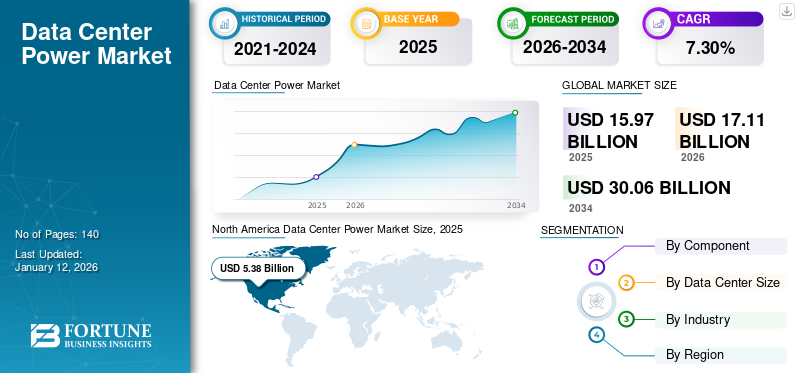

Data Center Power Market Size, Share & Industry Analysis, By Component (Solutions and Services), By Data Center Size (Small and Medium-sized Data Centers and Large Data Centers), By Industry (IT and Telecom, BFSI, Retail, Government, Healthcare, and Others), and Regional Forecast, 2026–2034

Data Center Power Market Size & Share

The global data center power market size was valued at USD 15.97 billion in 2025. and is projected to grow from USD 17.11 billion in 2026 to USD 30.06 billion by 2034, exhibiting a CAGR of 7.30% during the forecast period. North America dominated the global data center power market with a share of 33.70% in 2025.

The data center power term indicates the physical infrastructure that helps in providing and managing power in a data center. This infrastructure includes power distribution units, UPS, and generators, among others. These power solutions are used across several industry sectors, such as IT and telecom, BFSI, retail, and government.

The year 2022 had a notable impact on the data center power industry as the demand for data center cooling, power, and other physical infrastructure grew substantially due to rising digitalization, the need for effectively managing power consumption, and data storage needs. In recent years, the sector has shifted toward the trend of pre-assembling the data center components in facilities and then shipping them to sites to speed up the construction of data centers. This pre-assembling of equipment is due to the extended construction timelines of data centers, exacerbated by supply chain uncertainties. The trend is expected to continue in the coming years, further positively impacting the global data center power market growth.

The COVID-19 pandemic had a significant impact on the market due to the increasing demand and investments related to data center capacities. It also highlighted the need for adopting sustainable solutions, further prompting market players to incline toward sustainability focused solutions. The market players started implementing circular economy principles to reduce their carbon footprint. As per a GSMA study published in 2022, 5G network providers were aiming to focus more on minimizing their carbon footprint in the coming years. In the post-pandemic era, the market is expected to flourish owing to the increasing and consistent demand across the globe.

Download Free sample to learn more about this report.

IMPACT OF GENERATIVE AI

Need for Innovative Power Solutions for AI Processing Accelerates Market’s Trajectory

The recent AI boom has heavily impacted the data center power market by raising the need for new and highly efficient data centers. Companies operating in the data center infrastructure market have been developing innovative power solutions that cater to these increasing demands. Additionally, as per industry expert analysis, the industry has also witnessed a 27% increase in the AI data center demand in 2024 compared to 2023.

According to the recent developments in the industry, it has also been observed that in recent years, data center companies have been investing in new chip power. With the increasing gen AI applications, the need for specialized chips, GPU, or graphics processing units rises substantially. GPU helps in rendering graphics and images by performing fast mathematical calculations that are required in AI processing. For instance, NVIDIA reported that the company’s data center business showcased a revenue of over USD 18.4 billion in the fourth quarter, which ended on January 28, with significant contributions from the GPU business.

Thus, it is evident that generative AI has had a positive impact on the market in recent years and this effect is expected to continue in the coming years.

Data Center Power Market Trends

Rise in Renewable Energy Adoption to Boost Market Growth

The global data center power market trends include an increasing awareness of renewable energy solutions, businesses prioritizing hybrid cloud ecosystems, and increasing demand for sustainable data centers.

Several companies are working toward reducing their carbon footprint and achieving sustainability goals by adopting renewable energy solutions. However, most data centers cannot operate wholly from renewable energy sources alone. Thus, several market players are aiming to develop power solutions that cater to the end user’s specific requirements.

Additionally, the thriving edge computing market also proves to influence the global data center industry positively. The need for innovative power solutions that optimize customer experience is further bolstering market growth.

Furthermore, the rising demand for data storage is accelerating the need for green or sustainable data centers. According to Huawei, the demand for data centers is expected to increase by 3-10 times in the coming years. With this increasing demand, the need for energy efficient power solutions rises remarkably.

