Smart Sensors Market Size, Share & Industry Analysis, By Type (Radar Sensors, Touch Sensors, Temperature and Humidity Sensors, Biosensors, Level Sensors, Pressure and Flow Sensors, Optical Sensors, Image Sensors, and Others), By Technology (MEMS-based Sensors, CMOS-based Sensors, Optical Sensors, and Others), By End-User Industry (Automotive, Healthcare, Consumer Electronics, Industrial Automation, Aerospace and Defense, and Others), and Regional Forecast, 2026-2034

Smart Sensors Market Size

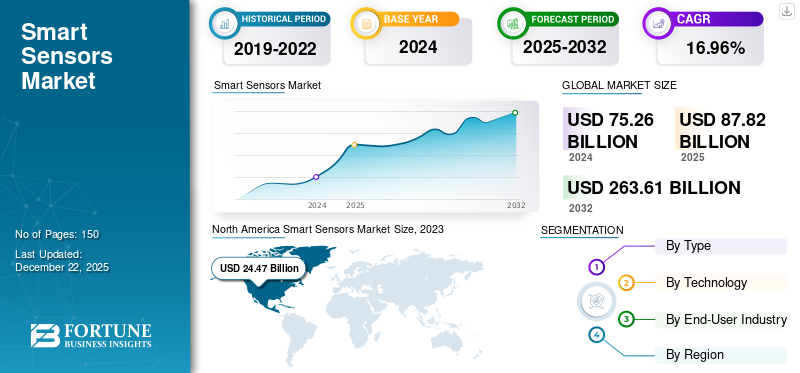

The global smart sensors market size was valued at USD 87.82 billion in 2025. The market is projected to grow from USD 102.57 billion in 2026 to USD 334.08 billion by 2034, exhibiting a CAGR of 15.91% during the forecast period.

Smart sensors are devices equipped with sensing capabilities, processing power, and communication features, enabling them to collect, analyze, and transmit data autonomously. Unlike traditional sensors, such sensors possess advanced functionalities such as real-time data processing, predictive analytics, and connectivity to other devices or systems. They have applications across industries, including industrial automation for monitoring machinery, healthcare for tracking vital signs, smart homes for energy management and security, and environmental monitoring for pollution control, among others.

The global market is driven by advancements in IoT, increasing demand for automation, and the proliferation of wireless technologies. The adoption of 5G technology is also a significant trend in the market, offering faster data transfer rates and lower latency. This advancement will enable more seamless and reliable communication between such sensors and connected devices, enhancing applications such as autonomous vehicles and smart 5G infrastructure. For instance,

- May 2022: A Chinese mining firm achieved significant labor reductions underground, ranging from 50% to 75%, by implementing a cutting-edge digital transformation solution. This solution, powered by a Comba FLeX5 5G network and Intel Xeon D CPUs, integrates such intelligent sensors and high-definition cameras, optimizing operations and boosting efficiency.

Moreover, the COVID-19 pandemic accelerated the smart sensor industry growth, driven by the growing demand for automation and remote monitoring. Industries, especially healthcare, sought advanced sensing solutions for real-time patient monitoring and contactless operations. Additionally, supply chain disruptions prompted companies to adopt such sensors for predictive maintenance and efficiency optimization.

GENERATIVE AI IMPACT

Advanced-Data Analysis and Predictive Modeling to Significant Push Vendors for Leveraging Generative AI

Generative AI (Gen AI) enhances the capabilities of smart sensor devices through advanced data analysis, predictive modeling, and automation. Gen AI algorithms can process vast amounts of data collected by such sensors, enabling more accurate and insightful interpretations. For instance, companies such as Philips are integrating Gen AI with such sensors in wearable devices to improve patient monitoring and personalized care. Similarly, Siemens is leveraging Gen AI to enhance predictive maintenance. Another example is Tesla, which uses Gen AI in conjunction with sensors in its autonomous vehicles.

Companies globally are making significant investments in Gen AI and smart sensor integration to facilitate smarter, more responsive environments, from smart homes to industrial applications. For instance,

- February 2024: Bosch and Microsoft joined forces to accelerate the use of generative AI. Together, they aimed to elevate automated driving capabilities by leveraging vehicle sensor data to enhance performance.

