Enterprise Video Platform Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (SMEs and Large Enterprises), By End-user (IT and Telecom, BFSI, Healthcare, Education, Media and Entertainment, Retail and E-commerce, and Others), and Regional Forecast, 2025 – 2032

Enterprise Video Platform Market Size

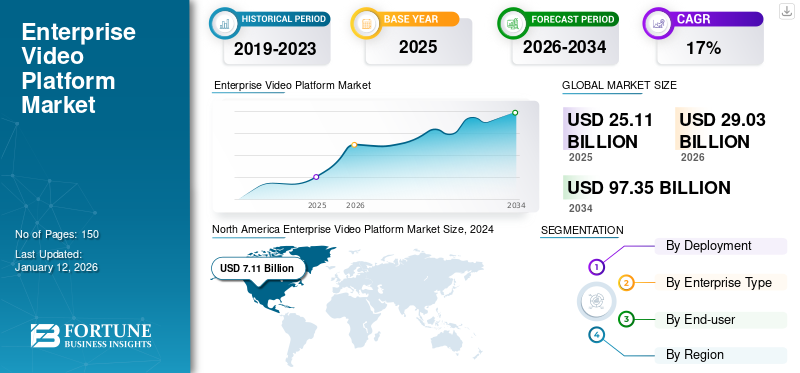

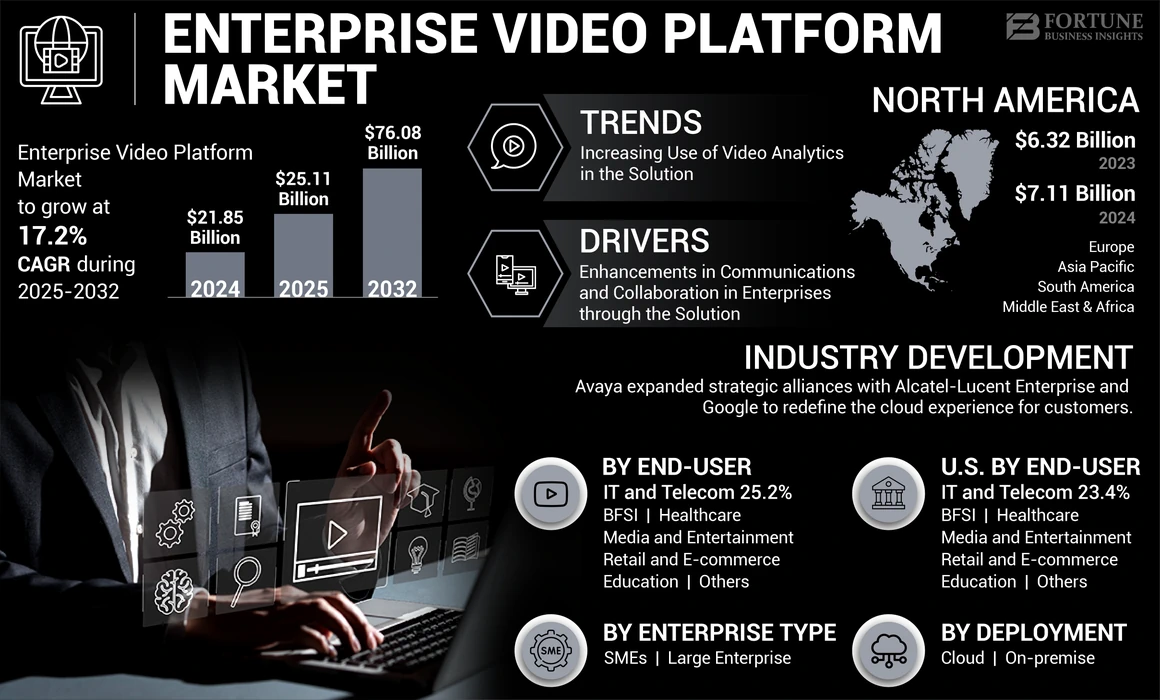

The global enterprise video platform market size was valued at USD 21.85 billion in 2024 and is projected to grow from USD 25.11 billion in 2025 to USD 76.08 billion by 2032, exhibiting a CAGR of 17.2% during the forecast period. North America dominated the global enterprise video platform market with a share of 32.54% in 2024. Additionally, the U.S. enterprise video platform market is projected to grow significantly, reaching an estimated value of USD 11,407.1 million by 2032.

