Data Center Networking Market Size, Share & Industry Analysis, By Component (Products, Services) By Industry (BFSI, IT & Telecommunication, Healthcare, Retail, Education, Government, Media & Entertainment, Manufacturing, Others) And Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

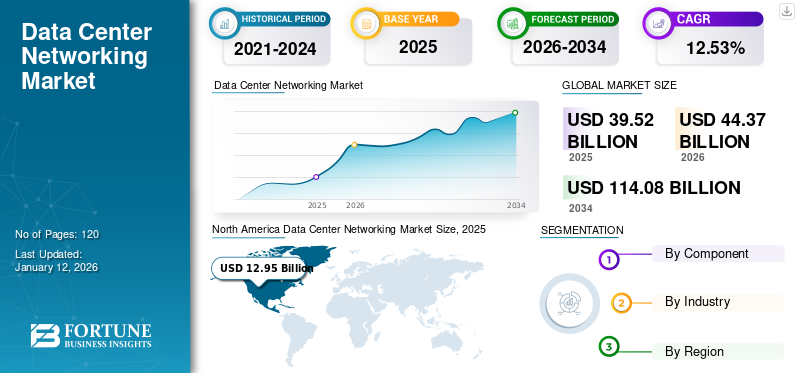

The global data center networking market size was valued at USD 39.52 billion in 2025. The market is projected to grow from USD 44.37 billion in 2026 to USD 114.08 billion by 2034, exhibiting a CAGR of 12.53% during the forecast period. North America dominated the data center networking market with a market share of 32.76% in 2025.

Data center networking is the interconnection of various computing and storage resources within a data center. It enables the seamless communication between servers, storage systems, and other data center resources to facilitate the storage, processing, and transfer of data. A well-designed data center network optimizes performance, ensures high availability, and supports scalability, making it critical for cloud services, enterprise applications, and digital infrastructure. The future of data center networking is closely tied to the increasing demands for high-speed data processing, cloud computing, edge computing, and the rise of technologies, such as artificial intelligence (AI), IoT, and 5G. AI-driven networks will lead to more efficient, self-optimizing data center infrastructures with minimal manual intervention. Moreover, key players in the market, such as Cisco Systems, Inc., VMware, Inc., Juniper Networks, Dell Inc., Equinix, Inc., and Fujitsu, are partnering with cloud providers such as Microsoft Azure, Amazon Web Services (AWS), and Google Cloud to optimize their networking solutions for cloud environment. These partnerships ensure that their networking solutions are compatible with cloud platforms, making it easier for enterprises to adopt hybrid and multi-cloud models.

GLOBAL DATA CENTER NETWORKING MARKET OVERVIEW

Market Size:

- 2025 Value: USD 39.52 billion

- 2034 Forecast Value: USD 114.08 billion, with a CAGR of 12.53% from 2026–2034

Market Share:

- Regional Leader: North America dominated in 2024 due to high investment in cloud infrastructure and data center upgrades.

- Fastest-Growing Region: Asia Pacific is the fastest-growing region, supported by rapid digitalization and increasing cloud adoption.

- End-User Leader: The IT & Telecom sector led the market, driven by demand for high-speed and scalable networking solutions.

Industry Trends:

- Rapid growth in hyperscale and edge data centers

- Adoption of software-defined networking (SDN) and automation

- High-speed interconnects (e.g., 400G) becoming standard

Driving Factors:

- Increasing cloud service adoption across enterprises

- Surge in data traffic from AI, IoT, and big data analytics

- Need for low-latency, high-bandwidth network architectures

- Expanding digital infrastructure in emerging economies

The COVID-19 pandemic had a significant positive impact on data center networks, as it fueled demand for digital infrastructure and pushed forward several technological trends. Many companies that were hesitant to adopt cloud services before the pandemic accelerated their move to the cloud as a result of COVID-19. Organizations realized the importance of cloud’s scalability, agility, and cost-efficiency, which in turn increased the need for modern, scalable data center networking solutions globally.

IMPACT OF GENERATIVE AI

Increasing Demand for High-Performance Networking Aids Market Growth

Generative AI is driving significant innovation and transformation in data center networking. As generative AI applications require massive computational power, real-time data processing, and advanced infrastructure, the market is evolving to meet these needs. Generative AI models, such as image-generating AI, require vast amounts of data processing, leading to high demand for robust, high-bandwidth, and low-latency networks. These AI models often need to be trained on massive datasets, requiring data center networks that can handle terabits of data per second. This drives the adoption of high-speed networking technologies, such as 100Gbps or even 400 Gbps Ethernet, to support fast data transfers between servers and storage systems. Advanced network infrastructure is critical to ensure AI models can be trained and deployed without bottlenecks. Also, the integration of AI into network management and optimization will lead to more automated, efficient, and secure data center networks, paving the way for future technologies such as quantum computing, edge AI, and real-time data processing. For instance,

- In June 2024, Cisco engaged in a partnership with NVIDIA Corporation to launch the Cisco Nexus HyperFabric AI cluster solution. This infrastructure is developed to scale generative AI workload efficiently.

