitcher filters, and others.

The countertop filters segment is the largest and fastest-growing segment in the market. These countertop units don’t require complicated plumbing connections for operations, are easy to install, and are specially designed to acquire minimum space. They also offer good quality water. The filter media used in these systems is activated carbon or ceramic, which is considered ideal filter media to remove contaminants and retain the taste of water. The segment is expected to dominate the market share of 37.30% in 2026.

The under the counter filters segment was the second-largest product type in the market in 2024. These systems are generally installed under the kitchen counter. Due to a higher flow rate, the water dispenses at a high rate through these systems, saving time in filling the bottle. Moreover, these filters save space over the kitchen counter and don’t require too many adjustments to mount. Under the counter RO systems are gaining popularity due to their high-quality water output and space-saving designs.

Pitcher filters segment is anticipated to exhibit a CAGR of 6.9% during the forecast period.

By Category

Excellent Features Led the RO Filters Segment to Hold Major Share in 2024

Based on category, the market is divided into RO filters, UV filters, gravity filters, and others.

Among these, the RO filters segment accounted for the largest revenue share of the market in 2024. RO systems have a highly advanced membrane filtration technology, capable of removing 99% of the water contaminants and delivering the same water quality as bottled water. Therefore, these systems are highly adopted for water purification systems and are growing with the highest CAGR. They are considered the best solution to treat hard water. Besides this, these systems are expensive, take more time to treat water, and remove essential minerals, such as iron, magnesium, sodium, and calcium, which alter the taste of the water. The RO filters segment is expected to hold a 46.73% share in 2026.

Gravity filters held the second-largest share of 24% in the market in 2024 as these systems are easy to install and quite simple. They don’t require electricity, as water purification is entirely based on gravitational force. Moreover, these systems can be placed anywhere in the home and require less maintenance. However, frequent filter media replacement is necessary to help gravity filters function properly.

The UV filters segment also holds a considerable share of the market. UV filter water purifier treats micro-biologically unsafe water with germicidal ultraviolet light. The UV wavelength scrambles the DNA of living organisms in the water and restricts their growth. UV filters come with the advantages of a simple mechanism with no use of chemicals, offering cost-effectiveness and thereby driving product demand.

The development of novel products with activated carbon filters, ceramic filters, ultrafilters, and nanofiber filters for residential and commercial applications is providing momentum to the product demand. These products offer water with high quality since the use of a single type of filter in a purification system removes or reduces several organic and inorganic contaminants.

To know how our report can help streamline your business, Speak to Analyst

By Application

Residential Segment Emerged as the Application in the Market Due to Increased Usage of Water

Based on application, the market is classified into residential and light commercial.

The residential segment was the largest application segment in 2024 and is projected to retain its position during the forecast period. The usage of water is high in residential buildings compared to light commercial buildings. According to the U.S. Environmental Protection Agency estimates, an average American family uses over 300 gallons of water daily. Out of indoor water use, approximately 20% of water is used for showers, 19% through faucets, and 17% for washing clothes. This segment is anticipated to forecast a CAGR of 8.6% during the forecast period.

Light commercial buildings include banks, restaurants, small shopping centers, offices, academic buildings, and others. Water purification systems installed in light commercial buildings are large-scale units with similar advantages such as residential compact filtration units. The segment is expected to dominate the market share of 53.96% in 2026.

By Distribution Channel

Offline Stores Segment Holds Major Share Owing to Hands-on Experience

Based on distribution channel, the market is classified into offline stores and online stores.

The offline stores segment was the largest distribution channel in 2024 and is projected to retain its position during the forecast period. Preference by consumers for hands-on experience on the water treatment systems and post-purchase service, especially in rural or semi-urban areas, are driving sales through offline distribution channels. This segment is anticipated to forecast a CAGR of 8.2% during the forecast period.

However, the online stores segment is growing with a higher CAGR and is anticipated to hold a considerable market share by 2032. The segment is expected to dominate the market share of 81.84% in 2026. Purchase convenience, broader product varieties, competitive pricing, and home delivery of the products are some of the major factors driving the online sale of water treatment systems. E-commerce platforms offer user ratings and reviews, helping consumers make informed decisions and further accelerating the online sales of point-of-use water treatment systems.

