Seismic Data Processing and Imaging Software Market Size, Share & Industry Analysis, By Service (Data Acquisition and Data Processing & Interpretation), By Technology (2D Image, 3D Image, and 4D Image), By Location (Onshore and Offshore), By Application (Geothermal, Carbon Sequestration, Oil & Gas Exploration and Production, Marine Surveys, Mineral Exploration, Groundwater Exploration, and Others), By End-User (Marine, Oil & Gas, Mining, Agriculture, and Others), and Regional Forecast, 2024-2032

Seismic Data Processing and Imaging Software Market Size

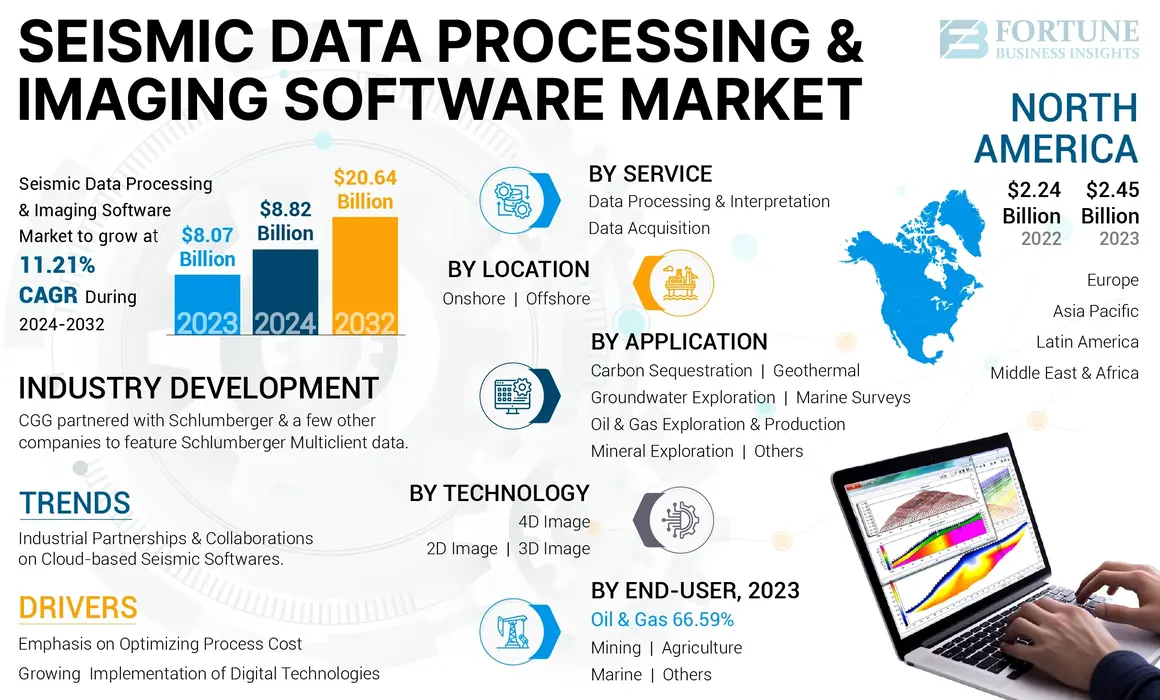

The global seismic data processing and imaging software market size was valued at USD 8.82 billion in 2024. The market is projected to be worth USD 9.69 billion in 2025 and reach USD 20.64 billion by 2032, exhibiting a CAGR of 11.41% growth during the forecast period. North America dominated the global market with a share of 30.36% in 2023.

Seismic imaging is one of the most commonly used tools to understand crustal processes. The hydrocarbon exploration industry primarily contributes to the advancement of seismic imaging. Seismic data processing is extremely important in imaging underground geological structures. It is used globally to search for hydrocarbons and explore the deepest parts of the Earth.