MARKET DYNAMICS

Market Drivers

Proliferation of Cloud Computing in Businesses Drive the Market Progress

Cloud services have become essential for businesses of all sizes, driving demand for scalable, high-performance, and flexible data center networks. The shift toward public, private, and hybrid cloud environments requires advanced networking solutions to handle massive data volumes, ensure data transfers, and provide seamless connectivity between data centers and cloud providers. The rise of cloud-native applications and services requires data center networks to support faster, more efficient, and secure cloud connectivity. As enterprises continue to modernize their infrastructure, the demand for high-speed, low-latency, and secure networking solutions will continue to fuel the growth of the market. For instance,

- In October 2024, Fujitsu and Supermicro, Inc. engaged in a partnership to build green AI computing technology and liquid-cooled data center solutions. Through this partnership, Supermicro will provide novel servers and solutions that are power efficient.

Market Restraints

High Initial Cost and Complex Network Architecture May Hinder Market Growth

Building and upgrading data center networks involves substantial capital expenditure. The need for advanced networking hardware (high-speed switches, routers, and fiber optics) and software can be cost-prohibitive, especially for smaller businesses. High costs may deter smaller or start-up companies from adopting cutting-edge networking solutions, limiting market growth. As data centers grow in scale and complexity, managing network infrastructure becomes more challenging. Configuring, maintaining, and optimizing multi-cloud, hybrid cloud, or edge networks requires specialized expertise. The complexity of deploying and managing data center networks can slow down adoption, particularly for businesses lacking in-house IT expertise. Thus, these factors are expected to hinder market growth over the forecast period.

Market Opportunities

Rising Adoption of AI and Automation in Network Management to Create Lucrative Opportunities for Market Growth

Integrating artificial intelligence (AI) and machine learning (ML) into data center networks allows for predictive maintenance, traffic optimization, and automated configuration of network devices. AI-based network management tools can help data centers reduce downtime and improve performance. As more companies adopt AI-driven network automation, there is an opportunity for solution providers to develop AI-powered tools that streamline network operations. Further, AI and machine learning workloads are expanding rapidly, and data center networks need to support real-time data processing for these applications. As more companies invest in AI technologies, data center networks must evolve to handle the increased computational and bandwidth requirements. Thus, the growing demand for AI and automation in network management is anticipated to create a major opportunity for market growth during the forecast period.

Data Center Networking Market Trends

Growing Adoption of Multi-Cloud and Hybrid Cloud Networking in Enterprises Boosts Market Growth

Enterprises are increasingly adopting multi-cloud and hybrid cloud strategies, requiring data center networks to integrate with multiple cloud service providers seamlessly. This trend calls for advanced networking solutions that can manage data flow between on-premises data centers, public clouds, and private clouds efficiently. Networking solutions that enable interoperability between various cloud environments and ensure high availability and secure data transfer are gaining prominence. Further, the rollout of 5G networks is driving the need for faster and more reliable data center networks. 5G enables higher data speeds and lower latency, which will increase the demand for network infrastructure that can support real-time applications, such as virtual reality (VR), autonomous driving, and IoT. These factors play a crucial role in fueling the market growth. For instance,

- In August 2022, VMware announced innovation in its networking and security portfolio. The company made advancements in its Project Northstar platform, which will help enterprises transform networking and security in a multi-cloud environment.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Component

Rising Adoption of Network Switches and Routers in Data Center Networks Fuels the Hardware Segment Growth

Based on component, the market is divided into hardware (application delivery controllers, servers, router, switches {ethernet, fiber channel, infiniBand}, and others), software (network management & monitoring software, network function virtualization, software defined networking, and others), and services.

Hardware captured the largest market share of 50.51% in 2026. Hardware devices, such as switches and routers, are the backbone of data center networks, enabling the routing of data between servers, storage systems, and external networks. Also, servers are the core hardware in a data center, processing data and running applications, while storage systems house vast amounts of data. Data centers are increasingly adopting high-performance computing (HPC) servers that support AI, ML, and real-time analytics.

Services are expected to grow at the highest CAGR in the coming years as data center networking becomes more complex. Consulting services that offer guidance on network infrastructure design, cloud integration, and security are in high demand. The need for expert guidance in navigating multi-cloud environments, AI workloads, and edge computing will drive continued growth in consulting services.

