Quantum Sensors Market Size, Share & Industry Analysis, By Type (Atomic Clocks, Magnetic Sensors, Photosynthetically Active Radiation (PAR) Sensors, Gravity Sensors, and Others), By Industry (Automotive, Healthcare & Life Sciences, Military & Defense, Agriculture, Oil & Gas, and Others), and Regional Forecast, 2026-2034

QUANTUM SENSORS MARKET CURRENT & FORECAST MARKET SIZE

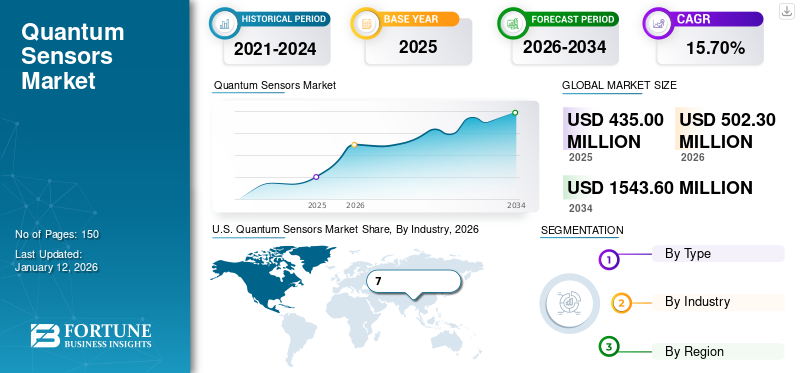

The global quantum sensors market size was valued at USD 435 million in 2025 and is projected to grow from USD 502.3 million in 2026 to USD 1,543.60 million by 2034, exhibiting a CAGR of 15.70% during the forecast period. North America dominated the quantum sensors market with a market share of 32.40% in 2025. The market is driven by continuous technological advancements in quantum computing and the growing demand for more accurate and early diagnostic tools in healthcare applications. Also, such sensors offer precise measurements crucial for advanced manufacturing processes, robotics, and automation.

Quantum sensors utilize the principles of quantum mechanics to measure physical quantities with unique precision and sensitivity. By tapping into the quantum properties of particles, these sensors can achieve extreme accuracy in detecting changes in gravity, magnetic fields, temperature, and other environmental factors. These sensors cater to various applications, including medical imaging and diagnostics, navigation and GPS, environmental monitoring, defense and security, and fundamental physics research.

The COVID-19 pandemic had a moderate impact on the market. The supply chain disruptions and economic slowdowns affected production and delayed some projects. However, the pandemic also accelerated the demand for advanced medical diagnostic tools, increasing investment in quantum sensor technologies for healthcare.

Moreover, the global market is forecasted to witness great potential in the forecast period. As quantum technologies mature, there will be broader commercialization and adoption of such sensors across different industries.

- For instance, in January 2024, Infleqtion acquired two companies specializing in integrated silicon photonics, iNoptiq Inc. and Morton Photonics Inc., to advance their initiatives in commercializing quantum products to market. This acquisition has bolstered their capabilities in enhancing these sensors, networks, and computers.

Also, integration with AI and machine learning enhances data analysis, enabling more accurate predictions and decision-making in real-time applications.

Impact of Generative AI: Real-Time Data Analysis Enhancing Quantum Sensing Applications

Real-time Analysis of Data offered by Generative AI to Foster Developments in Quantum Sensing

Generative AI can simulate and optimize quantum sensor designs, leading to more efficient and sensitive sensors. Quantum sensors generate vast amounts of data. Generative AI algorithms can process and analyze this data in real time, providing more accurate and actionable insights. This is particularly valuable in fields, such as medical diagnostics and environmental monitoring. In healthcare, Generative AI enhances the interpretation of data from these sensors, leading to better diagnostic tools and personalized treatment plans. It also analyzes data from such sensors to predict equipment failures, minimizing downtime and maintenance costs. Moreover, the convergence of quantum technology and AI will empower military drones to precisely measure and identify multiple targets simultaneously. Integrated with quantum sensing, these drones can scan the skies and seas for stealth threats, including large-scale hypersonic strikes.