Recent advances in seismic data acquisition techniques have increased the amount of data many times. Processing methods also changed for high resolution, which increased the computational effort. Large amount of data and complex mathematical algorithms make seismic data processing a very computationally intensive task, requiring high-performance and large-memory computers for exploration activities.

The outbreak of the COVID-19 pandemic had a a significant impact on the global seismic data processing and imaging software market, causing disruptions in field data collection due to lockdowns and restrictions on mobility. However, it also accelerated the adoption of remote working and digital transformation, driving demand for cloud-based seismic software solutions. With oil and gas companies facing financial strain, there was a shift towards cost-effective software solutions and increased focus on operational efficiency.

Seismic Data Processing and Imaging Software Market Trends

Industrial Partnerships and Collaborations on Cloud-based Seismic Softwares

Traditionally, seismic companies relied on physical, on-premises data centers and high-performance computing clusters to process seismic data. These systems often required significant upfront investments in hardware and maintenance, which could be costly and inefficient, especially for smaller firms or short-term projects. The trend toward cloud-based solutions offers a more flexible and scalable alternative. With cloud computing, seismic data is processed remotely on platforms like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, allowing companies to bypass the need for expensive, in-house infrastructure.

In 2022, Baker Hughes partnered with Microsoft Azure to create a cloud-based data platform that supports real-time seismic data processing. This collaboration focuses on improving data storage, access, and processing speeds for global energy projects, with an emphasis on enhancing operational efficiency in both traditional and renewable energy projects.

Download Free sample to learn more about this report.

Seismic Data Processing and Imaging Software Market Growth Factors

Increasing Emphasis on Optimizing Process Cost is Propelling the Market Growth

Developing technologies, such as cloud, big data, artificial intelligence, and analytics, drives market growth and holds immense potential for exploring the oil and gas industry. Technologies, such as cloud computing have improved business agility by splitting down business functions. Big data and analytics help key players analyze and innovate structured data from different sources and generate real-time insights. However, the rise of new techniques in geophysics inevitably leads to an increasing use of terms related to these techniques.

The evolution of digital and cloud capabilities has enabled operators to transfer their cost base from expensive and static tools to insightful and actionable analytics. This results in improved reliability, amplified flexibility, and unlocking innovation. For example, Petrosys Ltd., one of the major manufacturers of seismic data processing products, has developed the Petrosys Pro software that manages, manipulates, and analyzes the underlying information from the most common exploration, production, GIS data sources, and production costs.

In August 2022, CGG partnered with Schlumberger, one of the major players, and a few other companies on the Versal unified seismic data ecosystem to feature Schlumberger Multiclient data. It has become convenient for consumers to view data seamlessly from all the participating seismic multiclient vendors through Versal’s intuitive, user-friendly online interface, simplifying access to standardized global Multiclient data.

Growing Implementation of Digital Transformation to Propel Seismic Data Processing and Imaging Software Market

The oil & gas industry has started adopting digital technologies focused on a better understanding of reservoir resources and production potential. This has improved safety and health and, thereby, increased operational efficiency in the oilfields. Additionally, many companies are achieving incremental performance improvements through the targeted use of business and digital technologies, which is expected to drive geophysical software services market growth.

Moreover, companies have experienced digital transformation, leading to the adoption of evergreen storage. Rather than keeping valuable seismic data on numerous media types that will age and change over time, companies, such as Katalyst Data Management propose an evergreen storage solution to clients. They can recover E&P data from any media ever used to record seismic data.

The rise of new techniques in seismic imaging, coupled with the ability to quickly process and analyze data, and support real-time decision-making and implementation, has shifted the focus of several key players toward a sustainable energy future. For example, in March 2023, Halliburton announced that Petrobras planned to use the Landmark iEnergy digital platform to manage its subsurface challenges. The companies entered into a contract that provides Petrobras access to the entire Halliburton Landmark DecisionSpace® 365 Geoscience Suite, which includes cloud-based, next-generation technologies, such as Scalable Earth Modeling, Assisted Lithology Interpretation, Seismic Engine, and Neftex.