- July 2023: Infineon Technologies acquired Stockholm-based startup Imagimob A.B. to bolster its edge AI capabilities. This acquisition improved its range of such sensors and IoT solutions, empowering customers to leverage AI/ML advantages and accelerate product launches.

Smart Sensors Market Trends

Growing Integration of AI and Machine Learning in Smart Sensors to Boost Market Demand

The integration of artificial intelligence (AI) and machine learning (ML) in such sensors is a significant trend in the global smart sensor market. This integration enables sensors to collect data and analyze and interpret it in real time, facilitating more informed decision-making and predictive capabilities. Companies in the global market are leveraging AI/ML capabilities to enhance their product offerings. For instance, Bosch has been incorporating AI and machine learning (ML) algorithms into its sensors for predictive maintenance in industrial machinery and improving energy efficiency in smart buildings. Similarly, Honeywell has developed such sensors for HVAC systems that utilize AI to optimize energy usage based on occupancy patterns and environmental conditions.

As companies continue to invest in AI-driven sensor technologies, the global smart sensor market is expected to witness substantial growth and advancements. For instance,

- May 2024: Elliptic Labs, a leading AI software company renowned for AI Virtual Smart Sensors installed in 500 million devices, launched its AI Virtual Proximity Sensor INNER BEAUTY on Vivo’s latest entry-level smartphone, the Y200. This model, tailored for the Chinese market, utilizes Qualcomm’s Snapdragon 6 Gen 1 chipset.

Download Free sample to learn more about this report.

Smart Sensors Market Growth Factors

Reliance of IoT Systems on Sensors for Data Collection and Functionality to Drive Market Growth

The market is primarily driven by the increasing adoption of Internet of Things (IoT), as IoT systems rely heavily on a wide array of sensors for data collection and functionality. Companies are leveraging IoT technologies to optimize operations, improve efficiency, and create innovative products, which, in turn, fuels the demand for such sensors. Businesses such as Texas Instruments and Analog Devices Inc. offer these sensors for IoT applications, industrial automation and automotive sectors. Moreover, companies such as Honeywell International Inc. are investing in smart sensor technologies for building automation, focusing on energy efficiency and sustainability.

Moreover, the push for smart cities is driving the demand for such sensors in applications such as traffic management, energy optimization, and environmental monitoring. Overall, these developments emphasize the increasing significance of such sensors in various industries and highlight companies' efforts to capitalize on emerging opportunities in the global smart sensors market.

- April 2024: CallPass LLC, a leader in asset tracking, fleet management, and dash camera technology, launched LANA IoT, an innovative IoT smart sensor solution, aimed at transforming property monitoring for businesses.

RESTRAINING FACTORS

High Initial Investment Required for Deploying Smart Sensor Systems to Hamper the Market Growth

The market poses few restraints that hinder the growth of the global smart sensor market. One significant restraint is the high initial investment required for deploying smart sensor systems. The cost of implementing sensor networks, infrastructure upgrades, and data processing capabilities can be substantial for businesses, particularly small and medium-sized enterprises. The lack of standardization and compatibility between devices from different manufacturers can hinder seamless integration and data exchange, limiting the scalability and effectiveness of smart sensor solutions.

These restraints highlight the importance of addressing cost barriers, enhancing interoperability standards, and implementing stringent security measures to foster the widespread adoption of smart sensors.

Smart Sensors Market Segmentation Analysis

By Type Analysis

Increasing Demand for Radar Sensors across Various Industries Drives Segmental Dominance

Based on type, the market for smart sensors is divided into radar sensors, touch sensors, temperature and humidity sensors, biosensors, level sensors, pressure and flow sensors, optical sensors, image sensors, and others.

The radar sensors segment held the largest global smart sensors market share of 20.18% in 2026 due to their widespread use across various industries, including automotive, aerospace, defense, and industrial automation. Radar sensors are utilized for object detection, collision avoidance, speed measurement, and weather monitoring, among other applications. Their robust performance in harsh environments, ability to work in various weather conditions, and long-range detection capabilities make them indispensable in numerous sectors.

