UX Services Market Size, Share & Industry Analysis, By Service Type (UX Research, UX Design, UX Audit, UX Training, and UX Strategy and Consulting), By Industry (IT & Telecom, Finance, Advertising, Healthcare, Manufacturing, and Travel & Tourism), and Regional Forecast, 2026 – 2034

UX SERVICES MARKET SIZE AND FUTURE OUTLOOK

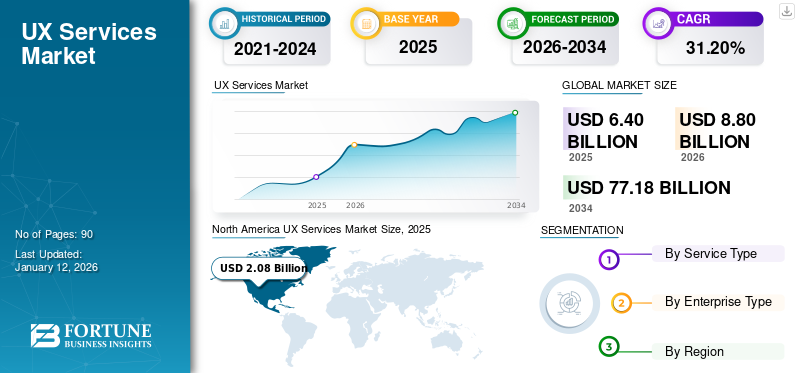

The global UX services market size was valued at USD 6.40 billion in 2025. The market is projected to grow from USD 8.80 billion in 2026 to USD 77.18 billion by 2034, exhibiting a CAGR of 31.20% during the forecast period.North America dominated the global market with a share of 32.50% in 2025.

The study considered companies offering User Experience (UX) services, such as UX research, UX design, UX audit, UX training, and UX strategy & consulting. The market’s growth is attributed to improved quality of content available, upgraded connectivity, and superior device capabilities. Prioritizing the creation of user interfaces, especially for users with disabilities, is crucial.

UX services refers to a set of professional services focused on designing and optimizing the "User Experience" (UX) of a product, website, or application, aiming to create intuitive, user-friendly interactions that meet the needs and expectations of the end user, often involving research, design, prototyping, testing, and iterative refinement to improve usability and overall satisfaction with the product.

MARKET DYNAMICS

Market Drivers

Proliferation of Digital Products and Services to Accelerate Market Growth

Digital adoption platforms are being deployed by several organizations to assist their staff in the efficient management of adoption initiatives. This adoption makes it possible to monitor a variety of activities, such as user experience research, organizational change management, and development of interface designs in any part of the process of adopting digital products from the first meeting until the final product launch. For instance,

- In August 2022, WalkMe Ltd. announced a partnership with Deloitte Canada to invest in technology adoption solutions for Canadian enterprises. This collaboration aimed to develop digital transformation strategies that focus on the effective, efficient, and sustained adoption of digital technologies.

As a result of these factors, this market has experienced tremendous growth, with more industries exploring the possibilities of enhanced UX due to the proliferation of digital products and services.

Market Restraints

Concerns Related to Data Privacy to Hinder Market Growth

Various end-users are using UX services in several countries, but their usage raises concerns about a design development gap and privacy, with some regions strictly controlling them. A data breach report by Ponemon Institute and IBM Corporation stated that the cost of data breaches reached USD 4.2 million in 2021, increasing by 10% from the average cost of USD 3.8 million in 2019.

Consequently, with greater emphasis on personal privacy, these restrictions are likely to become more stringent, hindering the development of the entire user experience services industry. According to an IBM report in 2021, approximately 44% of data breaches exposed personal customer information, including names, email addresses, and passwords.

Market Opportunities

Adoption of Product-Led Growth Model and Greater Focus On Accessibility to Create Market Opportunitie

UX is key to justifying the main risks related to adopting a product-led growth strategy. Organizations are creating opportunities to customize and improve UX services as a result of this strategy. The creation of user interfaces that are accessible to all users, including those with disabilities, could be given greater emphasis by organizations. To ensure the inclusivity of user experience, it will be necessary to include features, such as sense controllers, screen readers, keyboard navigation, and high contrast modes. For instance,

- In September 2023, Sony launched new features in PS5, including upgraded accessibility, audio, and social features to enhance the user experience. Its engineering and design teams worked together to develop a new form factor that provides more choice and flexibility to address the evolving needs of its customers.

Thus, the adoption of a product-led growth model and greater focus on accessibility are expected to create lucrative opportunities for the key vendors operating in this market.

Market Trends

Rising Technological Advancements and Digitalization to Set New UX Services Market Trends

The digital experience is being integrated with emerging technologies, such as Augmented Reality (AR), Virtual Reality (VR), chatbots, and voice-based user interfaces. These technologies offer immersive experiences, fostering enhanced product interaction and engagement. In these environments, major players are exploring new ways to create immersive and user-centric design services, from AR-enhanced shopping experiences to VR-driven gaming interfaces.

