Cardiovascular Health Supplements Market Size, Share & Industry Analysis, By Type (Natural Supplements and Synthetic Supplements), By Ingredients (Vitamins & Minerals, Herbal Extracts, and Others), By Dosage Form (Tablets, Capsules, and Others), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, Online Pharmacies, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

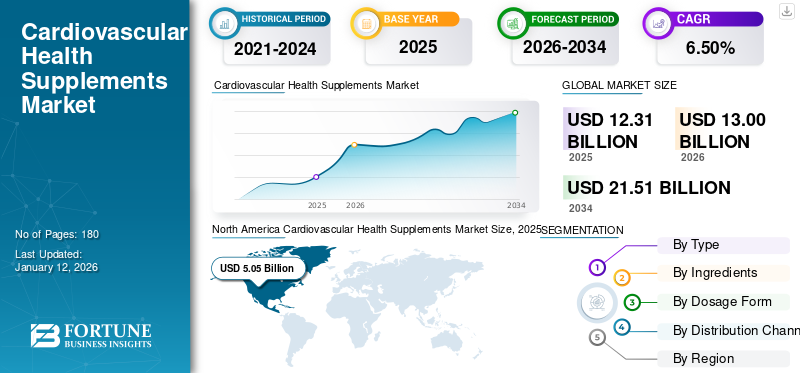

The global cardiovascular health supplements market size was valued at USD 12.31 billion in 2025. The market is projected to grow from USD 13 billion in 2026 to USD 21.51 billion by 2034, exhibiting a CAGR of 6.50% during the forecast period. North america dominated the cardiovascular health supplements market with a market share of 40.98% in 2025.

Cardiovascular health supplements aid in the maintenance of an individual’s heart health by lowering cholesterol and improving blood pressure, which if not addressed can cause the risk of heart disease. These supplements include dietary supplements containing essential nutrients, such as fish oil, omega-3 fatty acids, red yeast rice, and others for a heart-healthy lifestyle. It also consists of natural herbal ingredients, such as fiber, sterols, coenzyme Q10 (CoQ10), and flaxseed oil. The rising prevalence of heart-related disorders due to unhealthy lifestyles is majorly contributing to the cardiovascular health supplements market growth. In addition, the increasing focus of the aging population on adopting high-quality conventional supplements for improving their heart health and preventing further complications related to heart diseases is also augmenting the market growth.

- For instance, according to a press release by AstraZeneca in February 2023, cardiovascular diseases affect nearly 50% of the adult population in the U.S.

- Also, according to an article published by the American Academy of Family Physicians in September 2022, every year, 605,000 Americans have the first heart attack and around 610,000 experience a stroke for the first time.

Furthermore, an increasing number of market players, with a strong focus on the introduction of new products to meet the growing demand, are further accelerating the growth of the heart health supplements market.

The impact of the COVID-19 pandemic was positive on the market owing to the assistance provided by cardiovascular health supplements in the maintenance of an individual’s cardiovascular health. The major players operating in the market witnessed growth in their revenues due to the increased adoption of their products. For instance, according to an article published by Nutraceuticals World in October 2020, the sales of heart health supplements, such as magnesium and vitamin B/B complex increased by 16% and 19%, respectively. Post-pandemic, the sales of cardiovascular health supplements witnessed a steady growth owing to the increased awareness of the benefits offered by these supplements. Moreover, ad campaigns launched by the supplement manufacturers to promote their products is further augmenting the market growth.

Cardiovascular Health Supplements Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 12.31 billion

- 2026 Market Size: USD 13 billion

- 2034 Forecast Market Size: USD 21.51 billion

- CAGR: 6.50% from 2026–2034

Market Share:

- North America dominated the cardiovascular health supplements market with a 40.98% share in 2025, driven by rising awareness about cardiovascular diseases, high adoption of preventive supplements among the aging population, and increasing partnerships between supplement and botanical ingredient manufacturers.

- By type, natural supplements are expected to retain the largest market share in 2025 due to growing consumer preference for clean-label, plant-based ingredients that are perceived as safer and more effective for long-term heart health.

Key Country Highlights:

- Japan: Demand is fueled by a high incidence of ischemic heart diseases and the country’s strong adherence to preventive healthcare, including dietary supplementation through traditional and modern practices. Supplements with CoQ10, omega-3, and herbal extracts are gaining popularity.

