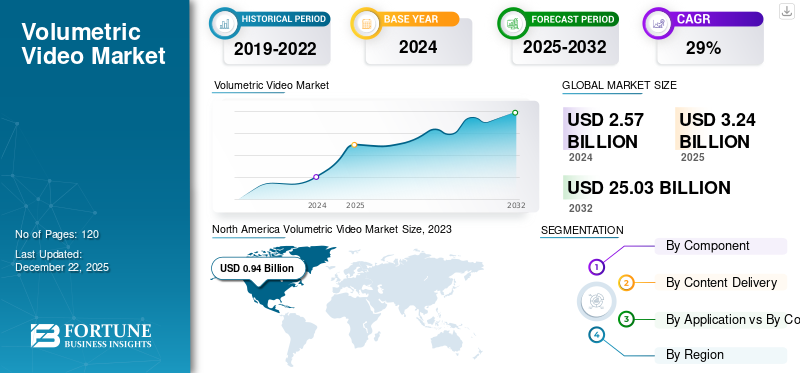

Volumetric Video Market Size, Share & Industry Analysis, By Component (Hardware and Software), By Content Delivery (Projectors, AR/VR HMDs, Smartphones, and Volumetric Displays), By Application vs By Component (Media & Advertisement, Sports & Events, Gaming, Education & Training, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global volumetric video market size was valued at USD 4.13 billion in 2025. and is projected to grow from USD 5.29 billion in 2026 to USD 35.03 billion by 2034, exhibiting a CAGR of 26.70% during the forecast period. North America dominated the global volumetric video market with a share of 35.00% in 2025.

Volumetric video is a cutting-edge video technology that captures three-dimensional spaces, objects, and people in motion to create an immersive, interactive experience. This is done using a collection of cameras and sensors to record data from every angle, which is then processed into a 3D model or video that can be viewed through various platforms, such as Augmented Reality (AR) and Virtual Reality (VR) headsets, smartphones, projectors, and volumetric displays. The market is poised for prominent growth due to the increasing adoption of innovative technologies, such as AI, AR, and VR. In addition, media companies are increasingly partnering with market players to create new content experiences for consumers. These collaborations will drive growth in areas, such as entertainment and sports in the coming years. Moreover, several companies are playing pivotal roles in developing and commercializing the volumetric video technology. Key players in the market include 4D View Solutions, Canon Inc., 8i, (Google LLC) Alphabet, Inc., Microsoft Corporation, and Depthkit. These organizations are launching solutions, such as Microsoft Mixed Reality Capture Studios, Google, Intel Studios, 8i, RealView Imaging, and others.

Furthermore, the COVID-19 pandemic had a significant impact on the market. As physical stores closed, brands turned to virtual marketing to reach consumers. Volumetric content enabled interactive 3D product demonstrations, virtual brand ambassadors, and holographic displays, allowing businesses to engage customers online in more innovative ways. This shift spurred investment in 3D video solutions for virtual advertising and e-commerce. As businesses, events, and consumers continue to embrace virtual experiences post-pandemic, the market is expected to see sustained growth.

IMPACT OF GENERATIVE AI

Enhancing Realism in Volumetric Video Through Generative AI to Boost Market Growth

Generative AI can enhance the realism of volumetric videos by filling in missing data points or improving the resolution of 3D captures. AI-driven algorithms analyze the captured data and reconstruct more accurate and lifelike models of people, object, and environments. AI can automatically generate textures, lighting, and shading for volumetric content, making the final output more visually compelling. It can also simulate realistic motion, reducing the need for manual intervention in animating 3D models. Also, generative AI can create fully synthetic 3D environments that integrate seamlessly with volumetric content. This allows for the creation of interactive virtual worlds that users can explore, blending real-world captures with AI-generated environments for a more immersive experience.

MARKET DYNAMICS

Market Drivers

Growing Demand for Immersive Media Experiences to Fuel Adoption of Volumetric Video in Media and Gaming

The demand for immersive content in industries, such as entertainment, advertising, gaming, and live events is one of the biggest drivers of the market. Consumers are increasingly seeking more interactive and engaging experiences, pushing companies to adopt volumetric video for AR/VR content, concerts, sports broadcast, and interactive movies. The rising popularity of AR and VR applications has accelerated the need for 3D videos as they offer a superior way to create 3D content for these platforms. The push for metaverse-related content, particularly by companies like Meta, is also fueling the demand for volumetric content. Furthermore, governments are increasingly supporting the use of 3D technology in sectors, such as education, public safety, and defense. This technology is being adopted for military training simulations and public safety drills, driving its use in the public sector. For instance,

- In November 2023, Accenture invested in Vū Technologies, a company that develops innovative technologies for virtual production and filmmaking. Through this investment, the company aims to help other organizations use simulated production to develop new, immersive experiences.

