Terahertz Technology Market Size, Share & Industry Analysis, By Application (Imaging, Communications, and Spectroscopy), By Product Type (Imaging Scanner, Imaging Cameras, Antennas, Spectrometer, and Body Scanner), By End-Use (IT & Telecom, Medical & Healthcare, Laboratory Research, Defense & Security, Semiconductor Testing, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

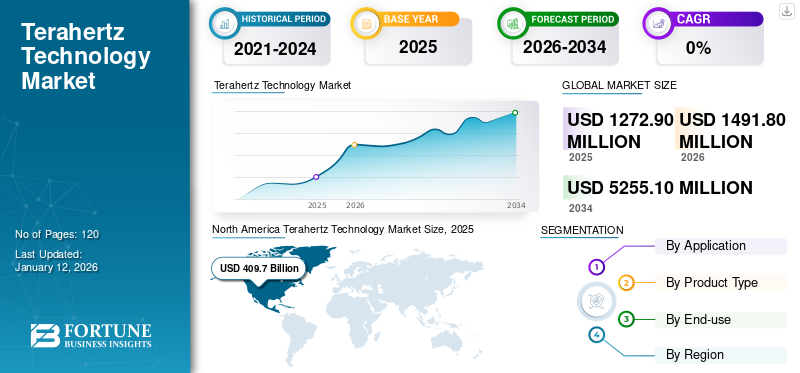

The global terahertz technology market size was valued at USD 1,272.90 million in 2025. The market is projected to grow from USD 1,491.80 million in 2026 to USD 5,255.10 million by 2034, exhibiting a CAGR of 17% during the forecast period. North America dominated the global market with a share of 32.20% in 2025.

Terahertz technology refers to the use of electromagnetic waves in the terahertz region of the electromagnetic spectrum. The potential applications of terahertz radiation are numerous and diverse. It is also known as electromagnetic spectrum sub-mm wavelength or far-infrared radiation with frequencies between 100 GHz and 30 THz. The advancements in terahertz imaging and spectroscopy are driven by swift progress in femtosecond laser technologies and innovative approaches for THz wave generation and detection. Terahertz waves are low-energy, non-invasive, and non-ionizing; hence, they are harmless to human beings and can penetrate through various materials. It has wide usage in various end-use applications, such as healthcare, laboratories, military, homeland security, aerospace, and industrial non-destructive testing (NDT). These factors will play an important role in driving the terahertz technology market growth during the forecast period.

The market witnessed growth during the pandemic owing to the technology’s widespread use in biological research, healthcare, and security applications. Governments in many countries encouraged healthcare businesses to take required measures toward developing novel Terahertz gadgets. Moreover, security practices changed during the COVID-19 pandemic and the adoption of terahertz technology increased as it can scan objects or people and detect things hidden beneath cloths from far distance.

The report’s scope has included solutions offered by companies, such as Advantest Corporation, Luna Innovations, HUBNER GmbH & Co. KG, Toptica Photonics AG, Menlo Systems, Gentec Electro-optics Inc., and others.

Terahertz Technology Market Trends

Increasing Use of Terahertz for Cancer Detection to Pave Way for Market Growth

Breast cancer is the leading cause of female deaths worldwide, and its early detection can significantly reduce the mortality rate. Research has shown that around 70% of breast cancer patients undergo Breast Conservation Surgery (BCS) and 15-20% of those cases require the patient to undergo more than one surgery. Therefore, accurate diagnosis is crucial to ensure complete resection and minimize the need for further surgeries. The demand for terahertz imaging and spectroscopy is increasing due to its potential for detecting cancer. Terahertz radiation has low photon energy, making it safe for biological tissues and posing no ionization hazard. These unique properties have sparked an increasing interest in terahertz imaging and spectroscopy for biological applications. THz imaging is used for biomedical applications, such as diagnosing burn wounds, colon tumors, breast cancer, skin cancer, brain tumors, and other diseases.

Also, many researchers have extensively studied THz imaging and spectroscopy techniques for identifying breast tumors, three-dimensional dehydrated breast cancer, and freshly excised murine tumors.

These factors are expected to pave the way for the market’s growth.

Download Free sample to learn more about this report.

Terahertz Technology Market Growth Factors

Adoption of Terahertz Technology in Security & Surveillance Systems to Fuel Market Growth

In highly populated areas, X-rays are used for detecting security threats while people pass through a metal detector. But metal detectors are not capable of sensing explosive devices that have low density of metal or non-metal handguns. These objects or devices can be found through frisk search, but as the number of persons entering is high, people are examined only if an alarm is prompted or there is some doubt.

Terahertz plays a significant role in security and surveillance applications as terahertz radiation is non-ionizing, making it ideal for security scanning of the general public. This technology has the significant capability of screening people and objects for explosives, hidden weapons, and other contraband. Terahertz waves can infiltrate various types of materials and clothing, allowing security personnel to identify hidden objects without requiring physical contact or aggressive searches. Therefore, adoption of terahertz technology in security & surveillance systems will fuel market growth.

