Disconnect Switches Market Size, Share & Industry Analysis, By Type (Fused and Non-Fused), By Mount (Panel, Din Rail, and Others), By Voltage (Upto 150 V, 150-300 V and Above 300 V), By Application (Utility, Industrial, Commercial, and Residential) and Regional Forecast, 2025-2032

Disconnect Switches Market Size

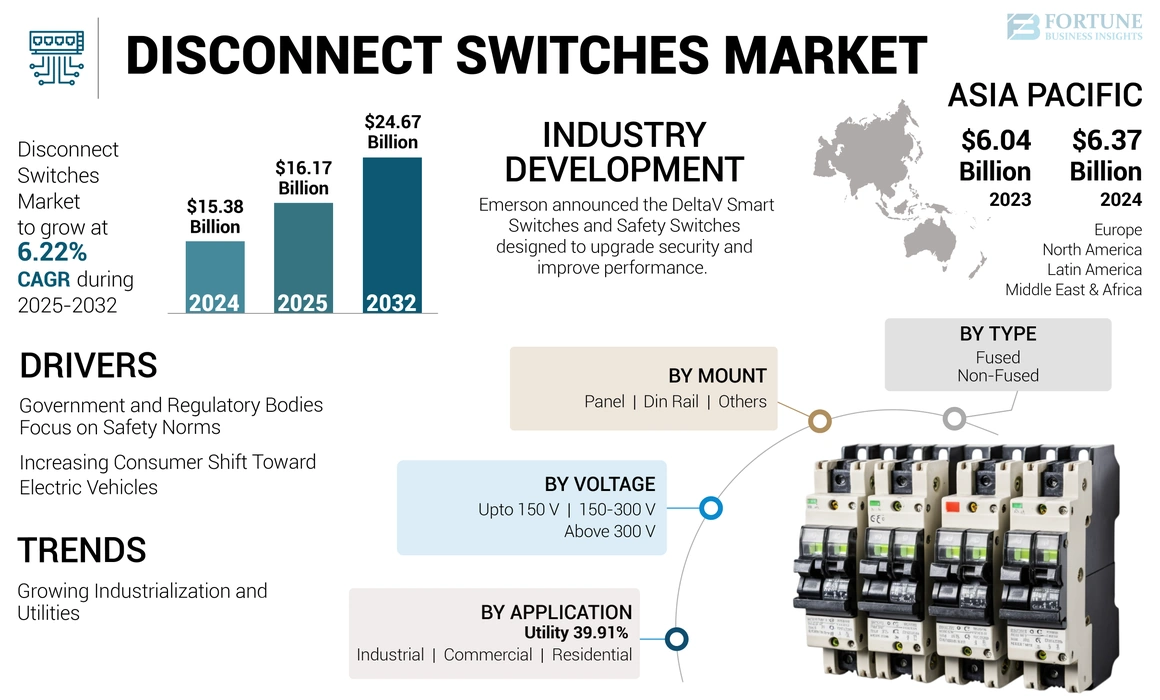

The global disconnect switches market size was valued at USD 15.38 billion in 2024. The market is projected to be worth USD 16.17 billion in 2025 and reach USD 24.67 billion by 2032, exhibiting a CAGR of 6.22% during the forecast period. Asia Pacific dominated the disconnect switches industry with a market share of 41.41% in 2024. The Disconnect switches market in the U.S. is projected to grow significantly, reaching an estimated value of USD 5.15 billion by 2032.

A disconnect switch is a safety device used in electrical circuits. The purpose of a disconnect switch is to ensure that a specific electrical circuit is de-energized during an emergency stop, service, or maintenance. The switch allows users to completely close the circuit, creating a safe environment where the user can perform necessary repairs, maintenance, or inspections. This ensures that no current flows into the circuit, reducing concerns about electrical hazards. These kind of switches are manually operated or remotely controlled and commonly found in electrical power distribution systems, industrial machinery, and power generation facilities. Rural electric providers or cooperatives often require customers to have a generator breaker if their system uses an auxiliary generator. A generator disconnect switch ensures that personnel working on the system are not at risk of electric shock. A generator disconnect switch is also called a transfer or isolation switch.

