Spray Dryer Market Size, Share & COVID-19 Impact Analysis, By Type (Rotary Atomizer, Nozzle Atomizer, Fluidized, Closed Loop, Centrifugal), By Drying Stage (Single Stage, Two Stage, Multi Stage), By Application (Food & Dairy, Pharmaceutical, Chemical, Others (Animal Feed)), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

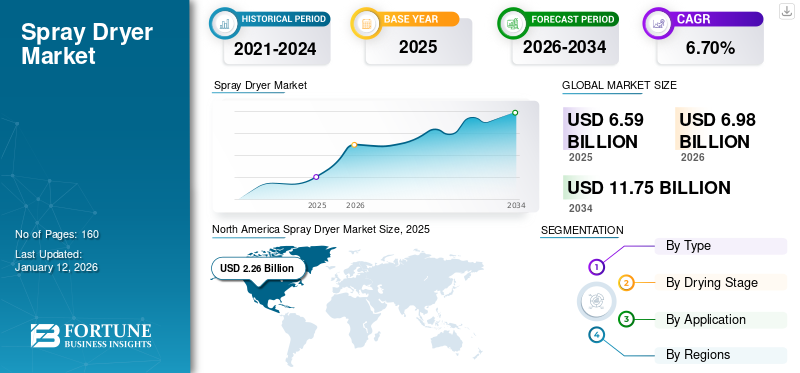

The global spray dryer market size was valued at USD 6.23 billion in 2024. The market is projected to grow from USD 6.59 billion in 2025 to USD 10.23 billion by 2032, exhibiting a CAGR of 6.5% during the forecast period. North America dominated the global market with a share of 34.02% in 2024.

Spray drying is a method of converting a liquid or slurry into a dry powder using hot air. Heat-sensitive products such as medicines and foodstuffs are dried using these dryers. Spray drying of certain industrial substances such as catalysts requires a uniform particle size distribution.

The growing food and chemical industry, pharmaceutical industry, and chemical industry are driving the global spray drying equipment market. In addition, rapid urbanization, population growth, changing lifestyles, and rising household incomes are macroeconomic factors that have a positive impact on the market. Other factors such as increased ingesting of processed foods, increasing awareness of nutritional value, technological developments, and innovations are also restraining the market growth of spray dryer.

COVID-19 IMPACT

Rising Demand from Pharmaceuticals Industry Accelerated Market Growth During COVID-19 Pandemic

The demand for spray drying pharmaceuticals has increased due to the COVID-19 pandemic. Pharmaceutical spray drying refers to the process of rapidly drying a drug product with hot gas to produce a dry powder from a liquid or suspension. This process is often used to improve the bioavailability of a drug.

The market was growing due to various desirable properties it offers such as better bioavailability, non-pollution, hygienic conditions and pressure control, properties that are ideal for pharmaceuticals manufactured during the COVID-19 pandemic.

Pharmaceutical spray drying distributes particles of uniform size for manufacturing industrial products such as catalysts. Air is the most commonly used dryer. However, if the liquid is flammable, ethanol can be used as a drying agent. The introduction of new medicines such as vaccines and biological substances that require spray drying technology is expected to provide good market opportunities, which is contributing to the spray drying market growth.

Spray Dryer Market Trends

Rising Popularity of Spray Dried Encapsulation to Drive the Market Growth

The popularity of the encapsulation process is increasing due to continuously developed value-added products in food and pharmaceutical industries. Various studies have been conducted worldwide to explore and innovate this concept. Volatile and chemically unstable liquid foods such as cardamom essential oil are processed using this concept. Cardamom essential oil is commonly used in Scandinavian, Arabic, and Indian foods, and is also used in the perfumery and pharmaceutical industries. However, the instability issue was related to the ingredient. Once encapsulation is introduced, the instability of the ingredients can be controlled.

Moreover, an important advantage of spray-dried drug processing is developing spray-dried products, which helps to reduce the loss of mineral & vitamin content. Amorphous Solid Dispersions (ASDs) are increasingly used in the pharmaceutical industry to address the need to improve the bioavailability of poorly soluble APIs, providing an opportunity for the development and production of ASDs.

Download Free sample to learn more about this report.

Spray Dryer Market Growth Factors

Surging Consumption of Processed and RTE Foods to Drive the Market Growth

As the name suggests, Ready-to-Eat (RTE) meals refer to foods of animal or plant origin or combinations that can be offered to customers after pre-washing, pre-cooking, processing, and freezing. Therefore, they do not require complex processing before consumption by end consumers, thus saving time and energy. Additionally, changes in consumer lifestyles over the past decade have resulted in high demand for processed and edible foods due to rapid urbanization.

The sudden rise in dual income levels, standard of living, and the demand for convenience has also increased the fast-paced lifestyle of consumers. A significant increase in the demand for maltodextrin has led to an increase in the use of these dryers among manufacturers of dietary supplements, which has a positive impact on this market.