- United States: The market benefits from the increasing prevalence of heart disease, high health awareness, and widespread use of cardiovascular supplements, particularly among the elderly. Legislation such as the Dietary Supplement Health and Education Act (DSHEA) continues to support market growth, while innovative product launches like Goli’s Beets Cardio Gummies attract younger demographics.

- China: Cardiovascular diseases affect over 330 million people, driving the adoption of heart health supplements. The region is witnessing rapid growth in nutraceutical consumption due to urbanization, poor dietary habits, and government initiatives to support preventive healthcare. Traditional Chinese Medicine (TCM)-inspired formulations also support product expansion.

- Europe: Growth is propelled by the rising burden of chronic illnesses like heart disease and diabetes, coupled with strong consumer demand for plant-based and vegan-friendly supplements. The increasing trend toward natural heart health products is reinforced by strategic collaborations like Evonik and Safic-Alcan’s partnership to expand nutraceutical distribution in Europe.

Cardiovascular Health Supplements Market Trends

Increasing Shift Toward Products Containing Natural Ingredients

Consumption of dietary supplements has become a lifestyle choice among youngsters as they are essential, in smaller amounts, for the proper functioning of an individual’s body. Easy availability of synthetic vitamins at a cost effective rate has majorly contributed to its increased adoption among young individuals and the elder population. Although synthetic ingredients are easily available and cost effective, over-consumption of synthetic nutrients can cause harmful side effects, such as allergic and skin reactions. For instance, according to an article published by HEALTHLINE MEDIA in December 2022, consumption of synthetic beta-carotene supplements is linked to an increased risk of cardiovascular diseases and mortality among individuals.

The benefits offered by natural cardiovascular health supplements, such as high energy, vitality, and increasing blood circulation toward the heart have contributed to their growing adoption. Moreover, the market trends of increasing preference of customers for health supplements that are free of artificial ingredients is further boosting the use of natural ingredients in dietary supplements.

- For instance, according to an article published by Elsevier B.V., in February 2022, lycopene supplements are beneficial for a person’s heart health due to their antihypertensive actions. These antihypertensive actions are attributed to their antioxidant and anti-inflammatory properties.

- Furthermore, an article published by the Life Extension Magazine also stated that the inclusion of lycopene in diet aids in reducing the risk factors associated with cardiovascular diseases.

In addition, the growing focus of manufacturers on launching new and innovative products to meet the growing demand for natural supplements in the market is further fueling the market growth.

Download Free sample to learn more about this report.

Cardiovascular Health Supplements Market Growth Factors

Rising Prevalence of Heart Diseases to Propel Growth of Market

The rising prevalence of cardiovascular health conditions, such as arrhythmia, angina, valve diseases, and coronary heart diseases among the general population is contributing to the growth of the market. The rising incidence of cardiovascular diseases is due to the sedentary lifestyle followed by people. For instance, according to a press release by Johnson & Johnson Services, Inc., in September 2023, more than 37.5 million globally are affected by atrial fibrillation, a type of heart arrhythmia. This figure is projected to increase by 60% by 2050.

Moreover, the prevalence of cardiovascular diseases is also rising among young individuals in developing countries, contributing to the growing number of consultations for the ailment.

- For instance, according to an article published by the National Library of Medicine in January 2020, the burden of hypertension in India is expected to rise to 213.5 million by 2025.

To mitigate the risk of cardiovascular diseases, many individuals are consuming heart health supplements that aid in the reduction of incidences of major cardiovascular events. For instance, according to an article published by the National Library of Medicine in August 2021, nearly 50% of the U.S. adult population consumes dietary supplements as a preventive measure against cardiovascular disease.

These factors, coupled with the measures taken by the general population for the prevention of heart diseases and rising awareness of heart-related conditions among the elderly population, will contribute to the cardiovascular health supplements market growth.

Increased Launches of Cardiovascular Health Supplements to Propel Market Growth

Dietary supplements play an essential role in the maintenance of an individual's overall health by meeting the regular need for essential nutrients. These supplements assist the body in supporting the structural and functional vitals of the heart by ensuring a regular supply of nutrients to the body. This support extended by the dietary supplements for the essential organs has contributed to their growing adoption among young individuals and the elderly population.

- For instance, according to an article published by WebMD, LLC., in December 2023, at least half of the adults in the U.S. consume dietary supplements.

This growing consumption of dietary supplements has brought opportunities for many of the industry players to manufacture nutraceutical products designed for the well-being of the heart, eyes, and other vital organs of the body. This increasing competition has also encouraged the existing players to focus on the launch of innovative products in the market.