The global impact of COVID-19 on the disconnect switch industry is moderate, as it hampered consumption in many end-use industries growth due to supply chain disruption of services and technology and hindrance in activities due to social distancing norms. Furthermore, in the power industry, the direct impact of COVID-19 reduced field services in general, especially maintenance services. In many cases, services have been delayed or extended until they are completed. An immediate consequence of this can be an increased risk of equipment failure. On the other hand, a controlled system load reduction, 10-30% of the pre-pandemic load, helps to keep service continuity under control. As a result of charging in general, energy prices fell, causing unexpected financial problems for generation companies, energy traders, network operators, and distribution utilities.

Disconnect Switches Market Trends

Growing Industrialization and Utilities are emphasizing the Use of Safety Switches

Rising industrialization and utility are uplifting the growth of the market as disconnect switches are the safety switches that protect maintenance and repair activities. During maintenance services, this switches provide a reliable means to de-energize the circuit to avoid electric disruptions or accidental harm. In utility, they are used for transmission and distribution along with load shedding purposes during periods of high demand or in emergencies to prevent overloading of the electrical grid. By disconnecting non-essential loads, utilities can maintain system stability and prevent power failure or brownouts.

For instance, Sempra is a prominent energy infrastructure company with deep expertise in emerging and operating safer and more reliable transmission and distribution infrastructure across three business platforms. In 2022, Sempra invested more than USD 5 billion in critical energy infrastructure to bring cleaner energy sources online, strengthen community resilience to extreme weather events, and help this type of switchesare vital for switching operations in utility grids. They enable the reconfiguration of transmission and distribution networks, allowing for routine maintenance, load balancing, and restoration of service after outages. The growing projects and investments from various major players in the disconnect switch and manufacturers for utility and smart grid technology are positively inclining the use of disconnect switches for safety and uninterrupted processes.

Download Free sample to learn more about this report.

Disconnect Switches Market Growth Factors

Government and Regulatory Bodies Focusing on Safety Norms Propel the Market Growth for Disconnect Switches

The duration of power outages in Germany decreased slightly in 2022 compared to the previous year, the Federal Network Agency reports. The average duration of power outages in the year marked by the European energy crisis was 12.2 minutes per connected end-user, slightly less than in 2021 when it was 12.7 minutes. In 2021, Germany experienced blackouts for the first time since 2017, mainly due to a substation accident and flooding. The Federal Network Agency reports the time, duration, extent, and cause of outages. Since 2022, 855 network operators have reported a total of 157,245 low and medium-voltage power outages. The number of defect reports decreased by approximately 9,300 compared to last year.

These outages can be triggered by various factors, such as overcurrent, electrical leakage, short circuits, or the need to prevent fire or protect downstream circuits. Safety switches prevent electric shocks that could be harmful or potentially fatal without safety precautions. In the event of electrical leaks, overloads, short circuits, or other electrical system problems, safety switches detect abnormalities and automatically shut off power. The overall goal of the S-CODE project is to research, develop, validate, and initially integrate radical new concepts for switches that can improve capacity, reliability, and security while reducing investment and operational costs. The project is based on existing European and national research to combine technologies and concepts that significantly reduce the limitations associated with existing switching technologies and develop a radically different solution.

Increasing Consumer Shift towards Electric Vehicles are Uplifting the Market for Disconnect Switches for Efficient Functionality

Electric vehicles are a key technology for reducing carbon dioxide emissions from road traffic, which accounts for more than 15% of global energy emissions. In recent years, there has been an exponential growth in electric vehicles, which provides model availability and better performance. The popularity of electric cars is surging. China accounted for nearly 60% of all new electric car registrations in the world in 2022. The share of electric cars in China's total domestic car sales was 29% in 2022 and 16% in 2021.

Electric vehicles are completely dependent upon the charging systems and require charging stations without any interruptions for moving as this kind of safety switches are employed in EV charging stations to provide a means of safely isolating the charging equipment from the electrical supply. This ensures that maintenance personnel can work on the charging infrastructure without the risk of electric shock or injury from live electrical components. Along with this switches they are integrated with overcurrent protection devices, such as fuses or circuit breakers, to safeguard against excessive currents that could damage the charging equipment or pose safety risks. In the event of an overcurrent condition, the disconnect switches interrupt the flow of electricity and prevent further damage.

RESTRAINING FACTORS

High Investment Cost and Maintenance Requirements Hinder the Market Growth

In recent years, the growing need for a reliable and continuous power supply for electricity consumers has led to the development of quantitative analysis of distribution network reliability and its applications, such as value-based reliability optimization. Greater reliability is associated with higher capital and operating costs. They are relatively expensive to procure when they are used in industrial and utility-grade applications that require high-quality components during setup. The cost consideration may pose a barrier to widespread adoption, particularly in cases where budget restraints are significant. These type of switches require regular maintenance to ensure optimal performance and reliability. This maintenance may include inspections, lubrication, testing, and replacement of worn parts. Failure to adequately maintain disconnect switches causes performance issues or premature failure, increasing operational risks and costs.

