B2B Payments Market Size, Share & Industry Analysis, By Payment Type (Domestic Payments and Cross Border Payments), By Payment Method (Bank Transfer, Cards, and Online Payments), By Enterprise Type (Small & Medium Enterprises and Large Enterprises), By Industry (Government, Manufacturing, BFSI, Metal & Mining, IT & Telecom, Retail & E-commerce, and Others), and Regional Forecast, 2026-2034

B2B Payments Market Size

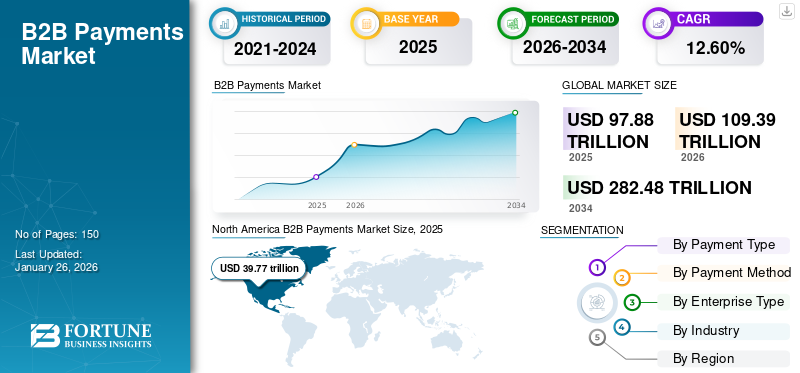

The global B2B payments market size was valued at USD 97.88 trillion in 2025. The market is projected to grow from USD 109.39 trillion in 2026 to USD 282.48 trillion by 2034, exhibiting a CAGR of 12.60% during the forecast period. North America dominated the global market with a share of 40.60% in 2025.

Business-to-Business (B2B) payments are the transfer of goods or services provided for a specific value in currency. The B2B payment process involves transactions between businesses and companies. This type of payments can be one-time transactions or recurring transactions, depending upon the terms agreed between seller and buyer. These payments involve repetitive high-volume and high-value transactions using processes that can be time-consuming compared to B2C transactions.

The rapid digitization and automation of B2B payment solutions have fueled the demand from business owners for B2B payment solutions, which drives the market growth. The growing trend of real-time payment and increasing investments in technology-based payment solutions drive the industry growth.

COVID-19 IMPACT

Increased Usage of B2B Digital Payments Solutions During Pandemic Boosted Market Growth

The COVID-19 pandemic has accelerated the digital transformation of the B2B that boosted customer demand through online and digital channels. The B2B payments have seen a sharp increase in demand, especially due to the increase in e-commerce and accelerated digitization amid the pandemic crisis. Amid the pandemic, according to Mastercard, 67% of small-sized companies upgraded their digital/e-pay solutions, of which 81% concluded that they have improved their customer satisfaction level.

Innovations in electronic invoicing, accounts payable automation, and payment digitization are some of the innovations in the market during the COVID-19 situation. These capabilities have made it easier to conduct cashless B2B transactions from remote locations. Tremendous growth has been observed in ACH (automated clearinghouse) payments during the pandemic situation. The businesses were expected to make payments digitally through apps and mobile platforms, offering convenience and flexibility to the users. This surged the adoption of digital payment solutions by businesses across the world. This factor has enhanced the demand for the market during the pandemic situation.

B2B Payments Market Trends

Integration of Artificial Intelligence for Faster B2B Transactions to Drive Market Growth

The increase in the adoption of AI has optimized the financial workflows to revolutionize the payment processes by bringing digitization and automation in the business-to-business (B2B) sector. Integration with AI-based bots will improve purchasing efficiency, speed up processing efficiency, and reduce the transactional errors of various businesses. The growing penetration of AI technology among different industry verticals provides a wide range of card issuance and fraud prevention solutions across multiple industry sectors. Thus, by using AI-based payment solutions, organizations can reduce fraud. For instance,

- In September 2023, Slope, an American startup specializing in B2B payments, secured USD 30 million in funding led by Union Square Ventures to build AI tools for cash workflow automation and cash management.

Similarly, increasing investments in developing technological infrastructure by integrating artificial intelligence (AI) enhances the traditional banking and money lending process, which leads to boosting the market demand. Hence, the integration of AI with B2B payment solutions is expected to improve the market growth during the forecast period.

Download Free sample to learn more about this report.

B2B Payments Market Growth Factors

Surge in Expansion of Trades in Import and Export Business to Boost Market Growth

Rise in demand for faster payments by bringing automation in transactional processes to ease out the supply chain in the next few years. As various businesses are focusing on deploying integrated technology to maximize the return on their investment, this is expected to boost the adoption of the technology in the industry. For instance,

- In July 2023, Grovara, an exports and imports wholesale marketplace, entered into a partnership with TransferMate to increase the speed of cross-border payments on the first B2B online marketplace to receive frictionless payments from customers.

Furthermore, the integration of B2B payment solutions with enterprise resource planning (ERP), customer relationship management (CRM), and supply chain management systems accelerate the demand for the market during the forecast period.

