Wearable AI Market Size, Share & Industry Analysis, By Product Type (Smartwatches & Fitness Bands, Smart Eyewear, Smart Earwear, Smart Clothing, and Others), By Application (Consumer Electronics, Healthcare, Automotive, Military and Defense, Media and Entertainment, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

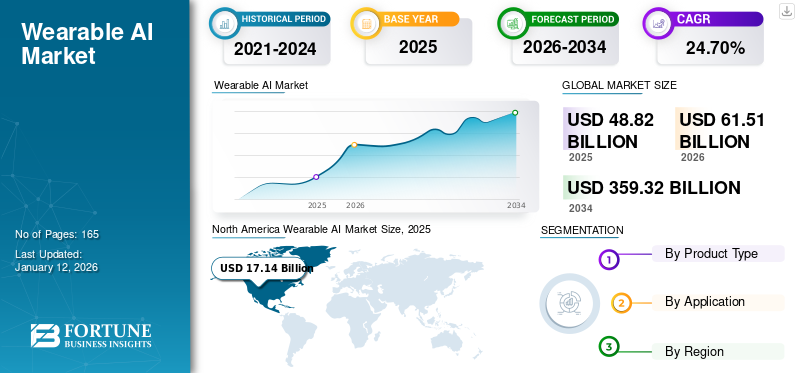

The global wearable AI market size was valued at USD 48.82 billion in 2025 and is projected to grow from USD 61.51 billion in 2026 to USD 359.32 billion by 2034, exhibiting a CAGR of 24.70% during the forecast period. North America dominated the global wearable AI market with a share of 35.10% in 2025.

Artificial Intelligence (AI) is disrupting virtually every industry and with the drastic rise of AI, researchers nowadays are focused on developing wearable AI devices for daily use. It is useful for tracking and monitoring the user's steps, heart rate, moods, sleep patterns, and quality, analyzing the gathered data, and providing warning signals on the device. The technology is under development and at this point, its interaction with real-time users and several applications is being witnessed. Wearable AI technology shows huge potential for both market prominence and profits.

Further, wearable AI devices such as smartwatches, wristbands, smart earwears, and others, are eventually observed for their potential to progress human health and well-being. Now, individuals are able to connect their smartphones to these wearable devices to track various aspects such as steps, heart rate, calories, sleep, emotions, and others. These devices generate ample amounts of health-related useful data for each person to deliver better outcomes and provide health treatment accordingly.

Despite severe restrictions imposed due to the COVID-19 pandemic, the wearable AI market continued to show steady growth and limited the pace of growth to only the next couple of years. Due to lockdowns imposed by the government, the supply chain was disrupted, causing losses for manufacturers and retailers. However, smart wearable devices depicted a huge upsurge in demand, especially during the COVID-19 pandemic. The population understood the importance of health-related capabilities and analysis obtained from these AI devices to maintain health.

For instance, during the pandemic, WHOOP Inc., a wearable technology provider, collaborated with major research organizations. The deal was centered on developing a COVID-19 identification system integrated into the WHOOP strap that measures respiratory rate with the use of Heart Rate Variability (HRV) and Resting Heart Rate (RHR).

IMPACT OF GENERATIVE AI

Transforming Wearable AI Devices with the Help of Generative AI Drives Market Growth

The integration of generative AI in the constantly evolving smart wearable technology opens up new opportunities for key players in terms of functionalities and personalizations. Generative AI algorithms unveil new aspects to fitness enthusiasts that are more than just heart rate monitoring and footstep counts. It now provides personalized fitness level setup and goals with real-time monitoring of various activities. Predictive analytics helps individuals identify probable health issues based on historical data.

Further, generative AI provides power to smart wearables to detect and analyze the user's emotions and suggest related activities. Nevertheless, few AI-powered wearable devices can assist and navigate visually impaired users by directing them to obstacles and surroundings. The evolution reflects the latest smart earbuds equipped with language translation features, which are crucial for various activities in many departments.

- In February 2024, Motorola, Inc., an American telecommunications company, introduced its prototype of an adaptive display concept in a smartphone that can fold similar to a wristband and can be worn on the wrist at the Mobile World Congress (MWC) 2024. The display is a flexible plastic-based OLED display.

- In October 2023, Rewind AI, Inc. introduced the Rewind Pendant, which is a wearable device on the neck that tracks your conversation and transcribes, encrypts, and stores it in smartphones.

Wearable AI Market Trends

Substantial Investments in AI-driven Wearable Technologies

The consistent development of mobile and other consumer electronics technologies, especially wearable technology, is gaining popularity and becoming an investment-worthy technology for leading market players across regions in terms of new product development. The AI-based wearable technology market is essentially related to the health sector. It is helpful in tackling inefficient health services in underdeveloped countries and continuously rising health costs across the globe. For instance,

- In January 2024, Epicore Biosystems, Inc., a U.S.-based digital health company, received investment from Pegasus Tech Ventures and a Japanese company 'Denka' to scale up and distribute deals in Japan and other Asian countries. These companies invested in Epicore's sweat-sensing wearable device, which is helpful in managing and monitoring body hydration levels.

