Dental Consumables Market Size, Share & Industry Analysis, By Product Type (Dental Restoration Products [Dental Implants {Endosteal Implants, Subperiosteal Implants, and Transosteal Implants} and Dental Prosthetics {Crowns, Bridges, Abutments, Dentures, and Others}], Orthodontics [Clear Aligners, Conventional Braces, and Others], Endodontics, and Others), By End-user (Solo Practices, DSO/ Group Practices, and Others), and Regional Forecast, 2026-2034

Dental Consumables Market Size

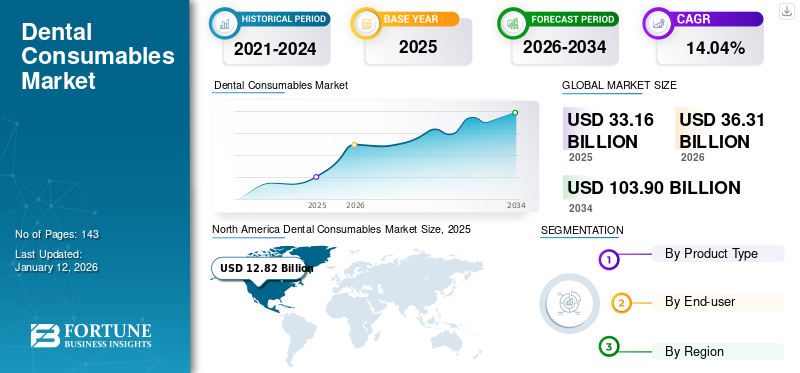

The global dental consumables market size was valued at USD 33.16 billion in 2025. The market is projected to grow from USD 36.31 billion in 2026 to USD 103.9 billion by 2034, exhibiting a CAGR of 14.04% during the forecast period. North America dominated the dental consumables market with a market share of 38.67% in 2025.

Dental consumables refer to the various instruments, chemicals, materials, and other products that are of a single-time use. Products such as clear aligners, implants, dental prosthetics, whitening products, and others are the types of dental consumables available in the market. Factors such as the increasing number of various dental treatments conducted across the world, such as prosthodontics, have exponentially increased the demand for these consumables. Moreover, the growing awareness about dental hygiene and the increasing rate of dental diseases is expected to increase the adoption of these consumables during the forecast period.

- For instance, according to the 2022 Global Oral Health Status Report published by the World Health Organization (WHO), around 3.5 billion people worldwide suffer from oral diseases.

Additionally, the introduction of various consumables in the market to meet the need of the growing demand for these products due to the increasing number of dental procedures is fostering market development. In addition, increasing usage of dental implants and other prosthetic procedures for aesthetic dentistry are also some of the factors responsible for the market growth.

The COVID-19 pandemic had a negative impact on the market, due to the temporary halt in dental procedures and the complete shutdown of the dental clinics for half a year in 2020. Furthermore, various prominent companies operating in the market were also impacted by a decline in their revenues in 2020. Moreover, the market recovered in 2021 due to the resumption of dental services along with the increase in the number of patient volumes.

Dental Consumables Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 33.16 billion

- 2026 Market Size: USD 36.31 billion

- 2034 Forecast Market Size: USD 103.9 billion

- CAGR: 14.04% from 2025–2032

Market Share:

- Regional Leadership: North America dominated the global dental consumables market with a 38.67% share in 2025, driven by robust healthcare infrastructure, increasing adoption of advanced dental technologies, and favorable reimbursement policies. The presence of key industry players such as Henry Schein, Dentsply Sirona, and Envista further reinforces the region’s dominance.

- By Product Type: Dental Restoration Products held the largest market share in 2024. This segment includes dental implants and prosthetics such as crowns, bridges, and dentures. Growth is supported by the increasing prevalence of tooth loss, rising demand for cosmetic dental procedures, and technological advancements enhancing the durability and aesthetics of these products.

Key Country Highlights:

- Japan: Japan is experiencing rising demand for advanced dental solutions due to a large geriatric population and widespread awareness of dental hygiene. Government initiatives supporting oral health and technological integration in dental care (such as CAD/CAM and 3D printing) are driving market growth.

- United States: The U.S. market is benefiting from strong investments in research and development, advanced dental practice infrastructure, and frequent product launches. Regulatory approvals like the FDA greenlight for new products (e.g., RevBio’s Tetranite in 2023) continue to support market expansion.

- China: China is witnessing rapid growth due to increasing disposable income, expanding dental tourism, and government-led healthcare reforms. Collaborations like Straumann’s exclusive partnership with Tianjin ZhengLi in distributing clear aligners are further propelling the Chinese dental consumables market.

- Europe: Growth in Europe is fueled by increasing public awareness of oral hygiene, supportive dental care policies, and the presence of advanced dental practices. Countries like Germany and the U.K. are leading adopters of innovative consumables such as clear aligners and CAD/CAM-enabled prosthetics.

Dental Consumables Market Trends

Integration of Latest Dental Technologies to Augment Development of Innovative Consumables

In recent years, companies operating in the market have increased their focus on integrating novel technologies, such as 3D printing and CAD/CAM systems, for the efficient production of dental consumables. These technologies allow for the precise customization of dental prosthetics, such as crowns, bridges, and dentures, enhancing both their functionality and aesthetic appeal.

Furthermore, 3D printing technologies can produce cost-effective dental implants, splints, and surgical guides. Hence, these companies are increasingly focusing on raising funds for the development and introduction of ingenious 3D-printed implants and prosthetic solutions through the utilization of 3D printing technology.

- For instance, in August 2023, LightForce Orthodontics secured USD 80.0 million in a series D funding round. This funding round aimed to advance the development of 3D-printed orthodontic brackets for personalized care.

The adoption of these advanced technologies streamlines dental procedures and boosts their efficiency in dental practices. Hence, the integration of these innovative technologies is identified as a significant global dental consumables market trend.

- North America witnessed a growth from USD 10.82 Billion in 2023 to USD 11.74 Billion in 2024.

Download Free sample to learn more about this report.

Dental Consumables Market Growth Factors

Growing Cases of Dental Disorders Coupled with Rising Awareness to Propel Market Growth

Increasing cases of various dental disorders, such as tooth decay, periodontal disease, and partial or complete edentulism, amongst others, have increased the adoption of a wide range of consumables, including restorative solutions.

- According to the WHO 2022 data, the global prevalence of severe periodontal disease is about 19% in people aged more than 15 years, which is approximately more than 1.00 billion across the globe.

Furthermore, various organizations are introducing programs and campaigns in order to raise awareness among the patient population that is suffering from any kind of oral disease. In September 2022, the FDI World Dental Federation launched the World Oral Health Day campaign, “Be Proud of Your Mouth,” to create awareness regarding oral health and encourage the population to adopt treatment for oral disorders. Moreover, the expanding dental tourism and advancements in technologies for efficient dental treatments further stimulate the global dental consumables market growth.

Growing Focus of Market Players to Introduce New Products to Boost Market Growth

The increasing incidence of oral disorders has stimulated the focus of companies to develop and launch innovative products to cater to the demands of the patient population. The introduction of advanced dental materials, such as ceramics and biocompatible polymers, enhances the durability and aesthetic appeal of dental restorations, such as crowns and veneers. Additionally, innovations in digital dentistry, including CAD/CAM systems, enable the precise and efficient manufacturing of dental prosthetics, which contributes to market expansion.

Furthermore, the surge in the number of minimally invasive procedures and demand for cosmetic dentistry drives the market for consumables, such as dental implants and orthodontics.

- For instance, in April 2022, Neodent introduced the “Zi”, a dental implant system. The implant has properties such as flexibility, aesthetics, stability, and made-up zirconium.

RESTRAINING FACTORS

Increasing Product Recalls to Hinder Market Growth

Increasing product recalls pose a significant threat to various companies’ brand presence and growth in the global market. Product recalls can occur for various reasons, such as defects in the design, manufacturing flaws, or safety concerns identified after the products have been distributed. These incidents tarnish the reputation of the brands involved and erode consumer trust and confidence.

- For instance, in December 2022, the U.S. FDA issued a class III recall for Denticator PICK-A-DENT, a periodontal kit. The manufacturer recalled the product because it was mislabeled.

Additionally, such product recalls can significantly disrupt the patient care and treatment plans, leading to inconvenience and harm to patients. Such issues related to product recalls are expected to limit market growth during the forecast period. Also, the high cost of dental treatments may be a deterrent to market growth, as these procedures are not often adequately reimbursed. This may lead to a limited adoption of these products in the forecast period.

Dental Consumables Market Segmentation Analysis

By Product Type Analysis

Increasing Cases of Tooth Loss Bolstered Dental Restoration Products Segment Growth

Based on product type, the market is segmented into dental restoration products, orthodontics, endodontics, and others. The dental restoration products segment is further sub-segmented into dental implants {endosteal implants, subperiosteal implants, and transosteal implants}, and dental prosthetics {crowns, bridges, abutments, dentures, and others}.

The dental restoration products segment held the largest global dental consumables market share of 40.54% in 2026. The robust demand for these product offerings, such as restorative materials, is driven by the geriatric population needing dental replacements and technological advancements enhancing these products’ durability and aesthetics. Additionally, the increasing focus on preventive and cosmetic dentistry further boosts their global market share. Furthermore, the growing prevalence of tooth loss across the globe is expected to increase the adoption of restoration products, such as crowns, bridges, and dentures.

- For instance, according to the WHO 2022 report, the prevalence of tooth loss has increased to 23.0% for adults aged 60 years and above.

The orthodontics segment is further sub-segmented into conventional braces, clear aligners, and others. It is expected to grow at the highest CAGR during the forecast period. The segmental growth is due to increasing awareness of dental aesthetics, advancements in orthodontic technologies, such as clear aligners, and growing adoption of orthodontic treatment options for both adults and children.

In 2024, the endodontics segment accounted for a substantial market share. The segmental growth in the forecast period is expected to be driven by the growing number of root canal treatments amongst patients suffering from dental caries. Furthermore, technological advancements in endodontic instruments and materials also contribute, enhancing treatment outcomes and patient comfort, thereby propelling the segmental growth.

- The Dental Restoration Products segment is expected to hold a 42.9% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Segment Dominated Market Due to Robust Preference of Personalized Care

On the basis of end-user, the market is segmented into solo practices, DSO/ group practices, and others.

The solo practices segment dominated the market share 55.86% globally in 2026. This segment’s growth is due to the growing number of dentists globally, which has increased the adoption of restorative solutions. Furthermore, the solo practices tend to prioritize personalized patient care, necessitating the adoption of high-quality and specialized consumables, which is expected to increase the segment’s growth during the forecast period.

The DSO/group practices segment is expected to grow at the fastest CAGR during the forecast period. There is a shift in terms of dentists joining group dental practices from individual/solo practices for the provision of better prosthetic treatments, as these organizations are equipped with better dental equipment. Furthermore, these groups often invest in advanced equipment and digital solutions, improving patient care outcomes and operational efficiency. Additionally, the increasing collaborations and partnerships between the group practices and manufacturers for the support of dentists are also propelling the segment’s growth.

- For instance, in July 2022, Envista extended its commercial partnership with dentalcorp offer high-quality care to people suffering from any kind of dental disease.

The others segment includes hospitals, academic research institutes, long-term care facilities, dental laboratories, and milling centers. The segmental growth is due to the increasing number of restorative procedures worldwide.

REGIONAL INSIGHTS

The global market is studied across the regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America Dental Consumables Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America generated a revenue of USD 11.74 billion and dominated the global dental consumables market share in 2024. The dominance of the region is attributed to the advanced dental infrastructure and technology adoption, coupled with substantial investments in research and development initiatives, which support the market growth. Additionally, favorable reimbursement policies and robust healthcare spending contribute to the growth of the market. Moreover, the presence of leading dental product manufacturers and their focus on seeking approvals for their products further consolidates the region's dominant position in the market. The U.S. market is projected to reach USD 12.87 billion by 2026.

- For instance, in August 2023, RevBio, Inc. announced that it had received regulatory approval from the U.S. FDA to commence a 20-patient clinical trial for its dental implant stabilization product, Tetranite.

Europe

Europe captured a noteworthy market share and is expected to grow at a significant rate in the forthcoming years. The increasing awareness about oral health and hygiene among the population has driven demand for these products. Moreover, the supportive government policies and initiatives promoting dental care have further propelled the market growth in the region. The UK market is projected to reach USD 1.2 billion by 2026, while the Germany market is projected to reach USD 2.32 billion by 2026.

Asia Pacific

The Asia Pacific market is projected to grow at the fastest CAGR during the forecast period. The increasing disposable incomes have boosted the demand for dental procedures and consumables across key countries, such as China, India, and Japan. Moreover, the rising awareness about oral health and aesthetic dental treatments has fueled the market expansion. Furthermore, advancements in healthcare infrastructure and technology adoption have facilitated easier access to dental care, driving the adoption of these products. Furthermore, a surge in the collaborations of prominent companies with domestic players to distribute their products, such as clear aligners and implants, is expected to increase the adoption of the consumables in the region during the forecast period. The Japan market is projected to reach USD 1.62 billion by 2026, the China market is projected to reach USD 2.62 billion by 2026, and the India market is projected to reach USD 0.89 billion by 2026.

- For instance, in January 2019, Tianjin ZhengLi Technology, a medical devices company situated in China, collaborated with Institut Straumann AG. Straumann received exclusive distribution rights for its clear aligners in the country through this collaboration.

Latin America and the Middle East & Africa

Furthermore, the Latin America and the Middle East & Africa regions are expected to grow at a steady rate in the coming years. The growth in these regions is due to increasing healthcare expenditures, rising dental tourism trends, and expanding dental care infrastructure. Furthermore, the growing awareness of oral health and higher prevalence of dental disorders also contribute to the market's expansion in these regions.

KEY INDUSTRY PLAYERS

Prominent Players Dominated the Market with Wider Distribution Network

Henry Schein, Inc., Dentsply Sirona, ENVISTA HOLDINGS CORPORATION, and Institut Straumann AG are some of the leading players holding a significant global dental market share. These companies lead in the competitive landscape due to their varied product offerings, such as implants, dentures, and clear aligners. Additionally, their strategy focuses on the introduction of new products and expanding into the high growth developing countries, which further propels the strength of their market position.

Other companies operating in the market include Argen Corporation, 3M, Coltene, Axsys Dental Solutions, ZimVie, Inc., and others. These companies are actively pursuing strategic activities, such as launching new products, forming partnerships, and collaborations. Their increased focus on expanding into developing countries and meeting the rising demand for dental consumables is projected to enhance their market share significantly.

List of Top Dental Consumables Companies:

- Dentsply Sirona (U.S.)

- Institut Straumann AG (Switzerland)

- ZimVie, Inc. (U.S.)

- Henry Schein, Inc. (U.S.)

- Envista Holding Corporation (U.S.)

- Ivoclar Vivadent AG (Liechtenstein)

- Osstem Implant (South Korea)

- Cortex (Israel)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Torch Dental announced a strategic partnership with the Chicago Dental Society (CDS), a prominent organization dedicated to promoting oral health and advancing the dental profession in the state.

- September 2023 - Boston Micro Fabrication (BMF) entered in the dental market with the introduction of UltraThineer, the thinnest cosmetic dental veneers.

- September 2023 - Neoss Group announced the launch of a multi-unit abutment for the company’s Neoss4 treatment solution. The multi-unit abutment is a technologically superior system developed to enhance dental professionals’ approach to full-arch restorations.

- May 2023: Clinical Research Dental (CRD) and Swedish Oral Care company TePe announced an exclusive distribution partnership covering Canada and the Caribbean. TePe develops quality oral health products, including interdental brushes, specialty toothbrushes, toothbrushes, and toothpicks, and distributes them around the world.

- April 2022: BoneEasy introduced Implantize Compact, a new subperiosteal implant with perforations in the implant plate, which allow fibres to pass through for soft tissue integration.

REPORT COVERAGE

The global market research report provides a detailed market analysis of the industry. It focuses on key insights related to the market, such as the advancements in various technologies and innovative product introductions. Also, it covers the key developments related to the industry, such as mergers, partnerships, and acquisitions. Moreover, it covers key trends, company profiles, and the competitive landscape of key companies. Besides these, the report offers the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.4% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Product Type

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global dental consumables market size was valued at USD 36.31 billion in 2026 and is projected to reach USD 103.9 billion by 2034.

In 2025, North America stood at USD 12.82 billion.

The market is projected to expand at a CAGR of 14.4% during the forecast period.

The dental restoration products segment is the leading segment in the market.

The dental consumables market is driven by the increasing prevalence of dental disorders, growing awareness about oral hygiene, rising demand for cosmetic dentistry, and the integration of advanced technologies like 3D printing and CAD/CAM systems.

Institut Straumann AG, Dentsply Sirona, ENVISTA HOLDINGS CORPORATION, and Henry Schein, Inc. are some of the major players in the global market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us