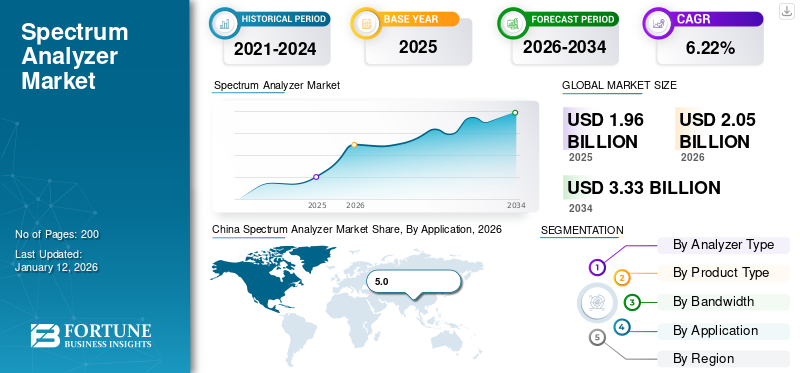

Spectrum Analyzer Market Size, Share & Industry Analysis, By Analyzer Type (RF Spectrum, Optical Spectrum, and Others), By Product Type (Benchtop, Handheld, and PC Based), By Bandwidth (1Khz to 5Khz, 5Khz to 9 khz, 9khz to 3Ghz, and above 3 GHz), By Application (Telecom, Optical communication, Radar & Radio system, Digital Signal Processing, Network, and Others)), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global spectrum analyzer market size was valued at USD 1.89 billion in 2025 and is projected to grow from USD 1.96 billion in 2026 to USD 2.95 billion by 2034, exhibiting a CAGR of 6.0% during the forecast period. Asia Pacific dominated the global spectrum analyzer market with a share of 32.8% in 2025.

Spectrum analyzers are equipment that detect and analyze the oscillation of signal amplitude on the vertical axis and frequency on the horizontal axis. The spectrum analyzer is offered in a variety of portable, benchtop, and handheld spectrum analyzers for various frequency ranges from 1 khz to above 9 GHz. The global market is set to observe robust growth driven primarily by the growing investment in wireless infrastructure, primarily in regions, such as Asia Pacific, North America, and Europe.

Further, the decline during the COVID-19 has made the analyzer demand drop for a shorter period. However, the growing internet penetration in developing countries has pushed the demand for analyzers steadily owing to the launch of 5G and growing auctions of the 5G spectrum. Such investments and increased penetration of 5G networks augmented the global market growth in the long term.

Spectrum Analyzer Market Trends

Focus on Frequency Range and Real-time Analyzers to Define New Trends

Global trends in the spectrum industry are changing very rapidly owing to the increased focus of the spectrum industry on expanding the frequency range and demand for analyzers that can detect high-frequency radio and photonics spectrum. Also, real-time spectrum analyzers are the new adoption of field spectrum analysis that maximizes scalability, flexibility, and cost-effectiveness compared to traditional hardware spectrum equipment. Thus, the trends are shaping the latest dimensions and growth rate of the global spectrum analyzer market size in the long term.

Download Free sample to learn more about this report.

Spectrum Analyzer Market Growth Factors

Increasing Demand for Wireless Communication Systems to Drive Market Growth

Spectrum analyzers have a dominant application in improving the capability, flexibility, and effectiveness of fiber optics and RF systems. The increasing usage of wireless communication systems for better internet accessibility is driving the demand. Also, governments in developing countries are focusing on increasing investment in spectrum auctions to make available affordable internet, which is driving global spectrum analyzer market growth during the forecast period.

RESTRAINING FACTORS

Regulatory Challenges and Complexity in Operation to Restrain Market

Regulations over the spectrum industry are changing dynamically as the rising penetration of the internet in developing and developed countries has grown progressively. Further, the operation complexity has caused a significant hindrance to the dominant adoption of analyzers in telecom and network applications. Despite the challenges for analyzers, demand is growing steadily throughout the communication and networking industry due to flexibility and portability.

Spectrum Analyzer Market Segmentation Analysis

By Analyzer Type Analysis

Growing Optical Communication System is Set to Bolster Optical Analyzer Demand

Analyzers are classified based on the different types, such as RF spectrum, optical spectrum, and others (electromagnetic spectrum).

The optical spectrum is set to dominate the analyzer type segment owing to the growing optical network and investments by developing governments and subsidiaries for better optical communication is bolstering demand.

Further, the RF spectrum observed the fastest growth due to heavy applications in equipment such as network, radar, and radio systems for the optimization of radar info systems.

Also, the electromagnetic spectrum has a potential demand in lab research and the growing telecom industry.

By Product Type Analysis

Growing PC Based Spectrum Use in Broadband Communication to Dominate Market

Product type has been segmented into benchtop, handheld, and PC-based spectrum systems.

The PC-based segment is projected to account for 43.02% of the market share in 2026 to dominant application of devices in rising optical networks and the use of analyzers in broadband spectrum applications.

Furthermore, the use of benchtop analyzers in mobile manufacturing and the IoT industry is growing steadily. Also, a handheld spectrum analyzer for the spectrum analysis of broadband and Wi-Fi network spectrum waves for installation and remote sites is helping the market grow steadily.

By Bandwidth Analysis

Expanding Spectrum Auctions and Infrastructure Investments to Flourish 5KHz to 9KHz Analyzer Business

On the based on bandwidth range are further classified into 1Hz to 5kHz, 5kHz to 9kHz, 9kHz to 3Ghz, and above 3 Ghz.

