Nasopharyngeal Swabs Market Size, Share & Industry Analysis, By Product Type (Swab, Transport Media, and UTM/VTM Kits), By Indication (COVID-19, Chlamydia, and Others), By End-user (Clinical Laboratories, Hospitals & Clinics, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

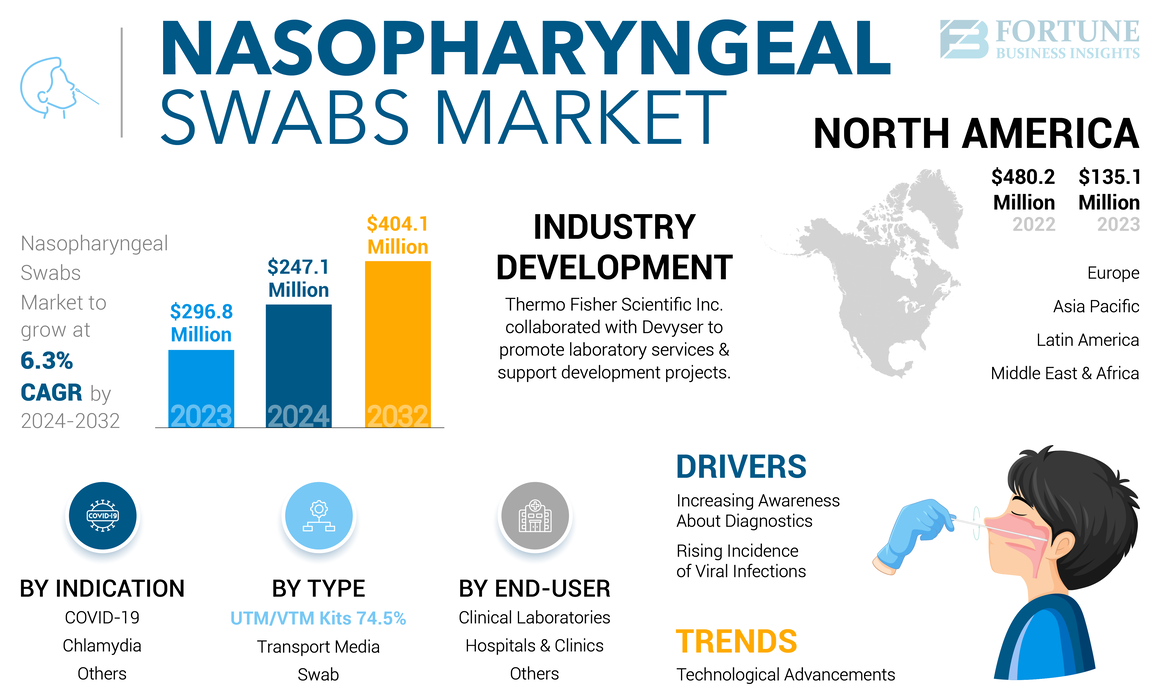

The global nasopharyngeal swabs market size was valued at USD 296.8 million in 2023. The market is projected to grow from USD 247.1 million in 2024 to USD 404.1 million by 2032, exhibiting a CAGR of 6.3% during the forecast period. North America dominated the global nasopharyngeal swabs market with a market share of 45.52% in 2023.

Nasopharyngeal swabs refer to medical swabs that are used to collect samples from the nasopharynx for diagnosis. These swabs are transported in sterile media, such as Viral Transport Media (VTM) and Universal Transport Media (UTM) for subsequent analysis. The market includes nasopharyngeal swabs and transport media as individual products and combined as kits.

The global market is anticipated to grow significantly in the coming years due to the increasing incidence of viral infections, such as influenza and RSV and rising prevalence of STIs that require nasopharyngeal samples. Additionally, the rise in zoonotic viral diseases, such as SARS and MERS is anticipated to further drive the market growth. Furthermore, technological advancements, such as 3D printing and improved sampling techniques are expected to fuel market growth.

In 2020, the COVID-19 pandemic increased the need for these swabs, which were essential for testing patients for the virus. The requirement for extensive testing to mitigate the virus' spread led to increased production and distribution of these products. Additionally, numerous investments and collaborative efforts from key industry manufacturers were aimed at enhancing production capabilities to meet the growing demand during this period. Governments in various countries also initiated measures to boost the availability of diagnostic tests and nasopharyngeal swabs, further promoting the domestic production of these swabs and transport media.

- For instance, in May 2020, Puritan Medical Products launched a new facility in Pittsfield, U.S., with the goal of manufacturing an extra 20 to 40 million swabs per month. The company received USD 75.5 million in funding to enhance the domestic supply of materials essential for addressing the spread of the COVID-19 virus in the U.S.