RESTRAINING FACTORS

Data Privacy and Cyberattacks Associated with Seismic Monitoring Equipment to Obstruct Market Growth

Geophysical instruments, such as seismic monitors are connected to the Internet, which makes the recorded data vulnerable to cyber threats, eventually interrupting data processing and collection. Concerns, such as unsecured protocols, non-encrypted data, and poor authentication lead to various security breaches. In addition, modern seismic systems are implemented using IoT devices that link and exchange data with other devices via the Internet. This can threaten the equipment and potential risk of data leakage that IT professionals commonly see in IoT applications.

Several industries, such as oil & gas and mining employ different operational technologies, including hardware and software, to support centralization. The convergence of active technology platforms enables greater access to the devices and components that cybercriminals primarily target. In addition, using new technologies such as big data, cloud computing, and analytics has brought complex security encounters and exposed them to cyber risks. However, protective measures like cyber espionage campaigns aim to safeguard access to the latest and modern technical knowledge and information so that they can maintain a reasonable advantage and flourish in a market-oriented global economy.

For example, in 2022, a cyberattack on companies in Northern Europe, including the oil refining hub of Amsterdam-Rotterdam-Antwerp (ARA), disrupted the movement of refined cargo. Cyberattacks like this breach the consistency of the supply, affecting the company, the economy, and the market.

Seismic Data Processing and Imaging Software Market Segmentation Analysis

By Service Analysis

Data Acquisition Dominates the Market Driven by the Demand for Accurate, High-Quality Subsurface Data to Support Energy Exploration

Based on service, the global seismic processing and imaging software market is segmented into data acquisition and data processing and interpretation.

The data acquisition segment has the highest market share among other services. The purpose of acquiring and processing seismic data is to learn about the Earth's interior and to understand certain aspects of the Earth. For this, it is first necessary to determine relationships between the proposed objects and the measured parameters. This segment is expected to attain 55.34% of the market share in 2025.

Then, as a first step, data collection is designed to solve the problem and analyze the recorded seismic signals to filter and eliminate the noise of unwanted components. Then, a surface image of the soil is created that allows a geological interpretation. Finally, an estimate of the distribution of material properties below the surface inversion is obtained. The second stage uses data processing, to detect and enhance the desired signal. The third stage interprets the data based on the processed data. The data processing and integration segment is poised to grow with a considerable CAGR of 10.93% during the forecast period (2025-2032).

By Technology Analysis

3D Technology Dominates the Market as it Allows Better Interpretation of Complex Geological Formations

The technology segment is divided into 2D, 3D, and 4D types. Two types of seismic imaging, 2D and 3D, are mainly used. 2D seismic imaging involves using a single seismic line, providing a two-dimensional subsurface geology image.

3D technology dominates the seismic data processing and imaging software market owing to the advancments in the 3D trechnology. In three-dimensional (3D) reflection seismic surveys, the numbering up to a thousand or more sound detectors is spread out over an area. Then, the sound source is moved from one location to another to get the desired results. 3D seismic systems are generally uniform and evenly spaced grids of lines. The 3D seismic tool also makes significant inroads into other areas of Earth sciences, such as igneous and structural geology. The analysis of 3D seismic data can provide information on the geometry of the reservoir, calibrate the rock properties, and flow surveillance. From this information, the recovery strategy is formulated. This segment is anticipated to hold 63.98% of the market share in 2025.

The 4D segment is forecasted to register a significant CAGR of 12.31% during the forecast period (2025-2032).

By Location Analysis

Offshore Seismic Activities Dominate the Market Primarily due to the High Value of Offshore Energy Resources

Based on location, the global seismic processing and imaging software market is segmented into onshore and offshore.

