COVID-19 Diagnostics Market Size, Share & Impact Analysis, By Product (Instruments and Reagents & Kits), By Technology (Polymerase Chain Reaction [PCR], Enzyme-Linked Immunosorbent Assay [ELISA], Lateral Flow Immunoassay [LFIA], and Others), By Sample Type (Oropharyngeal & Nasopharyngeal Swabs, Nasal Swabs, Blood, and Others), By Setting (Lab-Based and Point of Care), By End-user (Hospitals & Clinics, Laboratories & Diagnostic Centers, Home Testing, and Others), and Regional Forecast, 2022-2029

KEY MARKET INSIGHTS

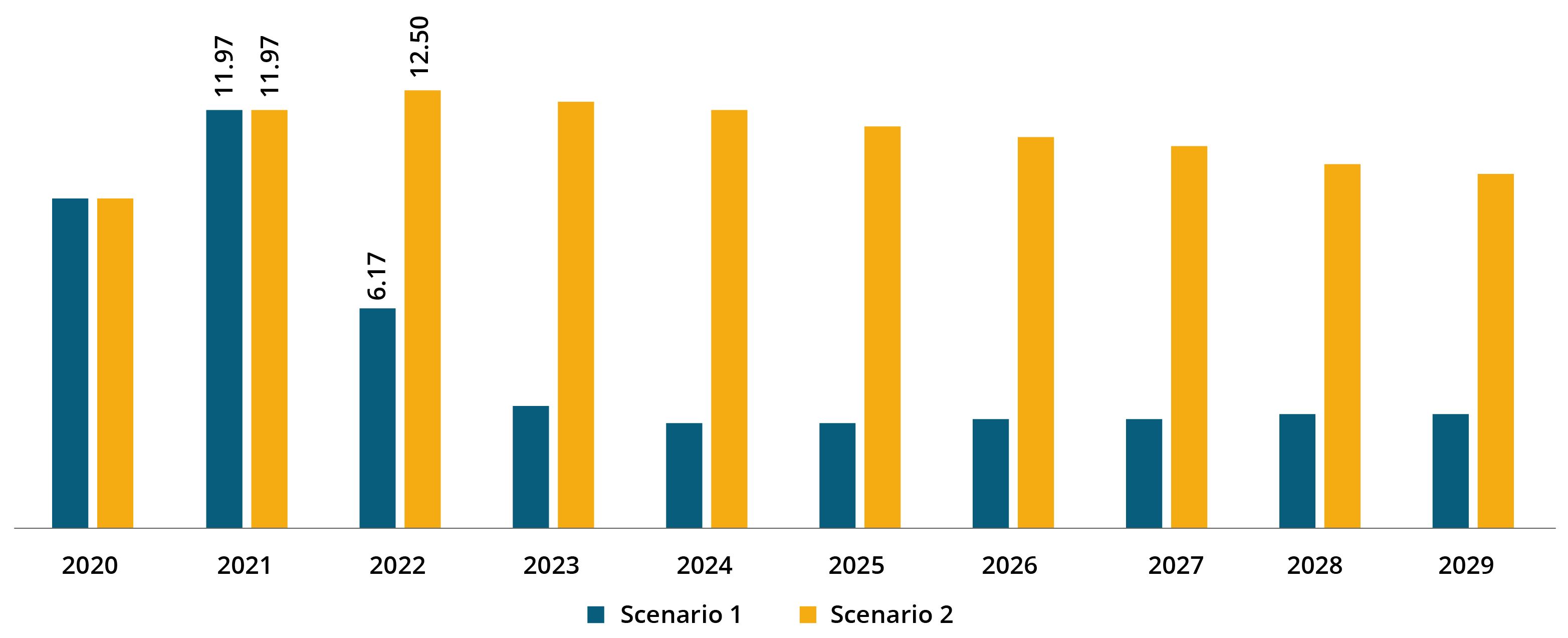

The report includes two scenarios for the global COVID-19 diagnostics market.

