U.S. Digital Twin Market Size, Share & Industry Analysis, By Type (Parts Twin, Product Twin, Process Twin, and System Twin), By Application (Predictive Maintenance, Business Optimization, Product Design & Development, and Others), By End-user (Aerospace & Defense, Automotive & Transportation, Manufacturing, Healthcare, Retail, Energy & Utilities, Real Estate, IT and Telecom, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

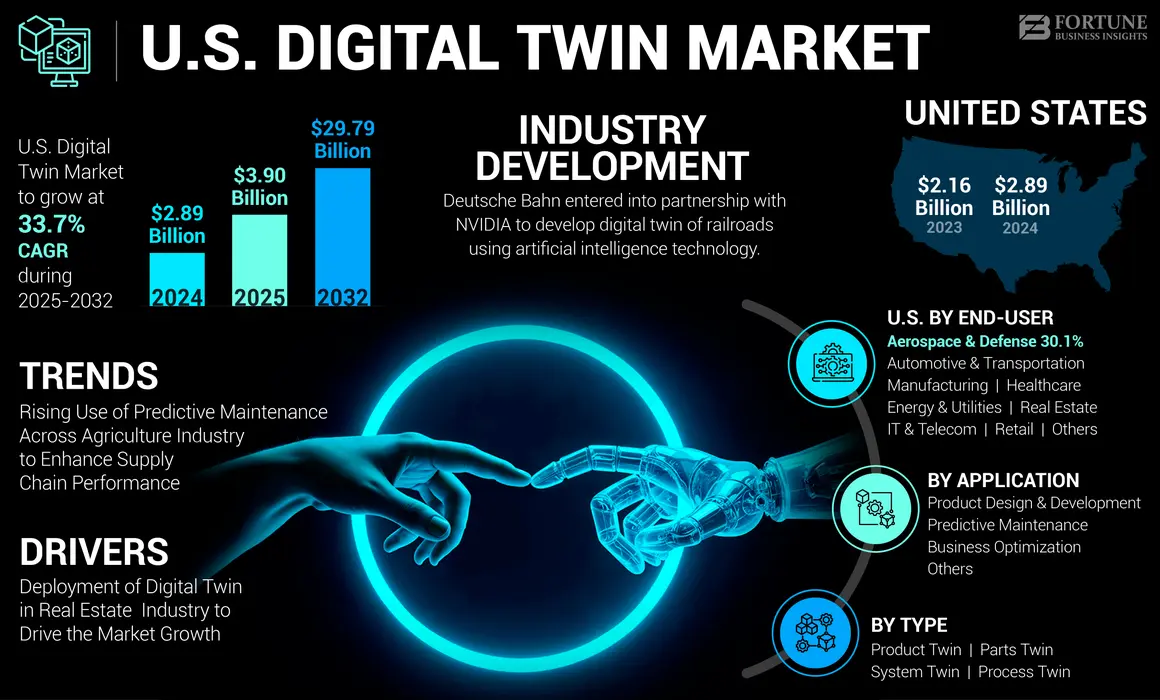

The U.S. digital twin market size was valued at USD 2.89 billion in 2024. The market is projected to grow from USD 3.90 billion in 2025 to USD 29.79 billion by 2032, exhibiting a CAGR of 33.7% during the forecast period.

The rising adoption and development of digital twin technology to resolve interoperability issues of various industries such as aerospace, automotive, energy, and utilities are expected to propel the demand for digital twin technology in the U.S. during the forecast period. With the rising adoption of these technologies across twin-type solutions, the market is expected to grow substantially in the U.S.

COVID-19 IMPACT

Technological Deployment in Different IT Projects to Drive the Demand for Digital Twin During the Pandemic

High technological investments by various key players and the government of the U.S. to deploy digital twins in different IT projects are likely to create demand for the adoption of the digital twin in automation and other end-use industries. For instance, in November 2020, Bentley Systems invested around USD 100 million to boost the infrastructure of virtual twins’ offerings.

Thus, the technological deployment in the different IT projects during the pandemic is likely to drive the growth of the market.

LATEST TRENDS

Rising Use of Predictive Maintenance Across Agriculture Industry to Enhance Supply Chain Performance

The penetration of digital twin technology in the agriculture sector helps to improve supply chain performance and is considered one of the emerging trends. According to Digital Twin Corporation, more than 20% of agricultural products suffer physical damage during the supply chain process. Thus, digital twin solutions are increasingly deployed across the agriculture sector to reduce waste and help detect supply chain failures using predictive maintenance tools.

Thus, the growing use of predictive maintenance across the agriculture industry helps to enhance supply chain performance.

Download Free sample to learn more about this report.

DRIVING FACTORS

Deployment of Digital Twin in Real Estate Industry to Drive the Market Growth

A digital twin can provide a 360-degree view of business, including all the details of different business units and systems. Growing digital transformation in the construction industry brings technological development in building architecture and design, significantly boosting the U.S. digital twin market growth.

According to EY, the growing use of this technology in the construction and real estate industries helps to reduce energy consumption by up to 50% and operating costs by 35% to help property owners to save operational costs.

Thus, digital transformation in real estate building design and reduces energy consumption during the forecast period.

RESTRAINING FACTORS

Lack of Digital Transformation Expertise to Hinder the Market Growth

Continuous digital transformation in the manufacturing and energy industry boosts customer expectations, which greatly impacts the production capability and consistency of business operations. This factor creates a demand for upskilling expert knowledge about newly developed technologies such as artificial intelligence, augmented and virtual reality, IoT, and many more.

Thus, a lack of knowledge about the developed technologies will likely hinder the growth of this market.

SEGMENTATION

By Type Analysis

Penetration of Product Twin Across Manufacturing Sector to Boost the Segment Growth

On the basis of type, the market has been segmented into parts twin, product twin, system twin, and process twin.

Increasing adoption of product twin helps to validate the product performance under several conditions. This leads to increase the integration of technology at a substantial progress rate during the projection period.

By Application Analysis

Usage of Predictive Maintenance to Optimize the System Performance to Drive the Market Growth

Based on application, the market is segmented into predictive maintenance, business optimization, product design & development, and others.

Predictive maintenance helps to predict the asset’s current condition with its maintenance history, which is able to optimize the system performance.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Adoption of 3D Simulation and 3D Printing Software Across Automotive & Transportation to Boost Growth

Based on end-user, the market is categorized into healthcare, real estate, IT and telecom, automotive & transportation, manufacturing, aerospace & defense, retail, and others. The incorporation of extended reality technology and predictive analysis tools has driven the product demand across manufacturing, automotive & transportation, and others.

REGIONAL INSIGHTS

To get more information on the regional analysis of this market, Download Free sample

The presence of large number of digital twin technology providers in U.S. is likely to grow with the maximum CAGR during the forecast period. The increased demand for the digital twin across various industries such as energy, pharmaceuticals, and cosmetics in the U.S. helps to reduce the risk of fraud-related financial losses.

KEY INDUSTRY PLAYERS

Key Players Develop New Platforms to Strengthen Their Positions

Autodesk Inc., ANSYS Inc., PTC Inc., IBM Corporation, and others are the prominent players in the market. Market players are concentrated on completing various business approaches to advance twin types.

List of the Key Companies Profiled:

- General Electric (U.S.)

- Microsoft Corporation (U.S.)

- Autodesk Inc. (U.S.)

- ANSYS Inc. (U.S.)

- PTC Inc. (U.S.)

- IBM Corporation (U.S.)

- Cognite (U.S.)

- Gramener (U.S.)

- Aspen Technology Inc. (U.S.)

- Esri (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2022 – Deutsche Bahn entered into partnership with NVIDIA to develop digital twin of railroads using artificial intelligence technology.

- June 2021 – General Electric introduced its new process analytics solution named Digital Smelter. This new software is used to develop a twin of the aluminum smelting process that will provide guidance to optimize energy consumption, reduce raw material costs, and increase production.

- March 2021 – Autodesk Inc. acquired Innovyze, Inc., a provider of water infrastructure solutions, headquartered at Oregon, U.S. This acquisition took place for USD 1 billion. It will help the company’s twin technology strategy to develop more sustainable and digitized water industry.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report highlights leading regions across the world to offer a better understanding to the user. Furthermore, it provides insights into the latest industry, market trends, and competitive landscape and analyzes technologies deployed at a rapid pace at the U.S. level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 33.7% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Application, By End-user |

|

By Type |

|

|

By Application |

|

|

By End-user |

|

Frequently Asked Questions

The market is projected to reach USD 29.79 billion by 2032.

In 2024, the market size stood at USD 2.89 billion.

The market is projected to grow at a CAGR of 33.7%

The energy and utilities end-user segment is likely to lead the market.

The deployment of digital twin in real estate industry is expected to drive the market growth.

General Electric, Microsoft Corporation, IBM Corporation, Autodesk Inc., ANSYS Inc., PTC Inc. (U.S.) are the top players in the market.

The product twin segment is likely to lead the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us