Europe Facial Injectable Market Size, Share & Industry Analysis, By Type (Botulinum Toxin, Collagen, Hyaluronic Acid, Calcium Hydroxylapatite, Polylactic Acid, Polymethyl-Methacrylate Microspheres (PMMA), Fat Injection, and Others), By Application (Wrinkle Reduction, Facelift, Acne Scar Treatment, Lipoatrophy Treatment, Lip Enhancement, and Others), By End-user (Hospitals & ASCs, Dermatology and Cosmetic Clinics, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

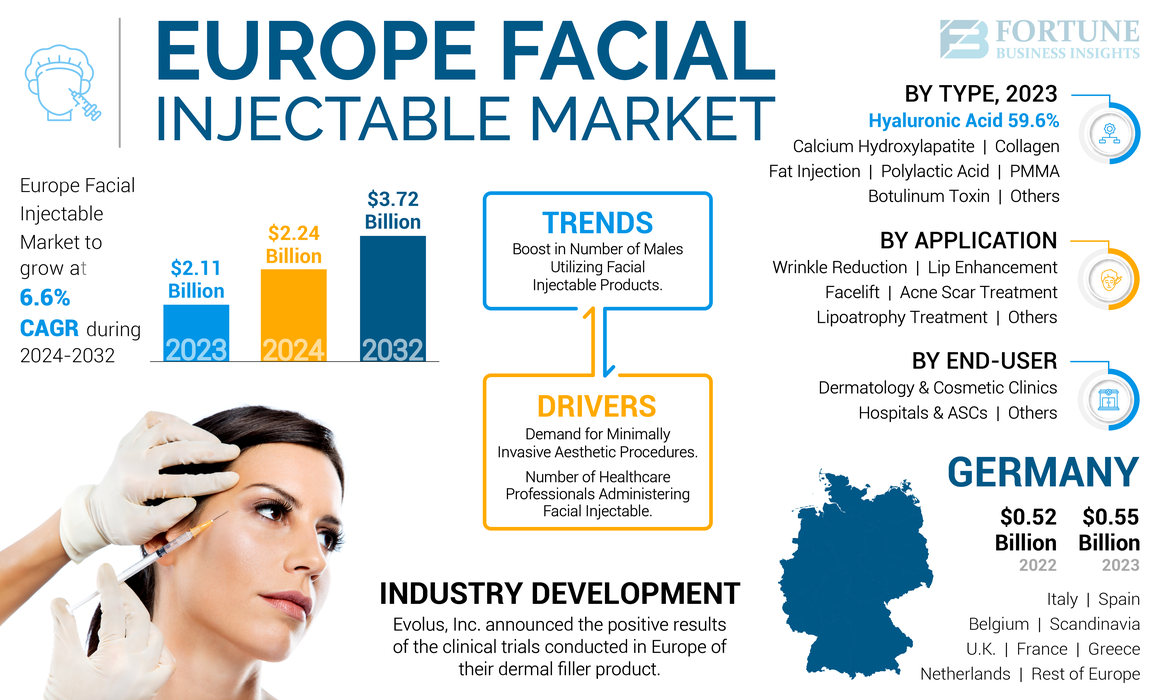

The Europe facial injectable market size was valued at USD 2.11 billion in 2023. The market is projected to grow from USD 2.24 billion in 2024 to USD 3.72 billion by 2032, exhibiting a CAGR of 6.6% during the forecast period.

Facial injectable comprises of products, such as dermal fillers and cosmetic botulinum toxins. A facial injectable refers to a product such as a dermal filler or an aesthetic neurotoxin that is injected under the skin to address the signs of aging, such as the wrinkles or fine facial lines. These products can also be used to augment the lost facial volume or for the enhancement of an individual’s facial contours. In the recent times, there has been a change in terms of attitudes toward the cosmetic procedures as people are seeking the enhancement of their looks. Increased awareness and higher disposable income in the European countries have also favored the greater adoption of these products. Additionally, as the procedures used for the administration of these products are minimally invasive, they have a considerable safety record and require very little recovery times. These factors have also contributed significantly to the market growth.