Disconnect Switches Market Segmentation Analysis

By Type Analysis

Non-fuse dominates the Market as It Is Easier to use and Convenient in Various Applications

Based on type, the market is segmented into fused and non-fused.

The non-fused market dominates the global disconnect switches market share during the forecast period. The segment leads as a non-fused disconnect switch is used without additional fuse protection, which increases its appeal and facilitates its wider adoption in the market. This factor is expected to boost the growth of the global disconnector market during the forecast period. Non-fused type are used in many residential and commercial applications, such as lighting control systems and motor circuits. They are also used in many industrial settings where the current is not expected to exceed the circuit breaker's rating. Non-fused type are easier to use and more convenient as they allow for quick recovery in the event of a power failure or overload.

The fused type is fixed within the switch assembly to offer both the function of circuit isolation and current fluctuation protection. And fuse type ensures that during the fluctuations of current or any short circuit fuse type will blow, and the indication will stop the flow of electricity and prevent circuit damage.

By Mount Analysis

DIN Rail Holds a Dominant Share Due to Extensive Use in Industrial Applications.

Based on mount, the market is segmented into the panel, DIN rail, and others.

DIN rail segment holds the majority of the share of the global market. DIN rail mount are designed for easy installation on standard DIN rails. They provide a modular and flexible approach, allowing for expansion, quick assembly, and reconfiguration, of the switch setup without additional modifications or drilling. Additionally, these switches are compact in size and conveniently fit in systems that need multiple disconnect switches or confined spaces. DIN rail mount are commonly used in industrial control panels to provide a means of isolating circuits or equipment for maintenance, troubleshooting, or safety purposes. DIN rail are compact and modular in design, allowing for easy installation in tight spaces and compatibility with standard DIN rail mounting systems.

Panel mount disconnect holds the second highest market share during the forecast period as it is designed to be installed directly on the control panel or else on the plain surface of the panel. They are efficient to use in heavy duty equipment’s such industrial and automation that requires quick accessibility to disconnect solution.

By Voltage Analysis

Up to 150 V Hold a Dominant Share Due to the Growing Adoption of Remote Monitoring and Control Systems

Based on voltage, the market is segmented into the up to 150 V, 150-300 V, and above 300 V.

The up to 150 voltage segment to dominate the market share in the forecast period. Majority of applications lay in this voltage range, including electronic devices, appliances, lighting systems, and small-scale electrical equipment. Low-voltage type play a significant role in protecting sensitive electronic equipment, computers, servers, telecommunications devices, and networking equipment from damage caused by voltage fluctuations, surges, or brownouts. These switches help ensure stable and reliable power delivery to critical systems, reducing the risk of costly downtime and equipment failure.

150-300 V is holding the second highest market share of the market as they are used in commercial facilities, industrial services, and utility substations for maintenance of the electrical system. These type of applications requires medium voltages for managing the frequency and fluctuations of current and to avoid and electrical failures during the usage.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Utility Segment Leads the Market with Grid Expansion and Maintenance Activity

Based on application, the market is segmented into utility, industrial, commercial, and residential.

The utility segment holds the majority of the market share and is anticipated to sustain its share during the projected period. Disconnect switch is mainly used to isolate power from electrical equipment connected to a circuit for safety reasons during maintenance activities. These disconnectors also break the electrical circuits in a large electrical distribution. This switches are essential for switching operations in utility systems, allowing for the reconfiguration of electrical circuits, feeder lines, and substations to accommodate maintenance, repairs, or changes in system configuration. It also enables operators to isolate, connect, or bypass specific components or sections of the distribution network as needed, ensuring efficient and reliable operation.

Industrial segment holds the second highest market share for the market as industrial segment includes various applications such as power plants, manufacturing units, processing units and various industrial equipment setting requires the safety settings and this need for safety standards is increasing the use of disconnect switch. Moreover this switches are used for prevention of electrical current fluctuations and electrical accidents this need increases the use for industrial applications.

