Virtual Production Market Size, Share & Industry Analysis, By Component (Technology/System, and Services), By Type (Pre-production, Production, and Post-production), By Application (TV series, Commercial Ads, Movies, E-sports, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

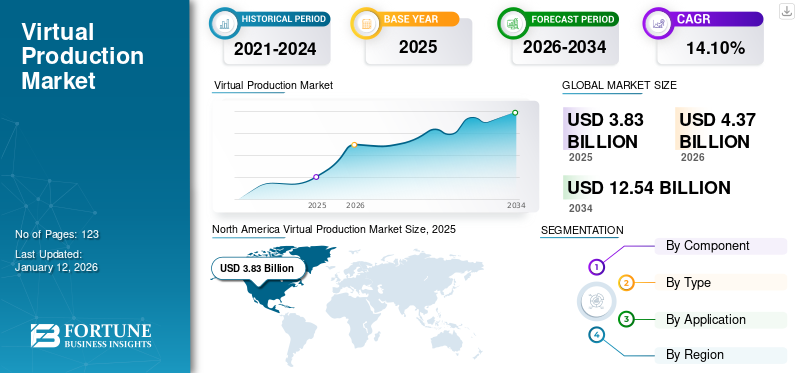

The global virtual production market size was valued at USD 3.83 billion in 2025. The market is projected to grow from USD 4.37 billion in 2026 to USD 12.54 billion by 2034, exhibiting a CAGR of 14.10% during the forecast period. North America dominated the global market with a share of 32.90%% in 2025. Additionally, the U.S. virtual production market is predicted to grow significantly, reaching an estimated value of USD 1.97 billion by 2032.

Virtual production (VP) integrates real-time computer-generated imagery (CGI) with live-action filming. It involves using technologies such as Virtual Reality (VR) and Augmented Reality (AR) to create interactive and immersive environments on set. This approach enhances the collaboration between physical and digital elements, streamlining the production process and potentially reducing post-production efforts. For instance,

- These techniques were extensively used in making “The Mandalorian” TV series. LED screens surrounded the set, displaying real-time virtual backgrounds that matched the filmed scenes. This allowed actors and filmmakers to engage themselves in the virtual environment, resulting in more authentic performances and saving time that would have been spent on adding backgrounds in post-production.

The COVID-19 pandemic accelerated the adoption of virtual production technologies in the entertainment industry due to restrictions on physical production. This led to increased investment and innovation in virtual production tools and techniques. As a result, the virtual production market experienced significant growth, with studios and content creators leveraging these technologies to produce high-quality content while adhering to safety protocols.

IMPACT OF GENERATIVE AI

Increasing Need for Enhanced Content Creation and Scene Generation Capabilities to Drive the Utilization of AI in Virtual Production Techniques

Generative artificial intelligence and machine learning transform the market by offering advanced content creation, scene generation, and character animation capabilities. This technology utilizes algorithms and machine learning techniques to generate content autonomously based on input parameters and training data. Generative AI enables the rapid creation of realistic environments, characters, and visual effects, significantly reducing the time and resources required for content development. For instance,

- In June 2023, Passage, a platform for producing and linking 3D virtual capabilities and worlds, raised USD 6 million to introduce an AI-powered virtual world builder.

Moreover, generative AI empowers virtual production teams to explore creative possibilities and iterate on designs quickly. By leveraging generative models, creators can generate multiple variations of scenes, characters, and visual effects with minimal manual input, allowing for faster experimentation and refinement of ideas. This iterative approach accelerates the pre-visualization process and enables filmmakers to visualize complex scenes and sequences before committing to costly production efforts. For instance,

- In April 2023, Disguise collaborated with Move.ai to develop a conventional AI technology based on actual-time motion capture software. The technology extracts normal human motions from video using advanced AI, biomechanics, computer vision, and physics to mechanically retarget the data to a specific character and generate a virtual character that can mirror human indication in real-time.

Thus, implementing Generative AI with these solutions has profoundly impacted the virtual production market growth.

Virtual Production Market Trends

Increasing Popularity of Real-Time Game Engines Adds Comprehensive Value to the Market Growth

The surging popularity of real-time game engines is significantly enhancing the progress of VP. Real-time game engines such as Unreal Engine and Unity leverage advanced rendering techniques and interactive capabilities to create immersive and dynamic virtual environments. These engines provide filmmakers with powerful tools for visualizing, creating, and manipulating virtual scenes in real-time, offering interactivity and flexibility previously unattainable with traditional production methods. For instance,

- The hit Disney+ series "The Mandalorian" extensively utilized Unreal Engine to visualize and refine virtual environments, enabling the production team to iterate on creative ideas and make real-time scene adjustments.

