Solid State Drive Market Size, Share & Industry Analysis, By Interface Type (Serial ATA (SATA), Serial Attached SCSI (SAS), and Others), By Storage (Under 500GB, 500GB – 1TB, 1TB – 2TB, and Above 2TB), By End-user (Individuals, Enterprises, and Others), and Regional Forecast, 2026 – 2034

Solid State Drive Market (2026-2034)

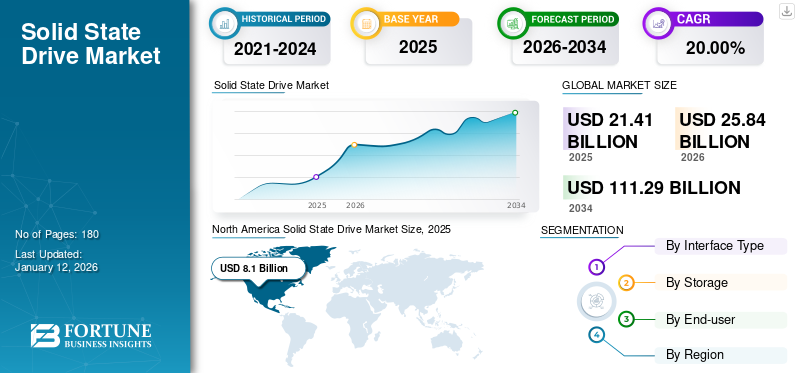

The global solid state drive market size was valued at USD 21.41 billion in 2025 and is projected to grow from USD 25.84 billion in 2026 to USD 111.29 billion by 2034, exhibiting a CAGR of 20.00% during the forecast period. North America dominated the solid state drive (SSD) industry with a market share of 37.80% in 2025.

The solid state drive is a vibrant sector within the computer hardware industry that revolves around the production, distribution, and consumption of SSDs, which have become integral components in modern computing devices. Unlike traditional Hard Disk Drives (HDDs), SSDs utilize flash memory technology to store data persistently, offering high speed, reliability, and energy efficiency advantages. The market is characterized by intense competition among manufacturers, ranging from established tech giants to niche players, driving innovation and continuous improvement in SSD performance and capacity. Decreasing production costs and increasing demand for high-performance storage solutions across gaming, enterprise, and data center applications are key factors driving the steady growth and evolution of the SSD market globally. Additionally, the ongoing transition toward cloud computing and digital transformation initiatives contribute to this market expansion. For instance,

- According to Komprise, Inc., enterprises allocate a significant portion of their IT budgets to data management, with 63% of companies handling more than 1PB of data. Moreover, 30% of IT budgets were currently dedicated to data storage and backups, with many organizations increasing costs in 2022. Thus, the demand for advanced data storage solutions is expected to grow significantly inupcoming years, fueling market growth.

During the COVID-19 pandemic, there was increased demand for solid state drives due to the surge in remote work and online activities, driving up sales for personal and enterprise use. However, disruptions in the supply chain and manufacturing processes also affected production and availability, leading to potential shortages and price fluctuations.

IMPACT OF GENERATIVE AI

Introduction of Advanced Algorithms for Enhancing SSD Performance, Reliability, and Lifespan to Aid Market Growth

Generative AI notably impacts the demand for solid state drives market by influencing various aspects of SSD technology development, manufacturing, and utilization. Generative AI can optimize SSD controller algorithms through AI-driven techniques, enhancing SSD performance, reliability, and lifespan. The technology also improves data compression and error correction algorithms within SSDs, maximizing storage capacity and data integrity. Additionally, AI-powered predictive analytics enable better demand forecasting and inventory management for SSD manufacturers, reducing costs and optimizing supply chains. Moreover, generative AI facilitates the creation of innovative SSD designs, such as neuromorphic or AI-specific SSDs tailored for specialized applications such as machine learning and artificial intelligence workloads. Therefore, integrating generative AI techniques enhances the competitiveness and capabilities of SSDs, driving global solid state drive market growth. For instance,

- In October 2023, ADATA, a memory brand, introduced the USB4 SE920 external SSD, catering to the increasing demand for large file transfers in AI computing. Supporting Thunderbolt 3 & 4 and backward compatibility with USB 3.2 and USB 2.0, it offers write speeds up to 3,800 MB/s. Its Type-C interface facilitates seamless file transfer across devices.

