Dental 3D Printer Market Size, Share & Industry Analysis, By Type (In-office and In-lab), By Technology (Stereolithography (SLA), Digital Light Processing (DLP), Liquid Crystal Display (LCD), and Others), By Application (Implantology, Orthodontics, Prosthodontics, and Others), By End-user (Dental Clinics, Dental Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

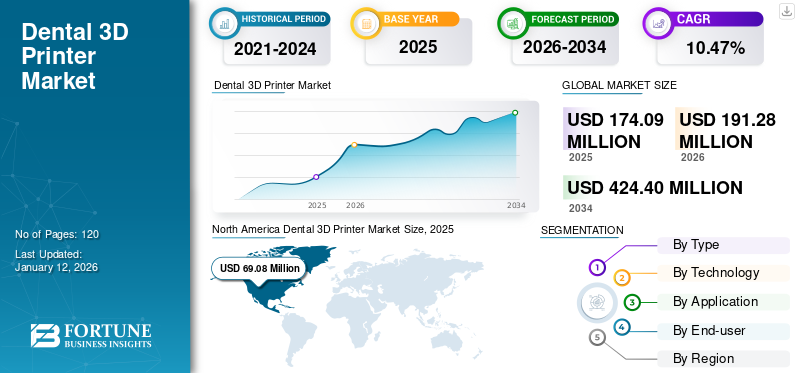

The global dental 3D printer market size was USD 174.1 million in 2025. The market is projected to grow from USD 191.28 million in 2026 to USD 424.4 million by 2034, exhibiting a CAGR of 10.47% during the forecast period. North America dominated the dental 3d printer market with a market share of 39.68% in 2025.

A dental 3D printer is a specialized dentistry device used to fabricate various dental appliances, prosthetics, and models with precision and efficiency. Unlike traditional methods, which often involve manual labor and multiple steps, these printers utilize additive manufacturing technologies to build objects layer by layer from scans. These printers can produce highly accurate and customized dental implants, crowns, bridges, and orthodontic devices tailored to each patient's unique needs. They offer dentists and dental technicians greater flexibility, speed, and control in the production of dental restorations, ultimately improving patient outcomes and reducing the production time.

The global market is driven by various factors, such as advancements in various technologies, such as improved printing speed and accuracy, which enhance the efficiency of dental procedures. Additionally, the rising prevalence of dental disorders and the aging population create a higher demand for dental restorations, driving market growth. Moreover, the cost-effectiveness and time efficiency offered by 3D printing compared to traditional methods further propels the market expansion. Moreover, the ongoing research and development efforts continue to lead to innovation and the expansion of the capabilities of 3D printers, stimulating market growth.

The COVID-19 pandemic greatly affected the sales of these printers. In 2020, the market experienced disruptions due to lockdowns, supply chain disruptions, and reduced patient visits to dental clinics. However, the pandemic also accelerated the adoption of digital dentistry, which included 3D printing, as dental professionals sought to minimize physical contact and enhance efficiency. Additionally, the growing awareness of infection control measures further fueled the demand for in-house 3D printing solutions, driving the market growth amid the pandemic.

Dental 3D Printer Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 174.1 million

- 2026 Market Size: USD 191.28 million

- 2034 Forecast Market Size: USD 424.4 million

- CAGR: 10.47% from 2026–2034

Market Share:

- North America dominated the dental 3D printer market in 2025, accounting for 39.68% of the global market share. This dominance is driven by the high concentration of dental laboratories and clinics, favorable reimbursement scenarios, and rapid integration of digital dentistry technologies. Additionally, increasing adoption of advanced dental technologies and a strong presence of key players such as 3D Systems and Formlabs contribute to regional leadership.

- By type, the in-lab segment is projected to maintain the largest market share in 2026, owing to its ability to produce complex dental prosthetics with high accuracy and volume. These printers are favored by dental laboratories for their performance, scalability, and professional-grade reliability, which are essential for handling large patient volumes and diverse restorative requirements.

Key Country Highlights:

- Japan: Market growth is supported by the country's strong innovation ecosystem and presence of leading manufacturers such as Roland DG Corporation. Increasing demand for high-quality dental restorations and the widespread use of advanced technologies, including stereolithography and digital light processing, are fueling adoption.