Moreover, the larger adoption of these products has led prominent companies in this market to increase their investments in various R&D activities for the development and introduction of novel facial injectable products. For instance, in June 2021, GALDERMA announced that their product of Alluzience, a ready to use BoNT-A neuromodulator, completed the European decentralized procedure for the temporary improvement of the appearance of the moderate to severe glabellar lines in the patients. This resulted in a positive decision, leading to the approval of the product. Such developments by key companies are predicted to increase the procedural volume and ultimately boost the Europe facial injectable market growth during the forecast period.

In terms of the COVID-19 scenario, the market reported a decline in terms of growth as the aesthetic and cosmetic clinics were closed and the elective procedures were postponed, due to the stringent lockdown restrictions imposed across the Europe. For instance, the revenues of the international segment of the Juvederm collection of Allergan Aesthetics witnessed a decline of 39.0% in FY 2020. However, in 2021 and 2022, the market witnessed a significant recovery as the lockdown restrictions were lifted and people sought to undergo their postponed cosmetic procedures.

In terms of 2023, the market underwent a comparatively slower growth to a restricted disposable income and subsequent reduction in the discretionary spending. In the forecast period of 2024-2032, the market is projected to witness considerable growth prospects.

Europe Facial Injectable Market Trends

Boost in Number of Males Utilizing Facial Injectable Products

In terms of the European market, one of the most important prevailing trends is the growth in the uptake of these products amongst the male demographic. A significant proportion of the male population has shown an inclination in the adoption of these products due to their heightened awareness regarding the signs of aging. As the male population becomes aware that aging can deteriorate their physical appearances, they are adopting these products to delay the aging process. An article by The Guardian in March 2021, reported that there was an estimated 70.0% increase in the demand for the injectable aesthetic procedures, which includes botulinum toxin.

Some of the trends witnessed in the younger male population includes the adoption of these products to delay the wrinkles formation, which can be done by the addition of volume and the plumping of the skin. Furthermore, these products can also help in the enhancement of the facial contours, and their definition. Also, an article published by Glowday stated that an increasing number of males are adopting products, such as lip fillers. The data published by the ISAPS in June 2023, indicated that hyaluronic acid fillers and botulinum toxin procedures are among the most popular facial injectable procedures amongst the men in Europe.

Download Free sample to learn more about this report.

Europe Facial Injectable Market Growth Factors

Surge in Demand for Minimally Invasive Aesthetic Procedures in Europe to Drive Market Growth

In Europe, the demand for cosmetic surgeries, especially the non-invasive procedures have witnessed a tremendous expansion over the past decade. Some of the examples of these minimally invasive procedures includes the cosmetic neurotoxins such as the botulinum toxin and the dermal fillers. Some of the reasons for this surge in the demand includes the superior patient outcomes of these procedures and the fact that these procedures do not require much recuperation time. Also, there is a greater influx of flexible financing options for these procedures as they are more than often, out of pocket expenditures for the patients. All these factors have made these procedures increasingly available and easier for the patient to adopt in the current situation.

As the demand for these procedures continues to grow and the expectation of the customers continues to mount, the manufacturers of these products are increasingly investing in the development of niche products. They have increasingly endeavored to introduce new technologies such as the development of dual effect hybrid injectable such as Allergan Aesthetics’ HArmonyCa. All these factors have led to a substantial growth in the procedural volume for aesthetic procedures. In terms of the data published by the International Society of Aesthetic Plastic Surgery (ISAPS) data for 2023, the number of nonsurgical procedures in Germany were 781,440, 269,136 in Spain, 560,100 in France, 495,188 in Italy, and 174,742 in Romania. These trends are further boosting the market.