Solid State Drive Market Trends

Increasing Demand for Superior Performance and Efficiency of Modern Computing Applications to Surge Market Growth

The increasing adoption of PCIe NVMe SSDs is fueled by their superior performance and efficiency compared to traditional SATA SSDs. Leveraging the PCIe interface and NVMe protocol, PCIe NVMe SSDs deliver higher data transfer speeds and lower latency, meeting the demands for modern computing applications, such as gaming, content creation, and data analytics. The transition to cloud computing and virtualization also emphasizes the need for high-performance storage solutions to support scalable infrastructure. As the cost of PCIe NVMe SSDs decreases due to advancements in NAND flash memory technology and economies of scale in manufacturing, they become more accessible to consumers and enterprises. For instance,

- In December 2023, Micron Technology launched the Micron 3500 NVMe SSD, powered by its 232-layer NAND, catering to demanding workloads in various fields, such as business applications, gaming, and content creation. Its superior performance, including a significant up to 71% improvement for product development applications, showcasing its competitive edge.

This trend highlights a shift toward maximizing storage performance and efficiency to accommodate data's increasing volume and complexity in today's computing landscape, thus driving the expansion of the solid state drive market share.

Download Free sample to learn more about this report.

Solid State Drive Market Growth Factors

Persistent Need for Enhanced Storage Performance and Reliability across various Computing Applications to Fuel Market Growth

The persistent need for elevated storage performance and reliability across diverse computing applications is essential for market growth. As computing tasks evolve and expand in complexity, from gaming and content creation to data analytics and cloud computing, there is an escalating requirement for storage solutions capable of delivering faster data access, reduced latency, and enhanced durability. For instance,

- According to SODA Data Storage, the proliferation of digital technologies, increased connectivity and widespread adoption of online platforms have contributed to exponential data growth as more and more information is generated, shared, and stored across several domains. It is stated that most organizations will be adopting upto 100 TB to 1,000 TB during 2022.

SSDs, with their inherent advantages over traditional hard disk drives in terms of speed, resilience, and energy efficiency, are increasingly favored by consumers and enterprises. Moreover, the ongoing technological advancements in NAND flash memory, including the development of Multi-Level Cell (MLC), Triple-Level Cell (TLC), and Quad-Level Cell (QLC) architectures, continues to drive SSD innovation, enabling higher performance and greater storage capacities to meet the escalating demands for modern computing applications. For instance,

- In April 2024, Kingston broadened its range of external solid state drives by introducing the XS1000 drive in India. The new Kingston XS1000 SSD provides read speeds of up to 1050MBs per second and is available in two storage capacities: 2TB and 1TB.

RESTRAINING FACTORS

Compatibility Issues with Legacy Systems and Infrastructure to Impede Market Growth

Despite declining prices, solid state drives remain relatively more expensive per gigabyte of storage, hindering widespread adoption, particularly among price-conscious consumers and businesses. Additionally, concerns about the limited lifespan of NAND flash memory, which powers SSDs, especially in high-write-intensive applications, can deter some users. Compatibility issues with legacy systems and infrastructure also pose challenges for solid state drive’s integration. Furthermore, market saturation in certain segments and regions can limit growth opportunities for SSD manufacturers. To overcome these challenges, organizations must focus on reducing SSD production costs, enhancing durability and reliability, and educating consumers and businesses about the long-term benefits of SSD technology in terms of performance, energy efficiency, and overall system responsiveness.

Solid State Drive Market Segmentation Analysis

By Interface Type Analysis

Surge in Demand for High-performance Computing Requirements to Fuel Serial ATA (SATA) Segment Growth

Based on interface type, the market is divided into Serial ATA (SATA), Serial Attached SCSI (SAS), and others. Among them, Serial ATA (SATA) holds the largest market share of 58.81% in 2026 due to its longstanding presence and widespread adoption across laptops, desktops, and servers. Furthermore, its widespread compatibility with existing hardware and lower cost compared to newer interfaces such as NVMEs make it an attractive option for both consumers and enterprises looking to upgrade from traditional hard drives without needing significant hardware changes.

The others segment, which includes NVMe SSDs, is expected to grow at the highest CAGR due to their superior speed and low latency, catering to high-performance computing needs. As AI, big data, and cloud computing evolve, there is a rising demand for efficient data handling, propelling NVMe adoption. Moreover, their increasing affordability and integration into data center solutions boost their accessibility.

