Endosteal Dental Implants Market Size, Share & Industry Analysis, By Material (Titanium, Zirconium, and Others), By Design (Tapered Implants and Parallel Walled Implants), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

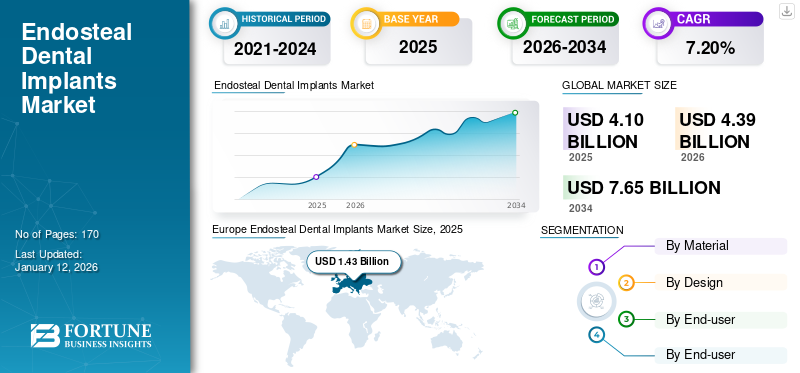

The global endosteal dental implants market size was valued at USD 4.10 billion in 2025. The market is projected to grow from USD 4.39 billion in 2026 to USD 7.65 billion by 2034, exhibiting a CAGR of 7.20% during the forecast period. Europe dominated the endosteal dental implants market with a market share of 34.86% in 2025.

The endosteal dental implants are a type of implant that involves directly placing implants into the jawbone. These implants are typically a screw or cylindrical structure made of titanium, zirconium, or other materials that act as artificial tooth roots to hold dental prosthetics such as bridges, crowns, or dentures.

The global market is anticipated to grow significantly in the coming years due to increasing demand for implants as a preferred dental treatment option for tooth loss. Factors driving this growth include the rising prevalence of dental conditions such as tooth decay and periodontal disease, the increasing aging population, and technological advancements. Major companies in the endosteal dental implants market are continuously focusing on research and development initiatives to introduce innovative implant designs and new technologies. In addition, various product launches and the wide availability of products are anticipated to drive the market in the coming years.

- For instance, in January 2022, Institut Straumann AG‘s subsidiary Neodent launched Zi, a ceramic implant system designed to offer optimal force distribution to the implant.

The COVID-19 pandemic negatively impacted the market in 2020 due to the global reduction in the number of restorative procedures. However, there was a rise in the number of patient visits to dental clinics and hospitals in 2021 as government regulations were eased. The market returned to pre-pandemic levels in 2022 and is anticipated to grow steadily in the coming years.

Global Endosteal Dental Implants Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 4.10 billion.

- 2026 Market Size: USD 4.39 billion.

- 2034 Forecast Market Size: USD 7.65 billion.

- CAGR: 7.20% from 2026–2034.

Market Share:

- Region: In 2025, Europe held the largest market share, accounting for 34.86% of the market. This dominance is attributed to a well-established healthcare system, high awareness of oral health, and the increasing adoption of advanced dental procedures. The region's large geriatric population also contributes to the high prevalence of edentulism and periodontal disease, further driving market growth.

- By Type: The titanium segment led the market in 2026. Titanium implants are widely used due to their biocompatibility, strength, and durability. Their cost-effectiveness and the growing adoption of endosteal implants as a permanent solution for tooth loss also contribute to the segment's growth.

Key Country Highlights:

- Japan: The demand in Japan is driven by a growing elderly population and a high awareness of aesthetic dentistry. Technological advancements in implant dentistry, such as digital scanning and 3D printing, are also significant drivers.

- United States: The market in the U.S. is fueled by a high prevalence of dental disorders and an aging population seeking solutions for tooth loss. Additionally, increased consumer awareness about oral health and the rising popularity of cosmetic dentistry are driving demand for dental implants.

- China: The Chinese market is propelled by government initiatives to improve the accessibility and development of dental procedures. A rising demand for aesthetics and increasing dental awareness are also key growth drivers.