- For instance, according to an article published by Cision U.S. Inc., Healthycell launched Heart and Vascular Health, a new ultra-absorbable gel supplement in the market. The new product is a blend of plant-based ingredients and designed to decrease cholesterol, triglyceride, and blood pressure levels.

Thus, the growing awareness of cardiovascular diseases and their severity will contribute to the adoption of cardiovascular health supplements. In addition, the increasing introduction of new products will further augment the market growth.

RESTRAINING FACTORS

Increasing Availability of Counterfeit Products to Limit Adoption of Cardiovascular Health Supplements

The increasing launch of new cardiovascular health supplements assuring that they aid in the prevention of heart diseases, along with the growing number of commercial ads promising more energy and improved heart health, is tempting consumers to think their consumption may improve their health. For instance, according to an article published by the National Library of Medicine in June 2023, an increase in the consumption of supplements, including heart health, has been observed in recent years due to rising promotion of these supplements by unauthorized figures on social media.

This factor has created opportunities for many market players by encouraging them to introduce new products to the market. Entry of new manufacturers into the market has also contributed to an increase in the number of companies introducing counterfeit products that do not have any scientific evidence of their benefits to the target population. For instance, according to an article published by Nutritional Outlook in November 2022, around seven dietary supplement companies selling heart health products in the U.S. received warning letters from the Food & Drug Administration (FDA). The agency said that the companies were selling misbranded drugs instead of legal dietary supplements.

Thus, the lack of an individual’s ability to differentiate between the legally branded heart health supplements and counterfeit products is hindering their adoption.

Cardiovascular Health Supplements Market Segmentation Analysis

By Type Analysis

Natural Supplements Takes Center Stage as Individuals Embrace Healthy Lifestyle

On the basis of type, the market is segmented into natural supplements and synthetic supplements.

The natural supplements, a dominant segment with a share of 60.63% in 2026, is also expected to record a significant CAGR. The growing number of consumers seeking natural ways to meet their healthy lifestyle goals will contribute to the growth of the segment. In addition, customers are realizing that the consumption of natural ingredients is healthier as compared to synthetic ones. This factor is also contributing to the shift of consumers toward natural supplements. For instance, according to an article published by the National Library of Medicine in October 2022, the majority of the consumers consuming dietary supplements believe that supplements with natural ingredients are safe.

The synthetic supplements segment held the significant cardiovascular health supplements market share in 2024 owing to their increased adoption due to their lucrative benefits. In addition, the increasing number of clinical trials and on-going research on supplements for maintaining heart health are further propelling the segment’s growth. For instance, according to an article published by QIMR Berghofer Medical Research Institute in June 2023, a clinical trial conducted by the institute found that the consumption of vitamin D supplements can reduce the risk of cardiovascular diseases, such as heart attack in people aged over 60.

Therefore, the increasing number of consumers preferring the inclusion of natural ingredients in their dietary supplements with the belief that these supplements can aid them in preventing cardiovascular diseases will contribute to the growth of the market in the future.

To know how our report can help streamline your business, Speak to Analyst

By Ingredients Analysis

Vitamins & Minerals Segment Dominates Owing to Their Benefits in Maintaining Heart Health

On the basis of ingredients, the market is segmented into vitamins & minerals, herbal extracts, and others.

The vitamins & minerals segment dominated the segment accounting for 42.23% market share in 2026. The increased adoption of vitamins and minerals in appropriate doses due to their benefits and assistance in lowering the risk of heart disease will contribute to the segment’s growth. Moreover, the other benefits offered by them in the maintenance of the overall body is also augmenting the segment’s growth in the market. For instance, according to a journal published by Health in November 2023, the consumption of vitamin D supports heart health by regulating blood pressure, reducing inflammation, and improving the functions of blood vessels by promoting better blood flow.

The herbal extracts segment is expected to record an optimum growth rate owing to the increasing shift of consumers toward dietary supplements, which include herbal ingredients. The promising potential demonstrated by supplements made from herbal ingredients in the prevention of cardiovascular diseases is majorly contributing to its growing adoption in the market. In addition, the increased focus of market players on launching new and innovative products in different dosage forms is further propelling the growth of the segment.

- For instance, in September 2023, HPCi Media Limited launched Cardiosmile, a natural plant sterol supplement, in the U.S. market. The product is available in a liquid sachet and can be used effectively in the management of cholesterol.