- In May 2023, Humane, Inc., an American consumer electronics company founded by former Apple executives Imran Chaudhri and Bethany Bongiorno, introduced its portable projector-based wearable AI assistant during the TED Talk. According to the company, the device has the potential to replace all smartphones in the upcoming years.

Following are the crucial benefits of AI wearable health technologies:

- Physicians can have more information about the patient and personalized health services

- Improve the human living quality of patients and individuals

- Helps to improve medical education

- Helps to create a vast health database on a social scale

- The collected database will help to direct the health policies on the bright side

- Consumers are able to detect deficiencies and negative activities that help to control and reduce the condition.

Thus, the investments in wearable technologies are a key trend in the market.

Download Free sample to learn more about this report.

Wearable AI Market Growth Factors

Rapid Digital Transformation Coupled with the Advent of AI Technology to Boost Market Growth

Digital transformation is presently leading to significant changes in this market. Digital transformation is primarily driven by a combination of innovations in AI, regulatory changes, and changing consumer preferences. It is further driven by the increasing demand for real-time health monitoring and personalized solutions and growing investments by prominent market players in research & development initiatives.

For instance, in January 2024, Samsung Electronics announced the launching of 'Galaxy AI' in its latest smartphone, Galaxy S24. They also announced the introduction of AI technology to its smart wearable devices. The company has aimed to revolutionize the digital health experiences of its customer base across the globe. Moreover, at CES (Consumer Electronics Show) 2024, the company disclosed its vision of 'AI for All' for using AI technologies in its devices to provide seamless, safe, and energy-efficient experiences in the future.

- In October 2023, a research team at the Northwestern University, Illinois, U.S., developed a new nanoelectronic device that performs accurate ML (Machine Learning) classification tasks in an energy-efficient way and is smaller in size than installed in a wearable device.

The factors mentioned above are key factors driving the global wearable AI market growth.

RESTRAINING FACTORS

Finite Battery Life of Wearable AI Devices to Hamper the Market Growth

The short battery life of AI wearable devices can be disappointing and frustrating to consumers, specifically when the consumer needs to charge the devices frequently. Furthermore, few wristwear devices generate too much heat during their consistent usage of GPS and also drain the battery faster. Many local/regional level companies are struggling to keep pace with the latest technology adoption for various reasons, which causes a backlash in the market competition.

Moreover, handling sensitive customer data on cloud-based platforms raises concerns about data security and privacy compliance. Stringent regulatory compliances and hurdles to clear licensing and regulations of different government councils, especially related to healthcare data, are the factors that result in the slow pace of these devices. These factors may hamper the market growth.

Wearable AI Market Segmentation Analysis

By Product Type Analysis

Multifunctionality and Versatility of Smartwatches and Fitness Trackers to Drive Segment Growth

Based on product type, the market is segmented into smartwatches & fitness bands, smart eyewear, smart earwear, smart clothing, and others (smart rings, smart patches).

The smartwatches & fitness bands segment leads in the market and is expected to grow exponentially during the forecast period with a CAGR of 36.64%. This prominence can be attributed to the multifaceted utility and widespread consumer adoption of smartwatches, which have transcended their initial role as timekeeping devices to become indispensable tools for communication, productivity enhancement, and health monitoring. Nevertheless, advanced AI integration has uplifted the capabilities of smartwatches, which are not limited only to entertainment purposes. Furthermore, its ability to analyze data in real-time and provide consumers with actionable insights about health and fitness are expected to create a lucrative demand for smartwatches & fitness bands.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Segment Leads the Market Owing to Diverse Applications

On the basis of application, the market is fragmented into consumer electronics, healthcare, automotive, military and defense, media and entertainment, and others (retail, agriculture).

The consumer electronics segment holds the maximum market share and is expected to grow at a CAGR of 32.06% during the forecast period. In 2024, the segment accounted for 31.0% of the global wearable AI market share. The segmental growth is due to the product adoption by customers seeking lifestyle advancements and rising usage of technologically advanced smartwatches, fitness bands, smart earphones, and others, for regular health monitoring. Furthermore, the media and entertainment industry reflects a large adoption of AR/VR (Augmented Reality and Virtual Reality) devices by gamers, educational institutions, training simulators, and other consumers.

Thus, the adoption of wearable AI devices acts as an opportunity for customer engagement in the consumer electronics industry.