- For instance, in June 2024, SandboxAQ introduced AQNav, the real-time navigation system that integrates AI and quantum technology. It aims to combat challenges, such as GPS denial, spoofing, and jamming. AQNav employs these sensors to utilize the Earth’s crustal magnetic field for reliable navigation in all weather conditions, resistant to interference.

KEY TRENDS AND TECHNOLOGICAL ADVANCEMENTS IN THE QUANTUM SENSORS MARKET

Growing Integration of Quantum Sensors in the Medical Field to Boost Market Growth

The integration of quantum sensors in the medical field is rapidly advancing, driven by their superior precision and sensitivity. These sensors are revolutionizing medical imaging technologies, such as MRI and PET scans. By providing higher resolution and more detailed images, they enable earlier and more accurate diagnosis of diseases, particularly in detecting tumors and neurological conditions.

Moreover, the development of non-invasive diagnostic tools using these sensors is a growing trend. These sensors can detect minute biological signals and changes at the cellular level, facilitating early detection of diseases, such as cancer and cardiovascular conditions, without the need for invasive procedures.

- For instance, in April 2024, Q.ANT, a German quantum technology firm, created a quantum magnetic field sensor capable of interfacing with prostheses, exoskeletons, and avatars through neural signals. This sensor excels in precision, detecting subtle electrical currents via their magnetic fields, offering natural and intuitive access to biosignals. Interpreting muscle signals facilitates precise control of prosthetic limbs, marking a significant leap forward in medical technology.

Download Free sample to learn more about this report.

GROWTH DRIVERS: WHAT’S FUELING THE QUANTUM SENSORS MARKET EXPANSION?

Reliance on Quantum Sensing for Precise Positioning and Secure Communication to Drive Market Growth

Quantum sensors offer unparalleled precision and sensitivity, essential for military and defense applications. These sensors can detect minute changes in magnetic fields, gravitational forces, and other environmental variables, providing critical data for navigation, surveillance, and target detection. Quantum accelerometers and gyroscopes provide highly accurate inertial navigation, which is crucial for submarines, aircraft, and autonomous vehicles operating in GPS-denied environments. This capability ensures reliable and precise positioning and secure communication, enhancing operational effectiveness. Additionally, these sensors can detect stealth aircraft and submarines by sensing disturbances in magnetic and gravitational fields. This ability to uncover otherwise undetectable threats, significantly bolsters defense capabilities against advanced stealth technologies.

Moreover, governments and defense agencies prioritize the development and deployment of cutting-edge technologies to maintain a strategic edge. Investments in such sensors are driven by the need to enhance defense capabilities, protect national security, and stay ahead of potential adversaries.

- For instance, in December 2023, Rydberg Technologies demonstrated high-bandwidth, ultra-sensitive RF quantum sensing to the U.S. Army. This technology facilitates long-range radio quantum communications with an atomic quantum sensor, exhibiting sensitivity across high-frequency to super high-frequency bands. The device's unique attributes include selectivity, high sensitivity, and wideband coverage, all achieved using a single atomic detector element.

MARKET CHALLENGES: BARRIERS TO WIDESPREAD QUANTUM SENSORS ADOPTION

Requirement of Significant Investments and Complex Scaling of Such Sensors to Hamper the Market Growth

The development and production of quantum sensors involve significant investments in advanced technology, materials, and skilled personnel. These high initial costs can be a barrier for many organizations which may slow the market growth. Also, scaling quantum sensor technology from laboratory settings to practical and large-scale applications is a major challenge.

Moreover, the field of quantum sensing is relatively new, and there is a limited pool of experts with the necessary knowledge and skills. This shortage of trained professionals can slow the research, development, and deployment of quantum sensor technologies. These sensors also face competition from well-established classical sensor technologies, which are often cheaper and more familiar to end-users.

Quantum Sensors Market Segmentation Analysis

By Type Analysis

Growing Need for Timekeeping Synchronization and Accuracy across Industries Propels Atomic Clocks Segment Growth

Based on type, the market is divided among atomic clocks, magnetic sensors, photosynthetically active radiation (PAR) sensors, gravity sensors, and others.

