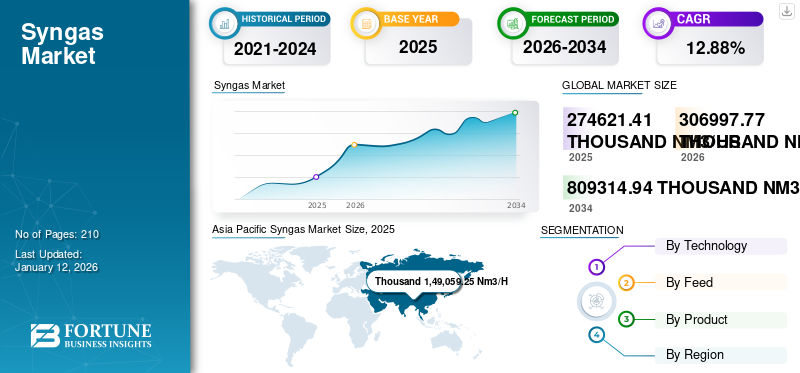

Syngas Market Size, Share & Industry Analysis, By Technology (Gasification and Steam Methane Reforming (SMR)), By Feed (Natural Gas, Coal, Petcoke, Biomass, and Others), By Product (Ammonia, Methanol, Hydrogen, Liquid Fuels, DRI, SNG, Electricity, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global syngas market was valued at 274,621.41 thousand Nm³/hr in 2025 and is expected to increase from 3,06,997.77 thousand Nm³/hr in 2026 to 8,09,314.94 thousand Nm³/hr by 2034, reflecting a CAGR of 12.88% during the forecast period. Asia Pacific led the market, accounting for 54.28% of the total share.

Syngas is an essential feedstock for the creation of hydrogen. With the growing interest in clean energy and hydrogen as a potential green fuel, there will be an increase in demand for this gas as a precedent for hydrogen production. The product is a significant raw material used to produce several chemicals, such as ammonia, methanol, and synthetic fuels.

The demand in the chemical industry is poised to increase the need for synthetic gas. Advances in gasification technologies used to make the product may make the procedure more effective and cost-efficient. This can encourage development in the market as industries adopt these technologies.

The product is manufactured from organic waste materials through a gasification procedure. As waste-to-energy projects obtain traction, the demand for the product from these sources could expand. Supportive government policies and incentives for clean energy and sustainable practices increase expenditure on product production technologies. Thus, combined factors such as rising demand for clean energy, the versatility of syngas, technological advancements, and availability of feedstock, supportive government policies, economic benefits, and environmental advantages are driving the market’s share.

The increasing pressure on industries to decarbonize their operations is driving demand for syngas. As companies face stricter emission targets, syngas offers a practical pathway to meet them. It can be used to power low-carbon technologies such as gas-to-liquids (GTL) and carbon capture, utilization, and storage (CCUS). Moreover, when paired with renewable energy sources, fuels derived from syngas can significantly cut overall industrial emissions. This alignment with global sustainability goals is expected to further boost growth in the syngas market.

The healthcare sector witnessed an increased demand for medical gases during the COVID-19 pandemic, positively impacting the market. The pandemic focused on the demand for cleaner and more sustainable energy sources. This led to a renewed focus on green hydrogen production, which requires utilizing renewable energy sources to manufacture the product through procedures such as electrolysis. As countries prioritize decarbonization, the need for green hydrogen and synthetic gas may increase.

Download Free sample to learn more about this report.

Syngas Market Trends

Growing Demand for Chemicals in Fertilizers and Plastics Bolsters Market Growth

Synthetic gas, mainly hydrogen and nitrogen obtained from it, is an important feedstock for ammonia production. Ammonia is a major component in manufacturing nitrogen-based fertilizers, which are important for crop cultivation to improve agricultural productivity. Methanol, obtained from the product, is also utilized to produce urea, another crucial nitrogen-based fertilizer. The product is an important intermediate in the manufacturing of methanol, which, in turn, is used as a feedstock for producing several chemicals comprising olefins, such as ethylene and propylene. These olefins are basic building blocks for the plastics and petrochemical industries.

Emerging economies, particularly in Asia-Pacific and the Middle East, are rapidly increasing their demand for syngas due to growing industrialization, urbanization, and energy needs. These regions are focusing on the development of cleaner, more sustainable energy solutions, driving syngas adoption for power generation, chemical production, and other industrial processes. As governments in these regions seek to diversify their energy portfolios and invest in renewable energy technologies, syngas production is expected to increase, contributing significantly to market growth.

