Specialty Optical Fibers Market Size, Share & Industry Analysis, By Type (Single-Mode Specialty Optical Fiber and Multi-Mode Specialty Optical Fiber), By Application (Military & Defense, Healthcare & Medical Devices, Energy/Rail Transit, Oil & Gas, Telecommunication & Devices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

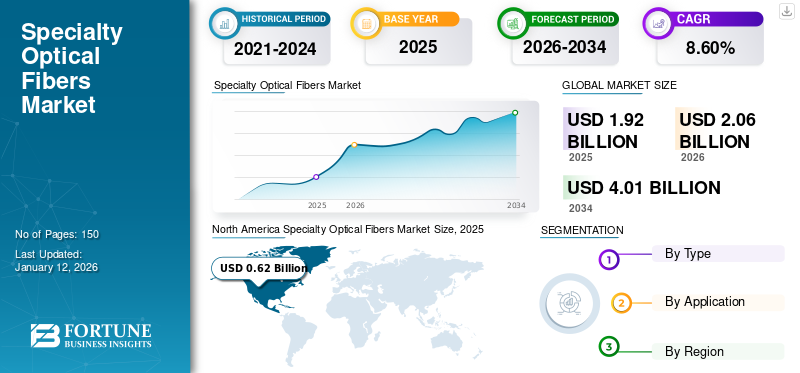

The global specialty optical fibers market size was valued at USD 1.92 billion in 2025. The market is projected to grow from USD 2.06 billion in 2026 to USD 4.01 billion by 2034, exhibiting a CAGR of 8.60% during the forecast period. North America dominated the global specialty optical fibers market with a share of 32.40% in 2025.

Specialty Optical Fibers (SOFs) are designed to meet specific requirements beyond standard optical fibers. These fibers can be engineered with unique properties such as high birefringence, dispersion, or nonlinearity to suit specific applications. They offer improved performance in terms of signal transmission, bandwidth, and resistance to environmental factors. Some specialty fibers are designed for miniaturized applications, offering compact and lightweight solutions.

These fibers are mostly used for shorter lengths than traditional optic fibers, which lengthen from a few centimeters to a few meters based on the application they are used in. In addition, specialty fiber optic networks are capable of sustaining extreme environmental conditions.

The implementation of SOF helps to reduce the number of components needed and minimize the module size by providing unrealistic flawless performance, safety, and security of the data with greater bandwidth. Such benefits drive the usage of SOF across different sectors, such as telecom FTTH, FDDI, and others, and robust duty operations in extreme environments, optical pump and beam delivery, CATV and data communication, and many others.

The COVID-19 pandemic had a significant impact on the specialty optical fiber sector. It caused disruptions in global supply chains, disturbing the manufacturing and distribution of optical fiber materials. These disruptions led to delays in project timelines and increased costs. Some optical fiber projects faced delays due to restrictions on travel and labor shortages caused by the pandemic. This affected the ability to install and maintain optical fiber networks in some areas.

During the pandemic, many countries increased their investments in Fiber-To-The-Home (FTTH) infrastructure to support remote work, online education, and other activities that require high-speed internet connectivity.

Here are some examples of countries that invested in FTTH initiatives during the pandemic:

- The U.S. government allocated funding for broadband expansion through various initiatives such as the CARES Act and BroadbandOhio Connectivity Grant and other investments in FTTH projects.

- The U.K. government aimed to provide a minimum of 85% gigabit-capable broadband to all parts of the country by 2025. As part of its effort, the government worked with private companies to expand FTTH networks across the country.

These investments aimed to improve internet speeds and connectivity for households and businesses, allowing them to adapt to the increased reliance on digital services during the pandemic.

Specialty Optical Fibers Market Trends

Rising Emergence of IoT Devices to Fuel the Demand for Specialty Optical Fiber to Provide Enhanced Connectivity

The increase in capacity and speeds of specialty optical fibers have led to the advancement of new mechanisms and services, such as the Internet of Things (IoT) and cloud computing, generating new market prospects for businesses. Moreover, the enhanced security and dependability of fiber optic cables have resulted in the growth of sectors such as disaster recovery and data center services.