- Europe: Market growth is supported by a rising geriatric population, increasing demand for dental prosthetics, and technological advancements such as digital workflows and 3D printing in implant procedures. Favorable healthcare policies in countries like Germany and France are also contributing to the widespread adoption of dental implants.

Endosteal Dental Implants Market Trends

Growing Demand for Immediate Prosthetic Restoration to Augment Market Growth

One of the key trends in the market is an immediacy solution which is placing the implants immediately after the tooth extraction. This also reduces the number of dental visits and enables the crown to be functional immediately after the surgery. Advancements in dental implants such as tapered designs to increase primary stability, support the immediate placement of functional teeth. Moreover, growth in the digital workflow solutions to streamline processes such as pre-operative planning and prosthetic designs are boosting the market growth during the forecast period.

New product launches and growing demand for minimally invasive surgeries are some of the factors enabling the adoption of tapered implants and digital technologies.

- For instance, in May 2022, Osstem Implant introduced a Key Solution (KS) implant systems in Europe. It is a next-generation tapered implant system that provides larger angular compensation and increases fracture resistance.

In addition, the rise in the use of digital platforms such as CAD/CAM, CBCT, and 3D printing technologies is revolutionizing implant procedures and offering more precise and efficient solutions.

Download Free sample to learn more about this report.

Endosteal Dental Implants Market Growth Factors

Rising Prevalence of Dental Disorders and Edentulism to Boost Market Growth

The growing prevalence of dental disorders such as tooth decay, periodontal disease, and edentulism is expected to drive the demand for endosteal dental implants. The older age group is predominantly impacted by edentulism, as they often display physical characteristics associated with the condition. As the aging population increases, tooth loss or other dental problems are rising, leading to a higher demand for these implants as a replacement option.

- According to the WHO oral health report in March 2023, oral diseases affect nearly 3.5 billion people across the globe, with edentulism having a higher global prevalence of around 23%.

Furthermore, advancements in implant technology, materials, and immediacy solutions are expected to drive market growth as more people opt for these implants as a long-term solution for their missing teeth.

Overall, the increasing prevalence of dental conditions and edentulism, along with the growing awareness and acceptance of dental implants as a viable treatment option, are likely to fuel the global endosteal dental implants market growth.

Technological Advancements and Enhanced Aesthetic Outcome to Increase the Adoption Rate

Technological advancements such as Cone-Beam Computed Tomography (CBCT) and 3D printing enable precise planning and placement of implants. In addition, using Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM) technology in endosteal dental implant procedures reduces the overall procedure time. Additionally, players are focusing on incorporating AI tools with these scanners which increases their accuracy and patient outcomes. For instance, in March 2023, PLANMECA OY launched an AI-based platform for Planmeca Romexis, a software that supports 2D and 3D imaging and CAD/CAM solutions. Robotic-assisted surgery, guided implant placement technologies, and customized implants reduce trauma to the surrounding tissues and speed up the healing process.

For instance, in December 2021, 3Shape A/S introduced 3Shape Dental System 2021 globally to offer a smooth workflow by adding features, such as real-time communications, auto case status update timelines, and others.

On the other hand, the aesthetic outcomes of these dental procedures are crucial factors expected to increase the adoption rate of these implants. Altogether, technological advancements, aesthetic outcomes, and growing awareness are the factors expected to propel market growth.

RESTRAINING FACTORS

High-cost Procedure and Limited Reimbursement to Hamper Market Growth

Endosteal dental implants are typically expensive based on customization and the type of material used. The high cost of dental surgery and implants often prevents individuals from receiving such treatment.

- According to Arlington Dental Excellence, a single tooth implant procedure can cost between USD 3,100 – USD 5,800, while a multi-tooth implant can range between USD 6,000 – USD 10,000, and full mouth implants can cost around USD 60,000 – USD 90,000.

Moreover, dental implant procedures are elective and rarely reimbursed. It relies on out-of-pocket and disposable income. Limited reimbursement and lack of dental facilities in emerging countries deter individuals from opting for endosteal dental implants, limiting market growth.