An enterprise video platform is a software solution that manages and enables video experiences across a business. The platform provides rights provisioning, user experience management, multi-facility live video distribution, asset management, recording, device management, and publishing.

Organizations employ enterprise video streaming solutions to coordinate processes and offer automation, which makes operations more seamless and efficient. The on-demand videos assist employees in attaining detailed information about the organization, which colleagues, executives, and trainers have previously recorded. Moreover, the growing demand for on-demand video streaming for learning and development across different organizations is driving the growth of the market. Many businesses are adopting enterprise video platforms for carrying out external activities such as marketing and sales to design a seamless, customized buyer experience that increases engagement, creates pipelines, and shortens deal cycles.

The COVID-19 pandemic impacted organizations due to remote working, which enabled them to use web conferencing as their primary means of communication between employees. The market players enhanced their business processes through the deployment of the enterprise video platform across various organizations and by providing interactive features such as chat, commenting, and surveys that allowed the employees to discuss and voice their questions or concerns.

IMPACT OF ARTIFICIAL INTELLIGENCE (AI)

Increasing Adoption of Artificial Intelligence into the Solution to Fuel Market Growth

Artificial Intelligence is transforming the landscape of businesses by bringing the wave of automation, personalization, and enhanced user experience. The companies are advancing their enterprise platform by leveraging artificial intelligence to make content accessible to all users.

Moreover, AI allows users to automate the transcription and translation of the content and analyze the video viewing data to provide insights into user behavior, such as watch time, completion rates, and engagement levels. For instance,

- In January 2024, Vbrick, an enterprise video solutions provider, introduced new artificial intelligence capabilities within its video platform. Vbrick’s new AI changes content management at scale, improves accessibility, automates tasks, and simplifies processes across the enterprise.

The use of AI in enterprise video platforms is still in the development phase, however it continues to evolve and is expected to lead to the innovation of powerful applications in the coming period.

Enterprise Video Platform Market Trends

Increasing Use of Video Analytics in the Solution to Propel Market Growth

Video analytics tools allow enterprises a source of insight into the online performance of all videos on a video hosting platform, which helps them optimize their content and improve their marketing strategies. These tools can also monitor user behavior and detect potential security threats and detailed statistics that cover all video assets, individual videos, and each viewer interaction.

Various enterprises are adopting video analytics tools to help identify the viewer's details regarding the video and make improvements where necessary. The analytic tools track information about video content consumption, which further enables enterprises to use that data to optimize content, update it and keep testing it. For instance,

- In March 2023, BriefCam introduced an additional feature for its video analytics platform. The features included customer-driven capabilities designed to accelerate video investigations, enabling users to modify the video analytics technology to meet evolving needs without sending data outsourcing classifier network training.

Moreover, the increasing smartphone adoption and availability of the internet have stimulated the adoption of video content for educational purposes for better learning experiences through visual recordings of courses and webinars.

Download Free sample to learn more about this report.

Enterprise Video Platform Market Growth Factors

Enhancements in Communications and Collaboration in Enterprises through the Solution to Drive Market Growth

The rise in remote working during the COVID-19 pandemic created a demand for effective communication and collaboration tools. The enterprise video platform offers live streaming, video conferencing, and content sharing, which bridges the gap and fosters real-time interaction and knowledge sharing.

Moreover, through video platforms, there has been an increase in engagement and knowledge retention compared to the traditional environment. Various providers are integrating with collaboration tools such as Slack, Microsoft Teams, and Zoom to enhance collaboration on video content, allowing the users to work on video within the preferred collaboration platform. For instance,

- In June 2023, Qualcomm launched the Video Collaboration Platform, a suite of video collaboration solutions that enables easy deployment of video conferencing products with good audio and quality video. This solution is deployed in various industries, including enterprise, healthcare, education, and home settings.

Thus, the enhancements in collaboration and communication in the enterprises through the solution drive the enterprise video platform market growth.