By Storage Analysis

500GB – 1TB Segment Dominated owing to Rising Need for Balanced Storage Capacity and Cost-effectiveness

In terms of storage, the market is divided into under 500 GB, 500GB – 1TB, 1TB – 2TB, and above 2TB. Among them, 500GB – 1TB dominates the market due to its balanced storage capacity and cost-effectiveness. It offers ample space for operating systems and applications at a reasonable price compared to higher-capacity solid state drives. This wide range is commonly found in laptops, desktops, and gaming consoles, further boosting its popularity. Moreover, it is favored in data centers and enterprises for its optimal performance, capacity, and cost balance. The 500GB to 1 TB segment is anticipated to hold a dominant market share of 38.69% in 2026.

The 1TB to 2TB capacity range is expected to witness the highest growth rate in the market. This is due to increasing demand for larger storage capacities driven by data-intensive applications and multimedia content, along with advancements in SSD technology, making higher-capacity SSDs more affordable and accessible.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Enterprises Segment Growth hold the Maximum Market Share due to Increasing Implementation of Technologies among Enterprises

On the basis of end-user, the market is divided into individuals, enterprises, and others. Enterprises hold the maximum market share of 62.29% in 2026 due to their extensive storage needs, requiring fast and efficient solutions for managing large volumes of data. SSDs offer superior performance, reliability, and security features, making them ideal for enterprise environments. With the increasing adoption of technologies such as cloud computing and big data analytics, the demand for SSDs in enterprises continues to rise, driving their market share.

The individuals segment is expected to grow at the highest CAGR due to increasing demand for faster and more reliable storage solutions in personal computers, laptops, and gaming consoles. Additionally, the growing popularity of digital content creation, streaming services, and gaming requires higher storage capacities and faster data access speeds, further fueling consumer demand for SSDs. For instance,

- In April 2024, Samsung introduced the T7 Shield, a compact external SSD resembling an ATM card in size and featuring an aluminum body. It is tailored for creative professionals and individuals with active lifestyles and offers 4TB of storage capacity. The company declares that this SSD is 9.5 times faster than traditional external hard disk drives, making it an optimal choice for frequent large file transfers.

Regional Market Analysis

Based on geography, the market for solid state drive is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America Solid State Drive Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The solid state drive industry in north america accounts for the largest market share due to its robust tech industry, innovation leadership, and strong consumer demand. Major technology companies based in North America invest heavily in research and development, driving innovation and the development of advanced SSD technology. Additionally, the region benefits from a well-established infrastructure for technology adoption, along with a large consumer base with high demand for SSDs across various sectors such as enterprise, consumer electronics, and data centers. The U.S. market is projected to reach USD 6.08 billion by 2026. For instance,

- In February 2024, Seagate Technology Inc., a mass-capacity storage solutions provider, unveiled its new e-commerce platform in the U.S. Customers can buy Seagate's top-tier storage products directly from www.seagate.com, access to exclusive deals, receive customer support via live chat, and the assurance of genuine Seagate products.

Furthermore, the region's favorable regulatory environment and intellectual property protection encourage investment and foster growth in the solid state drives market.

Asia Pacific

The solid state drive industry in Asia Pacific is expected to grow at the highest CAGR in the market owing to rapidly expanding economies such as China, India, and Japan, driving the adoption of SSDs in data centers. Moreover, the growing popularity of cloud computing, big data analytics, and artificial intelligence in the region fuels demand for high-performance storage solutions such as solid state drives. Additionally, the increasing penetration of smartphones, tablets, and other mobile devices in Asia Pacific countries is driving the need for faster and more reliable storage solutions. The Japan market is projected to reach USD 0.98 billion by 2026, the China market is projected to reach USD 1.63 billion by 2026, and the India market is projected to reach USD 0.96 billion by 2026. For instance,

- In September 2023, Western Digital released India's WD Blue SN580 NVMe Solid State Drive (SSD), targeting creative professionals, students, and consumers. According to a press statement, the SSD is engineered to improve PC performance and facilitate smooth content creation.

Furthermore, government initiatives aimed at digital transformation and infrastructure development also contribute to the growth of the SSD market in the region.

Europe

The solid state drive industry in Europe holds the second-largest market share as the region has a strong industrial base and a mature economy, fostering demand for SSDs across various automotive, aerospace, healthcare, and telecommunications sectors. Additionally, the region has a large consumer electronics market, including smartphones, laptops, and gaming consoles, which drives the demand for SSDs in these devices. Moreover, European companies are actively involved in SSD manufacturing, research, and development, contributing to the region's significant market share. The UK market is projected to reach USD 1.44 billion by 2026, while the Germany market is projected to reach USD 1.14 billion by 2026.