Growth in Number of Healthcare Professionals Administering Facial Injectable to Boost Market Growth

In terms of the volume of procedures and popularity, the dermal fillers and the botulinum toxin procedures rank amongst the top-most in the cosmetic procedures. As the global population ages, there is a greater demand for these products to effectively address the signs of aging and to also improve the appearances of the individuals. These factors have led to an increasing demand for qualified professionals to undertake these procedures. These products can be administered by a diverse and wide number of trained healthcare professionals, such as General Practitioners (GPs), nurses, dentists, cosmetic surgeons, and dermatologists. Hence, this has led to a substantial growth in the procedural volume for these products, and also eased their availability to the general public.

In terms of the European scenario, for instance, Germany ranks as one of the top most countries in terms of number of procedures in the region. Similarly, in terms of the estimated number of surgeons, Germany ranks 11th, in terms of the top 30 countries. Thus, the consistent increase in the number of healthcare professionals administering these products, will contribute to the market growth.

RESTRAINING FACTORS

Significant Expenditure and Possibility of Adverse Effects of Facial Injectable May Limit Market Growth

Although facial injectable offer several advantages in terms of favorable aesthetic outcomes, there are several parameters that may limit the market growth over the forecast period. Out of these, some of the most important factors includes the exorbitant costs associated with these products. The high cost of these products are contingent on the technological superiority of the product and the qualifications, coupled with the expertise of the professional administering these products. According to the Flawless Aesthetic Clinic in the U.K., the prices for the Juvederm facial fillers may range from approximately USD 320 to USD 640 per syringe. Furthermore, this cost is subject to fluctuations as the amount of the filler required tends to vary from person to person. Another critical factor impacting the costs of these products is that repeated treatments for these dermal filler and cosmetic neurotoxin products are required to maintain the aesthetic effect. This further adds up the cost for the customer, which may deter them from adopting these products. Hence, this is identified as a critical deterrent for the Europe facial injectable market growth.

Another important factor that impacts the uptake of these products are the side effects or the adverse reactions associated with them. Several studies have noted that the long-acting dermal fillers may exert negative reactions, such as formation of nodules and infection. Although the cases of adverse reactions are rarer, incorrect administration of these products by untrained professionals into the blood vessels may lead to blindness or blurring of vision and formation of scars.

Europe Facial Injectable Market Segmentation Analysis

By Type Analysis

Substantial Uptake of Hyaluronic Acid Fillers Due to Wider Benefits Offered to Contribute to its Market Dominance in 2023

Based on type, the market is segmented into polylactic acid, collagen, botulinum toxin, fat injection, calcium hydroxylapatite, hyaluronic acid, Polymethyl-Methacrylate Microspheres (PMMA), and others.

The hyaluronic segment dominated the market in 2023. Some of the advantages associated with these fillers include, a lower risk of adverse effects, significantly more natural looking impact on the facial features, and a greater longevity. Furthermore, the strong market presence of key products, such as the Juvederm range of facial fillers in the European market also contributes to the segment’s dominance in the region.

The second largest market share was accounted by the botulinum toxin segment in 2023. The substantial adoption of the aesthetic neurotoxins by the consumers, coupled with the availability of prominent products, such as the Botox Cosmetic and Dysport in the region has contributed to the segmental growth.

The segment of calcium hydroxylapatite accounted for the third-largest Europe facial injectable market share in 2023. The prominent segment share was attributed to the product type’s significantly higher longevity, versatility, and safety profile. Also several market players are focused on the research in these dermal fillers, which further augments the segmental growth.

The segment of polylactic acid is projected to register a significantly stronger CAGR, which is further driven by the re-launch of the product with added benefits, such as a shorter reconstitution time in the European market.

The collagen segment is estimated to grow at a comparatively limited CAGR.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Strong Demand for Innovative Products for Wrinkle Reduction Led to its Segmental Dominance

In reference to the application segment, the market can be classified into lip enhancement, wrinkle reduction, lipoatrophy treatment, acne scar treatment, facelift, and others.