RESTRAINING FACTORS

Data Security Concerns and Limited Scalability May Hamper Market Growth

The privacy and security of the data and devices create a barrier while live broadcasting over unprotected networks. These networks are frequently unencrypted, unprotected, and open to hackers who might access data, steal it, or infect it with malware. Moreover, DDoS attacks target video streaming applications, making them accessible to consumers and allowing them to steal user data or take over the application.

In addition, video content demands high storage capabilities and scaling it can be challenging. When devices are connected, the application must be set without lagging. Most streaming servers limit streams and viewers are active at once, due to which the server becomes overloaded and the performance suffers.

Enterprise Video Platform Market Segmentation Analysis

By Deployment Analysis

Enhancing the Function ability of On-premise Solution Across the Organizations Drives Segment Growth

In terms of deployment, the market is bifurcated into cloud and on-premise.

The on-premise segment holds the largest market share due to the enhancement of the functionality of the platform. The deployment of on-premise solutions allows the user to connect through private WAN connection to private datacenters. Various players provide built-in eCDN advanced caching solutions to offer good video delivery with optimized bandwidth, network utilization, and bufferless viewing experience, enabling successful solution adoption within the organization.

The cloud segment is expected to grow at the highest CAGR during the forecast period. The deployment of a cloud model offers the users the scalability and efficiency of a public cloud while maintaining the control and privacy of a dedicated cloud environment through the creation, management, and distribution of the video. Moreover, the growing uptake of cloud-based solutions across SMEs is expected to boost the segment growth due to investment in technology and easy accessibility to the enterprise video platform through laptops and mobiles. For instance,

- In January 2024, Savi announced a USD 12 million Series A funding. The funding comes from Savi’s increasing growth due to customer demand for cloud video solutions to meet the increasing demands of loss prevention and security teams across the organization, including retail, brands and restaurants, hospitality, and convenience stores.

By Enterprise Type Analysis

Large Enterprises Lead the Market Due to Rising Demand of Enterprise Video Solutions

By enterprise type, the market is segmented into SMEs and large enterprises.

The large enterprises segment holds the highest market share as enterprises increasingly depend on software applications to streamline operations, improve customer service, and develop effective marketing. Adopting the platform by a large enterprise improves digital customer experience and efficiency due to the increasing investment in video conferencing solutions by various large-scale organizations.

The deployment of solutions by small and medium-sized enterprises (SMEs) is steadily growing as these organizations benefit in several ways due to increasing adoption of the platform, allowing the SMEs to breakthrough marketing campaigns or internal corporate videos, production companies and creators, and promoting the adoption of cloud-based solutions across these enterprises. This information enables the SMEs to safeguard applications from data breaches, security threats, and other vulnerabilities. Thus, the SMEs segment is poised to expand significantly during the forecast period.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

IT and Telecom Segment Exhibits the Largest Market Share Due to the Adoption of the Solution by Developers

With respect to end-user, the market is divided into IT and telecom, BFSI, healthcare, education, media and entertainment, retail and e-commerce, and others.

The IT and telecom segment holds the largest market share due to the adoption of the solution by developers in organizations for collaboration and communication, onboarding processes, strategizing business models and increased investment in video conferencing solutions by IT and telecom organizations.

- In November 2023, Mcarbon, a CPaaS and telecom technology solutions provider, launched its new product, Spark, an enterprise video calling platform. The platform allows enterprises to engage and connect with their customers with enterprise back-end systems, including marketing automation engines or CRM.

The BFSI segment is set to grow at the highest CAGR during the forecast period. The increasing shift toward a digital-centric approach drives the segment growth. Many financial operations are adopting solutions through video-based marketing and sales for the enhancement of banking services and branch communications. The enterprise video solutions help banks communicate through video, audio, and digital content sharing with their customers. For instance,

- In October 2023, VideoCX.io introduced a Multiuser Video Conferencing Workflow for the BFSI industry with Amazon Chime SDK. This solution allows the developers and builders to quickly add audio, video, messaging, and screen-sharing to their mobile or web applications.

REGIONAL INSIGHTS

Based on region, the market is segregated into five key regions: South America, North America, Asia Pacific, Europe, and the Middle East & Africa.

North America Enterprise Video Platform Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

North America market is divided into the U.S., Canada, and Mexico. The region accounts for the largest enterprise video platform market share. It is poised to continue its dominance during the forecast period due to the presence of major market players, which has increased the demand for access to high-quality Internet along with the growing demand for visual meetings, which has generated lucrative opportunities for the market across the region.