- The Marvel blockbuster "Avengers: Endgame" utilized Unreal Engine to blend live-action footage with CGI environments and characters, resulting in visually stunning and immersive sequences.

Moreover, the accessibility and scalability of real-time game engines make them ideal for both large-scale studio productions and independent filmmakers. These engines offer a wide range of features and functionalities, from advanced rendering and lighting tools to robust animation and physics systems, catering to the diverse needs of content creators across various genres and budgets. For instance,

- In December 2022, the Infocomm Media Development Authority (IMDA) of Singapore announced USD 3.6 million in funds to help attract international partners in IP and content creation. IMDA is also partnering with Epic Games to route an industry challenge from early 2023, targeting to train and aid local firms in understanding and implementing Unreal Engine for virtual production.

Thus, real-time game engines enable filmmakers to harness the power of virtual environments and digital storytelling, driving the virtual production market share.

Download Free sample to learn more about this report.

Virtual Production Market Growth Factors

Growing Implementation of LED Wall Mechanisms in Virtual Production to Augment Market Development

The increasing adoption of LED wall mechanisms in VP is amplifying the development of the market. LED walls represent an advanced technology that leverages high-resolution LED screens to display immersive virtual environments in real-time during filming. These LED walls are integrated with rendering engines and camera tracking systems, facilitating the seamless integration of live-action footage with virtual backgrounds.

Furthermore, the growing implementation of LED wall mechanisms fosters collaboration and knowledge exchange among industry stakeholders, leading to advancements in hardware, software, and production techniques. This collaborative ecosystem is propelling the evolution of virtual production, introducing improvements and reshaping the future of filmmaking and entertainment. For instance,

- In June 2023, the LED Virtual Production Group of EBU, in alliance with Leyard and other key partners, organized a workshop on VP using LED walls. The workshop aimed to understand LED volume walls' benefits, complexity, and difficulties for television sports, news, sports, and other entertainment.

- In May 2023, LG introduced LG MAGNIT, a micro-LED display, for VP studios. The new LG MAGNIT offers enhanced content formation, easy installation, brilliant picture quality, and other operations. This solution provides versatility by allowing users to modify the magnitude of the demonstrated image and select either stacking or hanging installation.

Therefore, LED wall technology is transforming the market, expanding and propelling it into new realms of creativity and technological excellence.

RESTRAINING FACTORS

Limited Availability of Experienced and Skilled Workforce to Operate on Virtual Production to Hamper the Market

The limited availability of an experienced and skilled workforce to operate on VP poses a significant challenge to the market. It requires a highly specialized skill set encompassing expertise in real-time rendering, virtual cinematography, plug and post-process motion capturing data, and digital compositing, among others. However, the rapid growth and adoption of these technologies have outpaced the development of a sufficiently large and proficient workforce. As a result, there is a shortage of professionals with the necessary knowledge and experience to operate and manage VP workflows effectively. This scarcity of skilled personnel impedes the widespread adoption and utilization of VP techniques across various industries, hindering the market's growth potential and innovation in immersive content creation. For instance,

- According to Panasonic Report 2023, VP is persistently growing in the TV and film industry, with 40% saying they are using the technology on current projects, and while the remaining say they are likely to use the technology in the coming 18 to 24 months. As per the report, the inadequate pipeline of skilled workers is a major challenge filmmakers face.

Thus, the limited accessibility of skilled workers to operating in virtual production restrains market growth.

Virtual Production Market Segmentation Analysis

By Component Analysis

Technology/System to Dominate Supported by Rising Product Demand for Various Applications

According to our study, the component is bifurcated into technology/system and services.

Among them, technology/system is expected to dominate the market share of 73.96% in 2026 and is expected to grow with the highest CAGR over the forecast period. The Digital Content Creation Report 2023 underscores the rapid evolution of technology in content creation, particularly the shift from traditional green screens to advanced LED walls. These walls, renowned for their high-resolution visuals, play a central role in creating immersive environments for filming, enhancing realism in interactions. Moreover, TrendForce emphasizes the growing preference for LED video walls over green screens, leading to reduced post-production time and costs. This transition is most prominent in the entertainment industry, especially in filmmaking, where LED walls heighten on-site experiences. Consequently, there is a surge in demand for VP systems, such as motion capture workstations and simulation cameras, driven by their increasing integration into film studios and television productions.

The services in the virtual production market holds a lesser share compared to technology/system due to the intangible nature of services, which often includes consulting, training, and support. Some companies prefer to invest in acquiring hardware and software licenses rather than ongoing service contracts. Moreover, the complexity and specialized expertise required for virtual production services may also limit their adoption.

By Type Analysis

Escalating Need for Refining Raw Footage to Fuel the Post-Production Segment Growth

As per our study, the type is trifurcated into pre-production, production, and post-production.

Among them, post-production holds the highest market share of 49.06% in 2026, as it is crucial for refining raw footage through tasks such as editing, VFX integration, and sound design. Advanced technologies such as CGI and VR have enhanced its capabilities, meeting the rising demand for immersive storytelling. With streaming platforms driving the need for compelling content, investments in post-production are increasing, making it a dominant segment in the market.

The production segment is expected to grow with the highest CAGR over the projected period, driven by tech advancements such as LED screens and VR/AR. The pandemic has accelerated this shift, making virtual production a safer and cost-effective option. Major studios and tech firms are investing in expanding their capabilities.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Movies Segment Leads with Growing Use of Technology and Film Production Budgets for Movie-making

According to our research, the application is studied across TV series, commercial ads, movies, E-sports, and others.

Among them, the movies segment held the maximum share of 35.90% in 2026 and is expected to grow at the highest CAGR over the forecast period. Companies are intensifying their efforts to enhance solutions by integrating advanced technologies such as LED screens, Virtual Reality (VR), and Augmented Reality (AR) to provide viewers with immersive experiences. For instance, Sony Electronics Inc. introduced a toolset in April 2023 to enhance pre-production and on-set workflows, designed to complement HDR-enabled LED walls and Sony VENICE Crystal LED, aiming to enhance performance and address production challenges. The segment's growth is further fueled by the surge in film production budgets and the widespread adoption of visual effects in Hollywood and other regional studios. Additionally, the shift of movie broadcasts to OTT platforms is expanding filmmakers' reach to a broader audience.

The TV series holds the second-largest share in the market due to the industry's demand for high-quality, episodic content produced efficiently and cost-effectively. Virtual production offers TV series producers the ability to create immersive environments, streamline production workflows, and meet tight deadlines, driving its popularity in this segment.

REGIONAL INSIGHTS

Our report includes market research across five regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America

North America Virtual Production Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.26 billion in 2025 and USD 1.41 billion in 2026. North America is a frontrunner in adopting these techniques, particularly in the entertainment sectors of filmmaking/movies, TV series, and e-sports. The North American filmmaking/movies industry embraces technology to create visually captivating content, enhancing storytelling and audience engagement. The U.S. market is projected to reach USD 0.95 billion by 2026. For instance,

- In June 2023, Samsung Electronics introduced its latest digital signage collection at InfoComm 2023, the premier audio-visual trade event in North America held in Orlando, Florida. During the event, Samsung launched The Wall for VP, a specialized display set for enhanced storytelling and viewer engagement.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR throughout the projected period, which is attributed to increasing investments, collaborations, and acquisitions between regional and local players to expand their base. For instance,

- In May 2022, Pixotope revealed strategic partnerships with major broadcast firms across Hong Kong, South Korea, Taiwan, Japan, China, The Philippines, Malaysia, Myanmar, India, Thailand, and Singapore.

China holds the highest share in Asia Pacific owing to a growing focus on replacing green screens with LED walls and rising collaboration between Chinese filmmakers, driving the overall Asia Pacific market. The Japan market is projected to reach USD 0.17 billion by 2026, the China market is projected to reach USD 0.24 billion by 2026, and the India market is projected to reach USD 0.17 billion by 2026.

- In July 2023, Wuxi Studios introduced China’s largest LED volume for film production, utilizing cutting-edge Brompton technology to enhance visual quality and creativity.

Europe

Europe holds the second largest share in the global virtual recognition market owing to a surge in partnerships among key players and the introduction of enhanced products by integrating their solutions. Companies in the European region are introducing new products and enhancements to their existing ones to create a better visual experience for the viewers. The UK market is projected to reach USD 0.28 billion by 2026, and the Germany market is projected to reach USD 0.25 billion by 2026.