This gas can be transformed into synthetic fuels used to manufacture several plastic materials. The demand for plastics in diverse industries comprising packaging, construction, and consumer goods contributes to the overall demand for synthetic gas. The product is an adaptable raw material that can be utilized to synthesize a broad range of chemicals. Its adaptability in chemical procedures contributes to its role in the growth of the chemical industry.

Rising Use of Syngas for Hydrogen Production to Drive Future Growth

One of the main factors fueling growth in the syngas market is its expanding role as a key feedstock for hydrogen production. Hydrogen produced from syngas is finding broader applications from industrial operations to the rapidly developing hydrogen economy.

As the automotive industry moves toward hydrogen fuel cells to support cleaner transportation, syngas-derived hydrogen is expected to play a crucial role in meeting that demand. The growing emphasis on hydrogen as a green fuel for both the energy and transportation sectors will continue to accelerate the expansion of the syngas market.

Syngas Market Growth Factors

Continuous Advancements in Product Production Technologies to Drive Market Growth

Continuous research and development efforts aim to improve the efficiency of syngas production procedures or find sustainable ways of producing it. For instance, in January 2020, researchers from Rice University and UC Santa Barbara have evolved a greener and easier way to create the product. It produces room to react with captured greenhouse gases, lowering carbon emissions to the atmosphere and generating evaluative chemical feedstock utilizing a low-priced catalyst and renewable energy in the form of sunlight instead of fossil fuel.

In addition, in 2023, Researchers at the University of Colorado developed a unique and efficient route to produce green syngas, a precursor to liquid fuels. This could open the door for more sustainable energy utilization in industries such as ammonia production, transportation, and steelmaking.

Increased Focus on Digitalization and Automation to Optimize Syngas Production

The growing adoption of digitalization and automation in production processes is expected to further accelerate syngas market growth. By integrating advanced control systems, sensor technologies, and real-time data analytics, syngas plants can optimize operations, cut waste, and boost efficiency. These innovations also enable predictive maintenance, helping reduce downtime and improve the overall performance of gasification facilities. As industries aim to enhance profitability while meeting sustainability targets, the use of digital tools in syngas production is set to gain even more momentum.

Ongoing Infrastructure Development Projects are the Major Factors Boosting Market Growth

Infrastructure development often requires modern industrial facilities, such as power plants, refineries, and chemical manufacturing plants. These facilities use the product as a feedstock for several processes, which drives its demand. The construction of energy infrastructure, comprising power generation plants, can lead to growing demand for the product.

The product can be utilized as a fuel for electricity generation, mainly in Combined Heat and Power (CHP) systems. Infrastructure projects may include the development of gasification plants, which are important for manufacturing products from several feedstocks, further propelling the syngas market growth.

RESTRAINING FACTORS

Availability of Competitive Substitutes May Limit Market Growth

Natural gas is a direct competitor to the product, mainly in applications where its usage is well-established. Natural gas is available, and existing infrastructure supports its use in several industrial processes and power generation. In applications where hydrogen is the primary requirement, industries may select the direct usage of hydrogen as a substitute for producing it through the product.

The accessibility of cost-competitive hydrogen from substitute sources could impact the demand for synthetic gas-derived hydrogen. As the focus on renewable energy increases, electricity derived from renewable sources may be an alternative to the product in various applications. Electrolysis, powered by renewable energy, directly produces hydrogen without the demand for synthetic gas intermediates.

In the chemical industry, traditional feedstocks, such as naphtha and ethane, are involved with synthetic gas-derived feedstocks, such as methanol. The choice between these substitutes depends on cost, availability, and environmental considerations. In some cases, electricity may directly compete with the product as an energy carrier, mainly for applications such as heating or particular industrial processes.

Syngas Market Segmentation Analysis

By Technology Analysis

Gasification’s Market Dominance Propelled by its Emission Advantages

Based on technology, the global market is segmented into gasification and Steam Methane Reforming (SMR).

The gasification segment dominates the market, as it offers a clean, reliable, and flexible method for producing synthesis gas from low-value feedstocks to generate valuable products and power, accounting for a 65.93% market share in 2026. The increasing adoption of gasification in the market is driven by its versatility, environmental benefits, economic advantages, technological advancements, government support, and alignment with the global transition to clean energy.