However, later, in 2022, the demand for COVID-19-related drugs reduced significantly and this factor is expected to cause negative growth in the demand for these swabs in the coming years as the cases of COVID-19 have reduced across the globe.

On the other hand, in 2020, the demand for other indications, including chlamydia, had significantly declined due to COVID-19-related lockdown and restrictions, which reduced the visits for these indications. However, the market for chlamydia and other respiratory diseases is expected to grow in the future due to increased awareness of testing, incidences of seasonal flu, epidemic viral breakouts, and STIs across the globe.

Global Nasopharyngeal Swabs Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 296.8 million

- 2024 Market Size: USD 247.1 million

- 2032 Forecast Market Size: USD 404.1 million

- CAGR: 6.3% from 2024–2032

Market Share:

- North America dominated the nasopharyngeal swabs market with a 45.52% share in 2023, driven by the rising demand for nucleic acid amplification tests and rapid antigen testing for viral infections, chlamydia, and mycoplasma.

- By product type, UTM/VTM kits are expected to retain their largest market share owing to their convenience, streamlined sampling solutions, and growing emphasis on point-of-care testing and telemedicine.

Key Country Highlights:

- United States: Continuous focus on enhancing domestic production capacities and supply chains for swabs and transport media.

- Europe: Favorable regulatory policies encouraging healthcare providers to adopt nasopharyngeal swab tests for broader diagnostic applications.

- China: Surge in respiratory infections and zoonotic diseases is driving demand for nasopharyngeal swabs and transport media.

- Japan: Increasing awareness and guidelines for early diagnosis of respiratory illnesses are propelling the use of nasopharyngeal swabs in clinical settings.

Nasopharyngeal Swabs Market Trends

Technological Advancements to Augment Market Growth

Recent advancements in nasopharyngeal swabs have significantly influenced both their design and the overall market’s growth. Their high demand during the COVID-19 pandemic drove this advancement.

One such advancement is 3D-printed swabs. The use of 3D printing has allowed for the rapid production of these swabs, thereby addressing shortages during the COVID-19 pandemic. This technology enables the creation of rapid and efficient nasopharyngeal samples.

Similarly, in the viral transport media, inactivated media is currently trending in the market. These are gaining traction due to their enhanced safety and efficiency for transporting viral samples.

- For instance, in October 2020, EKF Diagnostics launched a PrimeStore MTM sample collection kit that inactivates infectious biological pathogens, including viruses and gram-positive/negative bacteria. These inactivating transport media are specialized types of viral transport media that contain chemicals designed to neutralize the infectivity of viruses while preserving their genetic material.

Download Free sample to learn more about this report.

Nasopharyngeal Swabs Market Growth Factors

Rising Incidence of Viral Infections to Fuel Market Growth

The increasing prevalence of infections has had a significant impact on the nasopharyngeal swabs market growth. Influenza, Respiratory Syncytial Virus (RSV), staphylococcus, chlamydia, and other infections have led to a rise in the demand for diagnostic tools, such as nasopharyngeal swabs.

- For instance, during the flu season of 2023-2024, the CDC estimated that there have been at least 35 million flu-related illnesses, further driving the need for these swabs and media.

Additionally, the outbreak of MERS-CoV, SARS-CoV, and COVID-19 has increased the demand for nasopharyngeal swabs and transport media as these samples have become a standard protocol for diagnosing respiratory infections worldwide.

Increasing Awareness About Diagnostics Can Propel Market Growth

Public awareness regarding the importance of diagnosing respiratory and sexually transmitted diseases has increased significantly. This awareness is driving the demand for these swabs, which are commonly utilized for sample collection in diagnostic testing. The rising incidence of respiratory illnesses, such as influenza and whooping cough further contributes to this awareness.

Additionally, various government and non-government initiatives, including public awareness campaigns, updated guidelines, free testing programs, approval of new testing kits, and subsidies for the production of these swabs during the peak phase of the COVID-19 pandemic, have played a crucial role in highlighting the significance of early detection.

- For instance, in June 2024, the CDC recommended the use of sterile dacron or nylon swabs to collect nasopharyngeal samples for influenza A testing, which should be placed in a sterile tube containing 1-3 ml of viral transport media. These established guidelines have led to a marked increase in the usage of these swabs. This trend is expected to continue in the future as well for diagnosing other respiratory conditions.

RESTRAINING FACTORS

Presence of Alternative Sampling Methods Can Limit Product Adoption

The growing popularity of user-friendly and non-invasive self-testing kits may impede the widespread adoption of nasopharyngeal swabs in the diagnostics sector. These self-testing alternatives, which eliminate the need for a specialized medium, are proving to be effective substitutes for traditional nasopharyngeal swab collection methods. Moreover, recent advancements in diagnostic technology have led to the development of highly accurate testing kits that utilize samples taken from the nose or saliva. These technological developments enable individuals to conduct tests with minimal instruction, making these sampling methods easier compared to the conventional nasopharyngeal swab technique. The COVID-19 pandemic witnessed a significant rise in the approval and launch of diagnostic kits that rely on saliva or nasal samples.