Market Restraints

High Costs of Capture and Production May Hinder Market Growth

Setting up a volumetric video studio requires a large number of specialized cameras, sensors, and advanced software, which are often expensive. For many smaller companies or independent content creators, the upfront costs of creating 3D video content are quite high. Even after capture, 3D video requires complex data processing and editing, which can be time-consuming and expensive. Skilled professionals are required to work with the large datasets generated during capture, further increasing production costs. These factors are expected to hinder the volumetric video market growth.

Market Opportunities

Expansion in E-commerce and Virtual Shopping to Create Lucrative Opportunity for Market Growth

As online shopping continues to grow, volumetric video can create virtual try-on experiences, allowing customers to see products in 3D before purchasing. This can be applied in fashion (for trying on clothes or accessories), automotive (for exploring car interiors), and home decor (for viewing furniture in 3D), leading to more engaging and personalized shopping experiences. Retailers can create entire virtual storefronts using 3D video, where customers can browse and interact with 3D product models. This would offer a more immersive alternative to traditional 2D e-commerce platforms and could lead to higher customer engagement and conversion rates.

Market Trends

Improvements in 3D Capture and Display Technologies to Aid Market Growth

The development of more affordable and accurate 3D cameras and sensors is a key trend driving the market growth. Companies are investing in high-resolution depth sensors, LiDAR technology, and multi-camera systems to improve the quality and efficiency of 3D captures. Emerging volumetric display technologies are being developed to showcase 3D video content without the need for special headsets or glasses. This includes light field displays and holographic displays that offer a more immersive visual experience. For instance,

- In January 2023, Accenture invested in Forma Vision, a provider of live-streamed 3D hologram images of objects, people, and places. Through this investment, Accenture aims to use the live-streamed 3D hologram image technology for training and small group meetings.

In addition, the widespread deployment of 5G is enabling the real-time streaming of 3D content videos. 5G’s low latency and high bandwidth are critical for transmitting the massive data volumes generated by 3D video captures. This trend is particularly important for live broadcasts and telepresence applications, such as remote collaboration and holographic conferencing.

SEGMENTATION ANALYSIS

By Component

Rising Adoption of Advanced 3D Cameras and Depth Sensors Boosted Demand for Immersive Volumetric Video Hardware

Based on component, the market is bifurcated into hardware and software.

The hardware segment captured the largest market share in 2023. High-performance cameras and sensors used in volumetric video setups are capable of capturing data in real-time, which is beneficial for live broadcasts, sports replays, and interactive experiences. The use of multi-camera arrays and depth sensors, such as LiDAR or Time-of-Flight (ToF) cameras, allows for the capture of fine details, resulting in high-resolution 3D images and videos. This precision is crucial for creating realistic and immersive volumetric content in applications, such as medical training and sports analysis.

The software segment is expected to record the highest CAGR during the forecast period with a share of 51.69% in 2026. Cloud-based platforms allow for scalable processing, making it easier to handle the large volumes of data generated while capturing volumetric content. This is especially advantageous for projects with extensive 3D data, such as live performances or sports events. Cloud solutions facilitate collaboration between teams in different locations, allowing multiple users to work on 3D video content simultaneously. This can speed up production timelines and enhance project efficiency.

By Content Delivery Analysis

Increasing Demand for Volumetric Content in Entertainment & Gaming Sector Fueled Adoption of AR/VR HMDs

Based on content delivery, the market is categorized into projectors, AR/VR HMDs, smartphones, and volumetric displays.

The AR/VR HMDs segment captured the largest market with a share of 59.93% in 2026. In gaming and interactive entertainment, AR/VR HMDs (Augmented Reality/Virtual Reality Head Mounted Displays) allow players to interact with characters and objects captured using volumetric content. This creates more realistic and dynamic in-game avatars, enhancing gameplay and storytelling. Volumetric video streamed through VR HMDs is used for virtual concerts, sports events, and live shows. Fans can interact with digital performers or athletes, choose their viewing angles, and explore the virtual venue, thereby transforming the way entertainment is consumed.

