Aquaculture Fertilizer Market Size, Share & Industry Analysis, By Source (Urea, Triple Superphosphate, Di-Ammonium Phosphate, Potassium Chloride, SSP, Specialty Fertilizers, and Others), Application (Seawater Aquaculture and Onshore Aquaculture), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

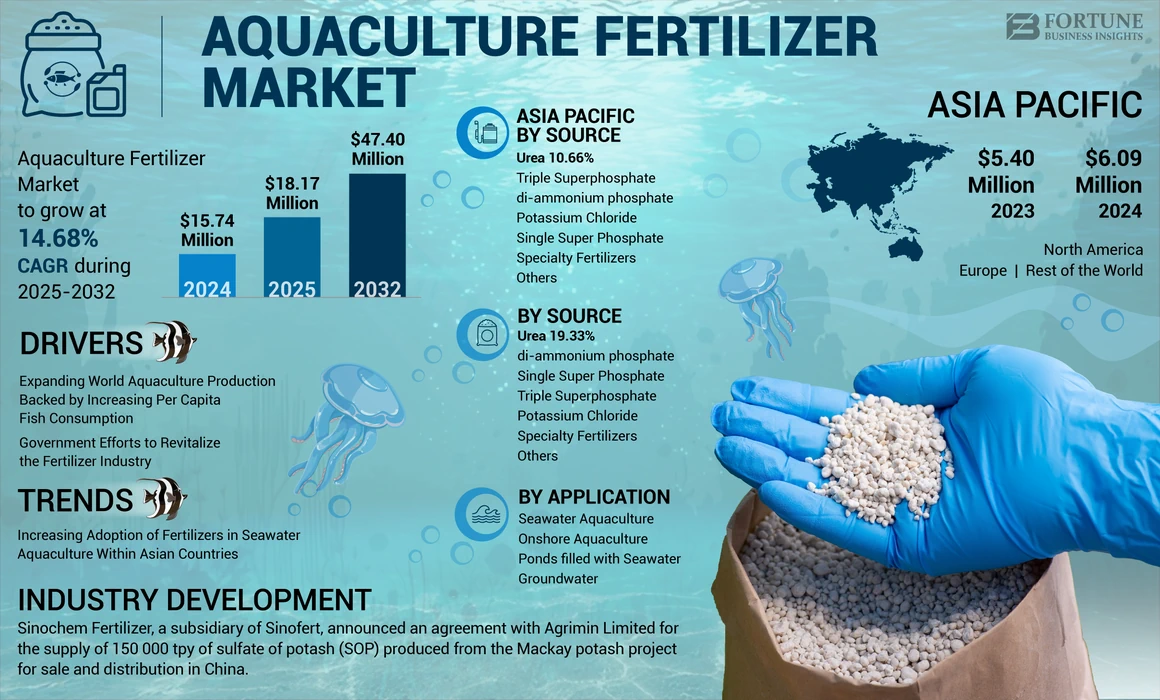

The global aquaculture fertilizer market size was valued at USD 15.74 million in 2024. The market is projected to grow from USD 18.17 million in 2025 to USD 47.40 million by 2032, exhibiting a CAGR of 14.68% during the forecast period. Asia Pacific dominated the aquaculture fertilizer market with a market share of 38.69% in 2024.

The global COVID-19 pandemic has been unprecedented and staggering, with aquaculture fertilizer experiencing lower-than-anticipated demand across all regions compared to pre-pandemic levels. Based on our analysis, the global market had exhibited a decline of 24.27% in 2020 as compared to 2019. The sudden rise in CAGR is attributable to this market’s demand and growth, returning to pre-pandemic levels once the pandemic is over.

Adequate aquaculture fertilization is known to increase fish yields up to five times. Phytoplankton communities are known to exhibit rapid successions of species in fertilized ponds. Pond fertilization increases phytoplankton productivity, acting as the food base for fish and crustaceans. At a macro level, the need for plankton turbidity is driving the demand for fertilizers in aquaculture. Fish in fertilized aquaculture ponds are easier to catch as plankton turbidity hinders their vision, making them less cautious.

