U.S. Core Banking Software Market Size, Share & Industry Analysis, By Deployment (SaaS/Hosted, Licensed), By Banking Type (Large Banks, Midsize Banks, Small Banks, Community Banks, and Credit Unions), and By End-user (Retail Banking, Treasury, Corporate Banking, and Wealth Management), 2025-2032

KEY MARKET INSIGHTS

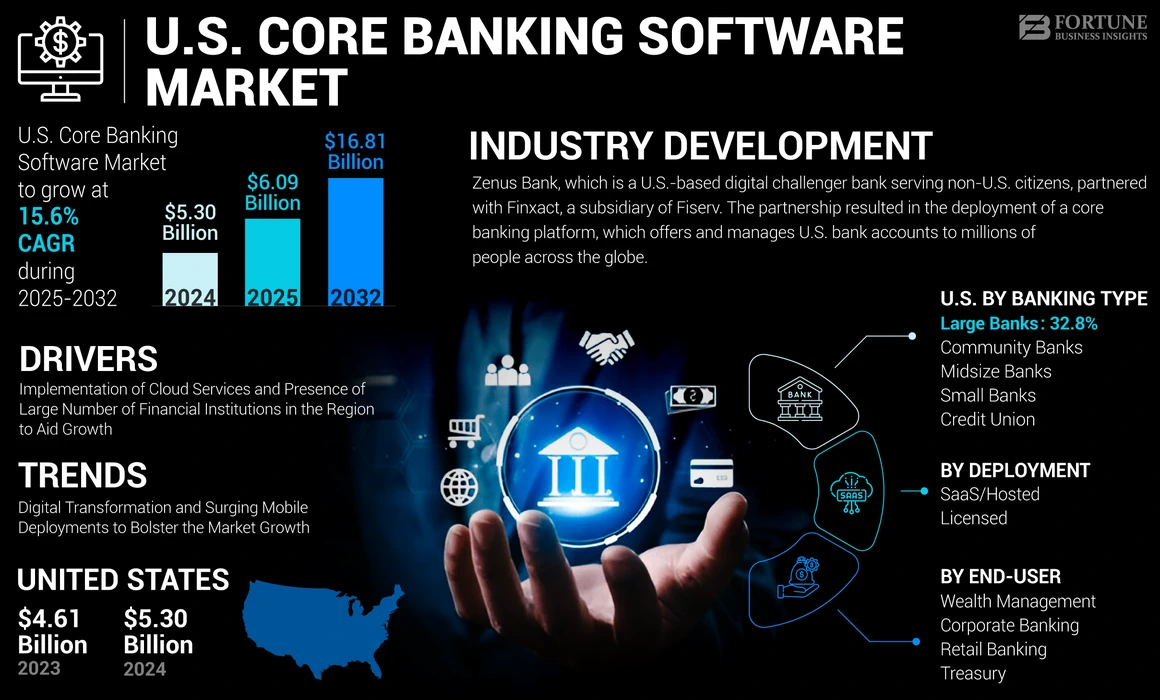

The U.S. core banking software market size was valued at USD 5.30 billion in 2024. The market is projected to grow from USD 6.09 billion in 2025 to USD 16.81 billion by 2032, exhibiting a CAGR of 15.6% during the forecast period.

Core Banking System (CBS) is a back-end solution used by banking organizations to manage their financial activities such as transactions, payments, account updates, and record-keeping. It provides real time, centralized online banking services to customers. Many banks are implementing CBS to enable their customers to perform various banking tasks, such as money transfers, loan processing, debt management, and access to their accounts.

The U.S. core banking software market growth is driven by major presence of key players in the country. Additional factors propelling industry growth are the increasing demand for centralized account management and regional expansion due to prior technological innovations and deployments.

COVID-19 IMPACT

Lower Interest Rates and Credit Management Issues Amid COVID-19 Pandemic Restricted Market Growth

The pandemic forced numerous banks and other financial institutes and their employees to adopt the Work from Home (WFH) policy, which resulted in majority of regional revenue being directed toward healthcare and medical institutions. According to Schroeder report 2021, the year-on-year profit decreased to USD 18.5 billion, as the industry suffered setbacks leading to an overall 70% decrease in profit ratios. Therefore, the pandemic caused a slight slowdown in the market due to depleted interest rates and industry profit margins. However, as quarantine limitations were relaxed, the market demonstrated an elevated growth rate.

LATEST TRENDS

Download Free sample to learn more about this report.

Digital Transformation and Surging Mobile Deployments to Bolster the Market Growth

The rising adoption of technologies such as cloud, Artificial Intelligence (AI), and Big Data is changing the landscape of the banking industry. According to Pendo.io, the usage of mobile banking applications increased by 41% and sustained the increased adoption after pandemic. In order to maintain market integrity, key players deployed online banking solutions to assist consumers in banking services. Additionally, players, such as Capital Banking Solutions and Fidelity, have initiated investments in digital experiences to withstand the consumer shift toward digital banking providers.

DRIVING FACTORS

Implementation of Cloud Services and Presence of Large Number of Financial Institutions in the Region to Aid Growth

One of the key drivers is the increasing deployment of SaaS-based or cloud-based solutions in the market. The industry growth will be further driven by the increasing need for productivity and efficiency in businesses as cloud-based platforms enable banks to keep a watchful eye on payments, transactions, and other banking operations. Additionally, according to the National Statistical Office, the country hosted 4,488 financial institutions in 2019. The large presence of financial institutions in the country provide innovations in data analysis, further contributing toward the increasing demand for core banking software.