- For instance, in December 2021, Angstrom Biotech Pvt. Ltd. unveiled the Angcard Saliva Self-Testing Kit in India, which provides a rapid antigen testing solution for home use using saliva samples. Furthermore, various studies have shown that saliva samples can offer accuracy levels similar to those of swabs, further challenging their dominance in the market.

Nasopharyngeal Swabs Market Segmentation Analysis

By Product Type Analysis

Convenient Usage of UTM/VTM Kits Drove Segment Growth

Based on product type, the market is classified into swabs, transport media, and UTM/VTM kits.

The UTM/VTM kits dominated the market in 2023. The dominance is attributed to the benefits offered by these kits. They provide a streamlined solution, enhancing convenience for practitioners. Additionally, the growing emphasis on point-of-care testing and telemedicine may further accelerate the development and adoption of VTM/UTM kits.

The swab segment held a significant share of the market. The growth is attributed to the increasing focus of key players on launching revolutionary swabs for testing respiratory diseases in children. These launches are stimulated by the high burden of respiratory viruses, including SARS-CoV-2, RSV, and Influenza.

- For instance, in November 2022, Rhinomed Limited launched Rhinoswab Junior, a child-friendly respiratory swab. This swab was integrated into rapid antigen and PCR tests for various respiratory viruses, including SARS-CoV-2, Influenza, and RSV.

To know how our report can help streamline your business, Speak to Analyst

By Indication Analysis

Increasing Incidence of Seasonal Viral Infections to Boost Others' Segment Growth

Based on indication, the market is segmented into COVID-19, chlamydia, and others.

The others segment dominated the market in 2023 and is expected to record a higher CAGR during the forecast period. The others segment includes flu, RSV, and other indications that require nasopharyngeal samples for diagnosis. This segment’s growth is attributed to the rising incidence and diagnosis of influenza and Respiratory Syncytial Virus (RSV) infections across the globe. Additionally, the World Health Organization (WHO) and CDC recommend nasopharyngeal swabs as a standard method for detecting respiratory viruses, such as influenza and RSV, further increasing their importance in public health. This factor also increased the demand for swabs, viral transport, and universal media.

The COVID-19 testing segment held the second-largest share of the market due to the focus on monitoring the spread of the virus through laboratory and rapid antigen tests that required sample collection via swabs. However, the demand for COVID-19 testing is projected to decline in the future as the burden of the virus and its diagnosis is decreasing across the globe.

The chlamydia segment is expected to grow considerably in the future. The growth of the segment can be attributed to the rising awareness about STIs, including chlamydia, which will increase the rate of diagnosis across the globe. Additionally, technological advancements in diagnostic tests and the development of highly sensitive and specific diagnostic tests, such as Nucleic Acid Amplification Tests (NAATs) are expected to increase the demand for these swabs for diagnosis.

By End-user Analysis

Hospitals & Clinics Segment Dominated Market Due to High Proportion of Sample Collection

Based on end-user, the market is divided into clinical laboratories, hospitals & clinics, and others.

In 2023, the hospitals & clinics segment dominated the nasopharyngeal swabs market share and is expected to witness significant growth during the forecast period as well. The increasing demand for precise respiratory infection diagnosis and surge in viral and infectious diseases are driving the demand for these swabs in hospitals and clinics, further boosting the segment’s growth in the coming years.

The clinical laboratories segment was the second-largest contributor to the market and is projected to experience substantial growth in the coming years. The rise in COVID-19 cases led to a proliferation of clinical laboratories in the U.S., many of which enhanced their capacity for viral disease testing. Despite the decrease in COVID-19 incidents in 2023, the prevalence of viral and bacterial infections remains high, prompting these expanded laboratories to focus on testing for such diseases. This trend is expected to propel the adoption of nasopharyngeal swabs and related products in regional clinical laboratories, driving the segment expansion. Additionally, an increasing number of certified labs across the globe is anticipated to boost the demand for these swabs in the future.

- For instance, a report by CLINICALLAB in August 2022 revealed that the number of CLIA-certified clinical laboratories in the U.S. rose by approximately 13% from 2020 to 2021, reaching 323,086.

The others segment is anticipated to record a moderate CAGR during the forecast period. The rising usage of swabs and UTM/VTM kits by academic & research institutes and rapid diagnostic test kit manufacturers for sample collection is projected to boost the segment’s growth during the forecast period.