Voice-enabled assistants, such as Amazon Alexa and Google Assistant are also being integrated with user experience services. These assistants are used to provide customers with personalized recommendations, answer queries, and automate routine tasks, which is why they are frequently used by sales representatives to access customer data and update records while on the go.

According to Zendesk in 2022, it is estimated that 80% of customers will be influenced by a better digital experience in their future purchase decision. Therefore, the increasing trend of digitalization and technological advancements in enhanced user experience services are key factors accelerating the UX services market growth.

SEGMENTATION ANALYSIS

By Service Type

Surge in Need for UX Design to Digitize Services Fueled Demand for UX Services in Major Sectors

Based on service type, the market is divided into UX research, UX design, UX audit, UX training, and UX strategy and consulting.

The UX design segment dominated the market share by 35.50% in 2024. As businesses across various sectors (e.g., healthcare, retail, and education) continue to digitize their services, the demand for intuitive, user-friendly digital products has surged. Thus, large enterprises are investing in UX design to improve customer satisfaction, increase retention, and drive conversions. For instance,

- In 2024, Wells Fargo launched a new mobile app focusing on personalization to provide customers with a better and seamless digital banking experience.

The UX strategy and consulting segments are projected to showcase the highest CAGR during the forecast period owing to the growing demand for digital transformation among various industries. Walmart and Target have invested heavily in UX to improve their e-commerce platforms, thereby enhancing the customer experience and streamlining checkout processes.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Growing Digitization in Telecom Sector Propelled Adoption of UX Services Among Users

Based on industry, the market is divided into IT & telecom, finance, advertising, healthcare, manufacturing, and travel & tourism.

The IT & telecom segment dominated the market in 2024 due to the growing digitization in the telecom sector. As telecom companies embrace digital transformation, they need to revamp their customer-centric platforms to deliver enhanced user experience. This involves simplifying complex processes and integrating a user-centric design. The IT & telecom segment is projected to dominate the market share by 27.90% in 2025. For instance,

- Verizon and AT&T invested heavily in redesigning their mobile apps and customer service portals to improve customer engagement.

The advertising segment is projected to showcase the highest CAGR of 40.90% during the forecast period. As companies increasingly move toward digital platforms, there is a growing demand for enhanced UX services. Companies, such as Amazon, Walmart, and Target have invested heavily in improving the UX of their online stores, thereby optimizing the buying journey for users.

UX SERVICES MARKET REGIONAL OUTLOOK

North America

North America UX Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America leads the UX services market share driven by the rising adoption of digital transformation initiatives and the presence of a tech-savvy consumer base in the U.S. and Canada. Enterprises across various sectors in the U.S. are actively engaged in digital transformation efforts, and user experience services play a critical role in these initiatives, ensuring that digital products and services meet the evolving needs of users. The North American market size was valued at USD 2.08 billion in 2025. In 2023, the regional market stood at USD 1.20 billion in 2023.

Download Free sample to learn more about this report.

The U.S. dominated the market in 2024 and is estimated to record a considerable CAGR during the forecast period. The U.S. market is likely to be USD 1.97 billion in 2026. The surge in online shopping, especially post-pandemic, has increased the demand for better user experience across e-commerce platforms and mobile applications in the U.S. Brands are prioritizing UX design to enhance customer engagement, streamline the purchasing process, and improve conversion rate. For instance,

- E-commerce giants, such as Amazon and Shopify have continually optimized their mobile app interfaces, offering features, such as one-click checkout and personalized recommendations to improve the user journey and boost sales.

Europe

Europe is expected to hold the third-largest market value of USD 2.24 billion in 2026 of the global market. This growth is due to the rising adoption of cloud-based services, increased data generation in telecommunications, healthcare, e-commerce, and retail sectors, and increased government spending on the adoption of advanced digital technologies to benefit their businesses. For instance, according to the European Organizations, about 70% of companies in Europe are migrating their workloads to the cloud. This is mainly due to cost optimization through cloud adoption, and about 50% of organizations have implemented a cloud-first strategy to increase their business efficiency. This trend will create various market opportunities for large-scale players to expand their UX services in the U.K., Germany, France, Spain, Italy, and other countries. The market in U.K. is expected to stand for USD 0.48 billion in 2026. Germany’s market size is projected to hit USD 0.43 billion in 2026 and France is likely to hit USD 0.25 billion in 2025.

Asia Pacific

Asia Pacific region is the second-largest region and expected to account USD 1.64 billion in 2025.

The Asia Pacific market is projected to register the second-highest CAGR of 37.90% during the forecast period owing to rapid industrialization, increasing adoption of smart devices, and a growing automotive sector. Market players in the region are focusing on expanding their geographical presence by offering advanced and user-friendly UX services to businesses in developing nations. The market in China is projected to stand for USD 0.58 billion in 2026, whereas Japan is projected to reach USD 0.35 billion and India’s market size is likely to hit USD 0.43 billion in 2026.