RESTRAINING FACTORS

Lack of Awareness and High Initial Cost to Restrict Market Growth

Lack of understanding of the terahertz technology is restricting its adoption in various regions. The research community has made noteworthy efforts in understanding the technology's potential by identifying key positives that are capable of generating a different market. However, a lack of awareness of terahertz is hindering the market growth.

Another important factor that affects the market’s growth includes high cost associated with installing the technology in various applications. In some industries, innovative technologies may tackle customer doubts about the companies they buy their products from. As companies are not entirely convinced of the benefits of terahertz technology, it becomes difficult for them to accept it due to the associated expenses.

Terahertz Technology Market Segmentation Analysis

By Application Analysis

Increasing Demand for Detailed Images in Healthcare & Manufacturing Boosted Use of High Resolution Imaging

Based on application, the market is divided into imaging, communications, and spectroscopy.

The imaging segment captured a larger share of 46.13% the market in 2026 and is expected to continue its dominance by recording the highest CAGR during the forecast period. Terahertz imaging can achieve high resolution, enabling detailed imaging of objects and materials, which is crucial for applications, such as medical imaging and quality control in manufacturing. Also, it is capable of capturing images quickly, thus, it is increasingly used in real-time applications, such as security screening and process monitoring in manufacturing.

The communications segment is expected to record a noteworthy CAGR during the forecast period as terahertz technology can support extreme communication capacity and, in particular, disruption in the network sensing capabilities. Terahertz communication complements the existing millimeter wave technologies, expanding the available spectrum and allowing more devices to communicate simultaneously without interference.

To know how our report can help streamline your business, Speak to Analyst

By Product Type Analysis

Growing Need for High Speed Imaging Cameras for Industrial Processes Aids Market Growth

Based on product type, the market is divided into imaging scanner, imaging cameras, antennas, spectrometer, and body scanner.

The imaging cameras segment captured the maximum terahertz technology market share of 28.01% in 2024. A terahertz imaging cameras can achieve high spatial resolution, allowing for detailed imaging of objects and structures. This is particularly useful in applications requiring precise, high-quality images, such as medical imaging and material inspection. These factors play a vital role to drive the market growth.

The antennas segment is expected to record the highest CAGR during the forecast period as the terahertz (THz) antenna is small sized and has wide frequency bandwidth and high data rate. This device is important for transmitting and receiving THz electromagnetic waves in the emerging THz systems. Terahertz antennas can facilitate point-to-point communication links. This is useful for applications that require high data transfer rates in localized areas, such as indoor communication systems or data center networks.

By End-use Analysis

Increasing Demand for High-Speed Wireless Communication in IT & Telecom Sector Propelled Market Growth

Based on end-use, the market is categorized into IT & telecom, medical & healthcare, laboratory research, defense & security, semiconductor testing, and others (agriculture, education, and automotive).

The IT & telecom segment captured the highest market share of 29.50% in 2026 and is expected to continue its dominance by recording the highest CAGR during the forecast period. THz technology offers the potential for ultra-fast wireless communication, with data rates significantly higher than current technologies, such as 5G. In the IT & telecom sector, this could enable high-bandwidth applications, such as Virtual Reality (VR), Augmented Reality (AR), and video streaming, which is expected to drive the segment’s growth.

The laboratory research segment is expected to register a prominent CAGR in the coming years. Terahertz spectroscopy enables laboratory researchers to study the properties of materials, including semiconductors, polymers, pharmaceuticals, and biological tissues. THz radiation interacts with molecular vibrations and rotations, providing valuable insights into the chemical compositions, structures, and physical properties of materials.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Terahertz Technology Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 409.7 million in 2025 and USD 474.8 million in 2026. In the region, the U.S. is the leading country in all aspects with respect to rising homeland security threats, increasing investments in R&D activities on both institutional and commercial levels, and increasing budgets of aerospace and defense departments. The U.S. market is projected to reach USD 278.8 million by 2026. Also, the rising consumer base and demands across various end-use industries, along with key players investing in better R&D activities, are crucial factors boosting North America market growth. For instance,

- In February 2024, a team of researchers from MIT University invented Terahertz-powered anti-tampering tags, which are smaller and cheaper than conventional RFID tags. They integrate microscopic metal particles into the glue, which adheres the tag to an object. It is a 4 square mm light-powered anti-tampering tag suitable for integration into a massive supply chain.