The biosensors segment is expected to grow at the highest CAGR in the smart sensor market. This is due to the increasing demand in healthcare, environmental monitoring, and food safety applications. With the growing prevalence of chronic diseases there is a rising demand for advanced diagnostic and monitoring tools. Biosensors offer real-time, accurate, and non-invasive monitoring solutions, which are vital in managing these conditions.

By Technology Analysis

Need for Low Power Consumption and High Sensitivity across Devices and Systems to Fuel MEMS-based Sensors Demand

By technology, the market for smart sensors is categorized into MEMS-based sensors, CMOS-based sensors, optical sensors, and others.

The MEMS (Micro-Electro-Mechanical Systems) sensors segment is likely to hold the largest share of 50.84% in the global smart sensor market in 2026. MEMS sensors offer advantages such as compact size, low cost, low power consumption, and high sensitivity, making them ideal for integration into a wide range of devices and systems. For instance,

- May 2024: STMicroelectronics introduced MEMS Studio, a comprehensive tool for evaluating and developing MEMS sensors. It seamlessly integrates with the STM32 microcontroller ecosystem and supports Windows, MacOS, and Linux operating systems.

The CMOS (Complementary Metal-Oxide-Semiconductor) sensors segment is anticipated to grow at the highest CAGR of 19.68% in the market due to advancements in technology and increasing demand for high-resolution imaging and sensing capabilities. CMOS sensors are predominantly used in imaging applications such as cameras, smartphones, and medical imaging devices.

By End-User Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Adoption of Remote Patient Monitoring and Wearable Health Devices Drives Demand for Sensors in Healthcare

By end-user industry, the market for smart sensors is studied among automotive, healthcare, consumer electronics, industrial automation, aerospace and defense, and others.

The healthcare segment is expected to hold the largest share by 37.70% in 2026 due to several factors. Firstly, the increasing adoption of remote patient monitoring and wearable health devices drives the demand for such sensors in healthcare. Secondly, regulatory mandates and initiatives promoting digital health technologies contribute to global smart sensors market growth. Additionally, aging population and the prevalence of chronic diseases create a significant need for remote monitoring solutions, further driving the uptake of such sensors in healthcare.

However, the automotive industry is anticipated to exhibit the highest CAGR of 18.82% in the market due to rapid technological advancements and the growing demand for connected and autonomous vehicles. Such sensors play a crucial role in enabling advanced driver assistance systems (ADAS), autonomous driving functionalities, and vehicle-to-everything (V2X) communication.

REGIONAL INSIGHTS

The global market has been studied across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Smart Sensors Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounts for the largest global smart sensor market size owing to increasing investments in IoT, automation, and smart infrastructure. The regional market value in 2026 was USD 38.04 billion, and in 2025, the market value led the region by USD 32.82 billion. The region's strong technological infrastructure, with growing demand for advanced sensing solutions across industries such as healthcare, automotive, and manufacturing, is expected to fuel market growth. Moreover, government initiatives promoting smart city development and sustainable practices further contribute to market expansion. The U.S. market size is estimated to hit USD 29.34 billion in 2026.

Europe region is to be anticipated as the third-largest market with USD 14.77 billion in 2025. The European market is promising, driven by the increasing adoption of IoT and Industry 4.0 initiatives across various sectors. Industries such as automotive, healthcare, and manufacturing are leveraging such sensors for automation, predictive maintenance, and process optimization. Additionally, supportive government policies and investments in smart infrastructure are fueling smart sensors market growth. Moreover, advancements in AI and ML technologies are enhancing the capabilities of such sensors, making them indispensable for achieving operational efficiency and competitiveness. The market value in U.K. is expected to be USD 3.58 billion in 2026.

On the other hand, Germany is projecting to hit USD 3.54 billion in 2026 and France is likely to hold USD 2.11 billion in 2025. For instance,

- February 2023: Sensoneo's smart waste monitoring solution was deployed in Madrid, marking Europe's largest smart waste installation. Over 11,000 smart sensors were installed across bins, enhancing efficiency and reducing emissions and traffic.