Scenario 1: This scenario considers an ‘endemic’ situation, where the COVID-19 pandemic is expected to reach an endemic stage during the forecast period.

Scenario 2: In this scenario, the market will witness ‘cyclic growth’, considering the emergence of future waves with other variants and the impact of factors such as vaccination and herd immunity.

The global COVID-19 diagnostics market size was valued at USD 46.76 billion in 2021. For this market, we have considered two scenarios. As per the first scenario, the market size is projected to fall from USD 23.79 billion in 2022 to USD 8.91 billion by 2029, exhibiting a CAGR of -13.1% during the forecast period. North America dominated the COVID-19 diagnostics market with a market share of 26.73% in 2021. In January 2020, WHO declared the coronavirus outbreak a public health emergency. The sudden exponential rise in the number of COVID-19 cases caused the emergence of diagnostics for COVID-19. The increasing number of cases has been propelling the market growth.

As per the second scenario, the market size is projected to fall from USD 48.64 billion in 2022 to USD 39.68 billion by 2029, exhibiting a CAGR of -2.9% during the forecast period. The global market growth is attributed to the sudden rise in the number of COVID-19 cases due to the occurrence of new COVID-19 waves.

COVID-19 IMPACT

COVID-19 Outbreak Resulted in the Emergence of COVID-19 Diagnostics

The sudden emergence of the COVID-19 crisis has caused an increase in its diagnostics activities, treatment procedures, and a rise in R&D activities to develop diagnostics, such as molecular tests and point of care tests. The growing demand for COVID-19 diagnostics procedures and products has created immense opportunities in the healthcare industry consequently augmenting the market. Diagnostic companies, such as Thermo Fisher Scientific, Abbott, Roche, and Bio-Rad, have developed various technologies to improve detection and treatment against COVID-19 infection. In April 2020, WHO listed two COVID-19 diagnostics tests, Real-Time PCR Coronavirus (COVID-19) and cobas SARS-CoV-2 Qualitative assay; both these tests are in-vitro diagnostics.

With the increasing number of COVID-19 cases, lack of presence of any therapeutic or vaccines, and rise in government focus on preventing further spread of COVID-19, an increased demand for time-efficient testing was observed. The major players in the market increased their focus on the development of time-efficient and accurate testing kits. For instance, the U.S. Food and Drug Administration (FDA) issued an Emergency Use Authorization (EUA) to Sofia 2 SARS Antigen FIA for the detection of SARS-CoV-2 in nasopharyngeal and nasal swab specimens. Following this, many companies launched COVID-19 diagnostics kits. Highlighting another instance, in December 2021, F. Hoffmann-La Roche Ltd announced plans to launch SARS-CoV-2 & Flu A/B Rapid Antigen Test for professional use in markets accepting CE Mark. Since the pandemic, the U.S. FDA has approved over 350 diagnostics tests for COVID-19, including 235 molecular, 34 antigen, and 88 antibody-based tests.

Furthermore, the market players have been focusing on adopting technological advancements to provide efficient diagnostic products and services. Citing an instance, in November 2021, Siemens Healthcare GmbH announced the development of Atellica COVID-19 Severity Algorithm, which helps predict the potential progression of diseases and life-threatening multi-organ dysfunction in COVID-19 patients.

The sudden outbreaks of new COVID-19 strains and the increasing demand for accurate diagnostic procedures are anticipated to give momentum to the global market. However, COVID-19 restrictions had a minor effect on the supply chain.

LATEST TRENDS

Point of Care Tests to Gain Traction Owing to Early Diagnosis, Improved Access, and Faster Turnaround Time

RT-PCR has been considered a standard test for COVID-19 diagnosis due to its high accuracy, but it may take around 24 hours to get the results. However, at times, urgent testing is required. Point of care/rapid COVID-19 diagnostics tests have played an important role in controlling the spread of the disease and facilitating the lifting of various restrictions through an increased number of daily tests.

In-vitro diagnostic companies and governments have focused on developing more reliable tests, providing faster results at considerably lower costs. By July 2021, more than 500 COVID-19 POC diagnostic tests were available in the market.