Middle East & Africa

The Middle East & Africa region is the fourth-largest region and expected to account USD 0.58 billion in 2025.

The market in the Middle East & Africa is still in the development phase owing to limited number of startups and domestic market players. Some governments in the region are emphasizing digitization and innovation. This push aligns with the adoption of user experience services, especially in sectors, such as e-government services and fintech. The UAE market size is expecting to hit USD 0.15 billion in 2025.

South America

The South America market is also in its early stages owing to rising investment from governments and key players in sectors, such as e-commerce & retail, IT & telecommunication, healthcare, education, and others. Key players in the regional market are focusing on expanding their geographical presence across the Caribbean countries, offering enhanced user experience services equipped with innovative technologies.

COMPETITIVE LANDSCAPE

Key Industry Players

Collaborations & Partnerships among Key Players to Propel Market Growth

Key players operating in the market are entering strategic partnerships and acquiring businesses. They are adopting these strategies to support their product portfolio and expand their scale of operations. Major global corporations are forming partnerships and alliances with other players to streamline and grow their business. For instance,

- September 2023: McKinsey partnered with Salesforce to develop generative AI for marketing, sales, commerce, and service. This collaborative effort involved a team of solution architects, UX designers, data scientists, cloud engineers, and organization culture specialists working alongside the company’s teams.

List of Companies Studied:

- Accenture (Ireland)

- PwC (U.K.)

- Ipsos (France)

- UX Studio (Hungary)

- Neilsen Norman Group (U.S.)

- Appnovation (U.S.)

- Answer Lab (U.S.)

- Bold Insight Inc. (U.S.)

- IDEO (U.S.)

- McKinsey & Company (U.S.)

- Frog Design (U.S.)

- Haptic Lab (Canada)

- Tetra Design (Canada)

- Atomix Motion (Canada)

- Huge, Inc. (U.S.)

- Cooper (U.S.)

- Critical Mass (Canada)

- The Buntin Group (Canada)

- UXXI (Canada)

- Ideo (U.S.)

…and more

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Google launched a suite of design tools leveraging quantum computing to improve user interaction predictions. The new set of tools was designed to help UX professionals predict and optimize user behavior patterns with unprecedented accuracy, allowing for more personalized and engaging design outcomes.

- February 2024: Adobe acquired Figmable to strengthen UX research capabilities. This acquisition allowed Adobe to offer more in-depth insights into user behavior, integrating advanced data analysis with design tools to optimize user experiences across its websites and mobile apps.

- September 2023: PwC declared a three-year partnership with Amazon Web Services (AWS) to fast-track and improve operational efficiency, foster innovation, and transform the way business is done. Together, PwC and AWS offered a combination of cloud infrastructure and consulting, including product design, UX/UI, and PMO activities.

- May 2023: Bold Insight Inc. launched the Check UX Consumer Duty service to aid financial services and fintech companies in complying with the Financial Conduct Authority’s (FCA) new Consumer Duty rules. The new UX service minimized strong action from the FCA and helped companies identify simple changes to be made in their digital products and services.

- January 2023: ReSight Global, parent company of Bold Insights Inc., acquired PeepalDesign, a UX firm in India. The acquisition benefited ReSight Global with access to 220 UX experts and offices in Shanghai, Tokyo, Chicago, Basel, London, Hamburg, Bangalore, Munich, and Pune.

INVESTMENT ANALYSIS AND OPPORTUNITIES

UX services encompass a broad range of activities that are aimed at improving the usability, accessibility, and overall experience of digital products and services. The market is expected to grow as companies increasingly recognize the importance of providing a seamless and engaging experience to users. As demand for skilled UX professionals grows, so does the need for UX training programs and platforms. Online learning platforms, such as General Assembly and DesignLab are capitalizing on this trend, offering courses in UX design, research, and strategy.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 31.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type, Industry, and Region |

|

Segmentation |

By Service Type

By Industry

By Region

|

|

Companies Profiled in the Report |

Accenture (Ireland), PwC (U.K.), Ipsos (France), UX Studio (Hungary), Neilsen Norman Group (U.S.), Appnovation (U.S.), Answer Lab (U.S.), Bold Insight Inc. (U.S.), IDEO (U.S.), and McKinsey & Company (U.S.) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 77.18 billion by 2034.

In 2026, the market was valued at USD 8.8 billion.

The market is projected to record a CAGR of 31.20% during the forecast period.

By industry, the IT & telecom segment is leading in the market.

Proliferation of digital products and services will accelerate the market’s growth.

Accenture, PwC, Ipsos, UX Studio, Neilsen Norman Group, and Appnovation are the top players in the market.

North America is expected to hold the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us