Middle East & Africa and South America

The Middle East & Africa and South America are expected to experience average growth rates in the market due to factors such as lower disposable income levels, infrastructure challenges, and geopolitical instability in some areas that may hinder the widespread adoption of SSDs. Moreover, alternative storage solutions such as traditional Hard Disk Drives (HDDs) and slower technological adoption rates in certain sectors may contribute to the moderate growth projections for SSDs in these regions. However, as economic development progresses and digital infrastructure improves, there is potential for gradual growth in SSD adoption over time.

Key Industry Players

Key Players Launch New Products to Strengthen Market Positioning

Major players in the market frequently launch new products to enhance their market positioning by leveraging the latest technological advancements, addressing diverse consumer needs, and staying ahead of competitors. These new SSD releases feature improved performance, higher capacities, and better reliability, catering to the needs of consumers and enterprises. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving industry.

List of Top Solid State Drive Companies Analyzed

- Samsung (South Korea)

- Western Digital Corporation (U.S.)

- Intel Corporation (U.S.)

- Micron Technology, Inc. (U.S.)

- SK Hynix Inc. (South Korea)

- Seagate Technology LLC (U.S.)

- Kingston Technology (U.S.)

- NetApp, Inc. (U.S.)

- ADATA Technology Co., Ltd. (Taiwan)

- KIOXIA Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Kioxia announced the LC9 SSD with a capacity of 245.76 TB. Built on PCIe 5.0, it is the highest-capacity drive the company has released, designed for data-heavy applications in enterprise and hyperscale environments.

- August 2025: SanDisk unveiled a 256 TB UltraQLC NVMe SSD. Using its BiCS8 QLC NAND technology, the drive is built for cloud and enterprise customers that need very high capacity with lower power use. Shipments are expected to begin in 2026

- November 2024: Micron Technology introduced the 6550 ION, a 60 TB solid-state drive designed for data centers. It uses the E3.S form factor with PCIe Gen 5 support and can deliver 12 GB/s of throughput while using only 20 watts of power. The drive is aimed at large-scale workloads such as AI, content delivery, and cloud storage.

- April 2024: Micron Technology, Inc. introduced the Micron 4150AT SSD, the world's first quad-port SSD for software-defined intelligent vehicles. It provides data center-level flexibility and power with features, such as the Single-Root Input/Output Virtualization (SR-IOV), PCIe Gen 4, and rugged automotive design.

- March 2024: Western Digital unveiled its latest SSD series targeted at mainstream PCs, offering high performance and affordability. The Western Digital lineup, PC SN5000S, comprises DRAM-less drives utilizing the company's 3D QLC NAND memory and proprietary platform, ensuring cost-effectiveness. With sequential read speeds reaching 6,000 MB/s, these SSDs aim to deliver impressive performance at a reasonable price point.

- February 2024: Samsung Electronics Co. Ltd. launched the SSD 990 EVO, its latest consumer SSD, promising high performance and improved power efficiency. It is designed for gaming, work, and editing, catering to diverse user needs. Phil Gaut, Senior Director at Samsung Australia, underscores its significance, representing Samsung's leadership in-memory technology and offering optimized storage solutions.

- December 2023: a memory brand, ADATA Technology Co., Ltd., unveiled its latest SD810 external SSD. With triple IP68 protection and USB 3.2 Gen2 x2 interface, it offers speeds up to 2000MB/s and a Type-C connector. The SSD is compatible with the iPhone 15 series and is seamless for outdoor photographers and videographers. It also ensures fast file transfer and backup while withstanding harsh conditions and protecting valuable data.

- June 2023: Seagate Technology Holdings Inc. unveiled its latest SSD technology, the FireCuda 540, for gamers, creators, and tech enthusiasts. This PCIe Gen5 NVMe SSD sets new standards with unmatched speed and endurance, enhancing Seagate's lineup of PC storage solutions.

SOLID STATE DRIVE REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading product end-users. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Solid State Drive Market Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Interface Type

By Storage

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 111.29 billion by 2034.

In 2026, the market was valued at USD 25.84 billion.

The market is projected to grow at a CAGR of 20.00% during the forecast period.

The 500GB to 1TB storage segment leads the market.

The persistent need for enhanced storage performance and reliability across various computing applications is a key driver fueling market growth.

Samsung, Western Digital Corporation, and Intel Corporation are the top players in the market.

North America dominated the solid state drive (SSD) industry with a market share of 37.80% in 2025.

By end-user, individual segment is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us