- United States: Growth is driven by the early adoption of in-office 3D printing, favorable dental insurance coverage, and demand for personalized dental solutions. According to the Journal of the American Dental Association (2022), 17% of U.S. dentists already use 3D printers, with a notable increase in adoption over the past two years.

- China: The market is expanding rapidly due to rising dental care awareness, a large aging population, and increasing disposable incomes. Government support for domestic innovation and manufacturing, along with the presence of key players like UnionTech, is accelerating the uptake of dental 3D printing across major cities.

- Europe: The region ranks second globally in terms of market share, supported by strong regulatory frameworks, growing demand for cosmetic dentistry, and the presence of well-established dental clinics and labs. Countries like Germany, France, and the U.K. are leading adopters of digital dentistry tools, boosting the demand for advanced 3D printing systems.

Dental 3D Printer Market Trends

Increasing Adoption of In-Office Printers in Dental Clinics

In recent years, the market has seen the increased adoption of in-office or chairside 3D dental printers among dental professionals. These 3D printing techniques involve the integration of 3D printers directly within the dental practices, enabling dentists to produce a wide range of dental restorations, such as crowns, bridges, and orthodontic appliances, in-house and on the same day as the patient's visit.

Digital printers have various benefits associated with them, such as their ability to drastically reduce the turnaround times for dental restorations, offering patients the convenience of same-day treatment, and eliminating the need for multiple appointments. Furthermore, it empowers dentists with greater control over the entire treatment process, from digital scan to the final fabrication, resulting in enhanced treatment outcomes and patient satisfaction. The development and introduction of more user-friendly 3D printers for chairside applications have increased the transition of dental consumable manufacturing from laboratory to clinic.

- For instance, in May 2024, UnionTech showcased its latest E128 and E230 desktop chairside dental 3D printers in the National Exhibition Centre in Birmingham.

Additionally, the availability of chairside 3D printing eliminates the reliance on external dental laboratories, reducing costs and streamlining workflow inefficiencies. The emerging dependency on the manufacturing of restorative solutions within dental clinics has increased the adoption of these printers among solo practices or group practices. Hence, this is identified as a key global dental 3D printer market trend.

- North America witnessed a growth from USD 69.08 Million in 2025 to USD 76.06 Million in 2026.

Download Free sample to learn more about this report.

Dental 3D Printer Market Growth Factors

Technological Advancements in Dental 3D Printers Propel Market Growth

Dental 3D printers are being continually enhanced with improved capabilities, precision, and efficiency, addressing the evolving needs of dental professionals and patients.

These advancements encompass various aspects, such as the development of printers with higher resolutions, faster printing speeds, and larger build volumes, enabling the production of more intricate and larger-scale dental restorations.

Furthermore, the ability to print with multiple materials simultaneously is another advancement. This capability allows for the creation of complex dental structures with varying properties, such as the combination of rigid materials for structural support with flexible materials for a comfortable fit and function. Multi-material printing enables the fabrication of highly customized dental solutions that closely mimic natural teeth and tissues.

- For instance, Stratasys, a prominent company in the market, has a product offering called the J5 DentaJet in its 3D printer portfolio. The printer is a versatile and powerful 3D printer capable of printing 5 materials simultaneously. It is designed with a large capacity print tray and full-color printing capabilities. The printer produces a mixed tray of biocompatible applications, realistic full-color dental models, or a monolithic denture.

Additionally, the ongoing research and development efforts for the innovation and introduction of novel dental 3D printing are expected to provide an opportunity for growth in the future. As a result, the market is expected to continue its growth, driven by innovation and the growing demand for superior dental care solutions.

Emergence of Demand for Cosmetic Dentistry and Preventive Dental Care to Augment Market Growth

The increasing number of cosmetic dentistry and preventive dental care procedures is poised to drive a surge in the demand for 3D printers within the dental industry. This desire for personalized, aesthetically pleasing dental solutions, and a growing emphasis on preventive measures to maintain oral health is augmenting the market growth.