In October 2021, the Department of Health and Human Services (HHS) invested more than USD 560 million to support the development and manufacturing of COVID-19 tests, including rapid diagnostic products.

Increasing demand for time-efficient and accurate testing and rising R&D investment by in-vitro-diagnostics companies are the major trends that will boost the market growth.

DRIVING FACTORS

Rising Prevalence of Coronavirus Disease to Fuel Demand for Diagnostic Devices & Kits

The sudden rise in the infectious coronavirus disease leading to a global pandemic resulted in the escalating demand for diagnostic procedures and products for COVID-19. According to Worldometer statistics, there has been a continuous rise in new daily cases across the globe. According to the World Health Organization (WHO), as of 18th May 2021, 163.3 million people globally were affected with COVID-19. Continuous daily rise in cases has surged the adoption of diagnostic tests to provide early treatment to patients. Even the emerging economies such as Brazil, experienced a notable surge in the number of cases and stood at 15.9 million as of May 2021.

These factors are likely to increase the sales of reagents & kits used to detect coronavirus infections. Additionally, rising R&D activities are likely to drive the market growth during the forecast period. Several companies are making higher investments to support the development of diagnostic solutions. For instance, in July 2020, the National Institutes of Health (NIH) invested USD 248.7 million in new technologies to address challenges associated with COVID-19 diagnostics (which detects SARS-CoV-2 coronavirus).

Launch of Innovative Products to Propel Market Growth

Protecting human lives is the most crucial element of the healthcare system during a pandemic situation. The increasing demand for time-efficient and effective testing has led pharmaceutical and medical device companies to invest in R&D to launch novel testing kits and assays. Large and small companies as well as startups are introducing products for patients and healthcare personnel. For example, Accurate Diagnostic in April 2020 announced the launch of an antibody test for the diagnosis of COVID-19. This serology test is performed by collecting and analyzing saliva samples to detect the coronavirus antigen. Citing another instance, in May 2021, Precipio announced the launch of the COVID-19 rapid antibody test capable of testing IgG and IgM antibodies. As of January 2022, around 700 tests have been available or approved by regulatory authorities in the North America, Europe, and Asia Pacific markets.

The number of approved products for some of the major companies is as follows:

- Abbott – 13 tests approved/available

- Quidel – 8 tests approved/available

- Roche – 7 tests approved/available

Therefore, the presence of a varied number of diagnostic products for COVID-19 and increasing investment by key market players positively impact the global market.

RESTRAINING FACTORS

Stringent Regulatory Framework to Develop New Test Kits to Limit Market Growth

Though this market has tremendous potential and upcoming opportunities. Some challenges are likely to hinder the growth of the global market. Owing to the continuous rise in COVID-19 infections across the globe, the demand for better, safer, and faster detection kits to provide successful treatment to patients has created havoc in the diagnostics market. However, manufacturers have to pass through stringent regulatory restrictions to launch novel kits despite the dire need for these diagnostic tools. For instance, every country has its regulatory authority implementing different regulations and guidelines for manufacturers. To ensure the safety of products, the U.S Food and Drug Administration (FDA), the Centers for Disease Control and Prevention (CDC), and other regulatory bodies have updated their guidelines. Moreover, increasing budgetary constraints are also likely to impact the COVID-19 diagnostics market growth during the forecast period.

SEGMENTATION

By Product Analysis

To know how our report can help streamline your business, Speak to Analyst

Reagents & Kits Segment to Register Highest Growth Rate Due to Launch of New Technologically Advanced Products

On the basis of product, the market is classified into instruments and reagents & kits. The instruments segment held a dominant COVID-19 diagnostics market share in 2021. Advanced assays and kits launched by major players to fulfill demand amid COVID-19 will increase the segment’s revenue. For instance, in December 2021, F. Hoffmann-La Roche Ltd announced the SARS-CoV-2 & Flu A/B Antigen Test plan. The test will be used to differentiate between COVID-19 and influenza.