The 5 kHz to 9 kHz segment is expected to represent 31.96% of the total market share in 2026, growing exponentially owing to the increasing spectrum distribution, investment in network infrastructure by public private partnership (PPP) model that raise the potential of spectrum analyzers for the broadband industry in long term.

Also, analyzers ranging from 1 to 5 kHz have raised the demand in HTTP (Home to the Premise).

Further, 9Khz to 3Ghz and above 3GHz have a moderate application in the radio and long range secure frequency analyzer application that flourish the demand for analyzers in the long term.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Expansion of Optical Network to Bolster Optical Communication Demand in Long Term

Analyzers have a broad application in telecom, optical communication, radar & radio systems, digital signal processing (DSP), networks, and others.

The optical communication segment is forecast to account for 32.82% of the market share in 2026, maximized fiber bandwidth and connectivity for better internet bandwidth and to handle high congestions had dominated spectrum analyzer sales in the long term.

Also, telecom and defense applications for better interconnectivity and long-range signals have steadily developed demand for analyzers in the forthcoming period. Further, with the broadened application of analyzers for long-range transmitting and signal processing into radar & radio systems, Digital Signal Processing (DSP) has bolstered demand in the long term. Additionally, the demand for better connectivity for internet facilities in information technology has flourished, as has the demand for analyzers in network applications in the long term.

REGIONAL INSIGHTS

The global analyzer market is studied for the different geographies of North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Among the geographical market dynamics, the Asia Pacific analyzer industry is expected to hold the largest spectrum analyzer market share owing to the large consumer base and growing spectrum range of the 5G networks in developing countries, such as India, Indonesia, Malaysia, and other countries.

Asia Pacific Spectrum Analyzer Market, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

China is expected to hold the largest market share due to China’s solid technological presence and manufacturing cluster catering to Asia. Further, Japan is expected to grow progressively owing to technological innovation in the network spectrum. Also, India is observed to have the highest CAGR owing to increasing investments in the expanding network infrastructure. The Japan market is projected to reach USD 0.14 billion by 2026, the China market is projected to reach USD 0.26 billion by 2026, and the India market is projected to reach USD 0.08 billion by 2026.

China Spectrum Analyzer Market Share, By Application, 2026

To get more information on the regional analysis of this market, Download Free sample

North America

North America has a significant market share fueled by technological advances and the strong presence of manufacturing players offering wireless technologies. The U.S. region is expected to grow substantially owing to the rising demand for high network and wireless connectivity in the technology and aerospace sector. The U.S. market is projected to reach USD 0.24 billion by 2026.

Europe

Europe is observed to grow progressively owing to stringent regulations, and the adoption of highly advanced technologies is driving the demand for the analyzer market during the forecast period. Germany and the U.K. are expected to showcase significant growth owing to steady demand for network solutions and stringent network regulations.

The Middle East & Africa growth is observed to grow steadily owing to solid investments and IoT development has been expanding the business in the geographic steadily.

Furthermore, South America is expected to hold stagnant growth owing to increasing investments in infrastructure development and IoT applications in industrial floor automation.

KEY INDUSTRY PLAYERS

Key Players Focus on Investment for Product Innovation and Better Spectrum Capability to Expand Potential

Key players in the market are focusing on investments to develop more innovative and capable products that are capable of integrating high-range spectrum and bringing more advanced technological products to the consumer market.

List of Top Spectrum Analyzer Companies:

- Tektronix (U.S.)

- Key Sight (U.S.)

- Anritsu Corporation (Japan)

- Transcom Instruments (U.S.)

- Aaronia AG (Germany)

- Teledyne (U.S.)

- Rohde Schwarz gmbh co kg (U.S.)

- Siglent Technologies America, Inc. (China)

- Thorlabs Inc. (U.S.)

- National Instruments (U.S.)

- EXFO (Canada)

- Yokogawa Test & Measurement Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Keysight Technologies and Capgemini have successfully tested and validated the NTN test cases in a setup using 5G New Radio (NR), Central Unit (CU), and Distributed Unit (DU) supporting NTN functionality.

- February 2024: Anritsu, a prominent test and measurement equipment manufacturer, has announced that it will integrate artificial intelligence (AI) capabilities for wireless communications using DeepSig’s proven AI machine learning technology.

- November 2023: Keysight has expanded the simulation capabilities of the Electronic Design Automation (EDA) software suite that includes simulation for Tower radio frequency (TRF) technologies for circuit and physical designs.

- July 2023: Keysight Technologies has launched its software-defined handheld analyzer that supports more than 20 vector network analyzers and analyzers that provide accurate network analysis down to 3 kHz.

- March 2023: RF Explorer, a testing equipment manufacturer, has introduced its RF Explorer Pro, a touchscreen RF Spectrum Analyzer that has been configured for wireless microphones and IEM Users. It supports sporting an integrated 6 Ghz analyzer that maximizes the performance of wireless communication.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the table of contents and report offer insights into the market segmentation trends and highlight key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.22% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Analyzer Type

By Product Type

By Bandwidth

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 3.33 Billion by 2034.

In 2025, the market was valued at USD 1.96 Billion.

The market is projected to grow at a CAGR of 6.22% during the forecast period.

PC based spectrum product dominates the spectrum analyzer market share.

Increasing demand for wireless communication systems to drive market growth.

Tektronix, Key Sight, Anritsu, Transcom Instruments, Aaronia AG, Teledyne, Rohde & Schwarz USA Inc., Siglent Technologies America, Inc., Thorlabs Inc., National Instruments, EXFO, and Yokogawa test & Measurement Corporation are the prime players in the market.

Asia Pacific region generated the maximum revenue in 2025.

The optical communication segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us