The field of cosmetic dentistry encompasses procedures aimed at the enhancement of the appearance of the teeth, such as veneers, crowns, and orthodontic treatments, such as clear aligners. With the utilization of 3D printing technology, dental professionals can produce highly precise and customized dental prosthetics and appliances tailored to each patient's unique dental anatomy. This customization improves treatment outcomes and enhances patient satisfaction, thereby propelling the adoption of these printers among dental laboratory technicians.

- For instance, according to a study published by Dentistry.co.uk in July 2023, one-third of individuals under the age of 35 have had a cosmetic dental procedure or treatment in the last 12 months in 2023.

Additionally, the rise in preventive dental care, including routine check-ups, cleanings, and early interventions, is driving the need for efficient and cost-effective dental solutions. 3D printers enable the rapid production of dental models, surgical guides, and orthodontic appliances, streamlining the workflow and enabling dentists to offer timely preventive care to their patients.

As the demand for cosmetic dentistry and preventive dental care continues to escalate, the adoption of 3D printers is expected to boost the global dental 3D printer market growth during the forecast period.

RESTRAINING FACTORS

High Initial Investment Costs is Significant Barrier to Widespread Adoption of 3D Printers in Dental Clinics

The high initial investment costs associated with 3D printers used in dentistry are anticipated to be a significant limiting factor for their widespread adoption within the dental industry. The substantial upfront expenses required for the procurement of the 3D printing equipment, along with the necessary software and materials, can pose a formidable barrier for many dental practices, particularly the smaller ones or those with limited financial resources.

These printers often come with a high average selling cost due to their sophisticated technology, precision capabilities, and specialized features tailored for various dental applications. Moreover, the investment extends beyond just acquiring the equipment, as ongoing maintenance, software updates, and material replenishment add to the overall cost of the ownership.

Furthermore, the dental professionals' integration of the in-office printers into their practice might cause financial imbalance, especially if they are uncertain about the return on their significant investment or the volume of cases that would justify the expenditure. Consequently, this financial barrier could impede the widespread adoption of these printers, limiting their availability primarily to larger practices or institutions with greater financial means.

Dental 3D Printer Market Segmentation Analysis

By Type Analysis

In-Lab Segment Held a Dominant Market Share Due to High Performance and Reliability

Based on the type, the market is segmented into in-office and in-lab.

The in-lab segment dominated the market with a share of 83.56% in 2026 and is expected to grow at a significant CAGR during the forecast period. These printers are typically larger and more robust and can handle a wide range of materials, and produce complex dental prosthetics with high precision. Dental laboratories often require printers with the capacity to handle large volumes of cases efficiently, making these in-lab printers indispensable for meeting the demands. Additionally, these printers offer professional-grade performance and reliability, ensuring consistent and accurate results for various dental applications, thereby propelling segmental growth.

The in-office segment holds a significant global dental 3D printer market share. The segment growth is due to their ability to offer streamlined workflows, enhanced patient experiences, and cost-effective solutions. Furthermore, in-office printers empower dental practices to maintain control over quality, confidentiality, and costs, making them an appealing choice for many dentists seeking to integrate advanced technology into their practices.

By Technology Analysis

Digital Light Processing (DLP) Segment Dominates Market Owing to Growing Orthodontic Procedures

Based on the technology, the market is segmented into stereolithography (SLA), digital light processing (DLP), liquid crystal display (LCD), and others.

The digital light processing (DLP) segment dominates the market due to its superior speed and precision, accounting for a 37.75% market share in 2026. DLP offers faster print speeds, allowing dental laboratories to increase productivity and meet the high patient demand efficiently. Additionally, DLP printers often come at a lower initial investment cost, making them more accessible to a wide range of dental professionals and practices. Furthermore, the growing number of implant procedures across the globe is expected to increase the adoption of these technologies to provide precise aligners, thereby boosting segmental growth.

- For instance, according to the annual report published by Institut Straumann AG in 2020, more than 200 per 10,000 adults were implanted annually in Spain.

The stereolithography (SLA) segment holds a significant share of the market due to its ability to produce durable, high-quality dental prosthetics with a wide range of materials. This technology enables the production of dental prosthetics with superior strength, accuracy, and biocompatibility, making SLA an attractive option for the production of long-lasting dental solutions.

Other segments include selective laser sintering (SLS) technology, liquid crystal display (LCD) technology , and polyjet technology.