The Steam Methane Reforming (SMR) segment will depict the fastest growth in the market during the forecast period. The abundant availability of methane, the primary component of natural gas, makes SMR a practical and cost-efficient procedure for product production. SMR is mainly known for its economic efficiency, majorly in large-scale applications.

By Feed Analysis

Natural Gas Holds Market Prominence Fueled by its Numerous Applications

Based on feed, the market is segmented into natural gas, coal, petcoke, biomass, and others. The natural gas segment holds a dominant position in the market, accounting for a 53.37% market share in 2026. Natural gas, mainly methane, is an important feedstock for product manufacturing and has several applications, including hydrogen production, chemical synthesis, and others. This gas is abundant and broadly reachable in various regions, making it a reliable and readily available feedstock for product production.

For instance, in May 2023, Air Products agreed with the Government of the Republic of Uzbekistan and Uzbekneftegaz JSC to purchase, own, and operate a natural gas-to-syngas processing facility in Qashqadaryo Province, Uzbekistan, for a sum of USD 1 billion. The natural gas-to-syngas industrial complex is essential to UNG's multi-billion gas-to-liquid site ― one of the most advanced energy production facilities globally. It produces ~1.5 million tons of valuable synthetic fuels per year for domestic applications.

Biomass is anticipated to be one of the fastest-growing segments in the market during the forecast period. It is one of the sustainable feed sources, and biomass resources are abundant and widely distributed worldwide. As waste-to-energy projects continue to gain traction worldwide, the biomass feedstock segment is expected to attract substantial investment, especially in regions with abundant agricultural waste. In addition, the increasing emphasis on carbon-neutral and net-zero solutions is strengthening the role of biomass as a key sustainable feedstock.

By Product Analysis

To know how our report can help streamline your business, Speak to Analyst

Ammonia’s Several Applications in the Agricultural Sector Leads to its Prime Position

Based on product, the market is segmented into ammonia, methanol, hydrogen, liquid fuels, DRI, SNG, electricity, and others. The ammonia segment dominates the market by holding the largest syngas market with a share of 31.57% in 2026. It is a major component in producing nitrogen-based fertilizers, such as urea. As global agricultural needs continue to increase, the need for fertilizers, and as a result ammonia, may increase.

Methanol is projected to be the fastest-growing segment in the market. Methanol is often more cost-competitive than other alternative fuels and chemicals, particularly syngas, derived from cheap and abundant feedstocks like natural gas, coal, and biomass.

For instance, in 2023, Germany inaugurated the world's green methanol pilot plant, demonstrating cost-efficiency in its operation. The pilot plant was inaugurated in November 2023 as part of the Leuna100 initiative, which commenced in August 2023 within Leuna Chemical Park and is scheduled to operate for around three years. It is being funded with a total of USD 10 to 12 million by the German Federal Ministry for Digital and Transport (BMDV) as part of the Renewable Fuels Funding Program.

Green Hydrogen as a Byproduct and Its Expanding Role in Clean Energy Initiatives

Hydrogen produced from syngas is increasingly recognized as a key clean energy carrier, especially in the transportation and power generation sectors. As nations push toward ambitious decarbonization goals, demand for green hydrogen is expected to rise sharply.

Syngas production serves as an important pathway to hydrogen generation, particularly when renewable feedstocks are used. The rapid growth of hydrogen-based technologies such as fuel cells is also creating new market opportunities for syngas-derived hydrogen, supporting the transition to a more sustainable and circular energy economy.

REGIONAL INSIGHTS

The global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Syngas Market Size, 2025 (Thousand Nm3/H)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest global market share and has experienced remarkable industrial growth over the past few decades, with China and India emerging as major industrial hubs, and the regional market size reaching 149,059.25 thousand NM³/hr in 2025. In addition, industries, including chemicals, fertilizers, and refining, which heavily rely on the product, have observed notable expansion. For instance, BASF has started working on a USD 10 to 12 billion syngas plant in Zhanjiang. The China market is projected to reach USD 1,29,805.05 Thousand NM3/Hr by 2026, and the India market is projected to reach USD 18,034.63 Thousand NM3/Hr by 2026.

Europe

The major factor driving the market’s growth is Europe's steady investment in research and development, which has led to advancements related to synthetic gas production. This technological proficiency could position European companies at the forefront of the market. For instance, in July 2023, Haffner Energy and Resilient Hydrogen joined hands in developing gas projects and renewable hydrogen in Europe. This collaboration aims to offer unique decarbonization solutions combining Haffner Energy's technologies to produce synthetic gas (syngas), renewable hydrogen, and others.