The others segment is projected to record a considerable growth rate during the forecast period. The increasing use of omega-3 fatty acids and Coenzyme Q10 in the manufacturing of cardiovascular health supplements owing to their ability to improve energy production in cells and prevent blood clot formation in the heart will contribute to the segment’s growth.

By Dosage Form Analysis

Availability of Capsules in Different Dosage Forms Contributed to its Dominance in Market

On the basis of dosage form, the market is segmented into tablets, capsules, and others.

Capsules dominated the segment accounting for 51.90% market share in 2026. The availability of capsules in different sizes and doses has contributed to its increased adoption. Moreover, the ability of capsules to encapsulate ingredients in various dosage forms has helped manufacturers promote their products with a clean label status. In addition, other attributes, such as its easy use and quick absorption in the body make it one of the preferred dosage forms among consumers, thereby propelling the segment’s growth. For instance, according to a study published by the National Library of Medicine in October 2022, 61.6% of the female participants preferred consuming capsules due to their ease of swallowing and high perception of therapeutic benefit.

The tablets segment is projected to register a considerable growth rate. The advantages associated with tablets, such as their easy & cost-effective handling, ease of identification, and availability in various shapes are increasing their usage among consumers and manufacturers. For instance, according to an article published by IntechOpen in December 2021, tablets are a unit dosage form that are available to consumers in accurate dosage at an affordable price.

The others segment is projected to record a significant growth rate. The increasing focus of manufacturers on introducing supplements in new dosages with an aim to embrace innovation and attract a new customer base for their products is anticipated to boost the growth of the segment. For instance, in June 2023, Goli Nutrition Inc. launched new Beets Cardio Gummies across its retail and other Direct to Consumer (DTC) platforms. These gummies consist of CoQ10 to support an individual's cardiovascular health.

By Distribution Channel Analysis

Growing Number of Drug Stores & Retail Pharmacies Globally Boosted Their Dominance

On the basis of distribution channel, the market is segmented into hospital pharmacies, drug stores & retail pharmacies, online pharmacies and others.

The drug stores & retail pharmacies segment dominated the market in 2024. The increasing number of drug stores and retail pharmacies across the world, along with the growing awareness of the severity of heart-related ailments among the younger population, is expected to contribute to the segment’s dominance. For instance, in January 2021, WW International, Inc., a wellness company, collaborated with The Vitamin Shoppe, a retailer of nutritional products. The collaboration was aimed at expanding their customer base through retail channels.

The online pharmacies segment is projected to record a significant growth rate during the forecast period. The fast and easy process of purchasing nutritional supplements through online pharmacies has contributed to its increased adoption in the emerging markets. The Others segment led the market accounting for 42.86% market share in 2026.

REGIONAL INSIGHTS

In terms of region, the market is divided into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

North America Cardiovascular Health Supplements Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest share of the global market by generating a revenue of USD 5.05 billion in 2025. The region is projected to dominate the market in the future as well owing to the increasing awareness of cardiovascular diseases among the general population. Moreover, increasing focus of dietary supplement manufacturers on collaborations with natural extract manufacturers for the development and launch of innovative products in the U.S. is further anticipated to contribute to the market’s growth in the region.

- For instance, in November 2023, dsm-firmenich, an affiliate of DSM Nutritional Products AG, collaborated with Indena, a company engaged in the manufacturing of nutritional field botanical extracts. The collaboration is aimed at developing new products combining botanical ingredients with essential nutrients for the benefit of heart and digestive health.

Europe also accounted for a considerable share of the market. The rising prevalence of chronic conditions, such as heart diseases and diabetes is primarily fueling the demand for cardiovascular health supplements. Moreover, a significant shift of consumer demand toward vegetarian and vegan diet is augmenting the demand for plant-based supplements in the region. Furthermore, increasing awareness among people about their heart health and immunity will also propel the demand for these supplements to maintain their healthy lifestyle.

Asia Pacific is projected to register a significant growth rate. The rising prevalence of hypercholesterolemia and ischemic heart disease due to changing lifestyles of the Asian population is contributing to the growing adoption of cardiovascular health supplements in the region. Moreover, the increasing number of people following their traditional practice of consuming preventive medicine will further augment the consumption of these supplements in the region. For instance, according to an article published by Biomedical and Environmental Sciences in July 2022, about 330 million suffer from some form of cardiovascular disease in China.

Furthermore, Latin America is expected to hold a considerable share of the market during the forecast period. The benefits offered by nutritional supplements with respect to the maintenance of heart and joint health of the region’s adult and elderly population is boosting the growth of the market.

