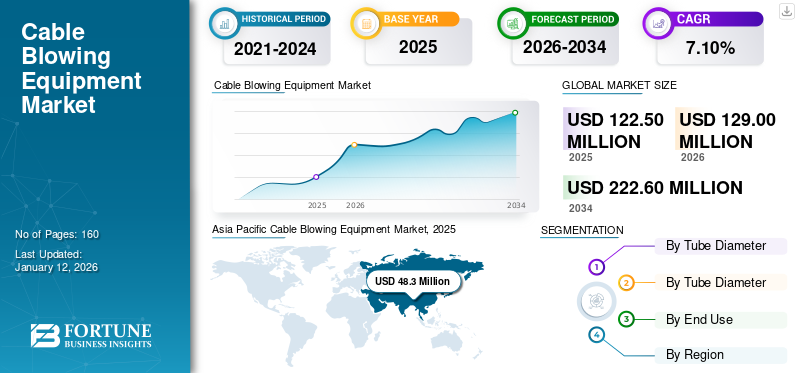

Cable Blowing Equipment Market Size, Share & Industry Analysis, By Tube Diameter (3 - 16 mm, 7 - 12 mm, and 12 - 63 mm), By Motor Type (Electric Motor, Pneumatic Motor, and Others (Hydraulic)), By End Use (Commercial, Telecommunication, Industrial, Defense, and Others (Microfiber)), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global market is set to grow with a steady progress, owing to the growing investment across telecommunication infrastructure. Additionally, supportive government policies for the Public Private Partnership (PPP) model have provided opportunities for established private and new telecom network companies. These initiatives significantly supported the demand for modern cable installation devices in the telecom industry, which has bolstered market growth in the long term.

Global Cable Blowing Equipment Market Overview

Market Size:

- 2025 Value: USD 122.5 million

- 2026 Value: USD 129 million

- 2034 Forecast Value: USD 222.6 million, with a CAGR of 7.10% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific held a 48.3% market share in 2025, led by strong telecom and commercial cable installation, 5G adoption, and a large consumer base in countries such as China, Japan, and India.

- End-User Leader: The telecommunication segment led the market in 2025, driven by fiber optic network expansion and 5G demand.

- Segment Leader: 12–63 mm tube diameter is the dominant segment, widely used in telecom and broadband; 7–12 mm segment is growing fastest due to technological upgrades in optical fiber.

Industry Trends:

- 5G Technology: Accelerates demand for fast, efficient fiber optic cable installation; cable blowing equipment enables rapid, flexible deployment.

- Automation & Portability: Industry focus on easy-to-operate, automated, and portable machines for complex installations.

- Optical Fiber Dominance: Optical fiber installation is the backbone of the market, enabling high-speed, low-latency connectivity.

- Post-Pandemic Recovery: Increased 5G and data demand have boosted long-term market growth after COVID-19 disruptions.

Driving Factors:

- Telecom Infrastructure Investment: Growing investments and supportive government PPP policies drive demand for modern cable installation devices.

- Dominant Optical Fiber Installation: Enables longer, faster, and more flexible cable deployment, especially in telecom and broadband.

- Technological Advancements: New products with smart interfaces and reduced cable damage are expanding market potential.

- Regional Expansion: Exponential investments in Asia Pacific, especially in China and India, are strengthening market growth.

- Commercial and Industrial Demand: Growing use in commercial, industrial, and defense sectors for specialized cable installations.

Cable blowing equipment are the industrial cable equipment used across industries for moving the cable from source by exerting focus from the initial point. The machines are usually offered with three main motor types, to blow the cable from the source by hydraulic motor, pneumatic force, and electric motor. The majority of cable diameter sizes range from 3 mm to 63 mm. The machines are primarily adopted across telecommunication, commercial cable, industrial, defense, and other microfiber installation businesses.

The COVID-19 pandemic caused a decline in the cable blowing market as strict restrictions on telecom equipment and more emphasis on new technology restrained the market’s growth. However, post-pandemic, 5G technology and data demand provided an extended benefit for the telecom network and broadband operators, which bolstered the demand for cable blowing equipment in the long term.

Cable Blowing Equipment Market Trends

5G Technology Trend and Growing Telecommunication Investment to Bolster Market Growth

5G technology has a significant impact on the telecom industry, which is expected to upsurge the capacity and network efficiency that enables massive data streaming and AI usage. However, the modern 5G technology requires high-cost infrastructure, technical expertise, and high security risks. Cable blowing machines are an important asset to the telecom sector. They offer cost-effectiveness and have extended the potential of 5G technology by laying underground optical cable. These machines enable faster installation of fiber optic cables by navigating through complex pathways. They can be routed through conduits, even if they have bends, obstacles, and multiple branches. Hence, post-pandemic, 5G technological trend and investment across telecommunication businesses for faster installation of optical cable and low network latency have expanded cable blowing equipment market size progressively.

- For instance, in September 2022, Mr. Ashwini Vaishnaw, telecom minister of India, announced USD 30 billion for the last mile connectivity of 4G and 5G connectivity in rural areas. The government had tested this model and approximately 80,000 connections were facilitated every month.