Investments in Greenfield & Brownfield Creations to Aid the Market

This industry has seen significant investments in brownfield and Greenfield sites across industries. Both developed and developing economies are gaining huge traction in the niche field of spray drying equipment behind more than 900 abandoned fields and green food, chemical, and pharmaceutical plants.

Also, in the manufacture of antibiotics, penicillin, enzymes, and whey proteins, the increasing use of products in the pharmaceutical and nutritional industries is expected to drive the market during the forecast period. However, the development of technology allows manufacturers to develop products that are energy efficient and free of hazardous gases, which opens up significant growth opportunities for the spray dryer industry.

RESTRAINING FACTORS

High Installation and Operational Cost to Hinder Market Growth

Spray drying of the necessary equipment and its continued operation is offered at a high price. The most important auxiliary equipment is equally expensive, regardless of the type of sprinkler and the power of the dryer. Due to the large amount of hot air circulating in the chamber without touching the particles, the thermal efficiency of these dryers is generally low. In addition, dryers using dual fluid nozzles require compressed gas. The high energy and pressure requirements have already increased the overall cost, not including labor costs and maintenance.

Spray Dryer Market Segmentation Analysis

By Type Analysis

Nozzle Atomizer to Hold Larger Share Owing to Increasing Adoption

By type, the market is classified into rotary atomizer, nozzle atomizer, fluidized, closed loop, and centrifugal.

The nozzle atomizer segment is projected to dominate the spray dryer market with a 42.55% share in 2026 owing to the widespread adoption of nozzle based equipment to produce free-flowing and coarser powders. In addition, these can also be deployed to provide an extensive range of flow rates with multiple nozzle configurations. Therefore, they are an ideal choice for applications requiring optimal flow rates and produce flexible particles.

The rotary atomizer segment is anticipated to register the highest CAGR over the forecast period. Rotary atomizers are considered the most flexible sprayer and are suitable for a wide range of products. They generally provide a narrower particle size distribution and looser powder than dual fluid nozzles.

Moreover, the fluidized segment is likely to exhibit considerable growth over the projected period. This is attributed to factors such as increasing demand for drying processes that improve product quality and reduce energy consumption, increasing number of industries opting for this technology, and increasing demand from emerging economies around the world.

Closed loop and centrifugal segments are expected to have a moderate growth during the forecast period. The closed dryers can reduce the energy consumption of milk powder production by up to 60% compared to current practice whereas centrifugal sprayers are most suitable for making solid powders or particles from liquid materials, such as solution, emulsion, suspension, and pumpable paste.

By Drying Stage Analysis

Two Stage Segment to Grow Considerably Due to Lower Production Costs

By drying stage, this market is divided into single stage, two stage, and multi stage.

The two-stage segment is expected to lead by process type, contributing 42.12% of the market share in 2026 and is envisioned to hold dominance within the future. Due to declining manufacturing costs, this could be attributed to growing call for those dryers throughout one of a kind commercial packages without compromising product quality.

Moreover, the multi stage segment is anticipated to depict the highest CAGR during the estimated period. This is due to its ability to control the pressure immediately between the first and last stages of the spray drying process and the production of dust-free agglomerated solutions with optimal spreadability.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Food & Dairy Accounted for Major Market Share Due to Rising Adoption in Baby Products

By application, the market is subdivided into food & dairy, pharmaceutical, chemical, and others (animal feed).

The food & dairy segment accounted for a market size of USD 50.14% of total market share in 2026 driven by significant adoption of egg powder, baby products, and coffee powder production equipment. In addition, favorable decisions by the governments of emerging economies such as India and China to raise Foreign Direct Investment (FDI) limits in the food industry encourage dairy companies to set up processing plants in these countries. This is expected to lead to the growth of the segment.

The pharmaceutical segment accounted for the largest CAGR during the forecast period due to increasing demand for drugs in various regions including North America and Europe. In addition, the increasing number of pharmaceutical industry initiatives by governments is expected to increase the demand for pharmaceutical products in India over the next eight years.

The chemical segment is expected to grow significantly due to increased product development in the chemical industry for spray drying of polymers, resins, and other chemical intermediates. The increasing need to ensure compliance with environmental and safety requirements in the use of products such as catalysts, flammable organic solvents, and other chemical compounds is also expected to propel segmental growth during the forecast period.

REGIONAL INSIGHTS

The market is analyzed across five main regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Spray Dryer Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for USD 2.26 billion in 2025 due to high demand for pharmaceutical products and technological advancements in the region. The region is also expected to rule in terms of revenue and is going to continue during the forecast period. The region has a well-established manufacturing sector that uses large amounts of water in production processes. This is due to the high demand for dry products from various end-use industries such as food and beverages, pharmaceuticals, chemicals, and others. This places high pressure on industry participants to develop cost-effective lower power consumption devices for industrial applications.