Data Center Power Market Growth Factors

Increase in Demand for Data Center Capacities to Drive the Global Data Center Power Ecosystem

Among the several driving factors of the market, the rising challenge of powering and cooling facilities with no downtime due to the higher need for resources within data centers to accommodate various data center operations has a substantial impact on the market. The chart below highlights the regions/cities that showcase the highest data center power capacity in 2022. (In megawatts) As per Cushman & Wakefield, Northern Virginia led the race for data center power capacity with 2,552 megawatts in 2022. Data center power capacity enhances the scalability allowing more extensive computing expertise.

Get comprehensive study about this report by, Download free sample copy

Moreover, the rise in amount of data from several sources, such as social media and streaming services is leading to the need for more extensive and more efficient data centers. The shift of companies toward adopting new-age technologies, such as artificial intelligence, 5G networks, and industries adopting digital transformation initiatives, is bolstering the need for data center infrastructure and power solutions to support evolving IT infrastructure, storage, and computational requirements. Thus, all the above factors positively influence and drive the global market’s trajectory.

RESTRAINING FACTORS

Implementation Complexity and Initial Infrastructural Costs of Data Center Power Solutions to Hinder Market Growth

Restraining factors in the global market include the complexity of power solutions for data centers, high energy, and initial infrastructural costs. Installation of newly improved power solutions into existing traditional data center infrastructure presents several complexities. These installations increase costs, which hinder market growth. However, the critical factor remains the energy costs associated with power solutions for data centers. As companies aim to attain their sustainability goals, the demand for energy-efficient power solutions grows substantially, posing setbacks to the existing power solutions.

Data Center Power Market Segmentation Analysis

By Component Analysis

Solution Segment Dominated due to Increase in Demand for Data Center Equipment and Physical Infrastructure

By component, the market is bifurcated into solutions and services. The solutions are further classified as power distribution units, UPS, generators, networking infrastructure, and others. The other solution types include switches and others.

In 2026, the solution segment dominated the market with a share of 13.16%, along with power distribution units. In recent years, the sales of data center cooling, power, and other physical infrastructure have grown substantially, mainly due to service providers expanding their worldwide data centers to cater to high demand, supply chain enhancements, and companies modernizing their on-premises data center infrastructure. Companies, such as Huawei, Legrand, and Eaton Corporation, have reported massive demand from end-users. This increasing demand also indicates that in the future, the demand for uninterrupted power supply will also grow. For instance,

- In July 2023, Fuji Electric introduced a new product with a single-unit capacity of 2,400 kVA by expanding the 7500WX Series of highly efficient uninterruptible power supply systems.

- In May 2022, Chennai’s data center's growing demand led to a rise in demand for Uninterruptible Power Supply (UPS) systems.

Both recent developments are considered to cater to the increasing demand for data center capacities.

In the coming years, the services segment is expected to cover the most substantial portion of the global data center power market share. The growing number of service providers, customer-specific services, and an effective service delivery model are expected to drive the service segment during the forecast period.

By Data Center Size Analysis

Small and Medium-Sized Data Centers Lead with Faster Data Center Construction and Efficient Customer Service

By data center size, the market is divided into small and medium-sized data centers and large data centers. In 2026, small and medium-sized data centers led the market with a share of 15.66%, owing to two primary factors: faster data center construction and efficient customer service.

Businesses are prioritizing data center capacity to promptly serve end-users, particularly for latency-sensitive digital services requiring distributed computing for enhanced analytics. This demand drives the need for edge data center capacity (as close to the end-user). Moreover, large data centers require large volumes of resources, appropriate site selection, construction differences, supply chain challenges, and many other factors that affect and delay the construction of large data centers. Thus, the data center industry is witnessing a massive demand for small-sized data centers, prompting an accelerated need for power solutions.

In the coming years, the adoption of power solutions for large data centers is expected to grow at the highest CAGR. This rise is due to several recently announced projects for the construction of large data centers that are expected to be completed in the coming years.

By Industry Analysis

IT and Telecom Sector’s Leading Position Fueled by Increasing Focus on Communications and Connectivity

By industry, the market is categorized into IT and telecom, BFSI, retail, government, healthcare, and others. The other industry types include education, energy & utilities, and others. The IT and telecom industry segment led the market in 2026 with a share of 7.01%. The IT and telecom sectors focus on communications and connectivity, further creating demand for cloud and edge computing services. Moreover, the shift toward a digital world, improved 5G connectivity, and generative AI capabilities are driving the need for data center capacities. This rising demand fuels the need for more extensive and energy-efficient hyperscale data centers. Besides, the industry also requires efficient analysis of large volumes of data, which can be facilitated through edge computing capabilities.

The retail segment is expected to grow with the highest CAGR during the forecast period. This growth is due to the rise in e-commerce operations that require a robust data center to support their IT infrastructure, improve operational capacities, and enhance customer experience.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Based on geography, the market is studied across five regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Data Center Power Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 5.38 billion in 2025 and USD 5.73 billion in 2026, attributed to the U.S. and Canada, which serve as prominent hubs for data centers. The chart below highlights the countries that were estimated to lead the data center market in 2023. According to the survey results, the United States market is projected to reach USD 4.01 billion by 2026.