- In January 2023, Studio Fares of Sweden introduced EEN, Europe's largest projector-based production wall. Situated in Trollhattan, Studio Fares is the second-largest soundstage in Scandinavia, encompassing an expansive area of 1,100 square meters. This development signifies a noteworthy advancement in production facilities, showcasing the integration of cutting-edge technology for enhanced business operations and creative events.

South America

South America’s growth is driven by the surge in R&D activities in the region to offer innovative and cost-effective solutions to consumers. For instance,

- In November 2022, Nestlé unveiled a new Research & Development (R&D) Center dedicated to Latin America to foster innovation in collaboration with regional consumers. This initiative harnesses Nestlé's global scientific expertise while embracing the proximity to local consumers, commercial teams, and production facilities. The center’s focus lies in crafting delectable, nourishing, cost-effective, and eco-friendly products that resonate with the preferences of local consumers. Moreover, establishing this center enhances collaborations with universities, startups, and entrepreneurial ventures throughout the Latin American region, benefitting the growth of the Latin American market.

Middle East & Africa

Furthermore, the Middle East & Africa is experiencing positive growth in the market. The increasing partnerships among the regional and local players are expanding the opportunity for producing enhanced systems. For instance,

- In July 2023, ROE Visual collaborated with AVI-SPL, Pixotope, and Illusion XR Studio to organize an XR broadcast in Dubai, providing valuable insights and immersive experiences. This event was tailored for participants, including content creators, TV/film production professionals, broadcasters, and e-sports enthusiasts interested in the technology.

Thus, the increasing partnerships among players have highlighted the expansion of the market in countries including Turkey, UAE, Saudi Arabia, and Dubai.

Key Industry Players

Key Players Launch New Products to Strengthen Market Positioning

Key market players are actively creating advanced solutions to cater to customer demands. They also focus on enhancing their existing product portfolio to deliver flexible solutions with unique attributes. Furthermore, these organizations proactively pursue collaboration, acquisitions, and partnerships to bolster their product offerings.

List of Top Virtual Production Companies

- Adobe (U.S.)

- Autodesk, Inc. (U.S.)

- HTC Corporation (Taiwan)

- Sony Corporation (Japan)

- ARRI AG (Germany)

- Mo-Sys Engineering Ltd. (U.K.)

- Pixotope (Norway)

- FuseFX (U.S.)

- 80six (U.K.)

- TREE Digital Studio (Japan)

KEY INDUSTRY DEVELOPMENTS

- February 2024: Planar, a visualization technology company, unveiled upgrades to three LED video wall solutions tailored for indoor, outdoor, and on-camera VP. These upgraded LED video wall families include the Planar Venue Pro VX Series, Planar VenuePro Series, and Planar Luminate Pro Series. These next-generation solutions offer increased durability, enhanced deployment flexibility, and superior visual performance.

- January 2024: Sony Corporation unveiled a spatial content creation system featuring an XR head-mounted display with high-quality 4K OLED Microdisplays, video see-through functionality, and optimized controllers for intuitive interaction with 3D objects. The company aims to collaborate with developers across various production software fields, including entertainment and industrial design.

- December 2023: Disguise, a VP company, partnered with the AI platform Cuebric to streamline virtual environment creation. Cuebric integration into Disguise enables rapid generation of 2.5D environments for seamless execution on LED stages in less than minutes. This collaboration democratizes immersive storytelling, significantly reducing pre-production time and expertise requirements.

- November 2023: Autodesk introduced Autodesk Flow, a cloud-based platform for the media and entertainment sector. The platform integrates production and post-production data, offering a unified source for asset storage, version control, and feedback tracking. It facilitates simultaneous collaboration on content and includes features such as Flow Capture and Flow Production Tracking for visual effects and animation project management.

- October 2023: Aptech Limited launched India's first holistic VP academy in Mumbai, named "The Virtual Production Academy by Aptech. The academy offers training in all stages of production, including Visualization, Motion Capture, Hybrid Green Screen, and LED wall-ICVFX.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on vital aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report includes insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Type

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach USD 12.54 billion by 2034.

In 2025, the market was valued at USD 3.83 billion.

The market is projected to grow at a CAGR of 14.10% during the forecast period.

Post-production leads the market.

Growing implementation of LED wall mechanisms in virtual production to augment market development

Adobe, Autodesk, Inc., HTC Corporation, Sony Corporation, and ARRI AG are the top players in the market.

North America dominated the global market with a share of 32.90%% in 2025.

By application, the movies segment is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us