Furthermore, plankton blooms also reduce light penetration to aquaculture pond bottoms, checking the growth of various aquatic weeds. Brands are likely to market their products by highlighting the other important benefits of aquaculture fertilization beyond plankton blooms to attract customers. At a macro level, advancements in and the rising availability of aquaculture equipment are favoring market expansion. CPI and Inc, Reef Industries, Pioneer Group, AKVA group, Lifegard Aquatics, Pentair Aquatic Eco-Systems, Inc. (PAES), Aquaculture Equipment Ltd, and FREA Aquaculture Solutions are the major aquaculture equipment suppliers worldwide.

There has been a rapid growth in digitization in the fertilizer industry globally. The rapid technological advancement through the supply chain of fertilizers has assisted in fueling the growth of the global fertilizer industry, including the aquaculture fertilizer industry. Manufacturers invest in high-tech solutions to optimize their manufacturing and transportation systems. The rising adoption of digital and precision farming is further fueling the growth. For instance, as per ABB Ltd., one of the leading automation manufacturers, its centralized digital platform, “ABB AbilityTM,” is said to solve multiple problems in the manufacturing process, connecting multiple stakeholders from various industry segments. Thus, it can further improve flow, quality, and production volume.

Key activities in the aquaculture fertilizer supply chain are fertilizer production, processing, distribution, retail and wholesale marketing. The COVID-19 impact and related measures significantly disrupted each stage of this chain. Households with financial distress slowed down their spending on fish consumption across countries amid the COVID-19 crisis, thereby indirectly affecting the demand for fertilizers in aquaculture.

According to a report published by the FAO in February 2020, the COVID-19 pandemic resulted in low market demand for most aquaculture businesses worldwide, having direct negative implications on quantities sold and reducing revenues. This analysis also indicates the low market penetration of aquaculture fertilizer during the COVID-19 crisis. With most farmers across countries focusing on maintenance rates rather than growth rates to minimize the impact of the COVID-19 pandemic on their businesses, the aquaculture fertilizer market is expected to grow slowly throughout 2021.

Aquaculture Fertilizer Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 15.74 million

- 2025 Market Size: USD 18.17 million

- 2032 Forecast Market Size: USD 47.40 million

- CAGR: 14.68% from 2025–2032

Market Share:

- Asia Pacific dominated the aquaculture fertilizer market with a 38.69% share in 2024, driven by strong aquaculture production in China, India, and Southeast Asia, along with growing use of fertilizers to enhance plankton productivity in fish ponds.

- By source, urea is expected to retain the largest market share in 2025, supported by high availability, rapid effect on plankton blooms, and strong manufacturing presence in Asia and the Middle East.

Key Country Highlights:

- China: World's largest aquaculture producer with widespread use of fertilizers in freshwater carp farming and increasing reservoir-based aquaculture development.

- India: Fastest-growing market due to expansion in freshwater prawn farming, catfish breeding, and brackish water shrimp aquaculture supported by government incentives.

- Indonesia & Vietnam: Emerging hotspots for seawater aquaculture and shrimp farming, creating demand for specialized fertilizers for marine environments.

- United States: Nascent but growing market with increasing use of fertilization in tank and pond-based aquaculture, especially for oysters, mussels, and salmon.

- Brazil & Mexico: Aquaculture expansion in inland regions is creating new opportunities for fertilizer companies targeting freshwater pond management.

- UAE & Saudi Arabia: Strategic seawater cage aquaculture investments along coastlines are encouraging demand for controlled nutrient inputs like aquaculture fertilizers.

Aquaculture Fertilizer Market Trends

Increasing Adoption of Fertilizers in Seawater Aquaculture within Asian Countries

While international companies have limited options to invest in capture fishing businesses in Asian countries owing to various foreign investment restrictions, the region’s significant coastline territory suggests that aquaculture holds a greater potential for foreign companies than capture fishing. Foreign companies are likely to partner with domestic entities in Asian countries to exploit the business opportunities in seawater aquaculture in the near future. Beyond China and India, seawater aquaculture is gaining immense popularity in Southeast Asian countries. Fish products are considered an important part of the average individual’s diet in Southeast Asia.

Download Free sample to learn more about this report.

Aquaculture Fertilizer Market Growth Factors

Expanding World Aquaculture Production Will Trigger the Demand for Aquaculture Fertilizer

The expanding global aquaculture production and per capital fish consumption is expected to encourage the entry of numerous fertilizer manufacturers into the aquaculture sector in the near term. According to an FAO report published in 2020, China emerged as the world’s largest aquaculture producer with 47,559 thousand tonnes of fish production, followed by India (7,066 thousand tonnes) and Indonesia (5,427 thousand tonnes). The robust fish production in these countries highlights the rising need for countries to achieve adequate domestic aquaculture production. From a fertilizer manufacturing standpoint, the rising aquaculture production in these countries clearly indicates potential business opportunities within Asian markets. Market players strategically place their production facilities near major markets. For instance, Tan International, a U.K.-based aquaculture fertilizer manufacturer, serves remote locations in Ireland and the U.K. through local distributors. The company principally focusses on strengthening its presence in the U.K. as it is one of the most prominent aquaculture producers within the European Union (EU).

Government Efforts to Revitalize the Fertilizer Industry is Favoring Regional Market Expansion

Recent years have witnessed various governments across countries, most notably in Asia, stepping up their efforts to boost domestic fertilizer production. While only a meager share of the total fertilizer production is used in aquaculture, major developments in fertilizer influence the aquaculture fertilizer industry. In February 2020, the Chinese government instructed local governments to maintain stable fertilizer prices and ensure a steady supply ahead of the spring season. Furthermore, the Chinese government also directed local road transportation authorities to prioritize agriculture-related industries, including fertilizers to ensure a steady fertilizer supply amid the COVID-19 crisis.

In its annual budget of 2017-18, the Government of India (GoI) allocated INR 70,000 crores (approximately USD 10.5 Billion) as subsidies for the Indian fertilizer industry. In this respect, the GOI assured to pay individuals the difference between production cost that is higher than the Maximum retail price (MRP) or the price at which the product (fertilizer) is sold, in the form of subsidies. Such government initiatives are expected to increase the production of fertilizers in the country while also encouraging new players’ entry into the fertilizers sector.

RESTRAINING FACTORS

Fluctuating Fertilizer Prices Paired with Consumers’ Lack of Knowledge Regarding Aquaculture Fertilization is Impeding Market Growth

Fluctuating fertilizer prices have been challenging manufacturers to fix profit margins. The supply and cost of fertilizers are usually intertwined with numerous variables, including global markets, energy costs, geography, and logistics. As fertilizers are typically heavy, logistics can be a significant expense for manufacturers. Furthermore, the availability of trucks and shipping containers, most notably in emerging economies, also considerably impacts the ability to transport goods in a timely fashion.

Fertilizer prices are likely to rise in the near term, increasing fertilizers consumption in the international market and mounting oil prices. Manufacturers and consumers are likely to switch to lower-cost fertilizers as fertilizer prices rise. However, this trend could result in the production and consumption of poor-quality fertilizers, which, in turn, would offer unpredictable and inconsistent results in aquaculture.

Aquaculture Fertilizer Market Segmentation Analysis

By Source Analysis

Urea to Hold Major Share Backed by Rising Urea Manufacturing Plants Worldwide

Based on source, the market is classified into urea, triple superphosphate (TSP), di-ammonium phosphate (DAP), potassium chloride, single super phosphate (SSP), specialty fertilizers, and others. The urea segment held a dominant aquaculture fertilizer market share in 2020. Urea is the most common fertilizer used for aquaculture purposes. The use of urea for aquaculture is known to increase the growth of aquatic life in a short period. In this respect, more aquatic life could be produced on relatively less land by fewer individuals within a relatively short period, thus supporting the needs of a huge population.

China is the world’s largest urea-consuming country, with a third of global urea production sold in the People’s Republic. China, India, and other countries in Middle East & Africa, such as Iran, Oman, Saudi Arabia, and Qatar are the most prominent urea manufacturers worldwide. Recent years have witnessed various developments in the urea manufacturing space. For instance, in July 2020, the Government of India (GoI) announced its plan to commission four new urea manufacturing plants by 2021 to reduce its dependence on Chinese imports.

TSP production amounts to approximately 5 million tonnes every year, 4 million tonnes traded internationally. TSP is manufactured only in a few countries worldwide. Chinese, Moroccan, Bulgarian, Israeli, Egyptian, and Tunisian companies are the largest manufacturers and exporters of TSP globally. On the other hand, Brazil, Bangladesh, the U.S., Iran, and countries in Northwest Europe are the main consumers of TSP globally. The increasing international prices of DAP are likely to increase TSP manifold consumption in the coming years as it is traditionally viewed as an economical substitute to DAP.