Specialty optical fiber is anticipated to become stronger in the upcoming years with the increasing demands from network vendors, data center operators, and carriers to deploy them become more severe. These demands comprise both mechanical (long-term reliability) and optical (bend loss) necessities. Specialty optical fiber providers need to present and support that their solutions are mechanically trustworthy and maintain optical reliability as they are bent and installed in ways that aid greater bandwidth and densification. Hence, various enterprises and vendors collaborate to form alliances to utilize optical communication components. For instance,

- In November 2023, Accelink and SCHOTT announced an alliance by signing a long-duration collaboration contract at the CIIE 2023 (China International Import Expo). The partnership is anticipated to reinforce the fiber optic communication operation chain and progress the technological proficiencies. With the long-duration collaboration agreement, Accelink and SCHOTT are poised to fast-track the deployment and development of innovative technologies such as the Internet of Things (IoT), 5G advancements, and cloud computing.

Such advancements and developments across IoT, cloud computing, and other high-tech mechanisms cater to the demand for specialty optical fiber solutions.

Download Free sample to learn more about this report.

Specialty Optical Fibers Market Growth Factors

Continuous Internet Growth and 5G Stabilization to Upsurge the Demand for Specialty Optical Fibers

The 5G technology is growing continuously, and its impact is being witnessed globally. For a national deployment, transporters desperately require and are keen for a larger spectrum in the sub-6 gigahertz series. 5G is also renovating various industries and the way businesses function.

For example, manufacturing enterprises are progressively adding 5G coverage to fulfill their changing data desires. With greater security and mobility over traditional Wi-Fi, 5G offers stronger connectivity across a factory's operations. It also enables more consumers and devices to connect to the network regardless of worrying about being crowded and experiencing lagging.

Thus, the usage of specialty optical fibers has become a backbone in any network system, particularly for 5G. Hence, the adoption of optical fibers across various areas is increasing to advance high-speed connectivity with 5G. For instance,

- In September 2022, Corning introduced an optical fiber manufacturing plant to fulfill the rising requirement for high-speed connectivity in Poland, Europe. Network operators in Europe are capitalizing on broadband development to introduce high-speed connections to people across more communities. Such initiatives, along with investments in cloud data centers and 5G, signify the early phases of a large, multi-year growth for networks developed on optical fiber with virtually limitless bandwidth.

Thus, the 5G mechanism is becoming a standard prospect rather than just a new trend of using the 5G technology. Moreover, its impact on various sectors continues to evolve, shifting the dynamics of network proficiencies and demands.

RESTRAINING FACTORS

Delicate Nature of Specialty Optical Fibers Can Result in Technical Challenges in Handling These Cables, Limiting their Usage

The specialty optical fibers are comprised of small cores and are fragile to handle. They usually have thinner cores to accomplish precise assimilations. These optical fibers are made of different materials, such as cladding or dropping materials, which can be easily damaged. It makes them more susceptible to damage through maintenance or installation. It is essential to handle these fiber cables with precaution and prevent bending or twisting them too forcefully during installation. Furthermore, the delicate features of these cables need more accuracy in handling. Extreme tension or bending outside the quantified limits can cause fiber breakage, affecting network dependability and service efficiency.

Such factors can impact the usage of these fibers among end-users, thereby hampering the market growth.

Specialty Optical Fibers Market Segmentation Analysis

By Type Analysis

Enhanced Features of Multi-mode Specialty Optical Fibers Supports Segment Growth

Based on type, the market is bifurcated into single-mode specialty optical fiber and multi-mode specialty optical fiber.

The Multi-Mode Specialty Optical Fiber segment is projected to dominate the market with a share of 56.31% in 2026. The multi-mode specialty optical fiber segment accounts for the largest market share and is anticipated to grow with the highest CAGR during the forecast period. The segment’s growth is fueled by its support for the minimum distance required for data centers and enterprise networks at a significantly lower cost than single-mode optical fiber. Multi-mode fiber offers higher bandwidth at greater speeds with transmission over shorter distances. In addition, multi-mode fiber optic components and cables are less expensive and flexible to work with than their single-mode counterparts. This is principally due to the fact that the multi-mode fiber core is bigger, and arrangement acceptances are much less dangerous than they are for single-mode fibers. Such benefits drive the usage and, thus, advancements in these multimode specialty optical fibers. For instance,

- In January 2024, OFS announced the launch of Dual-Band LaserWave OM4+ multimode optical fiber to supplement their present OM5 and OM4 products that top the industry in attenuation, bandwidth, and geometry performance.