Endosteal Dental Implants Market Segmentation Analysis

By Material Analysis

Titanium Segment Leads owing to Biocompatibility and High Success Rate of Titanium Implant

Based on material, the market is classified into titanium, zirconium, and others.

The titanium segment dominated the market with a share of 82.37% in 2026. Titanium implants are the most commonly used type of endosteal dental implants due to their biocompatibility, strength, and durability. The increasing adoption of endosteal dental implants as a permanent solution for edentulism and the advancements in implant technology are the factors boosting the growth of the segment. The cost of these implants is another factor that propels the segment's growth.

On the other hand, zirconium implants are gaining popularity in recent years due to their natural tooth-like appearance and low risk of allergic reactions, expected to grow at a significant CAGR in coming years. Moreover, the rising number of product launches are expected to propel the segment’s growth.

- For instance, in March 2022, bredent GmbH & Co.KG launched a new generation of whiteSKY zirconia implants. The implant is designed for various indications, including short-span bridges in the premolar and molar regions and single restorations in the aesthetic zone.

The other materials such as PolyEtherEtherKetone (PEEK) are anticipated to grow in the coming years due to their superior mechanical properties and increased R&D activities to enhance its biocompatibility.

To know how our report can help streamline your business, Speak to Analyst

By Design Analysis

Tapered Implant Segment Held the Major Market Share Due to its Stability

Based on design, the market is segmented into tapered implants and parallel walled implants.

The tapered implants segment accounted for the major global endosteal dental implants market share of 77.02% in 2026. Tapered implants are designed with a conical shape to offer enhanced stability and integration with the surrounding bone. The increased primary stability, and same-day placement of temporary crowns & bridges are the major advantages, increasing the adoption rate and demand of these implants. Moreover, the increasing prevalence of dental diseases is anticipated to increase the use of these implants due to its advantages

- According to the data published by WHO in 2022, severe periodontal disease affects approximately 1.00 billion people worldwide, representing a global prevalence of about 19% in individuals over the age of 15.

The parallel walled implants are anticipated to grow at a slower rate as they have minimal stability. However, these can be incorporated in areas with limited bone width, hence exhibiting growth opportunities in the coming years.

By End-user Analysis

Solo Practices Segment Dominated owing to Large Number of Solo Practices

Based on end-user, the market is divided into solo practices, DSO/group practices, and others.

The solo practices dominated the market contributing 65.47% globally in 2026 attributed to the high patient preference. Additionally, a large pool of solo practitioners is anticipated to drive the segment growth.

On the other hand, the DSO/group practices segment is anticipated to witness the highest CAGR during the forecast period. The shift among dental professionals from having solo practices to joining DSO in developed nations is expected to drive the market in the coming years. Moreover, DSO strategic acquisition is anticipated to expand the segment.

- For instance, in December 2020, Smile Brands Inc. acquired Midwest Dental, a dental services organization with over 230 offices located in the U.S. These transitions toward group practices are anticipated to increase the procedure volume, thereby boosting the market growth.

REGIONAL INSIGHTS

Based on geography, the market is studied across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Endosteal Dental Implants Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe held the largest market share in 2025, generating revenue of USD 1.43 billion. The region is expected to maintain its dominance during the forecast period. The growth is attributed to the presence of a well-established healthcare system, higher awareness about oral health, and increasing adoption of advanced dental procedures in Germany, France, and the U.K. Moreover, the increasing prevalence of periodontal disease and edentulism due to the huge geriatric population is anticipated to drive the region’s growth. The UK market is projected to reach USD 0.08 billion by 2026, while the Germany market is projected to reach USD 0.32 billion by 2026.

North America

North America held the second-largest revenue share of the global market. Factors such as the increasing prevalence of dental disorders, higher disposable income, advanced product launches, and advancements in dental procedures, are expected to contribute to the endosteal dental implants market growth. The U.S. market is projected to reach USD 1.17 billion by 2026.