The smartphones segment is expected to record the highest CAGR in the coming years. Volumetric content via AR apps on smartphones allows users to try on products virtually before purchasing. This is especially relevant in fashion, cosmetics, and home decor, where consumers can view products in 3D using their phones, thereby enhancing their online shopping experience. Brands are adopting volumetric content for creating engaging 3D ads that users can interact with on their smartphones. These interactive ads provide a more engaging and personalized advertising experience, leading to better conversion rates.

To know how our report can help streamline your business, Speak to Analyst

By Application vs By Component Analysis

Surge in Demand for Immersive Advertisements Propelled Use of Volumetric Video in Media & Advertisement

Based on application vs component, the market is classified into media & advertisement, sports & events, gaming, education & training, and others (medical and apparel stores).

The media & advertisement segment captured the largest market with a share of 46.09% in 2026. Brands are using volumetric video to create interactive ads that consumers can explore from different angles. This 360-degree engagement allows users to immerse themselves in the product experience, leading to higher engagement rates compared to the traditional flat ads. In media, volumetric content is being used to create 3D news reports, allowing viewers to see news anchors or reporters in full 3D environments. This enhances the storytelling experiences, especially for reports involving complex or dynamic visuals, such as natural disasters or war zones.

The gaming segment is expected to record the highest CAGR during the forecast period. AR gaming, particularly on mobile devices, is benefiting from volumetric content by allowing players to interact with 3D characters and objects in their real-world environment. This trend has been popularized by games, such as Pokemon Go, which uses AR to bring 3D characters into the physical world.

VOLUMETRIC VIDEO MARKET REGIONAL OUTOOK

North America

North America Volumetric Video Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest volumetric video market share in 2023 as brands across the region are utilizing volumetric content in advertising to create interactive and 3D advertisements. North America dominated the global market in 2025, with a market size of USD 1.449 billion. This is especially prominent in the retail sector, where consumers can engage with virtual product demonstrations via holographic displays or Augmented Reality (AR) experiences on their smartphones. With the rise of virtual events, especially after the pandemic, volumetric content has been adopted for product launches, trade shows, and virtual concerts. For example, volumetric capture is used to create lifelike holograms of celebrities or brand ambassadors, offering an immersive way to connect with audiences during virtual events.

Download Free sample to learn more about this report.

In the U.S. market, the entertainment industry, centered in Hollywood, has been an early adopter of volumetric content. Movie studios and production companies use this technology to create immersive 3D scenes for films, TV shows, and Virtual Reality (VR) experiences. The adoption of volumetric content in creating realistic digital doubles and holographic characters is transforming storytelling in cinema and streaming across the country. The U.S. market is valued at USD 1.31 billion by 2026. For instance,

- In June 2024, Gracia AI, located in the U.S., received USD 1.2 million in seed investment. Through this funding, the company launched its AI-powered technology, designed to create photorealistic volumetric content for VR and AR.

Asia Pacific

The Asia Pacific market is expected to record the highest CAGR during the forecast period. Countries, such as China, Japan, and Australia have invested in the establishment of volumetric content studios to support the local entertainment and advertising sectors. These studios provide the infrastructure needed for 3D capture and content creation, enabling local industries to produce high-quality volumetric content. Governments in countries, such as China and Japan are actively supporting the development of immersive technologies, including 3D video, through funding and technology initiatives.The Japan market is valued at USD 0.323 billion by 2026, the China market is valued at USD 0.381 billion by 2026, and the India market is valued at USD 0.202 billion by 2026.

For instance,

- In March 2023, NantStudios developed the largest permanent LED volume at Docklands Studios in Melbourne, Australia. This studio is designed for large-scale film and television projects. The large screen is connected to powerful computers driven by gaming software.

Europe

Europe is anticipated to grow at a prominent CAGR in the coming years. The European film industry, particularly in the U.K. and Germany, is incorporating volumetric content into high-end TV series and movies. Studios are using volumetric capture to create immersive special effects and 3D environments. The U.K., with its prominent film industry, is leading in the adoption of 3D video technology for both feature films and virtual reality projects. The UK market is valued at USD 0.359 billion by 2026, and the Germany market is valued at USD 0.316 billion by 2026.

For instance,

- In June 2024, WPP plc, a U.K. based advertising company, unveiled an AI-powered production studio, developed with the help of NVIDIA Omniverse. This studio streamlines the creation of 3D products throughout the production lifecycle.

Moreover, European healthcare institutions are adopting volumetric content for surgical training and medical simulations. Hospitals and universities are utilizing this technology to create 3D representations of surgeries and procedures for better training outcomes.

Rest of the World

The market in the rest of the world is expected to showcase noteworthy growth during the forecast period. In the Middle East & Africa, volumetric content is being adopted for industrial training, particularly in the oil & gas sector. Workers can use Virtual Reality (VR) headsets to engage with the 3D simulations of complex equipment and machinery, thereby improving safety and operational efficiency. Moreover, universities in Brazil and Argentina are starting to use volumetric content for educational simulations, particularly in fields, such as medicine and engineering. The 3D video technology allows students to interact with virtual models of anatomy, machinery, or architectural designs, thereby enhancing the learning process.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Players Are Focusing on Partnership and Acquisition Strategies to Expand Their Services

Key players in the market are focusing on expanding their geographical presence across the globe by presenting industry-specific services. They are also focusing on mergers and acquisitions with regional players to maintain their dominance across regions. These companies are launching new solutions to increase their consumer base. An increase in R&D investments for product innovations is enhancing the market’s expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Companies Studied:

- 4D Views Solutions (France)

- 8i (U.S.)

- Unity Technologies (U.S.)

- Canon, Inc. (Japan)

- Google LLC (Alphabet, Inc.) (U.S.)

- Mantis Vision Ltd. (Israel)

- Arcturus Studios Holdings, Inc. (U.S.)

- Depthkit (U.S.)

- IO Industries Inc. (U.K.)

- Microsoft Corporation (U.S.)

- Intel Corporation (U.S.)

- Sony Corporation (Japan)

- Meta Platforms (U.S.)

- Stereolabs (U.S.)

- Coretec Group (U.S.)

- VividQ (U.K.)

- Raytric GmbH (Germany)

- Evercoast (U.S.)

- Mod Tech Labs, Inc. (U.S.)

- Scatter (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Arcturus Studios Holdings launched a Volumetric Video Codec. This toolset was developed to provide scalable volumetric content to video engines with real-time representation.

- January 2023: Unity Technologies engaged in a partnership with Google LLC to support studios in the growth and development of live games. This partnership will play a vital role in enhancing real-time 3D (RT3D) content.

- August 2023: 4Dviews Solutions launched HOLOSYS+, its next-generation volumetric capture system. This solution consists of hardware and software and offers 1 year of technical support, along with on-site installation service.

- November 2022: Autodesk Inc. engaged in a collaboration with Arcturus Studios Holdings. The company invested USD 11 million in Arcturus’ volumetric video editing and streaming technology. This technology is capable of editing live-action 3D performances and this volumetric content can be streamed on any mobile device.

- May 2021: Arcturus Studios Holdings raised USD 5 million in a funding led by BITKRAFT Ventures in collaboration with telecom, sports, gaming, and music sector leaders. This funding was expected to be used to accelerate the popularity of volumetric content.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market are increasingly investing in research and development activities to improve volumetric content technologies, while startups specializing in the market are receiving significant venture capital investments. Collaboration between companies in the media, healthcare, education, and sports sectors is accelerating the adoption of 3D video content. For example, sports leagues are partnering with volumetric video companies to offer immersive fan experiences, and educational institutions are adopting the technology for virtual learning platforms. For instance,

- In July 2021, Canon Inc. and IBM Japan Ltd. engaged in a partnership to use volumetric capture technology to encourage visual arts.

Thus, the growing focus on strategic partnerships is expected to create a lucrative opportunity for the market growth.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and top applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 26.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Content Delivery

By Application vs By Component

By Region

|

|

Companies Profiled in the Report |

4D View Solutions (France), Canon Inc. (Japan), 8i (U.S.), Arcturus Studios Holdings, Inc. (U.S.), Unity Technologies (U.S.), Alphabet, Inc. (U.S.), Mantis Vision Ltd. (Israel), IO Industries Inc. (U.K.), Microsoft Corporation (U.S.), Depthkit (U.S.), etc. |

Frequently Asked Questions

The market is projected to reach a valuation of USD 35.03 billion by 2034.

In 2025, the market was valued at USD 4.13 billion.

The market is projected to record a CAGR of 26.70% during the forecast period.

Based on component, the hardware segment leads the market.

Growing demand for immersive media experiences will fuel the adoption of volumetric video in media and gaming.

4D View Solutions, Canon Inc., 8i, Arcturus Studios Holdings, Inc., Unity Technologies, Alphabet, Inc., Mantis Vision Ltd., IO Industries Inc., Microsoft Corporation, and Depthkit are the top players in the market.

North America is expected to hold the highest market share.

By content delivery, the smartphones segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us