The U.S. market is expected to grow at the highest CAGR due to the presence of key regional market players and numerous service providers. The surging virtual private networks demand across various businesses and educational institutions is expected to drive market growth.

In addition, Canada shows prominent growth in the market. Canadian organizations and institutions are strategizing their business through investment and technological advancement to reduce contact in both the customer and the agent expedition. This factor is bolstering the market growth in the country. For instance,

- In September 2023, Brock University, Canada’s top post-secondary institution, collaborated with YuJa Enterprise Video Platform to provide a wide range of video content creation, management and distribution solutions to the students campuswide.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is expected to grow at the highest CAGR during the forecast period due to surging usage of media in the region, expansion of network infrastructure and the presence of several small and medium enterprises in India, China, Australia and Singapore, which are positively impacting market growth. In addition, the increasing demand for the solution by enterprises for training, onboarding employees, customer engagement, education and e-learning across the region is creating ample opportunities for the companies. For instance,

- In December 2023, The University of Macau, China, collaborated with YuJa by deploying YuJa’s Enterprise Video Platform, including live streaming, lecture capture, media management and sharing with enhanced security across the university for students.

Europe is expected to hold a significant market share during the forecast period due to investment and advancement in technology and the deployment of GDPR compliance across European countries. For instance,

- In June 2023, Synthesia, an AI video creation platform for enterprises, raised USD 104 million in Series C funding to advance its work to make video production simple without the need for studios or cameras.

The growth of this market in South America and the Middle East & Africa is mainly driven by the increasing economic value of queries, services, and requests, strengthening platform investment across the region.

Key Industry Players

Market leaders Focus on Expanding their Geographical Boundaries to Gain a Competitive Edge

Key players in the global market, such as Avaya LLC, Panopto, VIDIZMO LLC, Vbrick, Vidyard, VdoCipher Media Solutions and others, are focused on expanding their geographical boundaries by introducing specific solutions and new products to interest a vast customer base, thus improving revenue.

List of Top Enterprise Video Platform Companies:

- Avaya LLC (U.S.)

- Panopto (U.S.)

- VIDIZMO LLC (U.S.)

- Vbrick (U.S.)

- Vidyard (Canada)

- VdoCipher Media Solutions (India)

- Vidyo, Inc. (U.S.)

- Vimeo.com, Inc. (U.S.)

- Brightcove Inc. (U.S.)

- Kaltura (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Brightcove collaborated with Acquia by integrating Brightcove’s solutions with Acquia Open DXP to create video-forward experiences and enable data collection and analytics to guide their marketing strategy.

- July 2023: Vbrick launched its platform by integrating with ServiceNow. The integration allows Vbrick-hosted video content to be embedded into ServiceNow apps and portals with security permissions and access controls.

- July 2023: Vidyard launched an AI Script Generator to help sales professionals and go-to-market teams embrace video to stand out with visions, deliver exceptional buying experiences, and create new revenue opportunities.

- June 2023: Avaya expanded strategic alliances with Alcatel-Lucent Enterprise and Google to redefine the cloud experience for customers. These advancements enable customers to benefit from cloud capabilities, including new functionality and features of the Avaya Experience Platform.

- June 2023: Vidyard launched Vidyard Rooms, a new Digital Sales Room solution that centralizes deal resources, uncovers, engages key stakeholders, and accelerates the sales process to change the way buyers and sellers collaborate in the digital era.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 17.2% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Deployment, Enterprise Type, End-user, and Region |

|

Segmentation |

By Deployment

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 76.08 billion by 2032.

In 2024, the market was valued at USD 21.85 billion.

The market is projected to grow at a CAGR of 17.2% during the forecast period.

The on-premise segment holds the highest market share.

The enhancements in communications and collaboration by the enterprises through the solution drive market growth.

Avaya LLC, Panopto, VIDIZMO LLC, Vbrick, Vidyard, VdoCipher Media Solutions, Vidyo, Inc., and Vimeo.com, Inc. are the top players in the market.

North America market for enterprise video platform is expected to hold the largest share during the forecast period.

By end-user, the BFSI segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us