On the other hand, the share of instruments segment is lower as most of the existing diagnostic equipment is compatible with the newly developed COVID-19 testing assays. The instruments segment is expected to grow at a considerably low CAGR.

By Technology Analysis

Higher Rate of Accurate Output through PCR Technique to Increase Adoption

By technology, the market is classified into Polymerase Chain Reaction (PCR), Enzyme-Linked Immunosorbent Assay (ELISA), Lateral Flow Immunoassay (LFIA), and others. The PCR technique segment dominated the market in 2021. The dominance is attributable to the increased quantification of patient samples by the use of PCR. According to a news article published by the Hindu in June 2020, researchers from the Center for Cellular and Molecular Biology (CCMB) said that they find the PCR method to be less expensive than others. Hence, patient samples are largely quantified using PCR. The launch of new PCR-based detection techniques is likely to surge the demand for PCR instruments in the upcoming years.

The ELISA segment grows at a substantial CAGR due to growing approvals for ELISA-based tests by the U.S. FDA and other regulatory authorities. The LFIA segment is anticipated to hold the second-leading position in the market. Such tests identify the existence of the novel coronavirus antigens through nasal or nasopharyngeal samples and provide results within 15 minutes.

By Sample Type Analysis

Oropharyngeal & Nasopharyngeal Swabs Segment to be Driven by Surging Number of Tests

By sample type, the market is segmented into oropharyngeal & nasopharyngeal swabs, nasal swabs, and blood. The oropharyngeal & nasopharyngeal swabs segment marked the higher position in the market owing to the increased COVID-19 testing through such swab tests. Swab tests are easy, convenient, and can be carried out quickly. Owing to the increased pressure of testing patients with coronavirus infections, these swab tests are consumer-friendly and can deliver results within a few hours. In June 2020, Global Times reported that Beijing sampled 2.29 million people using swab tests for screening COVID-19 cases between 11th June and 20th June.

The nasal swabs segment holds the second-leading position in the market owing to higher collection of samples for diagnostic purposes. The blood samples segment will register a significant CAGR during the forecast timeframe. Researchers have been collecting blood samples of patients to carry out exhaustive research activities to bring novel therapies, such as plasma therapy, for treatment.

By Setting Analysis

Lab-based Segment to Gain Traction due to Rigorous COVID-19 Diagnosis in Labs

By setting, the market is segmented into lab-based and point of care. The lab-based segment dominated the market in 2021, owing to the growing number of laboratories offering high-throughput technologies to speed up COVID-19 tests effectively. For instance, in June 2020, the Indian Institute of Technology, Hyderabad announced the development of an artificial intelligence-powered COVID-19 test, which can be performed at an affordable cost.

The point of care (POC) segment is estimated to exhibit the highest CAGR during the forecast timeframe as per the second scenario. The growth is attributable to the rising number of COVID-19 POC testing, coupled with the surging rate of U.S. FDA approvals for efficient and highly sensitive POC tests for the disease. For instance, in July 2020, BD received the Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration (FDA) for its Veritor System indicated for the rapid detection of SARS-CoV-2. This can be used in POC settings. However, as per the first scenario, the segment is expected to observe a decline in its growth due to decreasing growth in the number of COVID-19 cases.

By End-user Analysis

Increasing Number of Diagnostic Procedures to Drive Laboratories & Diagnostic Segment

The market share is segregated into hospitals & clinics, laboratories & diagnostic centers, home testing, and others in terms of end-user. The laboratories & diagnostic centers segment is expected to have a dominant share in the market during the forecast period. The dominance of this segment is attributable to the increasing diagnostic procedures and the sales of diagnostic products in developed and emerging economies.

The hospitals & clinics centers segment is expected to acquire the second-largest share by the end of forecast period in the global diagnostics market due to a sudden increase in hospital stays of patients suffering from COVID-19 as per the first scenario. Whereas as per the second scenario, the home testing market is expected to dominate the market due to the increasing demand for rapid testing kits due to the consequent outbreak of new COVID-19 variants.