Download Free sample to learn more about this report.

Cable Blowing Equipment Market Growth Factors

Dominant Optical Fiber Installation for Better Connectivity to Drive Market Growth

Optical fiber installation is the backbone of cable blowing business as the majority of new projects and installation of telecom networks for better connectivity are dominating cable blowing equipment industry. Optical fiber has dominated the global telecommunication and networking market due to its faster data streaming and low latency. Cable blowing equipment in the telecom industry enables optical fiber installation for a longer distance in a single go and in a more faster way. It enables working with cables in a more flexible way and navigate cables to tighter bends and can accommodate more dense fiber cables in smaller conduits. Thus, dominant fiber installation in the communication industry for better conductivity is expected to drive cable blowing equipment market growth in the long term.

- For instance, in February 2024, Nexfibre, a joint venture of (Liberty Global, Infravia, and Telefónica), a prominent Fibre to the Home (FTTH) access provider, announced an investment of USD 1.26 billion to expand the network access to 23 lakh homes internet access by 2026.

RESTRAINING FACTORS

Limitations in Compatibility and Adaptability of Cable Blowing to Restraint Market Growth

Cable blowing is highly dependent on the optical fiber installation business as it minimizes installation time and has significant advantages over traditional installation. However, cable jetting or blowing has limitations, based on many criteria, such as the type of cables, conduit materials, and the place of installation. Companies operating in the segment have to assess the feasibility of cable jetting for a specific project and installation. This limits the application of cable blowing across the industry.

Cable Blowing Equipment Market Segmentation Analysis

By Tube Diameter Analysis

Increasing Rate of Cable Blow Adoption to Drive the Dominance of Large 12-63 mm Tube

Based on tube diameter, the cable blowing market is studied for three major tube diameters that include 3 - 16 mm, 7 - 12 mm, and 12 - 63 mm.

Large size tube 12-63 mm in diameter is the dominant with a share of 42.40% in 2026 cable tube deployed by blowing, owing to their heavy usage in telecommunication and broadband line service providers. Large size cable tubes are a prime choice for the service operators, as they offer more flexibility for the telecommunication operators to easily upgrade from the existing bandwidth and old optical fibers. Also, frequent changing of the wire and required underground internet to protect from weather and harsh conditions are expected to expand cable jetting potential in long term.

Additionally, tubes with diameter 7-12 are growing with the highest CAGR, owing to technological upgradation of the optical fiber and getting more thinner over time. These thin glass fibers are developed to provide high internet speed and low latency to the network service providers and commercial network handlers.

Furthermore, stable demand for thin cable wires of tube diameter 3-12 mm in the electrical industry and other commercial zones is expected to expand cable blowing market share in the long term.

By Motor Type Analysis

Rise in the Demand for Pneumatic Motor Blowing Owing to Easy Installation to Bolster Its Segment Growth

Based on motor type, the market is studied for following categories, such as pneumatic motor, electric motor, and other motor (hydraulic motors, etc.).

Pneumatic motor type cable blowing is expected to dominate the share 41.40% in 2026 of the global cable blowing equipment market size, owing to its easy and safe operation. The pneumatic motor cable blowers use an aero piston, which is attached to the cable and ensures safety while moving in the forward direction. This makes the cable pass through the conduit and bend easily and in a faster way. Also, the pneumatic system allows minimal usage of electricity and a lesser chance of leakage compared to hydraulic motors.

Additionally, electric motor cable blowing is expected to grow at a progressive pace due to its easy portability and better fit for the conduits, such as ducts and small areas.

Followed by them, hydraulic motor cable blowing is set to lose its hold on the market due to competitive advantages of other blowing machines, such as portability, faster installation, and safety.

To know how our report can help streamline your business, Speak to Analyst

By End Use Analysis

Broadened Telecommunication End Use Due to 5G is Flourishing Cable Blowing Demand

Based on end use, the segment is categorized as commercial, telecommunication, industrial, defense, others (microfiber, etc.).

The telecommunication segment is set to dominate 31.40% in 2026 the end use, owing to the broadened expansion of fiber optic networks and demand for 5G. Additionally, major capital expenditure in developing nations to extend the spectrum range to ensure smooth last-mile connectivity in rural and untouched areas. This factor has flourished the demand for cable blowing equipment.

Additionally, the growing use of cable blowing in commercial spaces for easy installation of electrical and connectivity cable in small bends and conduits is expected to grow business in the long term.

Furthermore, there is a steady demand for blowing in industrial wiring, other microfiber installations, and defense conduits to extend the potential demand for cable blowing in the long term.