By Industry

Surge in Demand for Data Security and Regulatory Compliance in IT & Telecom Companies Propels Segment Growth

Based on industry, the market is categorized into IT & telecom, healthcare, retail, manufacturing, BFSI, government & defense, media & entertainment, and others (energy and education).

The IT & telecom segment captured the highest market share in 2024, as telecom companies handle vast amounts of sensitive data, including personal customer information. Secure data center networks are critical to ensuring the confidentiality, integrity, and availability of this data. Regulatory compliance, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), has driven the adoption of more secure data center networks that feature encryption, firewalls, and intrusion detection systems. The IT & telecom segment is projected to capture 20.02% of the market share in 2026.

The manufacturing segment is expected to grow at the highest CAGR of 16.50% during the forecast period. The manufacturing sector is increasingly adopting industrial automation powered by IoT devices, which generates enormous amounts of real-time data. The data center network helps connect these IoT devices and manage the flow of data amongst factory floors, cloud systems, and remote management platforms. This enables predictive maintenance, remote monitoring, and process optimization.

To know how our report can help streamline your business, Speak to Analyst

DATA CENTER NETWORKING MARKET REGIONAL OUTLOOK

North America

North America Data Center Networking Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America region held the largest market in 2026 with USD 14.08 billion. In 2025, the region dominated the market with USD 12.95 billion. North America holds the largest data center networking market share in 2024. Cloud adoption is one of the primary drivers of data center networking in the region. Companies across industries are migrating to cloud-based infrastructure to reduce costs, improve scalability, and enhance flexibility. The growth of public, private, and hybrid cloud environments has led to a demand for high-speed, low-latency data center networks that can support seamless connectivity between on-premise systems and cloud service providers. For instance,

- In November 2022, VMware, Inc. and Equinix, Inc. entered into a partnership. Through this collaboration, the company aims to provide multi-cloud and new digital infrastructure services across the globe.

These factors play a vital role in fueling the data center networking market growth in the region. The U.S. market size is estimated to be USD 9.93 billion in 2026.

The deployment of 5G networks in the U.S. is accelerating the need for edge computing to process data closer to end-users. Data center networking plays a critical role in ensuring efficient data traffic management between centralized data centers and edge locations. Further, telecom providers in the U.S. are investing heavily in edge data centers to support IoT applications, autonomous vehicles, and smart cities, which require real-time data processing and low-latency networks. For instance,

- In September 2024, Intel Corporation and Amazon Web Services, Inc. (AWS) expanded their partnership to develop custom chip designs. Also, AWS is aiming to invest USD 7.8 billion to enlarge its data center operations in the U.S.

Asia Pacific

Asia Pacific is the second-largest market, expected to show USD 13.04 billion in 2026 and grow at the second-highest CAGR of 17.90% during the forecast period. Asia Pacific is one of the fastest-growing markets for cloud services, with enterprises across China, India, Japan, and Southeast Asia adopting cloud-based services at larger scale. This drives demand for data center networking to support scalable and efficient data transfer. Governments in countries, such as Singapore, Japan, and South Korea are heavily investing in Information and Communication Technologies (ICT) infrastructure, fostering data center expansion and enhancing networking capabilities. Moreover, key players in the region are increasingly engaging in strategic partnerships to address the growing demand for data center networks across the region. For instance,

- In April 2024, Fujitsu collaborated with Oracle Corporation. Through this collaboration, the company aims to provide sovereign cloud and AI capabilities in Japan.

The market for China is estimated to be USD 2.97 billion in 2026. India’s market in 2026 is expected to be USD 2.16 billion and Japan is likely to stand at USD 2.65 billion in 2026.

South America

The adoption of data center networking solution is growing significantly in South America, this is due to growing cloud adoption across the region, especially in Brazil, Chile, and Argentina. Brazil, in particular, has become a key hub for data centers due to its large population and demand for digital services. Global cloud providers, including Microsoft, AWS, and Google, are expanding their presence in the region, leading to increased demand for advanced data center network solutions to ensure reliable and high-speed connectivity for cloud services. These factors play an important role in fueling the market growth in the region.

Europe

European market is expected to be USD 10.10 billion in 2026 as the third-largest market globally.

In Europe, the market is growing at a prominent pace. The region is witnessing a significant surge in cloud adoption as organizations shift workloads to the cloud. Edge computing is also gaining traction, enabling data centers to process data closer to the end-user, reducing latency. Further, the expansion of 5G networks is boosting demand for high-speed data center networking. This is driving the development of data centers capable of handling the increased data traffic resulting from 5G applications. For instance,

- In October 2024, Megaport, a Network as a Service (NaaS) provider, announced the launch of 14 new data center locations across the European Union. The company collaborated with Portus Data Centers, a data center operator, to expand its reach in Germany.