RESTRAINING FACTORS

Increasing Number of Business Email Compromise (BEC) Frauds Hampers Market Growth

The Business Email Compromise (BEC) is a typical form of B2B fraud in which email systems are compromised by fraudsters, mainly by internal employees. High-amount payments paid with cheques or bank transfers between businesses result in undetected fraudulent activity. As the B2B payment transactions involve high-volume transactions, this leads to large financial losses by companies, which also disturbs the business operations and causes delays in the supply chain.

According to Bottomline 2022, B2B Payments Survey Report, 49% of businesses experienced a serious fraud attempt in 2021, which has a huge impact on the market growth. Furthermore, the increase in the number of cyberattacks is the key factor that restricts the market growth. Thus, an increase in number of business email compromise (BEC) frauds hinders market growth.

B2B Payments Market Segmentation Analysis

By Payment Type Analysis

Rising Need for Seamless Cash Flow across International Businesses to Cross Border Payments

Based on payment type, the market is divided into domestic payments and cross border payments.

Among these, the cross border payments segment is projected to grow with a prominent CAGR along with dominant segmental share 59.62% in 2026. This is due to expanding global trade and increasing cross-border transactions involving multiple buyers, suppliers, wholesalers, retailers, and enterprises, which are the key drivers driving the global market. Thus, the rising penetration of technologies and rise in demand for raw materials from businesses present across the globe boost the demand for cross border transactions during the forecast period. Thus, the demand for the adoption of cross border payments is high due to an increase in international import-export businesses compared to domestic payment solutions during the forecast period.

Whereas domestic payments can be made within countries that charge less transaction fees than the cross border payments, which enhances the local business relationships to improve the customer experience.

By Payment Method Analysis

Businesses Still Using Bank Transfers for Business Workflows to Boost Bank Transfer Segment Growth

Based on payment method, the market is segmented into bank transfer, cards, and online payments. The bank transfer segment leads the market by holding the largest share 49.75% in 2026 of the market. This is due to various businesses still paying with bank transfers for fast-moving modern business workflows, which further involves a transaction fee for both sender and receiver.

Furthermore, many businesses are abandoning traditional paper payment methods, such as cheques and invoices, in favor of electronic payment methods, such as online transfers, mobile payments, and digital wallets. This has driven the adoption of online banking method as a method of managing business finances and making payments for seamless and faster transactions. The online payments allow you to meet your needs from anywhere in the world.

By Enterprise Type Analysis

Increasing Demand for Cost-Effective Payment Solutions by SMEs to Boost Small & Medium Scale Segment Growth

Based on enterprise type, the market is segmented into small & medium enterprises and large enterprises.

The large enterprises segment is projected to dominate the market with a share of 57.88% in 2026. The small & medium enterprises segment is expected to showcase maximum growth rate due to the availability of cost-effective B2B payment solutions designed mainly for SMEs for transparent and seamless payment transactions. It helps to optimize the business's operational performance by using different payment methods along with cross-border payments. For instance,

- In June 2022, Payoneer, a payment technology company, formed a partnership with EC21, a South Korean B2B marketplace, to provide support to the cross-border trade of Korean SMEs for analyzing their revenue.

Furthermore, the large enterprise segment holds the largest b2b payments market share due to increasing spending and adopting new digital technologies to carry out a large amount of transactions between suppliers and buyers.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Need for Procurement Management in Retail & E-commerce to Drive Retail & E-commerce Segment Growth

Based on industry, the market is segmented into government, manufacturing, BFSI, metal & mining, IT & telecom, retail & e-commerce, and others.

The retail & e-commerce segment is expected to lead the market, contributing 21.08% globally in 2026. The retail & e-commerce segment is expected to grow with the highest CAGR during the forecast period. This is due to the rising demand for real-time payment solutions from various businesses to bring transparency in large amounts of transactions by bringing innovations in digital payments globally. For instance,

- According to analysts, 89% of retailers say that real-time B2B payments can be strengthened by forming business partnerships to build strong buyer-supplier relationships among different industrial sectors.

The increasing usage of smartphones and the integration of cloud technologies to improve the procurement functions of the retail & e-commerce sector boost the demand for the market.

BFSI is the second leading segment of the market as the usage of B2B type of payments solutions reduces the need of mid- and back-office operations and improve the productivity of the BFSI operations.

REGIONAL INSIGHTS

The global market scope is classified across regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America B2B Payments Market Size, 2025 (USD trillion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 39.77 trillion in 2025 and USD 44.36 trillion in 2026. North America is estimated to hold the largest market share due to the presence of a large number of B2B payments companies across the region. Increasing investments in the development of reliable and efficient payment solutions to manage the cash flow and maintain relationships with the material suppliers present across the U.S. and Canada boost the market development. The presence of large-sized B2B type of payment solution providers in countries, such as the U.S. and Canada drive the demand in the market during the forecast period. The U.S. market is expected to reach USD 28.15 trillion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to grow with the highest CAGR due to the rising adoption of virtual debit and credit cards across different businesses in developing countries, such as India and China. This factor helps to drive market growth during the forecast period. Furthermore, there is a rise in the investments in small and medium-sized companies of various industries to enhance cross border payment transactions. Thus, these factors are responsible for the increase in the adoption of B2B type of payment solutions in Asia Pacific. The Japan market is expected to reach USD 3.23 trillion by 2026, the China market is expected to reach USD 8.70 trillion by 2026, and the India market is expected to reach USD 5.60 trillion by 2026.

