WiGig Market Size, Share & Industry Analysis, By Standard (802.11ad and 802.11ay), By Application (Networking Infrastructure Devices and Display Devices), By End-Users (Retail and Consumer Goods, IT and, Telecommunications, Media and Entertainment, Healthcare, Aerospace and Defense, and Others), and Regional Forecast, 2025 – 2032

WiGig Market Size

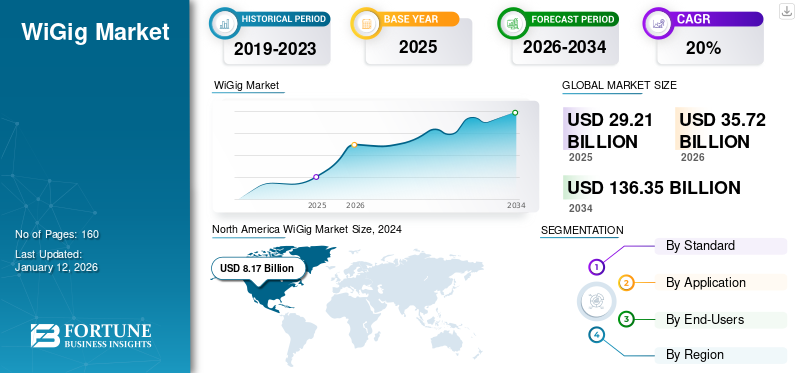

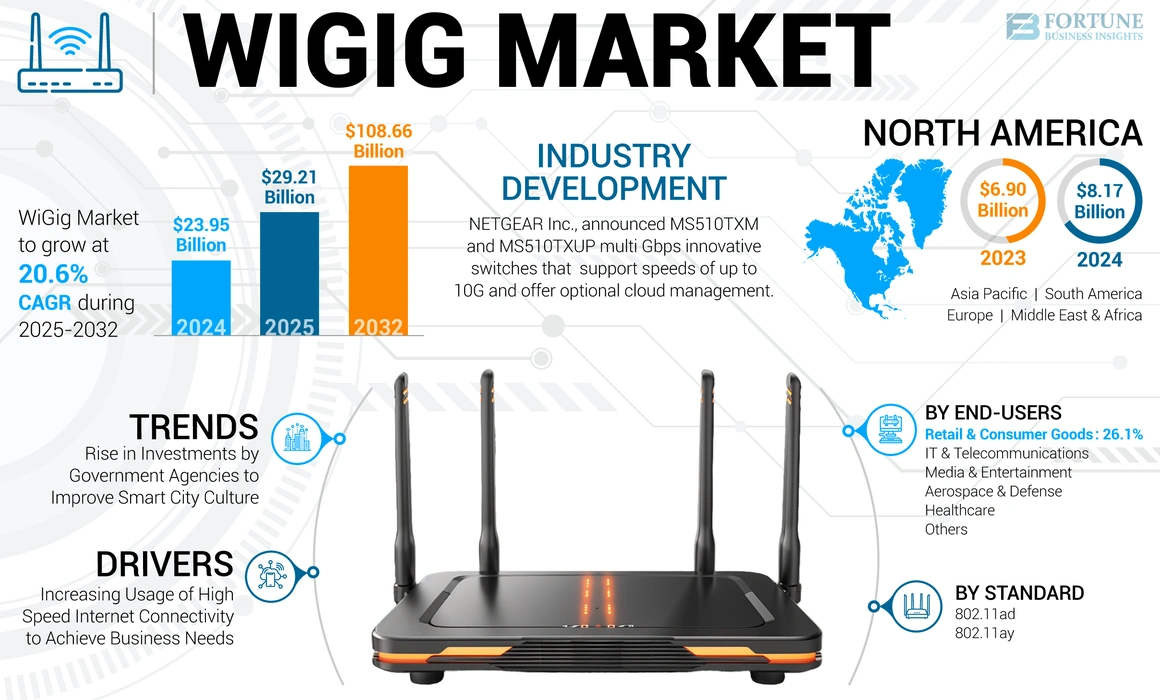

The global WiGig market size was valued at USD 23.95 billion in 2024. The market is projected to be worth USD 29.21 billion in 2025 and reach USD 108.66 billion by 2032, exhibiting a CAGR of 20.6% during the forecast period. North America dominated the global market with a share of 34.11% in 2024. WiGig is a wireless standard to ensure that network connections are capable of achieving substantially faster speeds. By operating within the 60 GHz frequency range, it offers a maximum speed of up to 40 Gbps, which is an important improvement in performance.