The single-mode SOF range of fibers is anticipated to grow substantially as it expands its range into the UV and allows usage in harsh environments. The fiber provides minimal photo-darkening and minimizes vulnerability to hydrogen ingression compared with conventional cored fibers.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Essential Requirements of SOF across Telecommunication & Devices to Upsurge the Segment Growth

Various applications of specialty optical fibers include military & defense, healthcare & medical devices, energy/rail transit, oil & gas, telecommunication & devices, and others (automotive,).

The telecommunication & devices segment held the largest market share in 29.15% 2026. Specialty optical fibers are employed in telecommunications for high-speed data transmission, dispersion compensation, and amplification. They are essential in making data connections possible and the requirement for higher bandwidth is predicted to rise owing to ongoing developments in the telecommunications and data space. Such essential requirements of SOF contribute to its usage across telecommunication & devices. For instance,

- In March 2024, Furukawa Electric announced a collaboration with Movistar, in which the telecommunications firm employs InvisiLight technology by OFS to offer its customers high-performance and easy-to-install fiber optics that preserve the appearance of buildings and the ecosystem.

The healthcare & medical devices segment is anticipated to grow with the highest CAGR during the forecast period. The product plays a critical role in medical imaging techniques such as Optical Coherence Tomography (OCT) and endoscopy. Several different medical instruments have initiated using fiber optics to enhance the medical field. They are developed as long, very flexible tubes with a light camera at the end. These medical apparatuses are some of the most highly regarded tools that require fiber optics to enable them to work efficiently and proficiently, causing less pain to the patients. Such rising usage of these products augments the specialty optical fibers market share across healthcare & device applications.

REGIONAL INSIGHTS

The market has been analyzed by region: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Specialty Optical Fibers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 0.62 billion in 2025 and USD 0.66 billion in 2026. North America held the largest market share in 2024, owing to rising demand for higher bandwidth and internet speed connectivity. The U.S. also had early acceptance of advanced mechanisms such as IoT devices. It has increased the adoption of 5G, contributing to the region's specialty optical fibers market growth. In addition, the region has the highest number of optical fiber cable exporters, with the U.S. being the leading exporter of optical fiber cables and bundles. The rising developments, advancements, and expansion of data centers in North America are leading to the highest revenue shares in the market. For instance, The U.S. market is projected to reach USD 0.52 billion by 2026.

- In August 2023, OFS launched fiber solutions for broadband buildout in America. With well-established U.S. manufacturing competencies, OFS enables positive broadband and middle-mile infrastructure constructs in the U.S. while aiding the objectives of the Buy America Act, Build America.

Asia Pacific

As per Fortune Business Insights, Asia Pacific is poised to grow with the highest CAGR during the forecast period. The region has enormous growth prospects due to the rising industrialization and developing economies of India, Southeast Asian countries, and South Korea. In addition, China accounts for one of the largest optical fibers markets with the presence of major market players that contribute to the region's growth. In addition, the growing focus on 5G adoption, broadband expansion across rural areas, expansion of telecommunication services, and others create various opportunities in the market. The Japan market is projected to reach USD 0.11 billion by 2026, the China market is projected to reach USD 0.22 billion by 2026, and the India market is projected to reach USD 0.07 billion by 2026. For instance,

- In August 2023, the Indian government Union Cabinet approved USD 17 billion worth of investments to drive the Bharatnet project led by the government with the aim of connecting Indian villages with fixed-line broadband connectivity by the Department of Telecommunications (DoT).

Europe

Europe is at the center of a digital evolution that can transform the communication infrastructure of the EU economies. To implement access to various digital services for its population and businesses, the European Union (EU) is continuously working on robust digital connectivity and Very High Capacity Networks (VHCN) such as wired-fiber optic technologies and wireless-5G systems. Investments in fiber optic technology are very crucial to the quality transmission of data services by network operators, government institutions, and media companies, among others. The U.K. market is projected to reach USD 0.13 billion by 2026, while the Germany market is projected to reach USD 0.16 billion by 2026.

The Middle East & Africa and South America

The Middle East & Africa and South America are anticipated to be driven by growing demand for consumer electronics, increasing urbanization, and changing lifestyles due to the growing penetration of the internet. Internet connectivity is an essential component of personal electronic devices and various businesses for the interconnection of electronic components, and FOCs provide the provision of electrical pathways to it. For instance,

- In January 2022, the Communication Ministry of Brazil launched a determined project that aimed to deliver broadband connectivity to the two Northern states population of the country. In this project, Infovia 00 fiber optic cable with a distance of approx. 770 km was deployed in Para and Amapa. The FOCs passed through the dense forest and the Amazon River.