The U.S. is expected to grow the fastest owing to a high preference for powdered milk as an alternative to liquid milk. The extraction and use of food additives and the growing demand for prepared foods such as instant coffee and soup mixes have expanded the possibilities of spray drying to facilitate rapid production. In addition, the U.S.-Mexico-Canada Agreement (USMCA) is expected to affect dairy trade flow in North America. Many companies are investing in the latest technology to increase consumer demand for processed foods, which will further increase the revenue of the spray dryer market growth in the region.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific registered the largest share in 2024. The growth is driven by the increasing demand for milk production in this region. According to the Food and Agriculture Organization of the UN (FAO), the total milk production in Asia was 379 million tons in 2020. Most of the companies producing dairy products have a strong demand due to exports and producers are expanding their capacity to meet the rising consumer demand. Therefore, manufacturers install these dryers to meet production goals.

India, China, and Japan are focusing on market expansion by expanding their product range in the region. In addition, plant-based milk substitutes are gaining popularity in the region and many consumers prefer to buy plant-based dairy products, which are strategically growing in demand for spray drying equipment in the region. The Japan market reaching USD 0.58 billion by 2026, the China market reaching USD 0.71 billion by 2026, and the India market reaching USD 0.44 billion by 2026.

Europe

The Europe market witnessed a stable growth in 2024. Growth in this region is driven by increased demand for processed food and dairy products. According to the Food and Agriculture Organization, the total milk production in Europe was 236 million tons in 2020. Technological development of food production and the improvement of large dairies have greatly contributed to the growth of market income in this region. In addition, trade and technology agreements such as the European Union (EU) and the Japan Economic Partnership Agreement (EPA) expand business opportunities, which, in turn, increases the market share in the region. the UK market reaching USD 0.33 billion by 2026 and the Germany market reaching USD 0.64 billion by 2026.

Middle East & Africa

The Middle East & Africa region is expected to witness steady growth during the forecast period. The contribution of the industrial sector to the economy is greatest due to local and large centralized chemical or pharmaceutical production facilities. This is leading to an increase in the demand for spray dryer in the industry, fueling the growth of the market in the Middle East & Africa.

The South America market of spray dryer is likely to grow moderately due to its niche in manufacturing development. However, the limited presence of global market players and the underdeveloped distribution channel of the market lead to the slow growth of the market in South America.

KEY INDUSTRY PLAYERS

The global market is moderately fragmented, with a number of key spray dryer companies functioning at global and regional levels. Major players have entered into strategic alliances to expand their portfolio and gain a firm position in the global market. Some of the major companies in the market report are SPX FLOW, Inc., Larsson Starch Technology AB, GEA Group Aktiengesellschaft, Tetra Pak Group, BÜCHI Labortechnik AG., Dedert Corporation, Carrier, European Spray Dry Technologies, Freund-Vector Corporation, Vibrating Equipment, Inc., and others.

List of Top Spray Dryer Companies:

- GEA Group Aktiengesellschaft (Germany)

- SPX FLOW (U.S.)

- European SprayDry Technologies (U.K.)

- Buchi Labortecknik AG (Switzerland)

- Dedert Corporation (U.S.)

- Advanced Drying System (U.S.)

- Larsson Starch Technology AB (Sweden)

- Tetra Pak Group (Switzerland)

- Yamato Scientific America (U.S.)

- Swenson Technology, Inc (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2022: Dedert Corporation launched a new spray dryer for food ingredients in Indonesia. The company also installed equipment at a new plant in China. The new plant has a manufacturing volume of 15,000 tons per year and would manufacture soluble dietary fiber.

- April 2020: GEA Group AG launched BallastMaster marineX. The launch will help the company to strengthen its market globally.

- July 2021: GEA Group Aktiengesellschaft (AG) launched the Mobile Minor spray dryer for small batch production. Small amounts of liquid can be dried into representative powder samples, making it easy to obtain process information for commercial products.

- May 2022: Subsidiary of Spraying Systems Co., Fluid Air, launched the PolarDry sprayer for the pharmaceutical, food and beverage, and chemical industries. These products are available in the U.S., Europe, Asia, and Australia.

- February 2022: Hovione signed a collaboration agreement with Zerion Pharma of Denmark. The aim of the collaboration was to improve the product range of Hovione sprinklers.

REPORT COVERAGE

The report provides a detailed spray dryer market analysis and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Drying Stage

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 6.59 billion in 2025.

The market is likely to grow at a CAGR of 6.70% over the forecast period (2026-2034).

Based on product type, the nozzle atomizer segment is expected to lead the market due to its increasing adoption.

The market size in North America stood at USD 2.12 billion in 2025.

The rising consumption of processed and RTE foods is expected to drive the market growth.

Some of the top players in the market are GEA Group Aktiengesellschaft, SPX FLOW, European SprayDry Technologies, Buchi Labortecknik AG, Dedert Corporation, and others.

The U.S. dominated the market due to extraction and use of food additives in 2025.

The high installation and operational cost of spray dryers is anticipated to restrain market expansion.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us