Similarly, continuously improving healthcare infrastructure and increasing collaborations of key companies for improving the accessibility of their nutraceutical products are augmenting the growth of the market in the Middle East & Africa.

List of Key Companies in Cardiovascular Health Supplements Market

Amway to Lead Market with Strong Product Portfolio

This market is fragmented, comprising a large number of players who have a wide range of products to offer. The increased focus of these companies on getting their products certified from renowned medical organizations for maintaining the standardization of their products and brand image in the market has further contributed to their increased market share. For instance, in March 2023, Amway Corp. received the Friend of the Sea certification for its nutraceutical products globally. These products consist of Nutrilite Omega and Nutrilite Advanced Omega which are sourced from sustainable fish oils and support a consumer’s brain, heart, and cellular health.

Thorne HealthTech, Inc. has increased its focus on the launch of new products to expand its product portfolio. Moreover, its increased focus on collaboration with nutraceutical product manufacturers to expand its geographical presence in the exclusive markets has further contributed to its growing market share.

- For instance, in January 2022, Thorne HealthTech, Inc. collaborated with Mitsui and TM HealthTech Pte. Ltd. and formed a joint venture named Thorne HealthTech Asia PTE, LTD. The aim of this collaboration was to market, distribute, and sell its products in Singapore, Hong Kong, Taiwan, Thailand, Indonesia, Malaysia, Australia, the Philippines, Vietnam, India, and New Zealand.

The other companies, such as Gaia Herbs, Sirio Pharma Co. Ltd., Banyan Botanicals, and NOW FOODS are witnessing an increase in their market share due to the growing interest of private investment firms to invest in nutraceutical product manufacturing companies. Moreover, the increasing number of market players with a strong focus on launching innovative products with the help of local manufacturers is further propelling their market growth.

- For instance, Sirio Pharma Co. Ltd., a global contract manufacturer, expanded its manufacturing capabilities in the U.S. through the integration of their daughter company Best Formulations. The integration of Best Formulations is expected to help the company expand its customer base by offering locally manufactured gummies to nutraceutical product manufacturers.

LIST OF KEY COMPANIES PROFILED:

- Amway (U.S.)

- Thorne (U.S.)

- Swisse Wellness Pty Ltd (Australia)

- Herbalife International of America, Inc. (India)

- BL Bio Lab, LLC. (U.S.)

- Church & Dwight Co., Inc. (U.S.)

- Vyta Health Limited. (Netherlands)

- Gaia Herbs (U.S.)

- Herb Pharm (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2023 – Guardian Botanicals developed a new product named Guardian Botanicals Blood Balance, which aids individuals in controlling their blood sugar and cholesterol levels.

- September 2023 – Probiotix Health Plc launched Cholbiome VH, a new formulation designed to support heart and vascular health. The launch of this product is mainly aimed at expanding the company’s product range.

- August 2023 – Life Extension launched Omega-3 Fish Gummy Bites, which is a sugar-free chew. The new product is a healthier alternative to fish oils and can deliver high concentrations of EPA and DHA fatty acids to individuals.

- June 2023 – Goli Nutrition Inc., launched Beet Cardio Gummies containing vitamin B12 and CoQ10 across DTC and retailer platforms. The launch is expected to support cardiovascular health and expand its product portfolio.

- May 2023 – Evonik, a provider of specialty chemical products, collaborated with Safic-Alcan to expand its customer base of nutraceutical products in Europe, Turkey, and Egypt. The company included products, such as AvailOm and IN VIVO BIOTICS in its nutraceutical product range for brain, eye, and heart health.

REPORT COVERAGE

The research report offers a detailed analysis and overview of the market. It is majorly focused on key aspects, such as the competitive landscape based on its type, ingredients, dosage form, distribution channel, and region. Besides this, it also offers market dynamics, such as factors that are driving and restraining the growth of the market. It also offers the impact of COVID-19 on the market and other key insights, such as prevalence of chronic diseases. In addition, it includes ongoing trends and opportunities offered by the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.50% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Type

|

|

By Ingredients

|

|

|

By Dosage Form

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 13 billion in 2026 and is projected to reach USD 21.51 billion by 2034.

The market will exhibit steady growth at a CAGR of 6.50% during the forecast period of 2026-2034.

By type, the natural supplements segment is leading the market.

Rising prevalence of heart diseases and growing focus of manufacturers on launching new products are the key drivers of the market.

Amway, Thorne, and Swisse Wellness Pty Ltd. are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us