The WiGig market growth can be attributed to several factors such as increasing demand for high speed internet connectivity, huge growth in the adoption of consumer electronics, and a rise in demand for high quality streaming and gaming. With faster development cycles, scalable and agile systems, and improved speed at reduced costs, the widespread adoption of wireless gigabit (WiGig) is helping users develop flexible environments and faster connectivity. According to the ITU, in 2022, around 5.3 billion people, or 66% of the world’s population were using internet.

The COVID-19 pandemic created a shift towards the use of wireless gigabit technologies. With increased network requirements, the wireless industry deployed Wi-Fi hotspots and services at higher frequencies. Various network operators deployed broadband internet services by ensuring adequate capacity for users.

WiGig Market Trends

Rise in Investments by Government Agencies to Improve Smart City Culture is a Key Trend

Public Wi-Fi is contributing to various smart city objectives, including bridging the digital divide, enabling the internet of things (IoT), and providing services and facilities to citizens and tourists. The increasing investments by government agencies from different countries to improve smart cities are the major reason for market growth. In addition, wireless gigabit devices are being used in many enterprises to allow employees to complete their work from different devices without having to connect to a cable.

It is also used to efficiently connect office networks, transfer large files, smoothly operate bandwidth-heavy applications, and display graphics and video on a wide screen in conference rooms. Moreover, wireless gigabit devices permit the use of wireless docking between smartphones, laptops, projectors, and tablets in public kiosk services. These trends are contributing to the growth of this market in combination with growing consumer spending on digital media.

Download Free sample to learn more about this report.

WiGig Market Growth Factors

Increasing Usage of High Speed Internet Connectivity to Achieve Business Needs Enhances Market Growth

Due to the rise of digital transformation, there is a rapid increase in demand for resilient, trustworthy, and high-speed connectivity. WiGig provides high-speed connections with reduced latency for use cases such as video conferencing, streaming 8K videos, gaming, and AR/VR applications, thus making them preferable to other technologies.

The key factors for adopting wireless gigabit devices are relative cost-effectiveness and flexibility, which allow networks to be effortlessly scaled to meet varying business needs. It also offers a complete set of configurable security and control options that allow seamless device launch and are easy to set up and manage. Moreover, to support the huge number of applications and services, a significant reliance on high network capacity and internet speed is also becoming essential due to the increasing use of cellular phones, laptops, and desktop computers at work. Consequently, market growth is stimulated by a growing need for high-speed internet connections to process applications and activities related to work faster.

RESTRAINING FACTORS

Lack of Integration and Technological Constraints to Hamper Market Growth

Integrating WiGig with existing Wi-Fi infrastructure is important for an organization’s digital transformation. Enterprises achieve a robust and complete connectivity solution once integrated properly. Ensuring compatibility between the two technologies, which allows device activation and deactivation without interruption, is a major constraint.

Organizations require higher frequency penetration rates due to their complex infrastructure; however, WiGig limits the penetration rate through physical barriers. Also, current technology operates at frequencies above 60Hz and uses a frequency of 2.4GHz to 5GHz in most modern Wi-Fi products. As a result, existing infrastructure needs to be upgraded to attract significant revenue from customers.