The market for U.K. is estimated to be USD 1.95 billion in 2026. Germany’s market in 2026 is expected to be USD 1.87 billion and France is likely to stand at USD 1.49 billion in 2025.

Middle East & Africa

The Middle East & Africa is expected to become the fourth-largest market with USD 4.43 billion in 2026, showcasing noteworthy growth during the forecast period. The GCC market is projected to hit USD 1.10 billion in 2025. Many MEA countries, particularly in the Gulf Cooperation Council (GCC), have ambitious “smart city” and digital economy initiatives, such as Saudi Arabia’s Vision 2030 and the UAE’s Smart Dubai program. These initiatives are pushing the development of advanced data center infrastructure to support AI, IoT, and other emerging technologies. Governments are also investing in local data centers to ensure compliance with data sovereignty regulations, which require sensitive data to be stored within national borders. For instance,

- In March 2023, VMware, Inc. launched its VMware Cloud service on AWS in Bahrain. This service will help customers in Bahrain shift their work to VMware cloud environments along with AWS services.

COMPETITIVE LANDSCAPE

Key Industry Players

Top Companies Concentrate on Acquisition and Partnership Tactics to Expand Their Analytics Services Globally

Key players are focusing on expanding their global geographical presence by presenting industry-specific services with strategically focusing on acquisitions and collaborations with regional players to maintain dominance across regions. They are launching new solutions to increase their consumer base. An increase in constant R&D investments for product innovations is enhancing market expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Key Companies Studied:

- Cisco Systems, Inc. (U.S.)

- Dell Inc. (U.S.)

- Intel Corporation (U.S.)

- Fujitsu (Japan)

- Equinix, Inc. (U.S.)

- VMware, Inc. (U.S.)

- ALE International (France)

- Juniper Networks, Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Hitachi Vantara LLC (China)

- NVIDIA Corporation (U.S.)

- Arrcus (U.S.)

- Arista Networks (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Epsilon Telecommunications Limited. (Singapore)

- Microsoft Corporation (U.S.)

- Larch Networks (Israel)

- Avaya, Inc. (U.S.)

- Extreme Networks Inc. (U.S.)

- Edgecore Networks (Taiwan)

…and more

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Equinix partners with Singapore's GIC and Canada's CPPIB to expand data center infrastructure across the U.S., reflecting the high demand for advanced data centers.

- October 2024: Celestica introduces high-performance switches optimized for AI and machine learning, targeting the needs of hyperscale and high-performance computing environments.

- September 2024: Ciena introduced high-bandwidth solutions designed for future data center networks, focusing on high-performance interconnect technologies.

- May 2024: Cisco Systems launched its Edge Data Center in Jakarta, Indonesia. Through this launch, the company aims to expand its cloud data center footprint in the country.

- December 2023: CoreSite introduced a 50Gbps multi-cloud networking capability, enhancing cloud connectivity for Oracle users in the U.S. markets.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market, such as Cisco Systems, Inc., VMware, Inc., Juniper Networks, Dell Inc., Equinix, Inc., and Fujitsu, are developing solutions that integrate seamlessly with multi-cloud environments, enabling enterprises to manage workloads across public, private, and hybrid clouds. For instance, Arista Networks focuses on cloud-scale networking with its EOS (Extensible Operating System) that provides unified cloud and data center network solutions. Moreover, with the growing concerns around cybersecurity, many players are incorporating advanced security features into their networking solutions. For example, Cisco integrates security into its data center offerings, emphasizing zero-trust frameworks and integrated threat protection. These factors are expected to create a lucrative opportunity for the market growth.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 12.53% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, Industry, and Region |

|

Segmentation |

By Component

By Industry

By Region

Rest of Asia Pacific |

|

Companies Profiled in the Report |

Cisco Systems, Inc. (U.S.), VMware, Inc. (U.S.), Juniper Networks (U.S.), Dell Inc. (U.S.), Equinix, Inc. (U.S.), Fujitsu (Japan), Intel Corporation (U.S.), ALE International (France), Hewlett Packard Enterprise Development LP (U.S.), and Hitachi Vantara LLC (China). |

Frequently Asked Questions

The market is projected to reach USD 114.08 billion by 2034.

In 2025, the market was valued at USD 39.52 billion.

The market is projected to grow at a CAGR of 12.53% during the forecast period.

By industry, IT & Telecom is expected to lead the market.

The proliferation of cloud computing in businesses drives market progress.

Cisco Systems, Inc., VMware, Inc., Juniper Networks, Dell Inc., Equinix, Inc., Fujitsu, Intel Corporation, ALE International, Hewlett Packard Enterprise Development LP, and Hitachi Vantara LLC are the top players in the market.

North America dominated the data center networking market with a market share of 32.76% in 2025.

By industry, manufacturing is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us