Asia Pacific

Asia Pacific is poised to experience rapid growth in the market, driven by the increasing adoption of dental implants and growing healthcare expenditure. Additionally, the key players’ geographical expansion in the region and advanced product launches, contribute to the market’s growth. The Japan market is projected to reach USD 0.08 billion by 2026, the China market is projected to reach USD 0.19 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

- For instance, in February 2024, ZimVie Inc. launched the TSX implants in Japan. The TSX screw-type titanium implants are designed to maintain the stability of the extraction site.

Middle East & Africa and Latin America

Furthermore, markets in the Middle East & Africa, and Latin America are estimated to grow moderately over the study period. Key factors contributing to this growth include increasing medical tourism and healthcare spending in the region.

List of Key Companies in Endosteal Dental Implants Market

Key Players are Focusing on New Product Launches to Sustain Their Growth

The endosteal dental implants industry has very few major players. Institut Straumann AG holds the largest share due to its technologically advanced and premium endosteal dental implants offerings. Additionally, a wide range of product portfolio enables the company to hold the largest share of the market.

Nobel Biocare Services AG, Envista Holdings Corporation, Dentsply Sirona, ZimVie Inc. also maintain a strong presence in the market with a wide portfolio. Envista Holdings Corporation and Dentsply Sirona are actively introducing new and advanced technological products such as DS OmniTaper implant system and All-on-4 implant systems to fuel market growth. ZimVie Inc. has a strong presence in Asia Pacific with its advanced portfolio. These factors collectively drive the growth of the companies in the market. Additionally, constant initiatives by these companies for collaborations and new product launches are anticipated to sustain their growth over the projected years.

LIST OF KEY COMPANIES PROFILED:

- Institut Straumann AG (Switzerland)

- Envista Holdings Corporation (Danaher) (U.S.)

- Dentsply Sirona (U.S.)

- Henry Schein, Inc. (U.S.)

- ZimVie Inc. (Zimmer Biomet) (U.S.)

- Osstem Implant (South Korea)

- BioHorizons (U.S.)

- Nobel Biocare Services AG (Switzerland)

- CeraRoot SL (Spain)

- Cortex (Israel)

- Dentium (South Korea)

- Zest Dental Solutions (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2023 – ABA Technologies, the authorized Indian partner of Israel-based AB Dental, launched AB dental’s i-ON endosteal dental implants system in India.

- December 2022 – ProSmile expanded its range of products by launching the SmartArches dental implants services, catering to patients in need of partial and full mouth restoration.

- November 2022– ZimVie introduced the Next Generation TSX endosteal dental implants in the U.S. market. These implants are specifically engineered for easy extraction and provide strong stability in soft and dense bone types.

- January 2021 – Dentsply Sirona acquired Datum Dental, Ltd. Datum Dental, an Israel-based company, to strengthen its product portfolio. Datum Dental has its proprietary technology GLYMATRIX core technology for the manufacturing of dental regeneration products.

- November 2019 – Glidewell Dental Launched ZERAMEX XT implant system. It is a zirconia tapered implant designed to offer better biocompatibility.

REPORT COVERAGE

The global market report provides an in-depth analysis of the industry. It focuses on market segments, such as by material, design, and end-user. Besides, it offers the market forecast in relation to the current market dynamics, the impact of COVID-19, and the latest market statistics. Additionally, the report consists of market share by various segments and the factors driving the market’s growth. The report also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.20% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Design

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 4.1 billion in 2025 and is projected to reach USD 7.65 billion by 2034.

In 2025, the market value of Europe stood at USD 1.43 billion.

The market will exhibit a steady CAGR of 7.20% during the forecast period of 2026-2034.

By material, the titanium segment led the market in 2026.

Rising prevalence of dental conditions and edentulism and technological advancements are the key factors driving the market growth.

Institut Straumann AG, Envista Holdings Corporation, Dentsply Sirona are the major players in the market.

Europe dominated the endosteal dental implants market with a market share of 34.86% in 2025.

Awareness of dental implants, cosmetic dentistry and wide availability are some of the factors expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us