The segment of wrinkle reduction accounted for the largest market share in 2023 and is also projected to register the fastest CAGR across the forecast period. The segment’s dominance is attributed to the presence of a large number of injectables dedicated to the treatment of this aesthetic indication, and a strong demand from the customer base for the management of this condition.

Lip enhancement segment held the second dominant position in the European market in 2023 and is expected to grow at a high CAGR throughout the forecast period. The robust demand for these cosmetic procedures, coupled with the innovative product launches in this segment is anticipated to further support the segment’s growth prospects.

The facelift segment was estimated to be the third leading segment in 2023. The growth of the segment is attributable to the ability of this cosmetic procedure to address the visible signs of aging, coupled with their long lasting effects.

The other prominent application area of these products, include the acne scar treatment and the lipoatrophy treatment.

By End-user Analysis

Segment of Dermatology and Cosmetic Clinics Dominated Owing to Strong Procedural Volumes in These Institutions

On the basis of the end-user, the market can be segmented into dermatology and cosmetic clinics, hospitals & ASCs, and others.

The dermatology and cosmetic clinics accounted as the largest segment in 2023 and is also projected to grow at the highest CAGR. This segmental dominance was due to the strong number of aesthetic procedures conducted in these settings. Furthermore, the expertise of these institutions in the treatment of common aesthetic problems such as loss of facial volume and wrinkles through injectables is also augmenting their segmental growth.

The segment of hospitals & ambulatory centers are estimated to account for a suitable share of the market in 2023. Some of the reasons for the segment’s growth across the forecast period includes the steady cosmetic procedural volume in these settings in the key countries such as the U.K. For instance, the ASET Hospital in the U.K., is one of the leading hospitals in the country for the cosmetic neurotoxin procedures.

COUNTRY INSIGHTS

High Cosmetic Procedural Volume in Germany to Enable its Dominant Market Position in 2023

On the basis of the country/sub-region segment, the European market can be segmented into U.K., Germany, Greece, France, Spain, Italy, Scandinavia, Belgium, The Netherlands, and the Rest of Europe.

In terms of the countries, Germany stood as the largest market in Europe. The Germany market was valued at USD 0.55 billion in 2023. Technologically superior healthcare infrastructure, strong volume of aesthetic procedures, presence of key manufacturers, and a highly aware customer base are the key factors contributing to the country’s market dominance. For instance, according to the data published by the ISAPS in 2023, the number of procedures involving injectables in Germany, amounted to 721,587.

France is estimated to account for the second largest share of the European market in 2023. Strong and consistent aesthetic procedural volume in the country, coupled with the presence of several domestic and international manufacturers of injectables, such as Ipsen Pharma, is anticipated to boost the country’s market growth and revenue share in the European region.

Italy accounted as the third largest country in terms of facial injectables in the Europe market. The country’s substantial market share is due to the strong number of aesthetic procedures in the country, coupled with a strong demand for aesthetic products including injectables such as cosmetic neurotoxins. For instance, according to the ISAPS in June 2024, in 2023, the number of cosmetic procedures involving botulinum toxin in Italy amounted to 194,335.

The U.K. is set to register the highest CAGR over the forecast period of 2024-2032. The substantial customer base, availability and access to key established and emerging manufacturers, and the presence of numerous end-user settings such as cosmetic clinics are anticipated to contribute to the country’s market growth.

Spain, and the region of Scandinavia, will account for a notable market share in 2023. However, the countries of Belgium, and the Netherlands will account for a comparatively lower market share owing to their relatively limited population base, and a lower expenditure on cosmetic injectables.

The Greece and the rest of Europe markets are projected to demonstrate a comparatively lesser market share in 2023, owing to a correspondingly lower customer base.