REGIONAL INSIGHTS

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Disconnect Switches Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to hold the largest share of the global market. The growing industrialization and urbanization in leading countries are propelling the demand for energy. In addition, leading countries are expanding distribution and electricity networks. For example, in 2022, China invested USD 166 billion in its transmission network, while other countries invested a total of USD 118 billion. According to the State Grid Corporation of China, in March 2022, China began construction of an ultra-high voltage direct current line connecting two provincial-level regions. The total 1,634-kilometer power transmission project starts in Northwest China's Ningxia Hui Autonomous Region and ends in Hunan Province. It passes through six district-level regions across the country. In addition, emphasis on electrical security, energy efficiency, and modernization of electrical distribution networks support market growth.

North America is expected to grow highly in the forecast period. The market is driven by the growing demand for reliable electrical safety solutions in the residential, industrial, and commercial sectors. In addition, stringent safety regulations, increased focus on industrial automation, and major investments in upgrading the electrical infrastructure create positive prospects for automation and growth. At the same time, the market’s growth is influenced by the presence of a mature renewable energy sector, which increases the demand for safety switches for safe maintenance and emergency isolation.

Europe's disconnect switches market is positively impacting the market growth as is classified based on high demand from established industrial sectors, the integration of renewable energy sources, and strict regulatory standards emphasizing energy efficiency and safety. In addition, the aggregate focus on renewable energy and the wider use of reliable switches for safe operation and maintenance are driving the market growth.

Latin America is consistently impacting the market and it is expected to grow in the forecast period due to continuous industrialization and urbanization in several countries. The demand is increasing to avoid power outages and energy disruptions. At the same time, the largest expansion of industry and the energy sector, as well as significant investments in power generation, transmission, and distribution, act as growth-accelerating factors.

The Middle East & Africa represents a moderate impact on the market growth, which is classified by increasing infrastructural growth in the electricity sector and increasing expansion. In addition, ongoing projects related to the energy sector increase the use of safety switches to avoid any blackouts and have safety and reliability.

Key Industry Players

Schneider Electric SE Holds a Significant Share, Focusing on Expanding Its Product Reach Globally

The global disconnect switch market is highly fragmented, with large and some medium-scale regional players delivering a wide range of products at local as well as country levels across the value chain. Numerous companies are actively operating across different countries to cater to the specific demands of the customers.

Schneider Electric SE is expected to account for a significant market share owing to its extensive product portfolio, strong brand value, and continuous technology development. Furthermore, the company is also focused on enhancing its sales, distribution, and marketing channels through partnerships with different local associates to fortify its product reach across the globe

List of Top Disconnect Switches Companies:

- General Electric (U.S.)

- Schneider Electric SE (France)

- Havells India Ltd (India)

- Siemens AG (Germany)

- Altech Corporation (U.S.)

- Eaton Corporation (Ireland)

- SDCEM (France)

- ABB (Switzerland)

- Sälzer Electric GmbH (Germany)

- Honeywell (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 – Siemens developed one of the most innovative circuit protection devices with cutting-edge electronic switching technology. SENTRON ECPD (Electronic Circuit Protection Device) electronically switches off circuit faults if errors occur and, if necessary, trips the mechanical isolating contact downstream.

- November 2023 – Emerson announced the next generation of DeltaV Smart Switches and Safety Switches designed with a focus on upgrading security and improving performance in today's antagonistic environments.

- October 2023 – Littelfuse, Inc. launched its Class J Fuse Disconnect Switch. The compact device combines a switch and multiple fuses into a single product, offering a simpler way to manually open and close a circuit while safeguarding against overcurrent and short circuits.

- June 2023 – Schneider Electric introduced a new version of its flagship Square D safety switch, the VisiPacT heavy-duty safety switch, bringing new features and refreshed design to the reliable offering.

- May 2022 – Eaton announced its eMobility business has introduced a Battery Disconnect Unit (BDU) that can be combined with upgraded Breaktor circuit protection technology to provide circuit protection in EVs while reducing overall complexity and cost.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies by types, mount, voltage, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.22% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Mount, By Voltage, By Application, and By Region |

|

Segmentation |

By Type

|

|

By Mount

|

|

|

By Voltage

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 15.38 billion in 2024.

The market is likely to grow at a CAGR of 6.22% over the forecast period.

The utility segment leads the market due to the major usage of safety switches for transmission and distribution.

Asia Pacific market size stood at USD 6.37 billion in 2024.

Increasing industrialization and urbanization lead to an uplift in the market growth for to avoid the uninterrupted power supply.

Some of the top players in the market are General Electric, Schneider Electric SE, and ABB.

The global market size is expected to reach USD 24.67 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us