CONSUMER BEHAVIOUR & PREFERENCES

Concerns over water quality, health, and convenience drive consumer behavior and preferences for buying point-of-use water treatment systems. Consumers prioritize systems that effectively remove contaminants such as bacteria, viruses, and chemicals, ensuring safe drinking water. Preferences vary based on region, with urban consumers often favoring advanced systems, such as RO or UV filters, while rural consumers may seek simpler, affordable options. Brand reputation, ease of installation and maintenance, and long-term cost-effectiveness also influence purchasing decisions.

EMERGING TECHNOLOGIES

Emerging technologies in point-of-use water treatment systems focus on enhancing sustainability, affordability, and efficiency. Innovation of nano-technology-based filters and graphene-based membranes offers superior filtration with enhanced durability. UV-LED technology is replacing conventional UV lamps, providing energy-efficient and longer-lasting disinfection. Electrochemical water purification is gaining attention for its ability to remove a wide range of pollutants with minimal energy use. Additionally, AI-empowered devices are emerging as cost-efficient point of use water treatment systems.

Point-of-Use Water Treatment Systems Market Regional Outlook

The regional market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific

Asia Pacific Point-of-Use Water Treatment Systems Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest market share and is projected to be the fastest-growing region at a CAGR of 10.1% during the forecast period. The market size of the region was USD 11.08 billion in 2026, and in 2023, the market value led the region by USD 9.14 billion. Rapid urbanization in the region creates lucrative growth opportunities for point-of-use water treatment systems. According to the World Bank Data, East Asia & Pacific is the world’s most rapidly urbanizing region, with a rate of 3% per year. One-third of the world’s urban population resides in this region. China is the major consumer of water treatment systems, followed by Japan, owing to increasing awareness about the benefits of water treatment systems. India is expected to register the highest growth rate in the future. Japan, South Korea, and Australia represent the highest adoption of water treatment systems. Therefore, Asia Pacific is expected to retain its dominance in the market during the forecast period. The market value in China is expected to be USD 5.79 billion in 2026.

On the other hand, India is projecting to hit USD 1.53 billion and Japan is likely to hold USD 1.03 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is anticipated to account for the second-highest market size of USD 7.65 billion in 2026, exhibiting the second-fastest growing CAGR of 7.20% during the forecast period. Europe was the second-largest contributor, with Germany leading the market, followed by the U.K. The increasing water consumption for household usage would result in the rising demand for point-of-use water treatment systems in this region. According to the European Environment Agency, over 12% of the total water is consumed by households in Europe. On average, 144 liters of water are supplied on the basis of per person per day. According to the European Commission, in 2015, the average consumption of tap water per person in Germany and the U.K. stood at 122 liters and 150 liters, respectively. The market value in U.K. is expected to be USD 2 billion in 2026.

On the other hand, Germany is projecting to hit USD 2.45 billion in 2026 and France is likely to hold USD 1.10 billion in 2025.

North America

North America is likely to account for the third-largest value of USD 6.42 billion in 2026, with the U.S. emerging as the most significant contributor, followed by Canada. Increasing concerns about water quality and water contamination due to aging infrastructure and water pollution due to several factors are the key drivers of U.S. point-of-use water treatment systems market growth. The growth in this region is mainly attributed to the high penetration of water treatment systems among consumers. Moreover, the presence of large-scale commercial manufacturers and their well-established distribution networks fuel the point-of-use water treatment systems market growth in the region. The U.S. market size is estimated to hit USD 5.07 billion in 2026.

Latin America

The Latin American market is majorly influenced by government policies to reduce single-use plastic water bottles. Also, rising awareness among consumers toward drinking clean water is expected to drive the market in Brazil and Mexico. The growth of commercial sectors, including IT, telecom, and banks, is fueling the adoption of water filters and promoting market growth.