KEY INDUSTRY PLAYERS

Varied Product Offerings Coupled with Strategic Initiatives for Facial Injectables to Pivot Allergan Aesthetics, GALDERMA and Merz Pharma to Peak Position

In terms of the competitive landscape, the European market is dominated by three key players, namely: Allergan Aesthetics, GALDERMA, and Merz Pharma. Allergan Aesthetics dominates the European market on account of the company’s market leading product portfolio of dermal fillers and aesthetic neurotoxins. The company’s product offerings of the Juvederm Collection and the BOTOX Cosmetic has enabled it to occupy the top position in 2023. Also, in order to further augment the company’s market position, the company’s continues to launch innovative products and also engage in strategic initiatives such as consumer campaigns.

The other two key companies in the European market includes GALDERMA and Merz Pharma. These two companies have consistently accounted for the prominent market shares owing to their diverse product portfolio comprising of key product types and strong distribution networks. For instance, GALDERMA’s key product offerings include their Restylane range of dermal fillers. However, the company may further strengthen its market share due to the regulatory approval and launch of their ready to use neuromodulator of Alluzience in Europe. Also, Merz Pharma occupies a robust market share on account of their wide product portfolio for facial injectables and recent regulatory approvals in Europe.

Other key companies include the emerging and established companies such as Teoxane, Sinclair and Ipsen Pharma. These companies are engaging in clinical trials, new product launches, and strategic activities to bolster their revenue share in the market.

List of Top Europe Facial Injectable Companies:

- Allergan Aesthetics (AbbVie Inc.) (U.S.)

- Ipsen Pharma (France)

- Merz Pharma (Germany)

- GALDERMA (Switzerland)

- BIOPLUS CO., LTD. (South Korea)

- BIOXIS Pharmaceuticals (France)

- Teoxane (Switzerland)

- Sinclair (Huadong Medicine Co., Ltd.) (U.K.)

- Prollenium Medical Technologies (Canada)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 - Evolus, Inc. announced the positive results of the clinical trials conducted in Europe of their dermal filler product (Evolysse/Estyme Lift). The company’s European Lift study met its primary endpoint of “non-inferiority”, when compared to the product of Restylane-L for the indication of improvement in the nasolabial fold severity.

- February 2024 - Merz Pharma received the EU approval for Radiesse, an aesthetic injectable to improve the moderate and severe wrinkles in the décolleté area.

- January 2024 - Prollenium Medical Technologies partnered with Sisram Medical Ltd, providing it distribution rights for Revanesse in Austria, Germany, Australia, and others.

- March 2023 - Galderma announced the launch of FACE by Galderma, an innovative aesthetic visualization tool powered by Augmented Reality (AR) that simulates injectable treatment results in real-time.

- February 2022 - Sinclair Pharma announced the acquisition of Viora. This acquisition helped the company expand its presence in the medical aesthetics devices market.

REPORT COVERAGE

The report covers a detailed analysis of the Europe facial injectable market report. Some of the key aspects that the report covers include the key industry developments such as the mergers, partnerships and acquisitions, the new product launches by the key players, the market dynamics governing the European market, and the key industry trends prevailing in the market. Furthermore, the market analysis also covers the impact of the COVID-19 pandemic on the European market. Some of the other insights provided in the report includes the pricing analysis, the overview of facial injection procedures by type for the key countries and the facial injectable procedures’ proportion in the total non-surgical procedures in EU5 countries. The report also deeply studies the competitive landscape of the European market and provides insights into the market shares, and the strategies adopted by the key companies. Additionally, the report also considers the several factors contributing to the Europe facial injectable market growth in the recent years and the opportunities in it.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.6% from 2024-2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Country/Sub-region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 2.11 billion in 2023 and is projected to record a valuation of USD 3.72 billion by 2032.

The market is expected to exhibit a CAGR of 6.6% during the forecast period.

In terms of the type segment, the hyaluronic acid segment dominated the market in 2023.

Some of the key factors driving the market in the region includes innovative product launches, increasing R&D initiatives for the development and introduction of the novel products, and a strong procedural volume for the aesthetics procedures across the key countries.

In terms of the key players for the European market, Allergan Aesthetics (AbbVie), Galderma, and Merz Pharma are the major companies in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us