To know how our report can help streamline your business, Speak to Analyst

Based on type, the specialty fertilizers segment is further categorized into potassium sulfate, potassium nitrate, monoammonium phosphate (MAP), and other specialty fertilizers. The potassium nitrate segment led the market in 2024. Potassium nitrate can be used as a soluble fertilizer for aquaculture purposes. This fertilizer is a potassium and nitric nitrogen source potassium and nitric nitrogen source, and is virtually chloride-free. Potassium nitrate is ideal for aquaculture as it is a rich source of K (potassium) and N (Nitrogen).

Fertilizers can be coated for delayed release of nutrients over weeks/months. While slow-release fertilizers were originally sprayed with fertilizer granules (molten S), polymer coatings are currently more commonly employed. Glycerol ester, ethylene vinyl acetate polymer, and dicyclopentadiene are the popular polymer coatings worldwide. Various studies suggest that slow-release aquaculture pond fertilizers are more effective than their fast releasing counterparts. However, these fertilizers are seldom used and are yet to gain widespread attention.

By Application Analysis

Rising Demand for Aquaculture Fertilization within the Onshore Aquaculture Sector will Favor Asian Markets

Based on application, the global market has been categorized into seawater aquaculture and onshore aquaculture. While North American and European countries predominantly rely on seawater aquaculture, Asian countries have traditionally relied heavily on groundwater aquaculture. However, the growing middle-class population in India, China, and other Asian countries, coupled with heightened demand for higher-value western seafood, is likely to contribute significantly to the growth of the seawater aquaculture segment in the foreseeable future.

For instance, the Atlantic salmon, a fish species traditionally farmed in Western countries, is gaining popularity in Asian countries, China imports approximately 70,000 tonnes of salmonids every year, mostly imported from Norway, Denmark, and Chile. Chinese farmers are stepping up their efforts to raise salmon, trout, and other temperate fish to reduce prices and import dependence. Such factors are likely to encourage fertilizer manufacturers to explore and exploit the seawater aquaculture sector in the near future. Cage culture of saltwater fish has been promoted across countries, notably India, in recent years. The increasing availability and access to genomic information of farmed fish paired with technological advancements in aquaculture production systems have been creating heightened interest in seawater aquaculture in the country. Cage culture is also popular in western markets. Aquafarm Equipment AS, a Norway-based company, is one of the world’s leading manufacturers of floating cage systems.

The growth of the global seaweed industry has a direct influence on the seaweed aquaculture fertilizer sector. Contrary to prominent seaweed producing/cultivating Asian countries such as China, Indonesia, South Korea and the Philippines, direct seaweed consumption is yet to emerge as a common practice in Western, most notably European countries. In this respect, European consumers differ from their Asian counterparts when it comes to the socio-cultural importance associated with seaweed.

Onshore Aquaculture Fertilizer by Type Analysis

Rising Demand for a Wide Variety of Freshwater Fish will create a Need for Freshwater Aquaculture

Based on type, the onshore aquaculture segment has been further sub-segmented into ponds filled with seawater and groundwater. Freshwater aquaculture is popular for producing striped catfish and tilapia, produced mainly for domestic and export consumption. The rising consumption of these fish, notably in Asian markets, will boost the demand for fertilizers in freshwater/groundwater ponds in the near future.

REGIONAL INSIGHTS

Asia Pacific Aquaculture Fertilizer Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific stood at USD 6.09 million in 2024. China is the most prominent market within Asia Pacific. China’s fish farming operations are characterized by freshwater aquaculture. The Chinese carps continue to be reared as the principal species in most of the country’s inland water bodies. However, in recent years, the Chinese government has also been focusing on exploiting water storage reservoirs for culture-based aquaculture. China is likely to expand its aquaculture in both coastal/marine and inland waters in the near term.

