Web Analytics Market Size, Share & Industry Analysis, By Solution (Heatmap Analytics, Search Engine Tracking and Ranking, Marketing Automation, Behavior-based Targeting), By Deployment (On-premise & Cloud), By Enterprise Type (Small, Medium & Large Enterprises), By Application (Mobile Analytics, Online Marketing, Email Marketing, Social Media Analytics, Target & Behavioral Analysis), By Industry (BFSI, Retail & E-commerce, Healthcare, Government, IT & Telecommunication, Manufacturing) & Regional Forecast, 2026-2034

Web Analytics Market Size

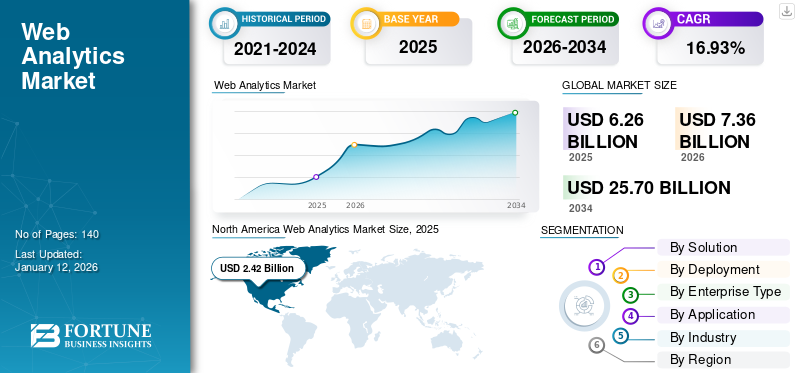

The global web analytics market size was valued at USD 6.26 billion in 2025 and is projected to grow from USD 7.36 billion in 2026 to USD 25.7 billion by 2034, exhibiting a CAGR of 16.93% during the forecast period. North America dominated the global market with a share of 38.61% in 2025.

Web analytics is a process of collection, measurement, analysis, tracking, and reporting of web data for analyzing and optimizing web usage. It is a systematic approach to find out more information about the behavior of website users, interpreting the data to gain deep insights about the interaction of users with the website. Web analytics tools help with website conversion rate optimization, i.e., increasing the percentage of visitors who become customers.

These analytical tools help to enhance Search Engine Optimization (SEO), paid advertising, and content generation strategies to track business progress. The growing usage of web analytics tools helps gain deep insights into available data and make data-driven decisions by analyzing real-time information. Increasing usage of various web analytics tools, such as Glassbox, Google Analytics, Hubspot, and Adobe Analytics, helps analyze website performance and improve the overall digital experience of users. The on-site and off-site web analytics tools also help to analyze and track the potential audience and website performance by streamlining better business decision-making.

- According to Forbes, in 2023, the number of social media users reached USD 4.9 billion globally. Thus, the growth of social media platforms boosts the demand for the adoption of social media analytics tools to meet the growing demand of customers continuously.

The COVID-19 pandemic had a significant impact on consumer behavior due to rapid changes in people's shopping habits along with increased adoption of online shopping channels. This factor accelerated the online presence of digital shopping channels that help optimize the digital experiences of the customers. This led to an enhanced demand for web and mobile analytics tools during the pandemic and post-pandemic periods.

IMPACT OF GENERATIVE AI

AI Integrated Web Analytics Solutions Automate Repetitive Tasks to Make Data-Driven Decisions

The integration of Artificial Intelligence (AI) with web analytics tools helps to improve the user experience and boost website traffic generated by various digital channels. AI, along with website analytics tools, enables websites to predict user behavior, deliver personalized content, and automate repetitive tasks to improve the overall user experience. Similarly, AI-powered search algorithms help analyze historical data and future trends, which significantly helps companies make data-driven decisions for business growth.

Artificial intelligence-driven web analytics tools can adjust and learn from changing data structures, resulting in more precise and actionable information. These tools enable businesses to identify unusual data patterns in web traffic and change user behavior and preferences. Furthermore, AI-powered analytical tools can analyze images, video, and text data present on websites. They can extract relevant information about customer sentiments, opinions, and preferences for delivering personalized experiences to customers globally.