The atomic clocks segment holds the largest global quantum sensors market share 35.36% in 2026 due to its critical role in various high-precision applications. These clocks provide unparalleled timekeeping accuracy, essential for global positioning systems (GPS), telecommunications, and financial networks. The demand for precise time synchronization in these industries drives the widespread adoption of atomic clocks. Additionally, their established technological maturity and extensive use in national defense and space exploration contribute to their dominant market position.

However, the magnetic sensors segment is expected to grow with the highest CAGR in the market. The growing need for precise magnetic field detection in medical imaging (e.g., MRI), industrial automation, and environmental monitoring, fuels the demand. Magnetic sensors are crucial for detecting minute changes in magnetic fields, which is essential in these fields. The defense sector's demand for advanced detection systems to identify stealth threats and submarines also contributes to the rapid growth of magnetic sensors.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive Segment Leads Due to the Need for Advanced Sensing Technologies for Autonomous Driving Systems

By industry, the market is categorized into automotive, healthcare & life sciences, military & defense, agriculture, oil & gas, and others.

The automotive segment holds the largest share of the global market share 26.90% in 2026 due to extensive use of advanced sensing technologies for safety, navigation, and autonomous driving systems. Quantum sensors offer superior accuracy in measuring parameters, such as acceleration, magnetic fields, and positioning, which are critical for enhancing vehicle safety and performance. Such applications range from Advanced Driver Assistance Systems (ADAS) to autonomous vehicles, where precise navigation and real-time data processing are essential. Additionally, automotive manufacturers are increasingly investing in research and development to integrate such sensors into next-generation vehicles, driving the global quantum sensors market growth.

However, the military & defense segment is forecasted to grow with the highest CAGR in the market. This growth is propelled by the sector's demand for cutting-edge technologies to enhance national security and defense capabilities. Quantum sensors provide unmatched sensitivity and precision in detecting stealth threats, improving navigation accuracy in GPS-denied environments, and securing communication through quantum encryption.

REGIONAL INSIGHTS: QUANTUM SENSORS MARKET DYNAMICS ACROSS KEY GEOGRAPHIES

The global market scope is classified across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Quantum Sensors Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America accounts for the largest market dominated the market with a valuation of USD 141.1 billion in 2025 and USD 157.6 billion in 2026. North America has a robust ecosystem for research and development, particularly in advanced technologies, such as quantum sensing. Additionally, North America benefits from substantial government investments in defense and aerospace sectors, where quantum sensors play a crucial role in enhancing national security through improved surveillance, navigation, and communication systems. Moreover, the presence of key market players and strong collaborations between academia, research institutions, industry, and government further bolster the market growth in the region.The U.S. market is projected to reach USD 121.6 billion by 2026.

U.S. Quantum Sensors Market Share, By Industry, 2026

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to grow with the highest CAGR over the forecast period owing to its rapid industrialization, increasing investments in research and development, and rising adoption of advanced technologies across various sectors, such as healthcare, automotive, and aerospace. Countries in Asia Pacific, particularly China, Japan, South Korea, and India, are making significant strides in quantum technology research and applications. Government initiatives to promote technological innovation and infrastructure development also contribute to the Asia Pacific region's rapid growth in the market.The Japan market is projected to reach USD 30.2 billion by 2026, the China market is projected to reach USD 44.2 billion by 2026, and the India market is projected to reach USD 37.7 billion by 2026.

- For instance, in June 2024, The Singapore Government announced that it is expected to invest USD 222.0 million into the National Quantum Strategy (NQS). This initiative aims to propel Singapore's increasing quantum industry and solidify its status as a hub for quantum technologies over the next five years.

The market in Europe is poised for significant growth, driven by strong government support, strategic investments in quantum technology research, and a robust industrial base. Innovations in healthcare, defense, and environmental monitoring are expected to propel the adoption of these sensors. With increasing applications in navigation, communications, and scientific research, Europe is positioned as a key player in advancing quantum sensor technologies on a global scale.The UK market is projected to reach USD 22.2 billion by 2026, while the Germany market is projected to reach USD 21.9 billion by 2026.