North America

North America is poised to observe a significant share in the market during the forecast period. as the U.S. has abundant reserves of natural gas. Natural gas is a major feedstock for product production through procedures such as Steam Methane Reforming (SMR), making it a readily available and cost-efficient resource. The U.S. market is projected to reach USD 26,428.93 Thousand NM3/Hr by 2026.

In addition, substantial investments in carbon capture and storage (CCS) technologies across North America are expected to boost syngas production efficiency, positioning the region as a key player in the global syngas market.

Key Industry Players

Collaborative R&D Efforts by Companies Speed Up the Advancement of Efficient and Cost-Effective Gasification

Partnerships between companies, research institutions, and technology providers can combine expertise and resources, fostering innovation in syngas production technologies. Collaborative research and development efforts can speed up the advancement of efficient and cost-effective gasification and syngas production technologies.

In September 2022, Raven SR and Emerging Fuels Technology collaborated to Improve syngas for SAF and Renewable Diesel Synthesis. Under the MOU, Raven SR and EFT will optimize their processes to maximize production and reduce emissions. The master license agreement allows Raven SR to deploy its technology with EFT technology worldwide, producing liquid fuels faster and closer to the market.

In addition, growing efforts to develop modular gasification systems that can operate on a smaller scale are expected to open new business opportunities in distributed energy generation especially for industries in remote or off-grid areas. These systems could also help lower the financial barriers tied to large-scale syngas production, allowing a wider range of market participants to enter the field.

List of Top Syngas Companies Analyzed:

- Air Products Inc. (U.S.)

- Linde plc (U.K.)

- KBR, Inc. (U.S.)

- BASF SE (Germany)

- McDermott (U.S.)

- CF Industries Holdings, Inc. (U.S.)

- Mitsubishi Heavy Industries Ltd. (U.S.)

- Methanex Corporation (U.S.)

- Topsoe (Denmark)

- Chiyoda Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: BASF started constructing its syngas plant at the Verbund site in Zhejiang, China. The global-level synthetic gas facility, wholly integrated into the Verbund site, will begin in 2025. BASF will acquire unique procedure concepts in the syngas plant to lower carbon emissions than conventional synthetic gas plants, leading to the company’s sustainability objectives.

- February 2023: Linde plc signed a deal with BASF for the engineering, construction, and procurement of synthetic gas plants in Zhanjiang, China. Linde Engineering’s multiservice solution for BASF collaborates modern technology with a broad EPC execution package.

- April 2022: KBR secured a project in Australia, an ammonia technology contract from DL E&C NeuRizer’s (previously Leigh Creek Energy Ltd) carbon-neutral fertilizer project. Under the deal, KBR will offer engineering and technology licensing for the 1600 tpd ammonia plant based on KBR purifier procedure.

- April 2021: Air Products declared that the Kochi Industrial Gas Complex responsibly supplies synthetic gas to the Propylene Derivatives Petrochemical Project at the Bharat Petroleum Corporation Limited Kochi refinery. Synthetic gas is contributed to by air product components for PDPP. It will permit BPCL’s entry into the propylene derivative petrochemical market on a large scale. This constitutes a remarkable multinational company investment in India and contributes to India’s self-sufficiency vision.

- May 2020: Linde plc. declared that it has established a modern syngas processing plant in Geismar, Louisiana. The modern plant will contribute carbon monoxide and hydrogen to a global chemical company and other chemical and refining consumers along Linde’s hydrogen pipeline network in Southern Louisiana, all under long-lasting supply agreements.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product, feed, and technology of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.88% from 2026 to 2034 |

|

Volume |

Thousand Nm3/Hr |

|

Segmentation |

By Technology

|

|

By Feed

|

|

|

By Product

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was at 2,74,621.41 Thousand Nm3/Hr in 2025.

The market is likely to grow at a CAGR of 12.88% over the forecast period (2026-2034)

Ammonia segment is expected to lead the product segment in the market.

Asia Pacifics market size stood at 1,49,059.25 Thousand Nm3/Hr in 2025.

Continuous advancements in product production technologies are set to drive the market growth.

Some of the top players in the market are Air Products Inc., Linde plc, Topsoe, BASF SE, and Methanex Corporation.

The global market size is expected to reach 8,09,314.94 Thousand Nm3/Hr by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us