Thus, growing advancements in artificial intelligence are anticipated to create lucrative opportunities and fuel market progress during the forecast period.

Web Analytics Market Trends

Integration of AI and ML Technology to Deliver Personalized Recommendations to Fuel Market Growth

The integration of Artificial Intelligence (AI) and Machine Learning (ML) with web analytics enables advanced predictive analytics to optimize the sales funnel and predict potential drop-off points. It also helps in anonymous threat detection and delivering personalized recommendations based on the user's behavior patterns. This integration provides real-time analytics capabilities to monitor and respond to the user's interaction promptly. For example, the Google Analytics 4 (GA4) platform integrated with machine learning helps to automatically identify trends from the collected data to generate deep data insights and deliver recommendations based on the gathered data.

In addition, the rise in reliance on web analytics among organizations to track web ad activity and help in marketing campaign analysis with real-time data and the need to deliver personalized ads by targeting individual customers based on their behavior and interests are the key factors that fuel the global market growth.

Download Free sample to learn more about this report.

Web Analytics Market Growth Factors

Surge in Demand for E-commerce Platforms to Drive Market Growth

Growing digital transformation across the e-commerce sector increases businesses' focus on strengthening their online presence and aims to reach the maximum number of customers. The adoption of analytics platforms by retail & e-commerce industries helps to analyze the website performance. The rapid change in consumer buying behavior has led to the rapid growth of the e-commerce industry and the e-retail sector. This results in increased adoption of analytics tools such as Google Analytics 4 (GA4), Adobe Analytics, and Shopify Analytics across e-commerce businesses.

As the demand for online shopping continues to grow, the demand for monitoring and analyzing the website data of businesses increases gradually. The analytics platform plays an essential role in understanding customer behavior, enhancing user experiences, and making data-driven business decisions, resulting in higher sales and overall e-commerce business growth.

- According to the U.S. Census Bureau 2023, the total e-commerce transactions reached a staggering USD 1,118.7 billion in 2023, accounting for 15.4% of total sales. Whereas in 2022, the total e-commerce sales reached USD 1,034.1 billion, accounting for 14.6% of total sales.

Integrated analytics solutions with e-commerce websites, applications, streaming media, and social media platforms help organizations optimize their digital experiences and enhance their marketing strategies to boost sales. The integration empowers data-driven decision-making by providing personalized experiences to customers and improving e-commerce performance. This factor led to an increase in the demand for web analytics platforms among e-commerce businesses.

RESTRAINING FACTORS

Data Security and Privacy Concerns Hamper Market Growth

Web analytics tools capture large amounts of data from various sources and digital channels, which significantly generate data privacy and security concerns that can hinder the growth of the market. The sensitive nature of the user information collected by using tracking tools contains personal identification information along with financial credentials.

Furthermore, complying with government regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), adds complexity to web analytics data privacy efforts. The encryption protocols for securing the data during transmission and storage restrict access for authorized persons by updating the software on a regular basis.

Web Analytics Market Segmentation Analysis

By Solution Analysis

Adoption of Search Engine Tracking and Ranking Tools for Enhancing Customer Engagement Drive Segment Growth

Based on solution, the market is divided into heatmap analytics, search engine tracking and ranking, marketing automation, behavior-based targeting, and others.

The search engine tracking and ranking segment held the major web analytics market with a share of 31.75% in 2026 and is expected to grow with maximum CAGR during the forecast period. The integration of web analytics tools with search engine tracking and ranking solutions helps to determine metrics, such as bounce rate, pages per session, and average session duration. These factors help marketers to review the customer engagement with the website. Thus, the demand for search engine tracking and ranking tools is high as compared to others.

Meanwhile, the heatmap analytics segment is estimated to gain traction as it increases sales by optimizing users' experience based on customer behavior. It also helps to remove unnecessary elements and direct users to reach the right place. Heatmap analytics can be used to crack the behavioral patterns of customers, which significantly boosts segment growth.

By Deployment Analysis

Cloud Segment to Grow with Higher Growth Trajectory Due to Rising Implementation of Cloud-Infrastructure

On the basis of deployment, the market is divided into on-premise and cloud.