REGIONAL INSIGHTS

Based on geography, the market is studied across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America Nasopharyngeal Swabs Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest market share in 2023 and generated a revenue of USD 135.1 million. The region is expected to maintain its dominance during the forecast period as well. The regional market’s growth can be attributed to the rise in the demand for nucleic acid amplification tests and rapid antigen testing for viral infections, chlamydia, and mycoplasma. This trend is driven by healthcare organizations' recommendations for nucleic acid amplification, which are anticipated to fuel the regional market growth.

- For instance, the Infectious Diseases Society of America (IDSA) advises utilizing nucleic acid amplification testing, such as RT-PCR or other molecular assays to identify influenza viruses in respiratory samples from hospitalized patients.

In 2023, Europe held the second-largest market share and is expected to experience steady growth at a moderate CAGR in the coming years. This growth is driven by favorable regulatory policies that incentivize healthcare providers for utilizing nasal swab tests more extensively, resulting in increased adoption of swabs, transport media, and UTM/VTM kits across various countries in the region.

Asia Pacific is poised to register a higher CAGR over the forecast period. The market’s growth in the region is attributable to the surge in respiratory infections, including influenza and other zoonotic diseases, which is boosting the demand for these swabs.

Furthermore, markets in the Middle East & Africa and Latin America are estimated to grow moderately over the forecast period. Key factors contributing to this growth include increasing healthcare spending in the regions for STI and other infection diagnoses. Additionally, growing awareness regarding the importance of early diagnosis of respiratory diseases is expected to increase testing and, consequently, boost the product demand during the forecast period.

KEY INDUSTRY PLAYERS

COPAN Diagnostics Inc. and Puritan Medical Products are Key Market Players Due to Focus on New Product Launches

The nasopharyngeal swabs market is highly fragmented. There are several small and mid-sized local players operating in various regions. Companies, such as COPAN Diagnostics Inc. and Puritan Medical Products are some of the key players with considerable shares in the market. These two companies are known for their focus on innovation, research & development, and expanding their production capacity and supply chain network.

- For instance, in January 2021, Copan Diagnostics Inc. introduced a new device featuring a mini tip foam swab for nasopharyngeal sample collection.

Other companies, such as Thermo Fisher Scientific Inc., BD, Wuxi NEST Biotechnology Co., Ltd., and various smaller players are concentrating on introducing new products and expanding their distribution networks.

LIST OF TOP NASOPHARYNGEAL SWABS COMPANIES:

- COPAN Diagnostics Inc. (U.S.)

- Puritan Medical Products (U.S.)

- Deltalab (Spain)

- Medical Wire & Equipment (U.K.)

- BD (U.S.)

- Titan Biotech Limited (India)

- Wuxi NEST Biotechnology Co., Ltd. (China)

- Thermo Fisher Scientific Inc. (U.S.)

- AdvaCare Pharma (U.S.)

- SG Medical, Inc. (South Korea)

KEY INDUSTRY DEVELOPMENTS

- September 2023: Thermo Fisher Scientific Inc. announced its collaboration with Devyser to promote laboratory services and support development projects.

- January 2023: The University of South Florida (USF) was awarded the Patents for Humanity award by the U.S. Patent and Trademark Office (USPTO) for its 3D-printed Nasopharyngeal (NP) swab. Currently, over 100 million swabs are produced globally using this USF-patented design.

- February 2021: BD collaborated with Scanwell Health to create an at-home rapid test for SARS-CoV-2 using a BD antigen test and the Scanwell Health mobile app.

- August 2020: Puritan Medical Products received a contract from the U.S. Department of Defense in coordination with the Department of Health and Human Services (HHS) to expand the industrial production of flock tip testing swabs.

- June 2020: Puritan Medical Products and The Jackson Laboratory formed a partnership with the Maine Maritime Academy for double testing of the students and ship crew for COVID-19 prior to boarding the ship.

REPORT COVERAGE

The report provides an in-depth analysis of the market. It focuses on market segments, such as product type, indication, and end-user. Besides, it offers the market forecast in relation to the current market dynamics, the impact of COVID-19, and the latest market trends. Additionally, the report consists of the market share of various segments and the factors driving the market’s growth. The report also provides the competitive landscape of the market.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.3% from 2024-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Indication

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 296.8 million in 2023 and is projected to reach USD 404.1 million by 2032.

In 2023, the market value stood at USD 135.1 million.

The market will exhibit a steady CAGR of 6.3% during the forecast period of 2024-2032.

By product type, the UTM/VTM kits segment led the market in 2023.

Rising incidence of viral infections and growing demand for point-of-care testing are some of the key drivers of the market.

Copan Diagnostics Inc. and Puritan Medical Products are the major players in the market.

North America dominated the market in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us