WiGig Market Segmentation Analysis

By Standard Analysis

Higher Data Exchange and Throughput Rates to Increase the Demand for 802.11ay Standard

Based on standard, the market is segmented into 802.11ad and 802.11ay. 802.11ay standard is expected to have a higher CAGR in the industry due to the increased input and output at frequencies over the 2.4 GHz to 5 GHz bands. Also, with the increasing rate of wireless technology in response to the upsurge of smart devices, data, and applications, the 802.11ay standard is fulfilling the demand for wireless gigabit devices. 802.11ay could play an important role in internal mesh and support networks for other uses, such as providing supporting server backups, connectivity to VR headsets, and handling cloud applications, as it requires low latency. Various internet service providers are focused on deploying 802.11ay applications with the aim of replacing Ethernet and other cables within offices or homes and providing backhaul connectivity for service providers.

Higher data exchange rates and frequencies in 802.11ay allow users to streamline their tasks easily. With its support for low latency, it is revolutionizing Wi-Fi networks and becoming the key enabling technology.

As per market share, 802.11ad dominated the market in 2024. By transmitting in the 60GHz wavelength band, 802.11ad provides greater data speed and reduced latency. Consumers are using 802.11ad in smartphones to share and download video content from various applications. 802.11ad provides 7 GHz of bandwidth at 60 GHz in WiFi to transfer high data rates and local wireless capacity, enabling residential, commercial, and public use.

By Application Analysis

Increase in Adoption of Advanced WiGig Chips for Display Devices to Aid Market Expansion

As per application, the market is bifurcated into networking infrastructure devices and display devices.

The display devices are expected to significantly grow at a higher CAGR during the forecast period owing to the increasing consumer adoption of 802.11ay access points. The cost effectiveness, availability, and mutability of wireless gigabit make them an attractive option for display devices with low budgets and non-conventional setups.

Wireless gigabit provides consumers with the fastest connectivity required to transfer HD content between tablets, smartphones, computers, set-top boxes, and so on. With the development of advanced wireless gigabit integrated chips, the demand for display devices for WiGig is expected to increase during the forecast period.

Based on the market share, networking infrastructure devices dominated the market in 2024, the growth was attributed due to need for devices with high data throughput.

By End-Users Analysis

Rising Need for High Performance Wireless Connectivity in Healthcare to Grow Market Share

Based on end-user, the market is categorized into retail and consumer goods, IT and telecommunications, healthcare, media and entertainment, aerospace and defense, and others, which are adopting wireless gigabit devices for enhancing their business activities. Among these, the healthcare sector is anticipated to grow at the highest CAGR during the forecast period.

This market in the healthcare sector is majorly driven by rising demand for Wi-Fi used for applications including voice-over IP, cardiac and radiology imaging, telemedicine, electronic medical record procedures, and handheld scanners. The healthcare industry needs high performance, large capacity, and universal wireless connectivity to ensure efficient and secure operation of such applications that drive growth in the sector. Additionally, healthcare organizations continue to invest in a wireless network solution to support current and future technology and simultaneously implement new technology to improve operations, security, patient care, and interoperability. For instance,

- March 2022 - Infineon Technology AG and Sleepiz AG, a Swiss electronic healthcare company, collaborated to offer a solution that monitors users' sleep. Any devices connected to the smart home, such as room lights, speakers, and fans, can be equipped with this system. The solution focuses on customers who are targeted at the wider consumer market, using Infineon XENSIV60GHz radar technology and Sleepiz’s proven algorithms.

Media and entertainment will follow the healthcare sector in terms of growth rate. The adoption of new business models, content applications and technology enablers will drive the growth.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Regionally, the market is fragmented into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America WiGig Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

As per the analysis, North America held a major WiGig market share due to the presence of key players in the region adopting advanced technologies. In addition, the growing demand for wireless gigabit devices from North American companies is forcing government agencies to develop new strategies. In June 2023, the Federal Radio Regulatory Commission published a report and an order updating its rules on the 60 MHz band, which includes 57 to 71 GHz. To support a broad range of new applications, the new rules allow unlicensed field disturbance detection sensors in the 60 GHz band.