REGIONAL INSIGHTS

Global market is studied for the following region such as North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Asia Pacific Cable Blowing Equipment Market, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific cable blowing equipment market size is projected to dominated the market with a valuation of USD 48.3 billion in 2025 and USD 51.6 billion in 2026. the global market landscape, owing to its progressive development in cable installation in the telecom and commercial industry. Furthermore, exponential investments by public and private telecom companies to extend their network potential and cater to the large consumer base post-5G revolution. These potential drivers have provided strength to the cable blowing in developed countries, such as China and Japan, followed by developing nations, such as India, Singapore, and ASEAN countries.The Japan market is projected to reach USD 6.7 billion by 2026, the China market is projected to reach USD 31.5 billion by 2026, and the India market is projected to reach USD 5.5 billion by 2026.

China market size is dominating Asia Pacific due to the strong presence of cable blowing manufacturers, high domestic and export demand, and competitive prices, which provide an upper edge for the Chinese companies. Additionally, India has extended potential for cable blowing because of the growing 5G adoption and lower data rates, which have expanded the cable bowing machine market size progressively.

North America is forecasted to grow at a steady pace due to the presence of prominent cable blowing equipment manufacturers and strong demand for cable installation across data centers, telecom operators, and other commercial cable installation businesses. These machines provide an added advantage for telecom operators for quicker installation and growing demand in countries such as the U.S. and Canada.The U.S. market is projected to reach USD 24 billion by 2026.

Europe region is growing at a stagnant pace owing to the region’s prominent demand for Fiber to the Home (FTTH) internet access and lower consumer base. U.K., Germany, and Italy are the prominent countries demanding cable blowing in the installation of cables and fibers in small conduits in ducts and small bends in the production of equipment.The UK market is projected to reach USD 7.5 billion by 2026, while the Germany market is projected to reach USD 8.3 billion by 2026.

Middle East & Africa is growing at a substantial pace. Heavy investment in telecom and network infrastructure in the urban landscapes has extended the potential for cable blowing across countries such as South Africa and GCC countries.

Latin America region cable blowing is set to grow at a subtle growth owing to progressive improvement in telecommunication policies and investments in establishing network infrastructure, and cables in small conduits and complex areas.

KEY INDUSTRY PLAYERS

Emphasis on Portability and Automation in Cable Blowing to Extend Market Potential

Companies across the industry are focusing on developing on products that are easy to operate and can automatically be controlled by a system. Also, developments across the industry to support the complex business operations have maintained the collective demand for portable cable blowing machines for the installation of microfiber and optical fiber. These technological advancements and innovations will drive cable blowing equipment market share in long term.

- For instance, in September 2022, a prominent cable blowing equipment manufacturer launched an advanced automatic fiber blowing machine that can easily be controlled by Easy Flow SMART interface, which eliminates cable damage by 5-10% through automatic modes.

List of Top Cable Blowing Equipment Companies:

- Fremco (Storskogen Group) (Sweden)

- Plumettaz S.A. (Switzerland)

- Condux International, Inc. (U.S.)

- CBS Products (KT), Ltd. (U.K.)

- LANCIER CABLE GmbH (Germany)

- SKYFIBERTECH (Turkey)

- Fibernet (Italy)

- NINGBO MARSHINE POWER TECHNOLOGY CO., LTD. (China)

- Jetting AB (Sweden)

- Katimex (Germany)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: Fibernet, a prominent fiber installation machine manufacturer, introduced an advanced fibernet product, the Lady Cable Jetting Machine. The machine is a suitable option for the faster installation of cabling for FTTH optical networks.

- June 2023: Jetting AB, a prominent Swedish manufacturer, entered into a partnership with Networks Centre Ltd. The partnership will extend the supply of its prestige range of fibre blowing machines and ancillary products to the UK FTTx and Datacom Markets.

- December 2022: Fremco, a prominent fiber installation solution provider, launched an update for the microflow log. The latest functionality has improved stability by the micoflow log app upgrading firmware on the log controller.

- November 2022: Plummettaz group, a prominent fiber installation machine manufacturer announced the acquisition of Jakob Thaler GmBH. The acquisition of the brand is will establish Plummetz as a establish global solution supplier for the telecom and energy market by integrating complementary product lines.

- June 2022: Jetting AB, a prominent cable blowing equipment manufacturer announced the launch of an effective FTTH fiber blowing machine. This machine is an advance compressed blowing machine that uses an electric motor to push fiber with optional compressed air to reduce friction.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed research methodology and analysis of the market and focuses on key aspects such as leading companies, cable types, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.10% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Tube Diameter, Motor Type, End Use, and Region |

|

Segmentation |

By Tube Diameter

By Motor Type

By End Use

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to record a valuation of USD 222.6 million by 2034.

In 2025, the market was valued at USD 122.5 million.

The market is projected to record a CAGR of 7.10% during the forecast period.

The pneumatic motor is the leading motor type segment in terms of market share.

Dominant optical fiber installation for better connectivity is expected to drive market growth.

Fremco (Storskogen Group), Plumettaz S.A., Condux International, Inc., CBS Products (KT), Ltd., LANCIER CABLE GmbH, SKYFIBERTECH, Fibernet, NINGBO MARSHINE POWER TECHNOLOGY CO., LTD., Jetting AB, and Katimex are the top players in the market.

Asia Pacific to generate the maximum revenue in 2025.

The telecommunication end use segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us