Asia Pacific is anticipated to account for the second-highest market size of USD 26.23 billion in 2025, exhibiting the second-fastest growing CAGR of 18.72% during the forecast period. The Asia Pacific market is expected to grow at the highest CAGR over the owing to rapid urbanization, industrialization, and technological advancements. The increasing adoption of IoT and smart infrastructure projects across sectors such as manufacturing, automotive, healthcare, and consumer electronics fuels market growth. With a large consumer base and a thriving electronics industry, the region offers significant growth opportunities for smart sensor manufacturers and suppliers. The market value in China is expected to be USD 7.78 billion in 2026.

On the other hand, India is projecting to hit USD 6.64 billion and Japan is likely to hold USD 5.33 billion in 2026.

The smart sensor market in the Middle East & Africa and South America regions is known for its steady growth due to increasing industrialization, urbanization, and infrastructure development. South America is likely to be the fourth-largest market with a value of USD 8.02 billion in 2025. The rising investments in sectors such as oil and gas, manufacturing, and construction drive the demand for smart sensors to enhance operational efficiency, safety, and resource management. The GCC market size is estimated to be USD 2.54 billion in 2025. For instance,

- August 2023: Iveda, a leading provider of cloud-based AI sensor and video solutions, partnered with The Arab Organization for Industrialization (AOI) to bolster and expand smart city initiatives in Egypt.

KEY INDUSTRY PLAYERS

Strategic Partnerships and Collaborations to Boost the Market Presence of Key Players

The key players are entering into strategic partnerships and collaborating with other significant market leaders to expand their portfolio and provide enhanced low-code and no-code tools to fulfill their customer's application requirements. Furthermore, through collaborations, the companies are gaining expertise and expanding their business by reaching a mass customer base. The major companies provide innovative solutions for industries and users to handle the growing expectations for customer retention.

List of Top Smart Sensors Companies:

- Microchip Technology Inc. (U.S.)

- Sony Semiconductor Solutions Corporation (Japan)

- Panasonic Corporation (Japan)

- STMicroelectronics (Switzerland)

- Texas Instruments Incorporated. (U.S.)

- Infineon Technologies AG (Germany)

- Analog Devices, Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Bosch Sensortec GmbH (Germany)

- TE Connectivity (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Infineon Technologies AG introduced the XENSIV Sensor Shield for Arduino, a tool for estimating smart sensor systems in various consumer applications and smart homes. This shield integrates a diverse range of sensors, including Sensirion’s SHT35 humidity and temperature sensors, streamlining capabilities and enhancing design journeys for Infineon’s customers.

- April 2024: Panasonic Eco Systems North America introduced an upgraded lineup of WhisperGreen Select ventilation fans, featuring Dual Sensor Technology (Condensation Sensor and Smart Action Motion Sensor) for enhanced fan performance and lighting control based on environmental cues.

- April 2024: STMicroelectronics expanded its edge-AI sensor range with the LSM6DSV32X inertial module, enabling in-depth movement analysis. This addition enhanced the smart sensor family, incorporating ST's machine-learning core with AI decision tree algorithms.

- December 2023: Ikea unveiled three smart sensors for home oversight and management, covering water leaks and unauthorized entries. The lineup featured BADRING Water Leakage Sensor, VALLHORN Wireless Motion Sensor, and PARASOLL Door and Window Sensor, utilizing Zigbee Software automation technology.

- December 2023: Panasonic collaborated with Atmosphere Vortex to offer its entire range of inline fans and dryer venting in the U.S. The DBF-DEDPV is a UL705-rated, hard-wired product, boasting an integrated lint trap and a pressure sensors for automatic dryer detection.

REPORT COVERAGE

The report provides the competitive landscape of the market and focuses on key aspects such as market players, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 15.91% from 2026 to 2034 |

|

Segmentation |

By Type

By Technology

By End-User Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 334.08 billion by 2034.

In 2025, the market size stood at USD 87.82 billion.

The market is projected to grow at a CAGR of 15.91% during the forecast period.

Based on type, the radar sensor segment is leading the market.

Reliance of IoT systems on sensors for data collection and functionality is a key factor anticipated to drive market growth.

Microchip Technology Inc., Sony Semiconductor Solutions Corporation, Panasonic Corporation, STMicroelectronics, Texas Instruments Incorporated., Infineon Technologies AG, Analog Devices, Inc., NXP Semiconductors, Bosch Sensortec GmbH, and TE Connectivity are the top players in the market.

North America holds the highest market share.

The Asia Pacific market is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us