The cloud segment is projected to grow with contribution of 51.05% globally in 2026, with the highest CAGR during the forecast period. The growing implementation of cloud-based infrastructure by various businesses generates demand for cloud-based analytics platforms to enhance the scalability and efficiency of business operations. These factors are expected to drive the growth of cloud-based platforms during the forecast period.

By Enterprise Type Analysis

Small & Medium Enterprises Segment to Lead Due to Rapid Adoption of Analytics Platform to Improve Customer Base

By enterprise type, the market is divided into small & medium enterprises and large enterprises.

The small & medium enterprises segment is expected to grow with a share of 51.26% in 2026, along with the highest CAGR during the forecast period. The adoption of web analytics tools by SMEs severely impacts their financial and non-financial performances and the decision-making process of the company's operations. Growing usage of web analytics tools among small and medium enterprises helps to enhance customer retention and loyalty with an improved customer base.

The large enterprises segment held the largest market share in 2023 due to the increased usage of analytics platforms for managing all marketing campaigns to make data-driven decisions.

By Application Analysis

Social Media Analytics Application Fueled by Rise in the Number of Social Media Platforms

By application, the market is segregated into mobile analytics, online marketing, email marketing, social media analytics, target & behavioral analysis, display advertising optimization, and others.

The social media analytics segment held the largest market with contribution of 25.47% globally in 2026. In recent times, enterprises are increasingly adopting social media applications to maximize customer reach and improve the user experience and sales. It is estimated to grow with maximum CAGR during the forecast period due to increasing engagement and interaction of the businesses with social media users to enhance the business operations and increase the business revenue.

The increasing importance of mobile analytics solutions drives the market. As smartphones and tablets have become the primary way people access the internet, businesses are increasingly aware of the need to monitor and analyze user activity on mobile devices. As a result, there is a growing need for mobile analytics in the broader web analytics market.

By Industry Analysis

Retail & E-commerce Industry Thrives by Tracking Customer Behavior to Increase Sales Using Analytics Platforms

By industry, the market is segregated into BFSI, retail & e-commerce, healthcare, government, IT & telecommunication, manufacturing, and others.

The retail & e-commerce segment held the largest market share in 2023. This is due to the rising usage of e-commerce analytics applications to analyze customer preferences and shifts in customer behavior while shopping. The usage of analytics solutions in e-commerce businesses helps to boost sales and achieve higher ROI.

The IT & telecommunication segment is expected to grow with the highest CAGR during the forecast period. This is due to the growing adoption of analytics platforms to analyze the large amount of data collected from multichannel marketing campaigns in the IT & telecom industry. The usage of web analytics platforms helps to identify the characteristics and preferences of their potential customers in the IT industry.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America

North America Web Analytics Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America held the maximum market share in 2025 and is expected to be a prominent contributor to the web analytics market growth. North America dominated the global market in 2025, with a market size of USD 2.42 billion. Rising technological advancements and growing investments by businesses to bring development in online advertising, social media marketing, SEO, and other digital channels drive the demand for web analytics tools in the U.S. and Canada. Similarly, the presence of significant web analytics tool providers, such as Google, AWS, Salesforce, Microsoft, and IBM, in the U.S., Canada, and Mexico will drive the market growth during the forecast period. The U.S. market is projected to reach USD 1.84 billion by 2026.

Asia Pacific

The market in Asia Pacific is estimated to grow with the highest CAGR during the forecast period. This is due to the continuous digital transformations in the e-commerce ecosystem and growing awareness of the importance of web analytics in India, China, Japan, and Singapore. Similarly, increasing investments in SMEs to enhance their social media presence and delivering developed marketing services to customers provide massive scope for market growth in Asia Pacific during the forecast period. The Japan market is projected to reach USD 0.32 billion by 2026, the China market is projected to reach USD 0.5 billion by 2026, and the India market is projected to reach USD 0.25 billion by 2026.

- According to the International Trade Administration e-commerce sales report 2023, India ranks first in retail e-commerce development between 2023 and 2027 among 20 countries across the world.

Europe

Get comprehensive study about this report by, Download free sample copy

Europe is anticipated to showcase moderate growth during the forecast period. This is due to the increasing implementation of web and mobile analytics solutions due to advanced IT infrastructure in various European countries. The UK market is projected to reach USD 0.43 billion by 2026, and the Germany market is projected to reach USD 0.34 billion by 2026. Moreover, the growing usage of automation and digital technologies will likely fuel market growth during the forecast period. For instance,

- In May 2023, Capgemini, in partnership with Google Cloud, generated a global Generative AI Google Cloud Center of Excellence (CoE) for enterprises to derive the full capabilities of AI technologies. This partnership helps to boost the value of the business transformation goals using AI techniques by engaging a large customer base.

Middle East & Africa

The Middle East & Africa is expected to grow with the second largest CAGR over the forecast period due to the growing implementation of data management technologies along with rising investments in AI and machine learning technology to drive the growth of the market. Rising digital transformation in the e-commerce sector boosts the demand for web and mobile analytics solutions in the MEA.

South America

Similarly, South America is in a developing phase due to the growing usage of social media platforms in Brazil and Argentina, fueling the adoption of social media management platforms during the forecast period. Similarly, increasing activities of Brazil-based tourism agencies using Natural Language Processing (NLP) technology for content and sentiment analysis of the customers strengthen the market's growth.

Key Industry Players

Technological Developments by Leading Companies to Aid Market Proliferation

Companies offering web analytics tools and services include Google LLC, matomo.org (InnoCraft Limited), Adobe Inc., Amplitude Inc., Sandstorm Analytics Inc. (kissmetrics), Crazy Egg, Inc., Glassbox Ltd. are focusing on bringing advancements in analytics tools to deliver better user experience. To expand their operations, market participants use various methods, such as acquisitions, partnerships, mergers, and collaborations.

List of Top Web Analytics Companies:

- Google LLC (U.S.)

- matomo.org (InnoCraft Limited) (New Zealand)

- Adobe Inc. (U.S.)

- Amplitude Inc. (U.S.)

- Sandstorm Analytics Inc. (kissmetrics) (U.S.)

- Crazy Egg, Inc. (U.S.)

- Glassbox Ltd. (U.K.)

- Webtrends Inc. (U.S.)

- Mouseflow, Inc (U.S.)

- Hotjar Ltd. (Malta)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: WebTrends launched Webtrends Analytics OnPremises version 9.5.1. This new on-premise version included security updates for the user interface, installer updates, along with bug fixes.

- December 2023: DAS42 formed a partnership with Snowflake to generate a Subscriber Analytics solution to resolve the challenges faced by subscriber-driven businesses. This solution helps to predict trends with transactional data and prevent customer churn and retention by analyzing users' data.

- July 2023: IONOS developed an AI-powered email marketing solution for SMEs to communicate with their customers. This solution helps to deliver promotional newsletters and offers to the customers of SMEs present globally.

- March 2023: Datajoin, an integration solution provider, developed its first digital analytics integration platform for Adobe Analytics and Google Analytics teams. This platform enables sales and marketing systems to integrate with Adobe and Google Analytics to analyze customer behavior with real-time data insights.

- January 2022: Glassbox, a software as a service (SaaS) provider, entered into a partnership with Optimizely, a Digital Experience Platform (DXP) provider, to deliver digital experience to the customer by unlocking the digital potential of the businesses.

REPORT COVERAGE

The study on the market includes prominent areas globally to gain enhanced knowledge of the industry verticals. Moreover, the research offers insights into the most recent endeavors and industry developments and an analysis of high-tech solutions being adopted. It also highlights some of the growth-stimulating limitations and elements, allowing the reader to obtain a comprehensive understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.93% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Solution

By Deployment

By Enterprise Type

By Application

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 25.7 billion by 2034.

In 2025, the market stood at USD 6.26 billion.

The market is projected to grow at a CAGR of 16.93% over the forecast period (2026-2034).

The search engine tracking and ranking segment leads the market.

A surge in demand for e-commerce platforms to drive the market growth

Google LLC, matomo.org, Adobe Inc., Amplitude Inc., Sandstorm Analytics Inc. (kissmetrics), Crazy Egg, Inc., and Glassbox Ltd. are the key players in the market.

North America held the largest market share in 2025.

Asia Pacific is expected to grow with the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us