RESTRAINING FACTORS

Unsatisfactory User Experience and Unskilled Workforce to Hamper Market Growth

Software bugs and technical issues cause substandard user experience, resulting in reduced growth of the market. Additionally, not all core banking software include operational flexibility at the scale, which results in data breaches and regulatory risks. According to the Financial Conduct Authority (FCA), data breaches at various banks and financial institutions increased by 52% in the 2020 - 2021 period. In March 2021, U.S.-based Flagstar Bancorp faced a data breach incident and lost employees’ and customers’ private data such as email ids, social security numbers, phone numbers, and more. The hacker exploited the company's data transfer file software to gain access to the entry.

Thus, the inability to properly secure the back-end functioning of core banking systems displays the necessity of skilled workforce to hamper the market growth.

SEGMENTATION

By Deployment Analysis

Major Adoption of Services and Key Presence of Cloud Vendors to Favor SaaS/Hosted Segment Growth

On the basis of deployment, this market is segregated into SaaS/hosted and licensed deployment techniques. Among these, the SaaS/hosted deployment is projected to hold the largest market share, while projecting highest CAGR during the forecast period. The increasing feasibility of cloud services and surging adoption rate contribute to enhance Software as a Service (SaaS)-based deployments.

By Banking Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Massive User Base of Large Banks to Aid the U.S. Core Banking Software Market Growth

The market is categorized into large banks, midsize banks, small banks, community banks, and credit unions, based on their banking type. Large banks segment is expected to have the highest market share due to their massive user base and capabilities to manage immense amount of data, even in tough times such as the pandemic.

The market is expected to witness the highest CAGR from community banks due to the trust factor and loyalties provided by the local financial institutions. Large institutions are contributing to support the community banks in terms of digital transformation, which plays a vital role to fuel the U.S. market. For instance, on July 2022, CSI partnered with Bankers helping Bankers, to support initiatives of empowering community banks. CSI aided in building and deploying digital banking strategies and providing core banking software solutions, enabling growth for numerous community banks.

By End-user Analysis

Rising Adoption of Advanced Banking Systems to Aid in the Growth of Corporate Banks Market Share

Based on end-user, this market is segregated into retail banking, treasury, corporate banking, and wealth management. The corporate banking segment is projected to have the largest market share during the forecast period. This is driven by the surging digitalization and adoption of mobile applications by users to avail advanced banking services and transact remotely.

Wealth management to grow at the highest CAGR in the forecast period. This is due to the rising adoption of process automation and growing demand for investment solutions.

KEY INDUSTRY PLAYERS

Emphasis of Key Players on Developing Advanced Banking Solutions Will Strengthen their Positions

Fiserv, Inc., Finastra, Fidelity National Information Services, Inc. (FIS), and Nymbus, among others are some of the key players in the U.S. fintech industry. These players are developing core banking software solutions with advanced technologies such as AI, cloud, block chain, Big Data, and others.

List of Key Companies Profiled:

- Oracle Corporation (U.S.)

- Jack Henry and Associates (U.S.)

- Nymbus (U.S.)

- nCino (U.S.)

- Capital Banking Solutions (U.S.)

- EdgeVerve Systems Limited (Infosys) (India)

- Fidelity National Information Services, Inc. (U.S.)

- Fiserv, Inc. (U.S.)

- SAP SE (Germany)

- Temenos AG (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- October 2022: Zenus Bank, which is a U.S.-based digital challenger bank serving non-U.S. citizens, partnered with Finxact, a subsidiary of Fiserv. The partnership resulted in the deployment of a core banking platform, which offers and manages U.S. bank accounts to millions of people across the globe.

- September 2022 – New York based financial service provider named Stash, launched Stash Core, which was a proprietary core banking platform. The platform implemented centralized banking, remote management, and faster delivery times to aid clients to enhance business growth.

- March 2022 – SoFi acquired Technisys, which was based in Buenos Aires, in a deal worth USD 1.1 billion. The company aims to merge Technisys with their payment subsidiary, Galileo Processing Inc., in order to develop new offerings built on Technisys banking system, such as credit cards and banking services. The company also planned to deploy banking solutions for community banks.

- October 2021 – Banking Industry Architecture Network (BIAN), inclusive of Fargo, JP Morgan Chase, and IBM launched its updated version of coreless banking platform to aid organizations in modernizing and digitalizing their core banking systems.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market research report offers an extensive market examination, emphasizing crucial elements such as major firms and product applications. Additionally, it emphasizes key industry advancements and gives an understanding of market trends. The report also includes various growth-contributing factors from recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019–2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025–2032 |

|

Historical Period |

2019–2023 |

|

Growth Rate |

CAGR of 15.6% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment, Banking Type, End-user |

|

By Deployment |

|

|

By Banking Type |

|

|

By End-user |

|

Frequently Asked Questions

According to Fortune Business Insights, the U.S. market is projected to reach USD 16.81 billion by 2032.

In 2024, the market stood at USD 5.30 billion.

The market is projected to grow at a CAGR of 15.6% in the forecast period (2025-2032).

By banking type, the large banks segment is likely to lead the market.

Implementation of cloud services and presence of a large number of financial institutions in the region are expected to drive the market growth.

Capital Banking Solutions, Fiserv, Inc., Fidelity National Information Services, Inc. (FIS), Alphabet Inc., and Temenos AG are the top companies in the market.

By banking type, community banks segment is expected to grow with the highest CAGR over the projected period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us