- The stereolithography (SLA) segment is expected to hold a 37.5% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Orthodontic Segment Held Dominant Market Share Due to Growing Adoption of 3D Clear Aligners

Based on the application, the market is segmented into implantology, prosthodontics, orthodontics, and others.

The orthodontics segment dominated the market with a share of 47.01% in 2026 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to the technology's capacity to produce customized aligners, braces, and retainers with exceptional precision and patient-specific fit. This capability enhances treatment efficiency and outcomes, meeting the growing global demand for aesthetic, comfortable, and effective orthodontic solutions. Additionally, the dental service providers' focus on incorporating 3D printing technologies to improve patient outcomes is being witnessed across the globe.

- For instance, in March 2023, Smile Health Orthodontics (SHO) initiated the offerings of 3D printed LightForce ceramic braces, 3D printed clear aligners, and other treatment solutions. Moreover, there has been an increase in funding initiatives for 3D printing across the market.

The implantology segment holds a significant market share. The segment growth is due to the printer's ability to create complex geometries and biocompatible materials that ensure optimal implant fit and longevity, making it indispensable globally in modern implant dentistry practices.

The prosthodontics segment is anticipated to grow at the highest CAGR over the forecast period due to the increased demand for advanced dental prosthetics.

The others segment include surgical guides and mouth guides. The segmental growth is due to the increasing number of oral surgeries that require advanced guidance.

By End-user Analysis

Dental Laboratories Dominated the Market Due to Their Expertise in Crafting Custom Dental Products

Based on the end-user, the global market is segmented into dental clinics, dental laboratories, and others.

In 2026, the dental laboratories segment held the highest share of the global market, accounting for an 83.56% market share. The segmental growth is attributed to dental laboratories' expertise in crafting custom dental products. This has increased the demand for 3D printers to provide precise dental products.

- For instance, in August 2023, Stratasys announced that its professional-grade, multi-material DentaJet 3D printer series is gaining traction amongst dental laboratory technicians. Moreover, many dental labs across the globe, including in key countries such as the U.S. and Germany, have recently adopted DentaJet 3D printers.

Furthermore, the demand for personalized dental prosthetics, such as crowns, bridges, and aligners, has surged, driving the need for efficient production methods offered by 3D printers. Additionally, dental labs often have the resources to invest in advanced equipment, staying ahead of the curve in technological innovation, which is expected to increase the adoption of these printers, thereby propelling their segmental growth.

The dental clinics segment is expected to grow at the highest CAGR during the forecast period. The segmental growth is due to the growing trend toward in-house production, which enables clinics to offer quicker turnaround times for patients, enhancing patient satisfaction. Furthermore, integrating 3D printing technology into clinics streamlines the workflow, reducing reliance on external laboratories and cutting costs in the long run.

The others segment include hospitals, military hospitals, long-term care facilities, and academic research & institutes.

REGIONAL INSIGHTS

Based on the region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Dental 3D Printer Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a revenue of USD 69.08 million in 2025 and is expected to continue its dominance during the forecast period. The region has a large number of dental healthcare facilities, including dental laboratories and clinics, creating a substantial market for such systems. Moreover, the favorable reimbursement policies, strong research and development activities, and increasing awareness about digital dentistry's benefits further contribute to the dominance of the region in the market. The U.S. market is projected to reach USD 71.14 billion by 2026.

- According to a 2022 survey by the Journal of the American Dental Association (JADA), 17% of respondents currently use a 3D printer, and 67% have used it for two years or less.

Europe

Europe held the second-highest market share in 2025 and is anticipated to expand at a moderate growth rate during the forecast timeframe. The regional growth is due to growing digital dentistry and the increasing demand for personalized dental solutions. Additionally, a strong network of dental clinics and laboratories across Europe facilitates the integration of 3D printing into dental practices. The UK market is projected to reach USD 7.89 billion by 2026, while the Germany market is projected to reach USD 16.1 billion by 2026.