- According to the State Council of the People's Bank of China 2022 report, the business volume of RMBs cross border payments in China has increased rapidly in 2021 as compared to the previous year. The value of 3.34 million transactions handled by China's RMB cross-border payment system stood at 79.60 trillion yuan (USD 12.53 Trillion) and grew by 75.83% in the next year.

Europe

Europe is projected to hold a significant CAGR during the forecast period due to the increasing adoption of SCA solutions to enhance the visibility of supply chain operations of different industry verticals. The U.K. market is expected to reach USD 5.21 trillion by 2026, while the Germany market is expected to reach USD 2.64 trillion by 2026. For instance,

- According to analyst research, U.K. SMEs spend 25 billion Euro annually on cross-border payments, which brings large innovations in SMEs’ payment businesses. Thus, there is high growth of these payments in various industries across Europe region during the forecast period.

The market in the Middle East & Africa and South America is in a growing phase due to the increasing adoption of smartphones and awareness of B2B digital payments in countries, such as Brazil, Turkey, and various African countries. The rising adoption of automation and advanced digital technologies by B2B payment solution providers boosts the demand for B2B payment solutions across both regions. For instance,

- In June 2023, PayMate India Limited, a B2B fintech startup, expanded its business in the Middle East & Africa (CEMEA), Central Europe, and the Asia Pacific (APAC) to deliver B2B payment automation solutions to small and medium-sized (SMBs) as well as large corporate customers.

Key Industry Players

Key Players Investing in Partnership Propel Market Growth

The key market players are forming partnerships to bring innovation in B2B type of payments solutions in order to enhance the company’s B2B payments capabilities. Advancements to the product portfolio are helping major players to maintain their competitive edge. These companies are also engaging in strategic partnerships, acquisitions, product launches, and collaborations to expand their business and distribution network to maintain their market growth. Mastercard Inc., FIS, Stripe, Paystand, Inc., Flywire, Squareup Pte. Ltd. and American Express are the key players of the market.

- September 2023 – Mastercard Inc. entered into partnership with Oracle Corporation to simplify end-to-end financial transactions and to automate B2B payments for enterprise customers. This collaboration integrates the Oracle Fusion Cloud Enterprise Resource Planning (ERP) into Mastercard’s virtual card platform for automating the b2b payment processes.

List of Top B2B Payments Companies:

- Mastercard Inc. (Spain)

- FIS (U.S.)

- Stripe, Inc. (U.S.)

- Paystand, Inc. (U.S.)

- Flywire (Netherlands)

- Squareup Pte. Ltd. (U.S.)

- Edenred Payment Solutions (Ireland)

- Payoneer Inc. (U.S.)

- American Express (U.S.)

- Visa Inc. (U.S.)

- JPMorgan & Chase (U.S.)

KEY INDUSRTY DEVELOPMENTS

- October 2023 – Visa Inc. entered into a partnership with Swift to facilitate international business-to-business (B2B) payments and help to improve communication across the vast networks of international businesses.

- September 2023 – Sprinque, a Netherlands-based payment service provider company, has expanded its geographical presence in Germany and Spain to conquer the European market by expanding the cross border B2B payments platform portfolio.

- July 2023 – ConnexPay, a payment technology company that helps to accept and make payments, developed revolutionary real-time B2B payment solutions in Europe in British Pounds (GBP) and Euros (EUR) currencies.

- June 2023 – Aria, a French FinTech Company, has opened its new office to expand the B2B Deferred Payment Infrastructure in the U.K. This expansion boosts online B2B commerce, brings connectivity to marketplaces, and enhances the trading SaaS platforms along with ERP systems.

- October 2021 – Kyodai Remittance, a Japan-based fund transfer business operator, collaborated with Western Union to launch cross-border B2B payment transfer solutions for corporate customers in Japan.

REPORT COVERAGE

The global B2B payment industry report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the advanced market over the recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.60% from 2026 to 2034 |

|

Unit |

Value (USD Trillion) |

|

Segmentation |

By Payment Type

By Payment Method

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 282.48 trillion by 2034.

In 2025, the market size stood at USD 97.88 trillion.

The market is projected to grow at a CAGR of 12.60%.

The retail & e-commerce Industry is expected to grow with highest CAGR over the forecast period.

The surge in expansion of trades of import and export business boosts market growth.

Mastercard Inc., FIS, Stripe, Paystand, Inc., Flywire, Squareup Pte. Ltd., Edenred Payment Solutions (Ireland), Payoneer Inc., American Express, and others are the top players in the market.

North America is expected to hold the highest market share.

Asia Pacific is expected to grow with the highest CAGR over the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us