To know how our report can help streamline your business, Speak to Analyst

India is forecast to emerge as the fastest-growing regional market. This growth is attributable to the increasing popularity of freshwater prawn farming countrywide. Induced breeding of catfishes and carps in the country further contribute to freshwater aquaculture development. India’s brackish water aquaculture continues to be focused around the giant tiger prawn. However, the culture of whiteleg shrimp is encouraging domestic farmers to invest in fertilizing ponds, given their fast growth and low prevalence of native diseases. The Southeast Asian sub-region, including Cambodia, the Philippines, Brunei Darussalam, Thailand, Singapore, and Vietnam, has the sea. Their coastlines are expected to be exploited for seawater aquaculture in the near term. Fertilizer companies are likely to target these countries to achieve regional expansion in the foreseeable future. The rising number of freshwater shrimp hatcheries is boosting shrimp production worldwide. Aquaculture of Texas, Inc., a U.S.-based company, is among the sizable number of shrimp hatcheries worldwide focusing on staying competitive in domestic markets.

As is the scenario across international markets, the North American aquaculture fertilizer market is still in its nascent stage. However, prospective fertilizer companies are likely to target North American markets, most notably the U.S., throughout the forecast period, given the rising need for domestic seafood productions to decrease the country’s dependence on imports. Most seawater aquaculture production in the U.S. consists of oysters, mussels, shrimp, and salmon. Advancements in management techniques and technology contribute to the availability of more fish species to the public, thereby leading to a heightened interest in pond/tank fertilization.

List of Key Companies in Aquaculture Fertilizer Market

Nutrien Limited, Yara International ASA, and Mosaic Company to Acquire Leading Position in the Global Market

Global fertilizer market exhibits a moderately consolidated structure. The three key players in the industry approximately hold the major share in the market backed by their huge clientele base, strong brand loyalty & distribution network. Mergers & acquisitions and partnerships & agreements are two strategies adopted in the global aquaculture fertilizer market for growth and global expansion. The rising concerns related to the environment and carbon emissions have provoked manufacturers to invest in the development of environment-friendly fertilizers, thereby accelerating growth in coming years.

LIST OF KEY COMPANIES PROFILED:

- URALCHEM JSC (Moscow, Russia)

- Sinofert Holdings Limited (Beijing, China)

- Luxi Chemical Group Co. Ltd. (Liaocheng, China)

- Yara International ASA (Oslo, Norway)

- Nutrien Limited (Saskatoon, Canada)

- The Mosaic Company (Florida, U.S.)

- OCP S.A. (Casablanca, Morocco)

- ICL Group Ltd. (Tel Aviv-Yafo, Israel)

- Saudi Basic Industries Corporation (Riyadh, Saudi Arabia)

- Koch Industries, Inc. (Kansas, U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Syngenta Group’s Modern Agriculture Platform (MAP) announced the launch of an enhanced efficiency fertilizer (EEF) product called Endos. The Endos is derived from endophytic microorganisms.

- May 2021: Sinochem Fertilizer, a subsidiary of Sinofert, announced an agreement with Agrimin Limited for the supply of 150 000 tpy of sulfate of potash (SOP) produced from the Mackay potash project for sale and distribution in China.

- January 2020: Sinochem, a subsidiary of Sinofert, announced its merger with ChemChina, a leading chemical manufacturer. This merger is expected to allow the company to form the country’s largest agrochemical company.

- May 2018: URALCHEM JSC partnered with the 22nd St. Petersburg International Economic Forum. The company was able to teach participants and guests about the latest developments and achievements in the production of mineral fertilizers and other products.

REPORT COVERAGE

The market research report includes qualitative and quantitative insights into the industry. It also offers a detailed industry outlook and analysis with market size and growth rate for all possible segments. Various key insights presented in the report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, SWOT analysis, the regulatory scenario in critical countries, and key aquaculture fertilizer industry trends.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 14.68% (2025-2032) |

|

Unit |

Value (USD Million) |

|

Volume (Tons) |

|

|

Segmentation |

By Source

By Application

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 15.74 million in 2024 and is projected to reach USD 47.40 million by 2032.

Registering a CAGR of 14.68%, the market will exhibit promising growth in the forecast period (2025-2032).

Based on source, the urea segment is expected to lead during the forecast period.

The expanding world aquaculture production backed by increasing per capita fish consumption is the key factor driving the market growth.

URALCHEM JSC, Sinofert Holdings Limited, Luxi Chemical Group Co. Ltd., Nutrien Limited, Yara International ASA., and The Mosaic Company are a few of the key players in the market.

Asia Pacific dominated the market in terms of share in 2024.

Based on application, the onshore aquaculture segment holds a major share in the global market.

Increasing adoption of fertilizers in seawater aquaculture within Asian countries is the key market trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us