Middle East & Africa

The Middle East & Africa region is to be anticipated the fourth-largest market with USD 1.43 billion in 2026. Changing consumer perception toward adopting advanced water filters instead of large water bottles aids market growth in the Middle East. GCC remains the key market for all water purification products. In Africa, South Africa is a well-established market for POU water treatment systems due to higher consumer spending on healthcare. Also, water awareness campaigns run by the WHO and the UN are pushing the demand for water purifiers in emerging African economies.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players Focus on Organic and Inorganic Growth Tactics to Uphold their Market Positions

At present, the competitive landscape of this market depicts a fragmented industry, with the top 10 companies accounting for a major share of the market. Key players have invested a considerable number of resources in researching and developing several point-of-use water treatment systems, products, and technologies to produce them. A diversified product portfolio, supported by superior operational efficiency and safe & novel technology development for water treatment systems applications, are the strategies used by the market leaders to gain momentum. Companies have adopted new product development and acquisition strategies to increase their regional presence and product offerings.

LIST OF KEY POINT-OF-USE WATER TREATMENT SYSTEMS COMPANIES PROFILED:

- A. O. Smith Corporation (U.S.)

- Brita Gmbh (U.S.)

- Helen of Troy Limited (U.S.)

- Pentair PLC (U.S.)

- Culligan International Company (U.S.)

- Unilever PLC (U.K.)

- Panasonic Corporation (Japan)

- LG Electronics (South Korea)

- Best Water Technology Group (Austria)

- Kent RO Systems Ltd. (India)

- Coway Co. Ltd. (South Korea)

- Katadyn Group (Switzerland)

- Eureka Forbes Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- February 2023 – GE Appliances announced its plan for a new distribution center in Greenville County. The investment for a new distribution center is part of its plant to expand its South Carolina operations. The new distribution center is anticipated to support the growing business of the company.

- July 2022 - Brita GmbH chose eco-friendly Styrenics options - Terluran ECO, Styrolution PS ECO, and NAS ECO to use in its line of water filter jugs. This step aims to reduce the company’s carbon emissions greatly.

- June 2022- A.O. Smith Corporation expanded its market by acquiring Atlantic Filter, a water treatment firm in Florida, with plans to broaden its influence in the region.

- October 2021 – Pentair acquired Pleatco for approximately USD 255 million in cash. Pleatco is used to manufacture water filtration products for pools & spas. With this acquisition, Pentair strengthens the distribution network across the U.S. and Europe.

- July 2021: A.O. Smith Corporation announced the all-cash acquisition of Master Water Conditioning Corporation, a Pennsylvania-based water treatment firm. Master Water's purchase underlines the company's commitment to the North American water treatment industry, which is a major component of the company's goal to supply new, unique water heating and treatment solutions.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product type, categories, and leading product applications. The report covers the point-of-use water treatment systems market share analysis by key segments and countries profiled under the scope of study. Besides this, it offers insights into the market, current trends, and highlights the key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 8.4% during 2026-2034 |

|

Segmentation |

By Product Type

|

|

By Category

|

|

|

By Application

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global point-of-use water treatment systems market size was valued at USD 26.37 billion in 2025 and is projected to grow from USD 28.63 billion in 2026 to USD 54.45 billion by 2034, exhibiting a CAGR of 8.4% during the forecast period.

Registering a CAGR of 8.4%, the market will exhibit significant growth during the forecast period.

The market growth is primarily driven by increasing awareness of water-borne diseases, rising urbanization, and growing concerns about safe and clean drinking water. Consumers are increasingly adopting compact water filtration units at homes and in light commercial spaces to avoid health risks.

One of the significant trends is the emergence of smart water purification systems powered by IoT. These advanced systems offer mobile connectivity, filter replacement alerts, and real-time water quality monitoring, enhancing user convenience and water safety.

The countertop filters segment dominated the market in 2025 due to its ease of installation, space efficiency, and use of activated carbon or ceramic media, which are highly effective in improving water taste and quality.

RO (Reverse Osmosis) filters held the largest market share in 2025. RO systems are favored for their ability to remove up to 99% of contaminants, providing water quality comparable to bottled water, despite higher initial and maintenance costs.

Key challenges include the high production and maintenance costs of filters and environmental concerns related to RO wastewater and filter disposal. These factors may hinder adoption, especially in price-sensitive or eco-conscious regions.

Key companies include A. O. Smith Corporation, Brita GmbH, Pentair PLC, Culligan International, Panasonic Corporation, LG Electronics, Kent RO Systems, and Eureka Forbes. These players focus on innovation, acquisitions, and expanding their global distribution networks.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us