List of Key Companies in Specialty Optical Fibers Market

Companies Focus on Mergers and Acquisitions and Alliances for Business Expansion

Prominent market players, such as Corning Incorporated, Coherent Corp, Fujikura Ltd., Furukawa Electric Co., Yangtze Optical Fibre and Cable, and Humanetics (Fibercore), among others, are attentive to offering advanced innovative technologies-driven specialty optical fibers. These players are expanding their product portfolio owing to the growing demand for internet penetration, IoT devices, 5G stabilization, and others. Market players are implementing several business strategies, such as mergers, acquisitions, and partnerships, to extend their businesses around the world.

LIST OF KEY COMPANIES PROFILED:

- Corning Incorporated (U.S.)

- Coherent Corp (U.S.)

- Fujikura Ltd. (Japan)

- Furukawa Electric Co. (Japan)

- Yangtze Optical Fibre and Cable (China)

- Humanetics (Fibercore) (U.S.)

- HENGTONG GROUP CO., LTD. (j-fiber GmbH ) (China)

- Molex (U.S.)

- Coractive (Canada)

- FiberLogix (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: YOFC announced the acquisition of RFS Suzhou and RFS Germany to expand its presence in the international cable markets. Both companies are known for their significant international brand presence and robust customer base. The two entities are at the top in the manufacturing, R&D, and distribution of specialized RF cables, hybrid cables, leakage cables, and other linked telecommunications infrastructure solutions.

- February 2024: YOFC introduced a product line of enhanced solutions and products at the MWC Barcelona 2024 (Mobile World Congress Barcelona). The company presented its latest optical fiber innovations, such as specialty communication fiber customized for particular industrial applications, ensuring performance and reliability. Other innovations include FarBand Ultra G.654.E Fibre, EasyBand Fibre, OM4/OM4+ Ultra Bending Insensitive Multimode Fibre, and GenBand Fibre.

- January 2024: OFS announced innovations in specialty optical fiber solutions and products at SPIE Photonics West. The company presented its technological expertise and industry management by offering seven highly projected educational conferences at the annual Photonics West Exhibition and SPIE BiOS Expo in San Francisco, California. OFS industry experts and research scientists highlight substantial advancements in multiple areas, such as new fiber designs and device infrastructures for amplifiers and fiber lasers, improved fibers for photonics, and sensing components for a range of applications.

- September 2023: Furukawa Electric announced an investment of USD 30 million to manufacture new fiber optic mechanisms in Brazil. The company inaugurated national manufacturing units for new fiber optic mechanisms, which were earlier only produced in the U.S. and Japan.

- April 2023: AFL announced the launch of the VHS400 Series. Verrillon portfolio of AFL in specialty optical fibers is developed to endure extreme environments within the industrial, oil and gas, geothermal, and military sectors. VHS400 range is a silica core double-wavelength single-mode optical fiber that is enhanced for usage at both 1550 nm and 1310 nm wavelengths. Moreover, the VHS400 range pure silica core chemistry offers improved performance over hydrogen darkening.

REPORT COVERAGE

An Infographic Representation of Specialty Optical Fibers Market

To get information on various segments, share your queries with us

The report highlights leading regions to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry growth trends and analyzes technologies deployed rapidly. It further highlights some drivers and restraints, helping the reader gain in-depth knowledge about the market analysis.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the global market is predicted to reach USD 4.01 billion by 2034.

In 2025, the market value stood at USD 1.92 billion.

The market is projected to grow at a CAGR of 8.60% during the forecast period (2026-2034).

By application, the telecommunication & devices segment secured the largest market share in 2025.

Continuous internet growth and 5G stabilization are poised to upsurge the demand for these solutions, augmenting the market growth.

Some of the top players in the market are Corning Incorporated, Coherent Corp, Fujikura Ltd., Furukawa Electric Co., Yangtze Optical Fibre and Cable, Humanetics (Fibercore), and HENGTONG GROUP CO., LTD. (j-fiber GmbH), among others.

North America held the largest share of the market in 2025.

By type, the multi-mode specialty optical fiber segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic