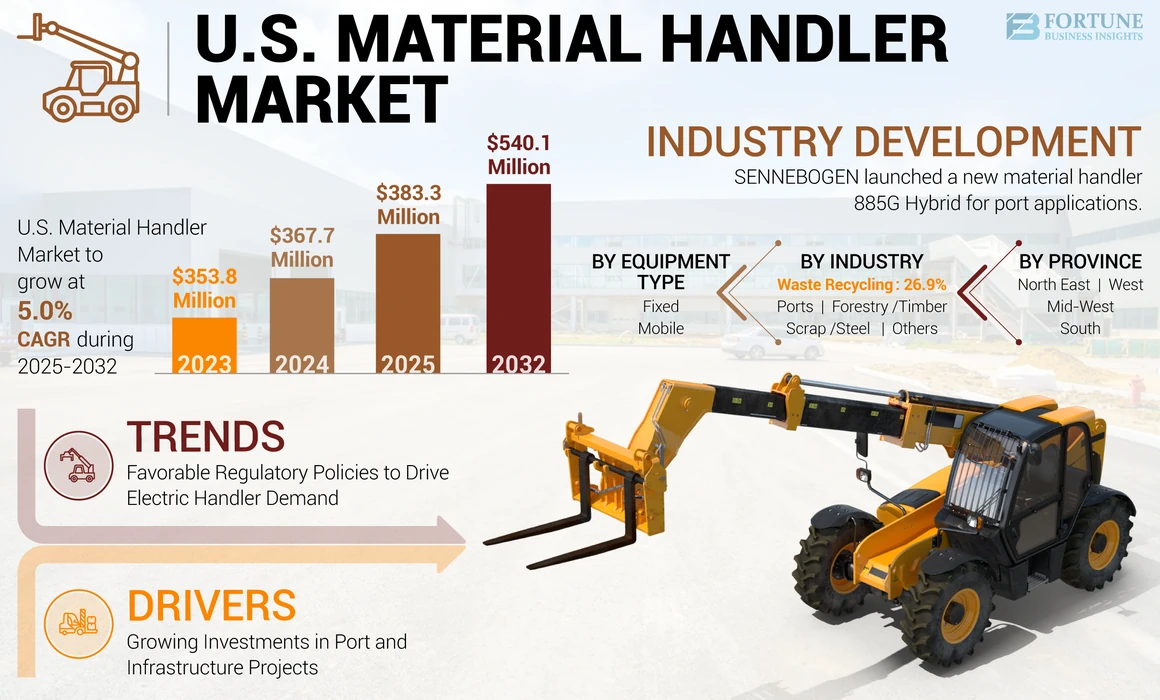

U.S. Material Handler Market Size, Share & Industry Analysis, By Equipment Type (Fixed and Mobile), By Industry (Ports, Waste Recycling, Scrap/Steel, Forestry/Timber, and Others), and By Province (North East, Mid-West, South, and West), and Country Forecast, 2025 – 2032

U.S. Material Handler Market Size

The U.S. material handler market size was valued at USD 367.7 million in 2024. The market is projected to grow from USD 383.3 million in 2025 to USD 540.1 million by 2032, exhibiting a CAGR of 5.0% during the forecast period.

Material handler is a type of heavy machinery utilized to handle, transport, and manipulate materials in various industrial settings, facilitating the efficient lifting, carrying, and placement bulk goods, containers, scrap metal, timber, and recyclables. Material handlers find application in ports, construction, manufacturing, forestry, waste recycling, scrapyard operations, and mining. Technological innovations such as automation, electrification, and Internet of Things (IoT) integration are expected to drive the market expansion, owing to products with improved efficiency, safety, and sustainability. Continued urbanization, infrastructure development, and e-commerce growth are anticipated to drive the product demand. The shift toward greener practices and circular economy principles is likely to influence equipment design and manufacturing processes, with an emphasis on energy efficiency and recyclability.

The COVID-19 pandemic negatively impacted the market, owing to disruptions in supply chains, decreased industrial activities, and reduced demand for material handling equipment. However, pandemic also led to an increased demand for automation and robotics to minimize human contact. This is anticipated to potentially drive the market growth in the long-term.

U.S. Material Handler Market Trends

Supportive Policies to Boost Sustainable and Electric Handlers Demand across Diverse Industries

Supportive regulatory policies and awareness about low carbon emissions are influencing the growing demand for electric material handling equipment in the country.

Changing climatic conditions and weather events are generating challenging environments for ports and other industries. Continuous facility expansions and new port development across the U.S. are generating heavy demand for cargo handling systems, further increasing the carbon emissions. Unlike conventional material handlers, electric equipment help reduce operating costs such as engine oil, filters, DEF injectors, water separators, and others. Along with equivalent performance and additional benefits such as the elimination of noise, air, and particulate emissions at ports, the demand for battery-powered material handlers is expected to grow over the coming years.

Several OEM manufacturers are introducing new models of electric handlers for a wide range of applications across the country and are supplying them for port handling operations. For instance, in January 2024, Volvo Construction Equipment (Volvo CE) introduced a new grid-connected electric material handler. The near-silent operating machine EW240 with a weight of 26 tons is used for outdoor and indoor applications at preferred low-carbon zones.

Download Free sample to learn more about this report.

U.S. Material Handler Market Growth Factors

Increasing Investment in Infrastructure and Port Projects to Boost the Sales of Material Handling Machines

The growing e-commerce industry and increased disposable income (both domestic and international) have resulted in enhanced trade logistics across the U.S. Ports play a crucial role in international logistics with increased freight transportation across several countries. Growing freight volumes and the expansion of port infrastructure are leading to huge capital expenditure across the country.

Furthermore, government initiatives and supportive programs are positively influencing the material handling machines market. For instance, in November 2023, the U.S. Department of Transportation Maritime Administration (MARAD) announced an investment of more than USD 653 million in 41 port projects under the Port Infrastructure Development Program. The Port Infrastructure Development Program is a grant program by the U.S. government where funds are provided to port projects to improve port infrastructure and enhance freight transportation. Financial assistance provided to several stakeholders is estimated to boost the demand for material handling machines across the country.

Port handling includes several pieces of equipment used for handling cargo and freight transportation. Material handlers both diesel and battery powered have their significant application for port logistics management. The handlers are versatile offering several loading, unloading, and sorting solutions for varied types of materials such as bulk and general cargo. A wide range of attachments allow the machines to be more flexible and versatile for handling operations with heavy lifting capacity.

RESTRAINING FACTORS

Environmental Regulations to Limit the Market Growth

The wood manufacturing industry is facing severe challenges such as an aging workforce and raw material shortages. Increasing awareness about environmental impact due to deforestation and decarbonization are all impacting the growth of wood products and their manufacturing. A range of regulations, related to safety and environmental concerns are being introduced, impacting the wood manufacturing industry. Furthermore, a considerable rise in alternative materials such as composites and engineered wood products, that have become customer preferences, is likely to impact the demand for wood-handling machines such as material handlers over the forecast period.

In addition, wood manufacturing companies are facing rising costs for raw materials, energy, and compliance with regulations significantly impacting the wood industry stakeholders and ultimately influencing the market expansion over the forecast period. The shortage of skilled workforce in the industry is leading to lower production rates and increased downtime, impacting the demand for material handling machines across the country.

U.S. Material Handler Market Segmentation Analysis

By Equipment Type Analysis

Mobile Equipment’s Flexibility Gives it an Edge over Fixed Equipment in Dynamic Working Environments

By equipment type, the market is segmented into mobile and fixed equipment.

The dominance of mobile equipment over fixed equipment in the market is attributed to several factors.

Firstly, the versatility and adaptability of mobile equipment allow it to be utilized across a wide range of industries and applications, including construction sites, ports, forestry operations, waste recycling facilities, and mining sites. This broad applicability of mobile equipment enables it to address diverse material handling needs efficiently, driving higher demand and sales volume.

Furthermore, the flexibility of mobile equipment makes it well-suited for dynamic work environments where materials need to be handled across different locations or terrains.

In contrast, fixed equipment, while still important for certain specialized applications within industries such as manufacturing, ports, and logistics, is more limited in its scope and application compared to mobile equipment. However, it is worth noting that the fixed equipment segment has been experiencing steady growth due to increasing demand for automation in specific sectors.

By Industry Analysis

Ports Segment Dominates Owing to Investments in Infrastructure and Automation to Enhance Efficiency

By industry, the market is segmented into ports, waste recycling, scrap/steel, forestry/timber, and others.

The ports segment dominates the U.S. material handler market share due to ongoing investments in infrastructure upgrades and automation, particularly along the East and West coasts, as well as the Gulf Coast, to effectively manage rising trade volumes.

The waste recycling segment is growing at the highest growth rate in response to increasing environmental awareness and regulations, driving the demand for equipment such as sorting systems, conveyor belts, and balers. Scrapyard operations are evolving with technological advancements, including the adoption of material handlers equipped with grapples, magnets, and shears for efficient scrap metal processing.

The forestry segment is experiencing a steady product demand, particularly in regions with significant timber resources such as the South and Pacific Northwest.

To know how our report can help streamline your business, Speak to Analyst

By Province Analysis

South Province to Hold the Highest Share Owing to its Strategic Geographical Position

By province, the market is segmented into North East, Mid-West, South, and West.

The South province of the U.S. is projected to dominate the market due to its strategic positioning as a hub for major ports along the Gulf Coast, driving significant demand for material handling equipment in maritime trade and logistics operations. Additionally, the South's growing industrial and manufacturing sectors, coupled with increasing investments in infrastructure and urbanization, further bolster the need for efficient handler solutions, contributing to its dominance in the market.

In the North East, waste recycling and ports are expected to have a higher share due to the region's dense population centers and strong emphasis on environmental sustainability, driving the demand for efficient waste management and recycling facilities.

The Midwestern region is anticipated to have the least share among the four regions due to its geographical distance from major coastal ports and lower population density, resulting in comparatively less product demand.

In the West, waste recycling and ports are likely to have a higher share due to the region's focus on environmental conservation and its significant coastal ports facilitating international trade and cargo handling.

COUNTRY INSIGHTS

The U.S. material handler market growth is driven by increasing demand across diverse industries. The U.S. government has been investing in infrastructure projects, including ports, roads, and bridges, which indirectly benefit the material-handling market by improving transportation networks and trade facilitation. For instance, in November 2023, the U.S. Department of Transportation's Maritime Administration has announced funding for 41 port improvement projects across the nation through the Port Infrastructure Development Program (PIDP). These investments aim to enhance capacity and efficiency at coastal seaports, Great Lakes ports, and inland river ports, supporting the movement of over 2.3 billion short tons of domestic and international commerce by water.

Key Industry Players

Key Players such as Terex Fuchs and Caterpillar Dominate the Market Owing to their Brand Reputation

Prominent players such as Terex Fuchs, Liebherr Group, SENNEBOGEN, Caterpillar, and Cargotec (HIAB) dominate the material handler market in the U.S. This is mainly due to their strong brand reputation, diverse product offerings, and established presence across key sectors such as ports, construction, and waste recycling. CNH Industrial and Volvo Group these two are considered tier-2 players in the market. Other players, including ATLAS GmbH, Sany Heavy Industry, Mantsinen, and LBX Company, hold a substantial share due to their capacity to offer competitive solutions, establish a robust market presence across diverse sectors, and effectively address the specialized needs of various industries within the market.

List of Top U.S. Material Handler Companies:

- ATLAS Maschinen GmbH (Germany)

- Cargotec Corporation (Finland)

- Caterpillar (U.S.)

- CNH Industrial LLC. (U.K.)

- LBX Company (U.S.)

- Liebherr Group (U.S.)

- Mantsinen Group Ltd (Finland)

- Sany Heavy Industry Co., Ltd. (U.S.)

- SENNEBOGEN LLC (Germany)

- Terex Corporation (Germany)

- Volvo Group (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: SENNEBOGEN introduced a new material handler in the upper-size class for port applications. The giant 885G Hybrid with 320t operating weight and 38m range provides customers with customized solutions and large capacity handling.

- September 2023: Liebherr Group unveiled its material handling equipment LH 26 M Timber Litronic for the timber and forestry sector. The new machine offers efficient timber handling with compact design and reduced fuel consumption.

- March 2023: Brandt unveiled its scrap material handler BMH40A at ConExpo 2023 which offers high productivity and enhanced reach of 52 feet. The machine offers reduced fuel consumption and increased uptime.

- March 2023: Liebherr introduced its material handlers LH 30M and LH 60M at ConExpo 2023 specifically for scrap handling applications. The two models offer an optimal view with adjustable cab elevation and optimal monitoring of the rear and sides of the machine along with safety features for the operators.

- November 2022: A new 885 G series material handler was introduced by SENNEBOGEN for port handling applications. The giant handler has an operating weight of 320 tons and reaches up to 38m.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading industries of the product. Besides, the report offers insights into the market trends, key players’ growth strategy, and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.0% from 2025 to 2032 |

|

Unit |

Value (USD Million) and Volume (Units) |

|

Segmentation |

By Equipment Type, Industry, and Province |

|

Segmentation |

By Equipment Type

By Industry

By Province

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 540.1 million by 2032.

In 2023, the market was valued at USD 367.7 million.

The market is projected to grow at a CAGR of 5.0% during the forecast period.

By equipment type, the mobile equipment segment is the leading segment in the market.

Increasing investment in infrastructure and port projects are expected to drive the market growth.

Terex Fuchs, Liebherr Group, SENNEBOGEN, Caterpillar, and Cargotec (HIAB) are a few of the top players in the market.

The South province generated maximum revenue in 2024.

By industry, the waste recycling segment is to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us