- For instance, in November 2023, QuantumDiamonds, a Munich-based company, secured USD 7.6 million in seed funding to advance the development of quantum sensors. The company specializes in creating atom-sized sensors for nano-scale imaging of magnetic fields, non-destructive, utilizing nitrogen-vacancy (NV) diamond technology.

The market in the Middle East & Africa and South America regions is known for its steady growth. While these regions are currently emerging in adopting quantum sensor technologies, investments in infrastructure development and growing industrial applications are expected to drive market expansion. Key sectors, such as oil & gas exploration, healthcare, and defense, are likely to lead the demand for quantum sensors.

KEY INDUSTRY PLAYERS

Strategic Partnerships and Collaborations to Boost Market Presence of Key Players

Key players operating in the global quantum sensors market are entering into strategic partnerships and collaborating with other significant market leaders to expand their portfolio and provide enhanced low-code and no-code tools to fulfill their customers' application requirements. Also, through collaboration, companies are gaining expertise and expanding their business by reaching a mass customer base. The sensors offered by major companies provide innovative solutions for industries and users to handle the growing expectations for sustaining customers.

List of Top Quantum Sensors Companies:

- Campbell Scientific, Inc. (U.S.)

- AOSense, Inc. (U.S.)

- Apogee Instruments, Inc. (U.S.)

- SandboxAQ (U.S.)

- M Squared Lasers Limited (Scotland)

- QDM.IO (U.S.)

- ID Quantique (Switzerland)

- Q-CTRL (Australia)

- LI-COR, Inc. (U.S.)

- Muquans SAS (France)

- Atomionics Pte Ltd (Singapore)

- SBQuantum (U.S.)

- Oxford Instruments (U.K.)

- Nomad Atomics (Australia)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: SandboxAQ partnered with the Chicago Quantum Exchange (CQE). The Palo Alto-based firm offers solutions in post-quantum simulation, cryptography & optimization, and quantum sensing for industries, such as financial services, healthcare, cybersecurity, and telecommunications.

- March 2024: ID Quantique launched the ID281 Pro SNSPD system, a compact and autonomous Superconducting Nanowire Single-Photon Detector System. This system facilitates high-performance discovery in quantum platforms and is designed for integration into photonic quantum computing and communication systems, as well as other applications demanding compactness.

- March 2024: SBQuantum partnered with Silicon Microgravity to advance mining exploration through quantum sensing. Their joint project, QUAMINEX (Quantum Accelerated Mining Exploration), aims to create a drone-based sensor system that integrates magnetic and gravimetric measurements.

- February 2024: Q-CTRL partnered with Transparent Earth Geophysics and the Australian National University to support the flight testing of airborne gravimeters. These devices, valuable for geophysical surveying, can significantly benefit Australia's mineral exploration and water monitoring sectors. The Australian government has provided a grant of USD 2.8 million to develop these airborne quantum sensors for resources and environmental monitoring.

- November 2023: QDM.IO is a quantum sensor startup that emerged from research conducted at the University of Maryland and Harvard University. The company introduced the Quantum Diamond Microscope, which employs nitrogen-vacancy diamond quantum technology to measure magnetic fields with nanotesla sensitivity.

REPORT COVERAGE

The report provides a competitive landscape of the market overview and focuses on key aspects such as market players, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key quantum sensors industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Growth Rate |

CAGR of 15.70% from 2026 to 2034 |

|

Segmentation |

By Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 1,543.60 million by 2034.

In 2025, the market size stood at USD 435 million.

The market is projected to grow at a CAGR of 15.7% during the forecast period.

The atomic clocks segment is the leading type in the market.

Reliance on quantum sensing for precise positioning and secure communication to drive market growth.

Campbell Scientific, Inc., AOSense, Inc., SBQuantum, Apogee Instruments, Inc., M Squared Lasers Limited, ID Quantique, SandboxAQ, LI-COR, Inc., Q-CTRL, Muquans SAS, Atomionics Pte Ltd, Oxford Instruments, QDM.IO, and Nomad Atomics, are the top players in the market.

North America holds the highest market share.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us