The offshore held the largest market share in 2023 due to the increased overseas projects and contracts in various regions. For example, Shearwater GeoServices Holding AS announced Petronas Suriname EandP B.V. (PSEPBV) and a subsidiary of Petronas to conduct a large towed 3D seismic survey for Block 52 offshore Suriname. Most seismic surveys focus on offshore areas as the oil & gas industry relies heavily on seismic surveys to locate offshore oil and gas reserves. The ground-based location is the fastest growing type since the acquisition of 3D seismic data from the ground is done by placing geophone stations near source locations, but not necessarily in the same direction. This segment is expected to gain 62.04% of the market share in 2025.

The onshore segment is foreseen to document a substantial CAGR of 12.15% during the forecast period (2025-2032).

By Application Analysis

Oil And Gas Exploration and Production is the Leading Segment due to Increasing Exploration Activities

Based on application, the global seismic data processing and imaging software market is segmented into geothermal, carbon sequestration, oil and gas exploration and production, marine surveys, mineral exploration, and groundwater exploration.

Oil and gas exploration and production is the leading segment as it enhances the ability to interpret seismic data and use it for basin evaluation, structural fault modeling, reservoir characterization, rock physics analysis, field development, and production studies. This segment is anticipated to dominate with a market share of 64.86% in 2025.

Effective use of seismic surveys allows industry professionals to identify prospects, assess potential resources, reduce risk, and even quantify reserves to make well-informed decisions that drive successful exploration efforts. Based on increasing activities, seismic methods are becoming established techniques in the mining sector.

This brings new opportunities for geophysicists. Three-dimensional surface seismic surveys are ideal in complex geologic environments such as mining areas. Applications also include borehole seismic methods, such as VSP and cross-hole imaging.

The mineral exploration segment is likely to exhibit a considerable CAGR of 10.28% during the forecast period (2025-2032).

By End-User Analysis

Oil & Gas Segment Leads the Market Due to the Industry's Ongoing Need For Exploration And Production Of New Reserves

The end-user is segmented into oil & gas, mining, agriculture, and marine.

The oil & gas segment is dominating the market. This industry has always been at the forefront of technological innovation. Technological advancements have driven the industry's growth, from drilling deeper and exploring remote locations to efficiently extracting hydrocarbons. The segment dominated the market with a share of 67.08% in 2024.

Mining holds the second-highest market value for the end-user segment as the seismic method, based on reverse vertical seismic logging, has developed recently. It is a newly-developed well seismic technology combining seismic exploration and petroleum drilling engineering technology. Marine seismic data acquisition collects information about the subsea surface by generating sound pulses and recording echoes from the ocean floor.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

North America Dominates the Market Due to Numerous Oil And Gas Exploration Activities Including Shale And Offshore Projects

Based on geography, the market has been studied across five key regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America Seismic Data Processing and Imaging Software Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Based on geography, the market has been studied across five key regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America held a dominant part in the seismic data processing and imaging software market share with a valuation of USD 2.45 billion in 2023 and USD 2.45 billion in 2024 and is expected to continue its dominance in the coming years. The Department of the Interior's United States Geological Survey Albuquerque Seismic Lab intends to award an indefinite-delivery/indefinite-quantity contract for seismic equipment to support earthquake and volcano monitoring programs. The U.S. market is likely to reach USD 2.67 billion in 2025.

Asia Pacific is the second largest market likely to gain USD 2.52 billion in 2025, displaying a CAGR of 13.45% during the forecast period (2025-2032). China is projected to hold USD 1.29 billion in 2025. In Asia Pacific, India is foreseen to reach USD 0.26 billion in 2025, while Indonesia is likely to hit USD 0.26 billion in 2025.

The solicitation will seek integrated systems containing sensors, data acquisition units, and separate sensors and units. The contract is set for a five-year ordering period beginning from May 1st, 2024. Responses to the pre-solicitation notice are due by January 12th, 2024. The contract will support the agency's Global Seismographic Network, Advanced National Seismic System, regional networks, and Volcano Program.