Get comprehensive study about this report by, Download free sample copy

Moreover, the increase in data traffic, demand for cloud services, presence of key market players, and increasing inclination of businesses toward sustainability goals are driving the regional market.

In the coming years, the Asia Pacific is expected to grow with the highest CAGR owing to the growing economies across the region. To follow this country, the Japan market is projected to reach USD 0.93 billion by 2026, the China market is projected to reach USD 1.03 billion by 2026, and the India market is projected to reach USD 0.51 billion by 2026. The expanding data center industry is further bolstering the regional market. For instance,

- May 2023: CyrusOne completed its strategic collaboration with Kansai Electric Power Company with the aim of developing data centers in Japan. With this, the firm would reach its objective of attaining a business scale of 900 MW. The initiative focuses on developing new data centers that are primarily custom-made to meet the needs of hyperscale platform businesses.

Europe is expected to showcase a robust growth rate owing to the inclination of businesses to attain sustainability goals. As per industry expert analysis, in the coming years, the region’s data center power demand is expected to rise to around 50%, owing to the expansion of data centers and acceleration of electrification. The regional market governance will be across two types of countries: first, that has an abundance of power resources, and second, that has financial and tech expertise. The first category includes Spain, France, and others, while the second type includes the U.K., Germany, and other countries. The United Kingdom market is projected to reach USD 1.04 billion by 2026, while the Germany market is projected to reach USD 1.14 billion by 2026.

Furthermore, South America and the Middle East & Africa regions are expected to showcase a slower growth rate compared to other areas. This slower pace of growth is due to the lack of appropriate infrastructure, geopolitical instability, and limited technological expertise. However, an inclination of colossal market players to expand their data center infrastructures is expected to speed up growth trajectories in the region.

List of Key Companies in the Data Center Power Market

Key Players are Developing Enhanced Data Center Power Solutions to Cater to the Rising Data Center Demand

Key market players in the market are strategically investing in improving their data center infrastructure solutions to meet the increasing demand. These players also focus on key business strategies, such as strategic collaborations, relevant acquisitions, and innovative partnerships, among others. With end-users increasingly focused on securing their sustainability goals, market players are majorly prioritizing providing solutions tailored to these specific demands.

LIST OF KEY COMPANIES PROFILED:

- Schneider Electric (France)

- Eaton Corporation (Ireland)

- ABB (Switzerland)

- Vertiv Group Corp. (U.S.)

- Siemens (Germany)

- Legrand (France)

- Generac Power Systems, Inc. (U.S.)

- Delta Power Solutions (China)

- Rittal GmbH & Co. KG (Germany)

- Cummins Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Atman, a Polish-based data center operator, secured over USD 345 million with the intent to help its further developments in Poland.

- April 2024: Nucor Corporation completed the strategic acquisition of Southwest Data Products, Inc., which specializes in providing data center infrastructure. With this, the company also introduces a new business unit, Nucor Data Systems, with the aim of better serving its end-users in the data center infrastructure ecosystem.

- February 2024: Edged Energy introduced four data center capacities in the U.S., which would house highly-density AI workloads. Besides, these facilities will be equipped with ultra-efficient energy and cutting-edge waterless cooling systems.

- November 2023: Schneider Electric entered into an agreement with Compass Datacenters at its Capital Markets Day meeting. The agreement was a USD 3 billion multi-year agreement that expanded both the business's existing partnership and promised advancements in modular data center solutions. Schneider has already provided the company with prefabricated data center power rooms.

- November 2023: Siemens disclosed plans to construct a USD 150 million site in Texas to develop electrical infrastructure for data centers. With this, the company aimed to provide efficient electrical equipment amidst the flourishing data centers industry. The investment forms a larger USD 500 million investment in the U.S., expected to create 1,700 jobs.

REPORT COVERAGE

An Infographic Representation of Data Center Power Market

To get information on various segments, share your queries with us

The report offers readers an overview of the market, focusing on factors that directly and indirectly affect the growth of the global market. Key considerations for gauging the impact include key market players, their flagship product and service types, and their use cases. In addition, the report highlights the recent market trends and primary industry engagements.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Data Center Size

By Industry

By Region

|

Frequently Asked Questions

The data center power market is projected to reach USD 30.06 billion by 2034.

In 2025, the market was valued at USD 15.97 billion.

The market is projected to grow at a CAGR of 7.30% during the forecast period.

The IT and telecom industry segment led the market in 2025.

An increase in demand for data center capacity is a key factor driving the global data center power ecosystem.

Schneider Electric, Eaton Corporation, ABB, Vertiv Group Corp., Siemens, Legrand, Generac Power Systems, Inc., Delta Power Solutions, Rittal GmbH & Co. KG, and Cummins Inc. are the top players in the market.

North America held the highest market share in 2025.

The retail industry is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic