Digital Identity Solutions Market Size, Share & COVID-19 Impact Analysis, By Type (Centralized and Decentralized), By Deployment (Cloud, On-premises, and Hybrid), By Enterprise Type (Small and Medium Enterprises (SMEs) and Large Enterprises), By Application (Authentication, Authorization, Access and Lifecycle Management, and Others (Accountability, Identity federation, etc.)), By Industry (BFSI, Automotive and Manufacturing, Energy and Resources, Healthcare, IT and Telecommunication, and Others (E-commerce, etc.)) and Regional Forecast 2026-2034

Digital Identity Solutions Market Size

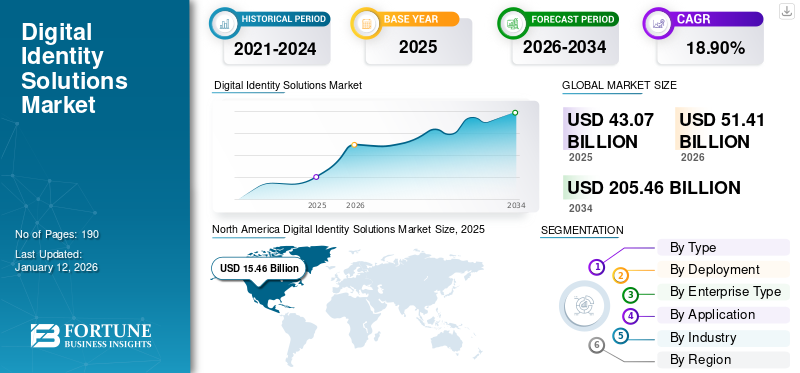

The global digital identity solutions market size was valued at USD 43.07 billion in 2025 and is projected to grow from USD 51.41 billion in 2026 to USD 205.46 billion by 2034, exhibiting a CAGR of 18.90% during the forecast period. North America dominated the global market with a share of 35.90% in 2025.

A digital identity solution constitutes of a comprehensive technological architecture that securely manages and verifies individuals’ online identities across diverse platforms and services. It leverages advanced cryptographic protocols such as PKI and sophisticated biometric authentication methods such as facial recognition or fingerprint scanning. These solutions prioritize seamless user experience while upholding stringent data privacy standards and safeguarding against identity theft or fraudulent activities.

Digital Identity Solutions Market Overview

Market Size:

- 2025: USD 43.07 billion

- 2026: USD 51.41 billion

- 2032 Forecast: USD 205.46 billion

- CAGR (2025–2032): 18.90%

Market Share:

- North America led with 35.90% share in 2025, driven by advanced technological infrastructure and early adoption of identity solutions.

- Asia Pacific is projected to grow fastest due to rising demand in fintech, digital banking, and favorable regulatory initiatives.

Industry Trends:

- Adoption of both centralized identity platforms and decentralized Self-Sovereign Identity (SSI) frameworks.

- Shift toward cloud-based and hybrid deployments for scalability, security, and flexibility.

- Growing use of multi-factor authentication and biometrics such as facial recognition and PKI across industries.

Driving Factors:

- Increasing demand for secure digital access amid growing remote services and regulatory pressures.

- Post-COVID acceleration of contactless identity verification and online onboarding.

- Rising adoption across finance, healthcare, retail, and telecom to secure transactions and ensure compliance.

- Advancements in AI, machine learning, and privacy-preserving technologies enhancing identity solutions.

The escalating demand for secure remote access, regulatory compliance, and pervasive integration of digital services across sectors such as finance, healthcare, and retail have propelled the adoption and evolution of digital identity solutions market growth.

In October 2023, Intercede launched an Enterprise Managed FIDO Authentication solution at Authenticate 2023 in California, enabling highly secure, phishing-resistant FIDO authentication to replace passwords, Windows Hello, and PKI for businesses. The solution utilized a multi-factor authentication and Yubico’s Yubikey hardware authentication to offer a centralized approach to protecting digital identities.

COVID-19 IMPACT

Surge in Secure and Seamless Identity Verification Processes amid Pandemic Spurred the Market Growth

The COVID-19 pandemic significantly impacted this market due to the sudden shift toward remote work and digital services, leading to an increased demand for seamless and secure identity verification processes. This demand spike stemmed from businesses seeking robust authentication methods to ensure secure access to sensitive data as employees worked remotely, thereby accelerating the adoption of digital identity solutions

According to data from Spiceworks in 2021, the authentication market experienced significant growth, particularly as online transactions surged. They also stated that businesses mitigated breaches by implementing layered authentication approaches to authorize user accounts for access to applications and devices.

The pandemic also highlighted the necessity for contactless interactions and transactions across several industries, intensifying the demand for sophisticated identity verification technologies such as biometrics and tokenization. As a result, the market experienced increased investment and innovation to meet the evolving needs of individuals and businesses in a rapidly digitizing world.

LATEST TRENDS

Rising Smartphone Penetration and Implementation of Biometric or Multi-factor Authentication to Augment the Creation of Digital Identities

The increasing ubiquity of smartphones, combined with the widespread adoption of advanced security measures such as biometrics and MFA (Multi-factor Authentication) has catalyzed the evolution of digital identities. The integration of biometric authentication enhanced the security landscape by providing an additional layer of identity verification, thereby mitigating risks associated with unauthorized access. This surge in smartphone penetration, complemented by robust authentication mechanisms augmented the creation of digital identities and established a foundation for secure and seamless user authentication across several online platforms and services.

According to GSMA, the number of unique mobile subscribers was 5.4 billion in 2022, which is expected to increase up to 6.3 billion in 2030, showcasing a penetration rate of 73% in 2030.

Download Free sample to learn more about this report.

DRIVING FACTORS

Regulatory Compliance Requirements such as GDPR and KYC Regulations to Drive the Adoption of Stringent Identity Verification Procedures

The stringent requirements outlined in regulations such as GDPR (General Data Protection Regulation) and KYC (Know Your Customer) are compelling businesses to adopt highly secure identity verification protocols. This has necessitated the implementation of sophisticated authentication methods, including MFA, biometric recognition, and encrypted data handling. Non-compliance solutions expose companies to substantial regulatory penalties and also challenge consumer trust and compromise the integrity of sensitive data. This emphasizes the crucial need for comprehensive and advanced identity verification solutions to meet these regulatory standards and safeguard business operations.

In October 2023, Clear launched its reusable digital identity service in the financial services sector through an innovative one-click KYC application. This expansion incorporated ID documents, selfie biometrics, and liveness checks to fulfill KYC obligations. The expansion aimed to streamline user processes, reduce friction, and minimize potential drop-offs during sign-ups. It offered a tailored workflow builder for KYC onboarding and seamless integration into onboarding systems using APIs, SDKs, and no-code identity verification links.

RESTRAINING FACTORS

Limited Digital Literacy and Identity Theft Concerns May Hamper the Market Growth

The limited digital literacy among certain demographics poses a significant hurdle in the widespread adoption of advanced digital identity solutions, impeding their growth trajectory. This lack of familiarity with sophisticated technological processes and security measures inhibits users' understanding and trust in the reliability of these systems, deterring their active participation in adopting such solutions. In addition, coupled with identity theft concerns stemming from persistent vulnerabilities in existing systems, this digital literacy gap amplifies reliability concerns around data privacy and security. As a result, this restrains the market's expansion, as users remain cautious and hesitant about embracing these technologies.

SEGMENTATION

By Type Analysis

Streamlined Management by a Single Authority to Boost the Reliability on Centralized Solutions

By type, the market is bifurcated into centralized and decentralized solutions.

Centralized digital identity refers to a system or structure where control, authority, or decision-making power is concentrated or held by a single central entity, often responsible for managing and overseeing various operations, resources, or functionalities within that system. The centralized solutions, characterized by consolidated authority, are anticipated to dominate the market share owing to their superior operational efficiency, streamlined governance, and robust reliability compared to decentralized counterparts, making them the preferred choice for organizations seeking advanced technological architecture. They also emphasize on security protocols and authentication measures, as centralization enables for more stringent and uniform control over access, reducing vulnerabilities and augmenting overall cybersecurity.

However, decentralized solutions have also been growing at a healthy pace due to its operations, enabling shared control and decision-making without relying on a central point of control. This approach promotes autonomy, transparency, and resilience by avoiding dependence on a single governing entity.

By Deployment Analysis

Enhanced Interoperability and Cost Reduction to Increase the Deployment of Cloud Solutions

By deployment, the market is trifurcated into cloud, on-premises, and hybrid.

Cloud based solutions are anticipated to hold the highest market share of 40.96% in 2026. Owing to their adoption rate by majority of organizations. Cloud-based solutions incorporate enhanced interoperability and faster deployment, reducing challenges and costs associated.

On-premises deployment maintains significance in digital identity solutions due to its ability to ensure data sovereignty, regulatory compliance, and enhanced security measures tailored to specific needs, primarily of large organizations.

By Enterprise Type Analysis

Large Volumes of Data and Greater Resources Propelled the Adoption of Solutions in Large Enterprises

As per enterprise type, the market is bifurcated into small and medium enterprises and large enterprises.

Large enterprises held the highest market share of 65.49% in 2026. Owing to their infrastructure capabilities and higher budget. These enterprises commonly adopt digital identity solutions due to their greater resources, complex IT environments, and higher risks associated with managing large volumes of sensitive data. This mandates robust identity management to ensure security and regulatory compliance. Small and medium enterprises often face budget constraints, limited IT infrastructure, and may perceive lower immediate risks, resulting in slower adoption rates of sophisticated digital identity solutions.

However, SMEs have also been adopting digital identity solutions at an accelerated growth rate, due to increased deployments in cloud and hybrid modules, resulting in cost reduction and lower maintenance.

By Application Analysis

Constant Integrations and Innovations in Authentication Processes to Enhance Market Growth

As per application, the market is segregated into authentication, authorization, access and lifecycle management, and others.

Digital solutions for authentication are anticipated to hold the highest market share of 34.04% in 2026. Owing to the recent launches and demand for employee authentication, as well as buyer authentication solutions deploying latest technologies such as biometrics and MFA. However, there is a growing emphasis on access and lifecycle management in digital identity solutions. This is due to the growing complexity of organizational systems, the need for precise control over user access rights, and the requirement for efficiently managing user identities throughout their systems’ lifecycle.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Cybersecurity Imperatives and Regulatory Alignment to Fuel the Growth in BFSI Sector

By industry, the market is segregated into BFSI, automotive and manufacturing, government and public services, energy and resources, healthcare, IT and telecommunication, and others.

BFSI sector is anticipated to hold the highest market share, propelled by the rising demand for robust authentication mechanisms to combat cyber threats and safeguard sensitive financial data. The sector's adoption of digital identity solutions aligns with regulatory compliance measures such as PSD2 and GDPR, necessitating advanced identity verification technologies to ensure secure transactions and protect customer data against fraudulent activities and unauthorized access.

In healthcare, these solutions streamline patient data access, ensuring accurate medical record retrieval, enhancing care coordination, and maintaining data security and privacy. For governments, digital identity solutions bolster secure online services, enabling streamlined citizen interactions, reducing identity fraud, and fostering transparent and efficient governance across several public service domains.

REGIONAL INSIGHTS

Based on geography, the market is studied across North America, South America, Europe, the Middle East and Africa, and Asia Pacific. These regions are further categorized into several dominating countries.

North America Digital Identity Solutions Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 15.46 billion in 2025 and USD 18.45 billion in 2026. The U.S. digital identity solutions market is predicted to grow significantly, reaching an estimated value of USD 32,440.4 million by 2032. North America holds the highest market share as it leads in digital identity solution adoption due to its technologically advanced ecosystem, strong regulatory frameworks such as HIPAA and financial compliance standards, compelling businesses to prioritize secure identity verification. Additionally, the region's proactive stance on cybersecurity risks and a culture emphasizing advanced authentication methods further accelerate the adoption of these solutions, ensuring compliance, data protection, and bolstered trust in digital transactions. The U.S. market is projected to reach USD 12.61 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

According to Javelin Strategy, an estimated 15 million Americans fell victim to identity theft in 2021, with a significant majority of cases going unreported. Additionally, the FTC received over 1.4 million reports of identity theft last year, resulting in approximately USD 52 billion stolen by identity thieves from U.S. citizens.

Europe

Asia Pacific has been significantly growing at the highest compound annual growth rate (CAGR) in digital identity solutions market. The UK market is projected to reach USD 2.42 billion by 2026, and the Germany market is projected to reach USD 2.44 billion by 2026.

Asia Pacific

Asia Pacific has been significantly growing at the highest compound annual growth rate (CAGR) in digital identity solutions market due to adoption of these solutions in burgeoning digital economy and rapid technological advancements. Governments and businesses in the region are increasingly investing in innovative identity verification technologies to address cybersecurity concerns and regulatory compliance, further fueling the uptake of these solutions. Additionally, the region's diverse and expansive population, coupled with increasing digital transactions, necessitates robust identity management solutions, further driving the adoption of digital identity technologies in Asia Pacific. The Japan market is projected to reach USD 2.18 billion by 2026, the China market is projected to reach USD 2.3 billion by 2026, and the India market is projected to reach USD 3.01 billion by 2026.

Middle East & Africa

The Middle East & Africa market have also been growing due to the rapidly expanding digital infrastructure and a focus on modernizing governmental services. Additionally, the region's emphasis on enhancing cybersecurity measures and improving access to digital services for a growing population has propelled the uptake of these solutions.

KEY INDUSTRY PLAYERS

Key Players are Bolstering their Support for Solutions with the Utilization of Biometrics and Artificial Intelligence (AI)

Players in the market are bolstering their support for solutions by incorporating biometric and artificial intelligence (AI) technologies, showcasing a strategic emphasis on enhancing security and intelligence capabilities. This expansion signifies a broader industry trend toward leveraging advanced technologies to fortify and optimize several solutions in response to evolving security and efficiency requirements, resulting in increased individual digital identity solutions market share. For instance,

In November 2023: BigBear.ai acquired Pangiam in a USD 70 million stock deal. The objective is to integrate Pangiam's facial recognition and biometric capabilities with its computer vision analytics. This strategic merger is set to deliver near-field and far-field vision AI solutions for localized and global-scale environments. The emphasis is on unlocking the potential of perceptive and interactive AI, benefiting U.S. government and enterprise customers.

List of Top Digital Identity Solutions Companies:

- IBM Corporation (U.S.)

- Thales (France)

- NEC Corporation (Japan)

- SailPoint Technologies, Inc. (U.S.)

- Samsung Group (South Korea)

- Saviynt Inc. (U.S.)

- TELUS Communications Inc. (Canada)

- ImageWare Systems, Inc. (U.S.)

- Daon, Inc. (U.S.)

- ForgeRock, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Certn acquired Trustmatic, a Europe-based remote ID verification company, aimed at bolstering its biometric Know Your Customer (KYC) capabilities. With Trustmatic's facial biometrics comparison capabilities and automated processes, Certn aimed to strengthen identity verification, preventing fraudulent and duplicate accounts across several industrial sectors.

- October 2023: KONA I and IDEX Biometrics formed a strategic partnership to introduce global biometric cards, encompassing recycled PVC and metal variants for banks worldwide. The collaboration leveraged KONA I's vast production capabilities and certifications from major card networks, including Visa and Mastercard, to offer innovative biometric payment cards, with IDEX Pay's initial order promptly delivered to KONA I.

- September 2023: Thales introduced CipherTrust Cloud Key Management's Hold Your Own Key (HYOK) integration with Oracle Cloud Infrastructure (OCI) across 45 global countries, including Oracle EU Sovereign Cloud. This collaboration aimed to assist OCI customers in meeting data sovereignty and compliance needs by enabling encryption with externally controlled keys, complementing existing Bring Your Own Key (BYOK) capabilities, and supporting data protection objectives in response to growing demand and OCI's expanding platform.

- September 2023: Cionlabs collaborated with Fingerprint Cards AB to develop biometric door locks and embedded applications in India. This collaboration involved the exclusive integration of Fingerprints' biometric sensor, software, and algorithm into Cionlabs' portfolio, aiming to enhance security and user experience in smart door locks and IoT products, enabling faster market launches for OEMs and ODMs while reducing development costs.

- August 2023: Journey.ai Inc., expanded its cybersecurity suite by collaborating with Avaya, and integrating biometric authentication capabilities into Avaya Hybrid Cloud Services (HCS). This integration enabled Avaya's contact center agents to utilize biometrics, such as face scans, for agent desktop application logins, improving security, enhancing the agent experience, and eliminating the need for costly password resets, averting potential data breaches associated with compromised passwords.

REPORT COVERAGE

The report provides a detailed digital identity solutions market analysis and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Deployment

By Enterprise Type

By Application

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 205.46 billion by 2034.

In 2025, the global market was valued at USD 43.07 billion.

The market is projected to grow at a CAGR of 18.90% during the forecast period.

The BFSI sector is expected to lead the market.

Regulatory compliance requirements such as GDPR and KYC regulations to drive the adoption of stringent identity verification procedures.

IBM Corporation, Thales, NEC Corporation, SailPoint Technologies, Inc., Samsung Group, Saviynt Inc., TELUS Communications Inc., ImageWare Systems, Inc., Daon, Inc., and ForgeRock, Inc. are the top players in the market.

North America dominated the global market with a share of 35.90% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us