The MEA region is the third largest market expected to be worth USD 1.84 billion in 2025. In this region, the GCC market is poised to stand at USD 0.36 billion in the same year.

South Africa represents a key emerging market for seismic surveyors. The cessation of offshore seismic surveys would undermine South Africa’s projected market growth by threatening the local upstream seismic survey.

KEY INDUSTRY PLAYERS

Competitive Landscape is Driven by the Adoption of Advanced Technology and Growing Focus on Renewable Energy Sectors

The market is a highly fragmented competitive landscape, with many players delivering a wide range of services across a global value chain with multi-client survey services. Numerous companies are actively operating in seismic data software to meet the specific demands of the end-use customers, primarily in oil & gas, mining, and others. Equine ASA is one of the major companies operating in the seismic data processing & imaging software market. The company offers a wide range of solutions. The company has a strong market presence and a diverse product and service portfolio, catering to industrial and commercial applications. Tesla's market share is substantial, due to its extensive customer base, technological expertise, and global reach.

List of Top Seismic Data Processing and Imaging Software Companies:

- Halliburton (U.S.)

- CGG (France)

- SLB (U.S.)

- Equinor ASA (Norway)

- Fugro (Netherlands)

- Shearwater Geoservices (Norway)

- DUG Technology (Australia)

- TGS-NOPEC Geophysical (U.S.)

- AspenTech (U.S.)

- GLOBEClaritas (New Zealand)

KEY INDUSTRY DEVELOPMENTS:

- May 2023- Halliburton announced that itsDecisionSpace Geosciences software is its standard geoscience toolbox, and OpenWorks features an open subsurface data universe as its corporate database for interpretations of the subsurface data. The senior vice president for a landmark Halliburton Digital Solutions, Nagaraj Srinivasan, said that DecisionSpace Geosciences is projected to provide a platform for subsurface insights, expertise with multidisciplinary teams, and skills at Equinor.

- May 2023- CGG, a global seismic data firm, signed a contract with the oil firm OMV to continue its dedicated operation at a centre at its head office in Vienna for an initial three years. Under the agreement, CGG declared that OMV would continue to incur advantages from in-house access to advanced seismic imaging & reservoir characterization technology of CGG.

- March 2023- Halliburton announced that Petrobras planned to use the Landmark iEnergy® digital platform to manage its subsurface challenges. The companies entered into a contract that provides Petrobras access to the entire Halliburton Landmark DecisionSpace® 365 Geoscience Suite, which includes cloud-based, next-generation technologies like Scalable Earth Modeling, Assisted Lithology Interpretation, Seismic Engine, and Neftex.

- February 2023- Equinor’s Cappahayden K-67 discovery has been issued a license by a Canadian offshore oil regulator in the Flemish Pass Basin offshore Newfoundland, Canada. Based on the well and seismic data interpretation associated with the discovery, C-NLOPB estimates that the Cappahayden K-67 discovery holds approximately 385 million barrels of recoverable oil.

- August 2022- CGG partnered with Schlumberger and a few other companies on the Versal unified seismic data ecosystem to feature Schlumberger Multiclient data. It has become convenient for consumers to view data seamlessly from all participating seismic multiclient vendors through Versal’s intuitive, user-friendly online interface, simplifying access to standardized global Multiclient data.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects, such as leading market players, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 11.41% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service

|

|

By Technology

|

|

|

By Location

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 8.07 billion in 2023.

The market is anticipated to record a CAGR of 11.21% over the forecast period of 2024-2032.

The oil & gas is the leading segment in the market driven by the development of seismic data processing and imaging software globally.

The market size of North America was valued at USD 2.45 billion in 2023.

Stringent GHG emission reduction norms and the increasing focus on decarbonization are the key factors driving market growth.

Some of the top players in the market are Equinor, ExxonMobil, Flour Corporation, ADNOC Group, and NRG Energy.

The global market size is expected to reach USD 20.64 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us