Asia Pacific

On the other hand, Asia Pacific is projected to expand at the highest CAGR during the forecast period. The market growth across the region is attributed to the large population with a growing demand for dental care, including implant procedures. The Japan market is projected to reach USD 9.94 billion by 2026, the China market is projected to reach USD 11.59 billion by 2026, and the India market is projected to reach USD 5.23 billion by 2026. Additionally, the presence of leading manufacturers in prominent countries, such as Japan and South Korea, ensures access to cutting-edge 3D printing technology.

- For instance, in March 2024, UnionTech, a prominent company in stereolithography, made a significant appearance with its new fully automated 3D printer, EvoDent D300, at Dental South China.

Latin America and Middle East & Africa

The market in the Latin America and Middle East & Africa regions is expected to expand at a comparatively lower CAGR during the forecast timeframe. The growth is attributed to the region's rising healthcare expenditure and growing awareness about oral health and aesthetics, which drives the demand for advanced dental instruments, such as 3D printers. Additionally, the government initiatives aimed at improving the healthcare infrastructure and technological innovation further contribute to the adoption of 3D dental printers in Latin America, the Middle East & Africa, solidifying their positions in the market.

KEY INDUSTRY PLAYERS

Stratasys, 3D Systems, Inc., and Formlabs with Advanced Printers to Maintain the Market Position

The market is consolidated due to the presence of prominent key players, such as Stratasys and 3D Systems, Inc., with significant market share. These companies provide a comprehensive range of 3D printers for the dental industry with a vast application of these devices. Furthermore, these printer manufacturers are continuously focusing on extensive research and development to introduce advanced dental 3D printer brands, and strong distribution channels contribute to their dominance in the market. Furthermore, Formlabs is one of the leading players in the market, as it offers robust, user-friendly machines that deliver high precision and reliability. Its extensive range of biocompatible materials and intuitive software integration support seamless workflows for dental professionals, ensuring superior quality and efficiency in producing customized dental prosthetics and models.

Other companies such as Dentsply Sirona, Amann Girrbach AG, Asiga, DWS - VAT, and others held substantial market shares due to high demand in their domestic countries. Furthermore, the focus of these companies on increasing their presence in developed countries by introducing their products in those countries is expected to increase their share in the market.

List of Top Dental 3D Printer Companies:

- Asiga (Australia)

- Stratasys (Israel)

- Prodways (France)

- Formlabs (U.S.)

- 3D Systems, Inc. ( U.S.)

- Dentsply Sirona (U.S.)

- Amann Girrbach AG (Germany)

- DWS S.r.l. (Italy)

- Roland DG Corporation (Japan)

- Desktop Metal, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2024 – SprintRay launched its Pro 2 line of desktop 3D printing systems alongside two new resins from the company's BioMaterial Innovation Lab.

- November 2023 - B9Creations announced the release of its new 3D printers for dentistry and materials, dubbed B9 Dent XL 3D printer.

- March 2023 - 3D Systems announced a new 3D printer platform and brand new materials to enhance its dentistry portfolio.

- September 2022 - Nexa3D announced the availability of its new professional series upgrade for its NXD 200 dental 3D printer.

- December 2021 - Stratasys introduced a Stratasys dental 3D printer, known as Origin One Dental, to its portfolio of 3D printing solutions for the dental industry.

REPORT COVERAGE

The global dental 3D printer market analysis provides a detailed overview of the market and focuses on the market dynamics, such as drivers, restraints, opportunities, and trends. The various key insights provided in the market report are the new product launches and key industry developments such as partnerships, mergers, and acquisitions. Furthermore, the report also includes the dental workforce in key countries and the prevalence of key oral diseases in key countries. In addition to the aforementioned factors, the report encompasses the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Growth Rate |

CAGR of 10.47% from 2026-2034 |

|

Segmentation |

By Type

|

|

By Technology

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 174.09 million in 2025 and is projected to reach USD 424.4 million by 2034.

In 2025, the North American market stood at USD 69.08 million.

The market is expected to exhibit a CAGR of 10.47% during the forecast period.

The in-lab segment is projected leads the market by application.

North America dominated the dental 3d printer market with a market share of 39.68% in 2025.

The rising prevalence of dental disorders, the growing digital dentistry among dentists in developed countries, and the increasing number of 3D printers for dental models are expected to drive market growth.

Stratasys, 3D Systems, Inc., and Formlabs are the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us