REGIONAL INSIGHTS

The global market scope is classified across five regions, namely North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

North America Wearable AI Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American region captured a major share of the wearable AI market in 2024, with a market size of USD 17.14 billion in 2025. This is due to the strong presence of key market players in the U.S., such as Fitbit, Inc., Google Inc., Garmin Ltd., Apple, Inc., and others. Further, higher consumer purchasing power and robust technological infrastructure of tech companies are anticipated to increase growth substantially during the forecast period. Furthermore, top organizations are heavily investing in technological advancements, IT spending, and early adoption of the latest tech as compared with other regions.

The advancement of healthcare has also heightened the demand for wearable AI devices that indulge in continuous health monitoring of patients. Various tech-savvy companies have announced multiple projects and collaborations in the U.S. and expanded the domestic value chain, leading to the demand for wearable AI.

In the North American region, the U.S. holds a major market share during the forecast period.The U.S. market is projected to reach USD 15.68 billion by 2026.

Asia Pacific

Asia Pacific is projected to grow exponentially due to the significant expansion of top wearable AI providers in developing countries such as China, Japan, South Korea, and India. The region is anticipated to grow with a leading CAGR in the global market, with increasing investments in advanced technology-based electronic devices. Asia Pacific comprises half of the world's population after the U.S. The region has faster-developing economies such as India, South Korea, Japan, Australia, and others, which are growing more quickly with the rapid acceptance of smart wearable AI devices with favorable government initiatives. The Japan market is projected to reach USD 3.56 billion by 2026, the China market is projected to reach USD 3.99 billion by 2026, and the India market is projected to reach USD 1.69 billion by 2026.

Europe

Europe is projected to record a notable market share during the forecast period. The wearable AI market is growing at a faster pace due to companies putting in the effort to improve and deliver excellent services. Government investments and initiatives for Artificial Intelligence (AI) adoption and implementation drive the market progress across European countries. Private organizations to accelerate AI devices with rising investments and business developments in the region. The UK market is projected to reach USD 3.15 billion by 2026, while the Germany market is projected to reach USD 3.83 billion by 2026.

Middle East & Africa

The speedy economic growth of GCC countries in terms of technology innovation adoption across industries is a result of the extensive development of wearable AI devices by local and regional players, as well as the increasing presence of market-leading organizations and business expansions in the upcoming years. These factors are contributing to stagnant growth in the Middle East & Africa market.

List of Key Companies in Wearable AI Market

Market Players to Adopt Merger and Acquisition Strategies to Expand Business Presence

Leading market players such as Sony Corporation, Fitbit, Inc., Garmin Ltd., Apple, Inc., Samsung Electronics, and others are implementing various business plans and strategies. Global leading companies focus on expanding their businesses and market presence through mergers and acquisitions. Furthermore, these companies aim to acquire small and local firms to grow their business presence.

List of Key Companies Profiled:

- Sony Corporation (Japan)

- Fitbit, Inc. (U.S.)

- Google Inc. (U.S.)

- Garmin Ltd. (U.S.)

- International Business Machines Corporation (IBM) (U.S.)

- Huawei Device Co., Ltd. (China)

- Xiaomi Corporation (China)

- Samsung Electronics Co. Ltd. (South Korea)

- Apple, Inc. (U.S.)

- Amazon, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Xiaomi Corporation, a global smartphone and consumer electronics company, launched its latest smart wearable products portfolio, which includes the Xiaomi Watch 2, Xiaomi Smart Band 8 Pro, and Xiaomi Watch S3 for the utmost sports and health and wellness experience to its customer base.

- October 2023: Garmin Ltd., an American, Swiss-domiciled multinational technology company, unfolds its global revenue growth by 6% in 2Q23 and 23% revenue growth in its health and leisure business unit despite a sluggish market.

- September 2023: Fitbit Inc., an American consumer electronics and fitness company, launched a wearable smartwatch ‘Fitbit Charge 6' with pricing of USD 160. The smartwatch has an improved heart rate tracking monitor compared to the previous version, i.e., Fitbit Charge 5.

- November 2022: Sony Corporation, a Japanese multinational conglomerate corporation, launched its latest smart wearable motion trackers/sensors named 'Mocopi,' which costs approx. USD 358. It would be available in six sizes: ankle, wrist, neck, and head.

- August 2022: IBM Corporation's research department developed a wearable fingernail sensor prototype that uses AI and ML to measure and monitor human health activities and generate progression reports with the help of fingernail movements and bends.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 24.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 359.32 billion by 2034.

In 2025, the market was valued at USD 48.82 billion.

The market is projected to grow at a CAGR of 24.70% during the forecast period.

By application, the consumer electronics segment led segment in the market in 2026.

Rapid digital transformation coupled with the advent of AI technology boosts market growth.

Fitbit, Inc., Garmin Ltd., Apple, Inc., and Sony Corporation are the top players in the market.

North America dominated the global wearable AI market with a share of 35.10% in 2025.

By product type, smartwatches & fitness bands are expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us