Asia Pacific is expected to record the highest CAGR over the study period. This is due to the wide application of technologies in several end-uses, such as telecom, lab research, and healthcare and medical industries in developing countries, such as India, South Korea, China, and Indonesia. In addition, the increase in semiconductor production and adoption of advanced technologies will boost the market expansion in the region. Also, the major focus on commercializing THz activities in China and Japan is due to the rising number of THz system manufacturers with better accessibility and competitive pricing offered by these countries than the West. End-users benefited from the growing competition through lower cost, customer-oriented systems, and quick support. The Japan market is projected to reach USD 95.2 million by 2026, the China market is projected to reach USD 87 million by 2026, and the India market is projected to reach USD 70.3 million by 2026. For instance,

- In January 2023, Canon Inc., a Japanese multinational corporation, developed a compact THz semiconductor device with the highest output and directivity, which is quite useful for security applications. The developed active antenna array device is integrated with the semiconductor chip and is 1000x smaller than other conventional device sizes.

Europe is expected to grow substantially during the forecast period due to support and investments by governments. Market players are focusing on launching new technologies in the market and expanding their footprints in emerging countries. The UK market is projected to reach USD 101.2 million by 2026, while the Germany market is projected to reach USD 135.2 million by 2026. Additionally, there is a growing interest in communication satellites and innovative technologies across the region, which will create a favorable environment for terahertz technologies. For instance,

- In February 2024, the European Union-funded ERC (European Research Council) project named TIMING, which includes Loughborough’s Emergent Photonics Research Centre members, collaborated with Exeter University’s professor Jacopo Bertolotti. Through the collaboration, they developed a technique that enables precise spatiotemporal control of terahertz waves while passing through disordered materials.

The Middle East & Africa is expected to showcase robust growth during the forecast period. THz technology delivers strong penetration, perfect directionality, great safety, and higher bandwidth, which are beneficial in the military & defense industry in the region. In the past years, the defense sector has been testing the feasibility of radars, sensors, and various communication devices operating on the THz frequency spectrum, which will drive the market growth in the region.

Moreover, in South America, terahertz technology is majorly used for astronomy applications. Herschel Space Observatory, a man-made satellite that was planned to be launched in 2008, is a terahertz version of the Hubble Space Telescope. In Chile, one of the world's largest telescope arrays, the Atacama large millimeter wave submillimeter wave interference Array (ALMA), is being constructed. It will detect terahertz electromagnetic waves.

List of Key Companies in Terahertz Technology Market

Key Market Players Are Focusing on Partnership and Acquisition Strategies to Expand Their Services

Key players are focusing on expanding their geographical presence across the globe by presenting industry-specific services. They are focusing on mergers and acquisitions with regional players to maintain their dominance across regions. Top market participants are launching new solutions to increase their consumer base. An increase in R&D investments for product innovations is enhancing the market expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Key Companies Profiled:

- Advantest Corporation (Japan)

- Luna Innovations (U.S.)

- HUBNER GmbH & Co. KG (Germany)

- TeraView Limited (U.K.)

- Toptica Photonics AG (Germany)

- Gentec Electro-optics Inc. (Canada)

- Bakman Technologies LLC (U.S.)

- Menlo Systems (Germany)

- QMC Instruments Ltd. (U.K.)

- TeraSense Group (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Gentec Electro-Optics, a provider of laser beam and terahertz technology, launched a new PRONTO-250-FLEX laser power meter. It has flexible calibration options, allowing customers to pay only for the services they avail.

- December 2023: Luna Innovations acquired Silixa, a U.K.-based distributor. With this acquisition, Luna aims to boost its position in the fiber optic sensing market by adding Distributed Temperature Sensing (DTS) and Distributed Acoustic Sensing (DAS) capabilities for mining, energy, and defense applications.

- August 2023: Luna Innovations secured a major order for its terahertz sensing solution to produce batteries for Electric Vehicles (EVs). The company will use its facility in Atlanta, Georgia to complete the order, which is of four times greater capacity.

- November 2022: Nokia Bell Labs chose Keysight's Sub-Terahertz Testbed to check the performance of its 6G transceiver (TRX) modules. NOKIA Bell Labs and Keysight have expertise in advanced semiconductor methods, which will help them support 6G technology.

- October 2022: The Center for Nondestructive Evaluation (CNDE) acquired a novel terahertz continuous-wave (CW) spectrometer developed by Bakman Technologies. This spectrometer is equipped with fiber-coupled semiconductor lasers and digital control software and hardware to offer terahertz spectroscopic system.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application

By Product Type

By End-use

By Region

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 5,255.10 million by 2034.

In 2025, the market was valued at USD 1,272.90 million.

The market is projected to record a CAGR of 17.00% during the forecast period.

By application, the imaging segment led the market in 2025.

Adoption of terahertz technology in security & surveillance systems is fueling the market growth.

Advantest Corporation, Luna Innovations, HUBNER GmbH & Co. KG, Toptica Photonics AG, Menlo Systems, and Gentec Electro-optics Inc. are the top players in the market.

North America held the highest market share in 2025.

By end-use, the IT & telecom segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us