Asia Pacific is projected to grow at a higher growth rate, and the trend is expected to continue over the forecast period. Regional growth has been driven by increased production of Ethernet switches and routers in large economies such as India, China, and Japan. Due to rising IT spending and changing budgetary allocations in developing countries, technologically advanced products are being upgraded to improve the existing enterprise infrastructure. Evolving economies such as India, Japan, and China have made significant contributions in aiding the region's adoption of the WiGig platform. For instance,

- September 2022 - Fujikura Ltd. created and started distributing samples of a 60 GHz mm-Wave wireless module that is independently tested for technical regulations conformity certification in Japan, requiring no certificate. The new structure of the 60 GHz band mm-Wave wireless module has been advanced and optimized for certification.

Key Industry Players

Market Players Announce Merger & Acquisition, Collaboration and Product Development Strategies to Expand Reach

Prominent players operating in the global market focus on supporting more users and enabling more devices to run on a network by switching from 802.11ad to 802.11ay. These companies focus on acquiring small and local firms to expand their business presence. Moreover, merger & acquisitions, strategic partnerships, and leading investments in wireless gigabit technologies help increase market demand.

List of Top WiGig Companies:

- Qualcomm Technologies, Inc. (U.S.)

- PERASO TECHNOLOGIES INC (U.S.)

- Cisco Systems, Inc. (U.S.)

- ASUSTeK Computer Inc. (Taiwan)

- TP-Link Corporation Limited (China)

- NETGEAR (U.S.)

- Lenovo (China)

- Ubiquiti Inc. (U.S.)

- Tensorcom, Inc. (U.S.)

- Marvell (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: Move Up Internet (MUI), an Australian Internet Service Provider, partnered with Meta, Facebook's parent company, to launch an Internet service developed by Meta. The company uses Meta's multi-gigabit Terragraph technology, a 60GHz spectrum and WiGig standard technology to provide gigabit Internet service to residents and businesses across the Sunshine Coast region of Australia.

- June 2023: Marvell announced the release of a new Ethernet based central single chip switch to help automotive OEMs deliver software defined services on the next generation of cars and improve security. Marvell designed the chips to comply with security specifications that OEMs demand, such as Layer 2 MACsec link protection for authentication and encryption.

- June 2022: Siklu, the provider of millimeter wave broadband solutions for digital cities and gigabit wireless access (GWA), announced two new connectivity options to their MultiHaul product family: TG MPL260 and MGT N265. Siklu provides the largest selection of Terragraph-certified products for wired 5G wireless broadband access, Wi-Fi hotspot and small cell backhaul, smart towns, and connectivity in other applications.

- May 2022: Peraso announced that during COMPUTEX TAIPEI 2022, seamless wireless transmission using augmented reality (AR) glasses has been successfully demonstrated by Jorjin Technologies Inc., the Taiwanese manufacturer of innovative AR Glasses. Jorjin revealed the use of the Peraso X130 mmWave chipset in its JReality J7EF AR Glasses system.

- February 2022: Peraso Inc. announced that its 60 GHz mmWave platform, designed for wireless applications on the Metaverse, has been made available immediately. The platform includes 802.11ad/ay ICs, Peraso's 60 GHz wireless modules, advanced phased array antennas, and an extremely extensible Falcon software stack.

- January 2021: NETGEAR Inc., a player in networking products that power businesses of any size, announced the MS510TXM and MS510TXUP multi Gbps switches. NETGEAR's innovative switches support speeds of up to 10G and offer optional cloud management.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 20.6% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Standard, By Application, By End-Users, and By Region |

|

Segmentation |

By Standard

By Application

By End-Users

By Region

|

Frequently Asked Questions

The market is projected to reach USD 108.66 billion by 2032.

In 2024, the market value stood at USD 23.95 billion.

The market is projected to grow at a CAGR of 20.6% during the forecast period.

The healthcare sector is likely to lead the market.

Increasing usage of high speed internet connectivity to achieve business needs enhances market growth.

Qualcomm Technologies, Inc., PERASO TECHNOLOGIES INC, Cisco Systems, Inc., ASUSTeK Computer Inc., TP-Link Corporation Limited, NETGEAR, Lenovo, Ubiquiti Inc., Tensorcom, Inc., and Marvell are the top players in the global market.

North America is expected to hold the highest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us