REGIONAL INSIGHTS

North America COVID-19 Diagnostics Market Size, 2021 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the global market in 2021. The dominance of this region is due to the massive burden of COVID-19 cases in most European countries and increased emphasis on more tests for controlling infection. For instance, according to the World Health Organization (WHO), 15.2 million cases were registered in France as of 8th January 2022. New product launches in the Europe region by major players also propelled the growth of the market. For instance, in March 2021, FUJIFILM Holdings Corporation announced that they launched a rapid antigen test kit for SARS-CoV-2 with CE mark approval in Europe.

The market in North America stood at USD 11.97 billion in 2021. As per scenario 2, the market in the region is expected to grow at a substantial CAGR, owing to the sudden rise in the number of COVID-19 cases and increase in demand for diagnostics.

The Middle East & Africa is expected to grow at a fastest CAGR during the forecast period. This growth is attributable to the increasing adoption of coronavirus detection kits and instruments.

KEY INDUSTRY PLAYERS

Abbott to Hold Key Market Share Owing to its Diversified and Strong Products Portfolio

Abbott is one of the major players in the market. The company accounted for the largest share of the market in 2021. Abbot’s revenue in 2021 observed an increase of 21.8% from USD 34.61 billion in 2020. Its dominance in this market is due to the expansion of its product portfolio for COVID-19 diagnostics. New product launches and significant product approvals from regulatory bodies also contribute to its high market share. In March 2021, Abbott received Emergency Use Authorization from the U.S. Food and Drug Administration (FDA) to use BinaxNOW COVID-19 Ag Self Test, which can be used for the detection of the infection.

F. Hoffmann-La Roche Ltd is another major player in the global market. The company’s revenue for COVID-19 diagnostics increased in 2021 due to the launch of multiple products. Other important players in the market include Danaher, PerkinElmer Inc., and Siemens Healthineers AG.

LIST OF KEY COMPANIES PROFILED:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- Danaher (U.S.)

- Siemens Healthineers AG (Germany)

- Quidel Corporation (U.S.)

- bioMérieux SA (France)

- Quest Diagnostics Incorporated (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- PerkinElmer Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2021 - Trusted Laboratory of DTPM announced that the FDA reissued the Tide Laboratories DTPM COVID-19 RT-PCR test emergency use authorization. With a modification, the test will detect SARS-CoV-2 omicron variant.

- October 2021 - PerkinElmer Inc. announced that the U.S. FDA issued Emergency Use Authorization for its Pkamp Respiratory SARS-CoV-2 RT-PCR Panel 1 assay. This RT-PCR panel can be used to qualitatively detect and differentiate SARS-CoV-2, Influenza A, Influenza B, and Respiratory Syncytial Virus (RSV).

REPORT COVERAGE

An Infographic Representation of COVID-19 Diagnostics Market

To get information on various segments, share your queries with us

The COVID-19 diagnostics market research report provides a detailed industry analysis. It focuses on key aspects such as leading companies, product type, and application. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2020-2029 |

|

Base Year |

2021 |

|

Estimated Year |

2022 |

|

Forecast Period |

2022-2029 |

|

Historical Period |

2020 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Technology

|

|

|

By Sample Type

|

|

|

By Setting

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

The global market value stood at USD 46.76 billion in 2021. Fortune Business Insights says that as per scenario c, the global market size is estimated to decline to USD 8.91 million by 2029. As per scenario 2, the market size is estimated to reach USD 39.68 billion by 2029.

The market is expected to experience a CAGR of -13.1% according to the first scenario and a CAGR of -2.9% as per the second scenario during the forecast period (2022-2029).

By product, the reagents & kits segment is set to lead the market.

Growth in the number of COVID-19 tests due to increase in number of cases is expected to drive the market growth.

F. Hoffmann-La Roche Ltd, Abbott, Danaher, and Perkin Elmer, Inc. are the top players in the market.

Europe is expected to hold the highest share in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic