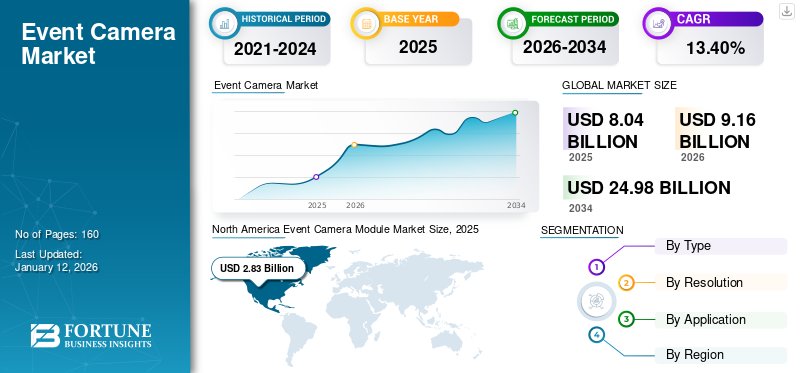

Event Camera Module Market Size, Share & Industry Analysis, By Type (Dynamic Vision Sensors (DVS) and Event-based Vision Sensors (EVS)), By Resolution (Standard and High), By Application (Automotive & Mobility, Industrial Automation & Robotics, Consumer Electronics, Security & Surveillance, Healthcare & Biomedical Imaging, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global event camera module market size was valued at USD 8.04 billion in 2025. The market is projected to grow from USD 9.16 billion in 2026 to USD 24.98 billion by 2034, exhibiting a CAGR of 13.40% during the forecast period. North America dominated the global market with a share of 35.30% in 2025.

The event camera module market refers to the industry focused on the development, production, and distribution of cameras that capture visual data based on changes in the scene rather than traditional frame-based imaging. These modules are designed to enhance efficiency in various applications by reducing data redundancy, improving low-light performance, and enabling ultra-fast imaging. The market is driven by increasing demand for real-time vision processing across various applications such as automotive, industrial automation, consumer electronics, healthcare, and others.

Samsung, Sony Corporation, Prophesee.ai, iniVation AG, Northrop Grumman, CenturyArks Co., Ltd., Omnivision, Imago Technologies GmbH, Pepperl+Fuchs SE, and LUCID Vision Labs Inc. are the key players in the market.

EVENT CAMERA MODULE MARKET TRENDS

Integration of Event Cameras with Edge Computing is a Market Trend

The integration of event cameras with edge computing enables real-time visual processing. This is particularly beneficial in applications requiring immediate responses, such as surveillance systems or smart city infrastructure. As AI and IoT technologies advance, integrating AI chips into edge devices, including smart cameras, will further enhance the capabilities of these systems. This trend is expected to continue, with edge computing playing a central role in optimizing IoT ecosystems. Moreover, the low data output of event cameras allows for low power consumption, making them suitable for edge computing environments where energy efficiency is essential. For instance,

- Companies such as Eoptic and Prophesee are integrating event cameras with edge computing platforms to enhance real-time visual processing capabilities. This integration is expected to unlock new applications across various industries. Also, new chips such as Intel’s Loihi 2 are being developed to support better neuromorphic processing, which will further enhance the capabilities of event cameras in edge computing environments.

Therefore, the integration of edge computing in event cameras is a key trend that is accelerating the event camera module market growth.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Increasing Demand for High-speed Imaging Applications across Various Sectors, Including Robotics, Automotive, and Industrial Automation, is Driving Product Adoption

Event camera modules are gaining traction in industrial automation, robotics, and automotive. They provide dynamic range and are used in applications requiring rapid data tracking and low latency, such as robot-assisted surgeries. Advancements in automation and manufacturing technologies have expanded the use of such event cameras for detailed inspections and real-time monitoring. In robotics, event cameras allow for the immediate processing of visual information, improving machine learning algorithms and enabling quicker decision-making. For instance,

- According to a report from the International Federation of Robotics, around 4,281,585 industrial robots were sold globally in 2023, highlighting the rapidly growing automation industry and the need for sophisticated imaging technologies.

In automotive, event cameras capture detailed data on vehicle deformations and safety features during crash simulations, aiding in vehicle design improvements. The development and deployment of autonomous vehicles are pushing the need for high-speed imaging systems that can operate effectively under various environmental conditions (e.g., changing lighting and high quality motion). These factors are accelerating the adoption of these modules for automotive applications.

Market Restraints

High Costs, Data Processing Complexity, and Regulatory Compliance to Hinder Market Growth

Developing event camera solutions tailored to specific applications requires substantial investment in R&D, unique talent and skills, prototyping, and validation. This poses significant barriers to entry for smaller players and startups. The asynchronous nature of event camera data necessitates specialized algorithms and processing pipelines for event extraction, feature tracking, and scene reconstruction. This increases computational complexity and resource requirements, which can be a challenge for many potential users. Furthermore, compliance with industry regulations, privacy laws, and safety standards for event camera-enabled systems adds complexity and cost to product development and certification. This is particularly challenging in applications such as automotive, healthcare, and surveillance.

Market Opportunities

Increasing Popularity of Smart Cities is Generating Numerous Opportunities for Event Camera Modules in Fields of Urban Planning and Infrastructure Management

The growing culture of smart cities presents a significant opportunity for event camera module manufacturers to innovate and expand their offerings in urban infrastructure and planning.

Modular designs allow for customization and scalability, making them adaptable to various innovative city applications, from public safety to infrastructure management. The combination of IoT connectivity and AI processing in these modules offers opportunities for advanced analytics and real-time decision-making in urban environments. Moreover, cameras and IoT sensors provide valuable data on urban activities, helping planners make informed decisions about infrastructure development and resource allocation.

Organizations are upgrading and providing event camera modules for enhanced surveillance and security. For instance,

- Fibocom's 5G/4G modules enable IoT cameras to provide high-definition surveillance, supporting real-time monitoring and analysis. This enhances urban safety by facilitating intelligent applications like video retrieval and behavior analysis.

- According to Enterprise Apps Today, by the year 2050, it is expected that approximately 60% of the world's population will be living in Smart Cities. Advanced technology, improved connectivity while retaining urban characteristics, and upgraded infrastructure will transform the landscape of these cities.

These modules are pivotal in enhancing urban planning and infrastructure management by providing real-time data, improving security, and optimizing traffic flow. As smart city initiatives continue to grow, these modules will play an increasingly important role in shaping more efficient and sustainable urban environments.

SEGMENTATION ANALYSIS

By Type

Rise in Real-time Application across Various Industries to Drive EVS Segment’s Growth

By type, the market is divided into Dynamic Vision Sensors (DVS) and Event-based Vision Sensors (EVS).

EVS sensors hold the highest market share of 58.96% in 2026. They are expected to grow at the highest CAGR due to their higher capabilities in capturing high-speed data with low latency, making them suitable for real-time applications for various industries. Additionally, their energy-efficient performance and ability to process complex dynamic events have accelerated their adoption across sectors.

DVS accounts for the second-highest share of the market as they offer enhanced motion detection and low-light imaging, making them ideal for diverse applications such as industrial automation and automotive systems. Their cost-effectiveness and ability to work in challenging environments continue to sustain their requirement.

By Resolution

Increasing Need for Moderate Resolution to Fuel Standard Segment’s Growth

By resolution, the market is distributed into standard and high.

Standard resolution dominates the market share of 61.15% in 2026, due to its widespread use in well-known applications that require moderate resolution. These modules offer a balance between performance and affordability, supporting high adoption rates across industries such as manufacturing and logistics.

High resolution is expected to witness the highest CAGR as the demand for advanced imaging quality and detailed scene analysis grows in sectors such as autonomous vehicles and security. The need for precise and high-definition data capture to enhance decision-making processes is driving this segment’s growth.

By Application

To know how our report can help streamline your business, Speak to Analyst

Push for Industry 4.0 Initiatives Boosts Industrial Automation & Robotics Application

Based on application, the market is divided into automotive & mobility, industrial automation & robotics, consumer electronics, security & surveillance, healthcare & biomedical imaging, and others.

Industrial automation & robotics dominate dominates the market share of 27.30% in 2026, due to the wide range deployment of event camera modules in factory automation, machine vision, and robotic systems to enable real-time object detection and process optimization. The increasing push for Industry 4.0 initiatives and smart manufacturing further fuels the demand within this segment.

Automotive & mobility is projected to grow at the highest CAGR, driven by the rapid integration of event-based vision technologies in Advanced Driver Assistance Systems (ADAS) and autonomous vehicles. The need for low-latency, high-speed visual data processing for safer and more efficient mobility solutions is propelling this segment’s rapid expansion.

EVENT CAMERA MODULE MARKET REGIONAL OUTLOOK

North America

North America Event Camera Module Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.83 billion in 2025 and USD 3.25 billion in 2026. North America holds the largest share of the global market due to its strong technological infrastructure, advanced R&D ecosystem, and high adoption rate of advanced technologies. The presence of leading market players, including Google, Apple, and Intel, has facilitated the rapid development of event-based vision technology. The U.S. market is projected to reach USD 2.38 billion by 2026. For instance,

- In February 2025, Apple is developing its Vision Pro operating system with the release of visionOS 2.4, introducing several new features aimed at improving user experience. The solution will feature AI-powered functionalities, including writing tools and image processing capabilities.

Additionally, significant investments in autonomous vehicles, robotics, and artificial intelligence (AI)-driven applications further strengthen the region’s market position. The increasing demand for real-time vision solutions in the U.S. for sectors such as defense, healthcare, and consumer electronics is also contributing to the region’s dominance.

Asia Pacific

Asia Pacific is expected to witness the highest CAGR in the global market, driven by rapid technological advancements, increasing industrial automation, and growing investments in AI and robotics. The Japan market is projected to reach USD 0.53 billion by 2026, the China market is projected to reach USD 0.71 billion by 2026, and the India market is projected to reach USD 0.31 billion by 2026. For instance,

- The Deloitte Asia Pacific AI Institute provides C-suite executives and technology leaders with practical insights on fostering trustworthy AI. The report emphasizes the need for strong frameworks as AI investment in the Asia Pacific is projected to increase fivefold to USD 117 billion by 2030.

The region’s strong manufacturing base, particularly in China, Japan, India, and South Korea, is fostering the adoption of event cameras in various applications. Additionally, rising government support for smart infrastructure and digital transformation is accelerating market expansion.

Europe

Europe holds the second-largest share of the global market, driven by substantial technological advancements, a well-established automotive industry, and increasing demand for industrial automation. The UK market is projected to reach USD 0.6 billion by 2026, and the Germany market is projected to reach USD 0.53 billion by 2026. For instance,

- According to the European Commission, the automotive industry is a key pillar of the European economy, employing approximately 13.8 million people, which accounts for 6.1% of total EU employment. The EU remains one of the world’s top motor vehicle producers, manufacturing around 14.8 million vehicles annually, including 12.2 million passenger cars.

The U.K., Germany, and France are at the forefront of innovation in AI-powered vision systems, contributing to the widespread adoption of event cameras. Additionally, European Union (EU) initiatives supporting smart manufacturing and digital transformation are fostering market growth across various industries.

Middle East & Africa and South America

The Middle East and Africa & South America are expected to grow at an average CAGR in the market, driven by increasing investments in smart city initiatives, infrastructure development, and security applications. Governments in the UAE, Brazil, Saudi Arabia, and South Africa are focusing on enhancing urban surveillance systems, leading to moderate adoption of event camera technology.

- In January 2025, the Brazilian president and 12 government ministers invested USD 32 billion to advance IoT, AI, and significant data infrastructure. This initiative aims to support Brazil’s digital transformation in the manufacturing and industrial sectors.

The automotive sector in Middle East & Africa is still developing, with limited penetration of autonomous vehicles and ADAS technologies. However, increasing investments in AI-powered mobility solutions, particularly in the UAE, are expected to contribute to market growth. For instance,

- According to PwC, the Middle East invested USD 2.4 billion in AI-driven climate technology in 2024, representing nearly 2.5 times the investment made in the previous year. Autonomous vehicles accounted for 96% of this investment, highlighting the region’s commitment to transforming the future of mobility.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strategic Alliances and Investments Pave the Way for Growing Business Trajectories

The market players are updating their existing products and developing new products to meet the changing customer requirements. New Innovations, advancing present portfolios, and new integrations help businesses increase their product expertise, deliver better user experience, and determine measurable evaluations and analysis for marketers. In addition, strategic agreements, partnerships & collaborations, and mergers & acquisitions are prominent fundamental business strategies adopted by every market player to expand their business operations and geographical presence. The strategy aids in the overall development and expansion of the event camera module market share.

Major Players in the Event Camera Module Market

To know how our report can help streamline your business, Speak to Analyst

The market players, such as Samsung, Sony Corporation, Prophesee.ai, iniVation AG, and OmniVision, are among the prominent players with a market share of 55% - 60%. These leading players sell their products in various regions worldwide, such as the Americas, Asia Pacific, and Europe, among others. Moreover, these companies aim to engage in collaboration, product launches, partnerships, mergers, and acquisitions (M&A) activities to expand their business and geographical presence. For instance,

- In May 2024, Prophesee announced that its event-based Metavision HD sensor is compatible with the AMD Kria KV260 Vision AI Starter Tools, offering a robust and efficient solution for accelerating the advancement of sophisticated machine vision applications. This development works with an AMD platform in the industry, giving customers a means to evaluate and move towards production with an industrial-grade solution tailored for applications like security cameras, retail analytics, smart cities, machine vision, and more.

List of Event Camera Module Companies Profiled

- Samsung (South Korea)

- Sony Corporation (Japan)

- Prophesee.ai (France)

- iniVation AG (Switzerland)

- Northrop Grumman (U.S.)

- CenturyArks Co., Ltd. (Japan)

- OMNIVISION (U.S.)

- IMAGO Technologies GmbH (Germany)

- LUCID Vision Labs Inc. (Canada)

- Pepperl+Fuchs SE (Germany)

- SynSense (Switzerland)

- Framos (Canada)

- OpenMV, LLC (U.S.)

- Cognex Corporation (U.S.)

- Teledyne Technologies (U.S.)

- Keyence Corporation (Japan)

- Allied Vision Technologies GmbH (Germany)

- Chicony Electronics Co., Ltd. (Taiwan)

- Other players

KEY INDUSTRY DEVELOPMENTS

- February 2025: Apple plans to develop its Vision Pro operating system with the release of visionOS 2.4, introducing several new features aimed at improving user experience. The solution will feature AI-powered functionalities, including writing tools and image generation capabilities.

- January 2025: Prophesee teamed up with Eoptic, Inc., recognized for its optics systems integration and imaging, to form a strategic alliance focused on integrating Eoptic’s prismatic sensor module with high-speed event detection. This partnership aims to combine Prophesee’s event-based Metavision sensors with Eoptic’s Cambrian Edge imaging platform to tackle challenges in real-time imaging and investigate new opportunities in dynamic visual processing.

- December 2024: Ultraleap unveiled a development kit combining Prophesee’s GENX320 event camera with advanced micro-gesture control via the Helios SDK. This innovation aims to transform interaction technology for smart glasses, enabling precise gesture-based control for various applications.

- October 2024: LUCID Vision Labs, Inc., a company that designs and manufactures industrial cameras, introduced the Triton2 EVS event-based 2.5GigE camera. This camera is equipped with IMX637 and IMX636 event-based vision sensors, developed in partnership with Sony and Prophesee.

- October 2024: The Volkswagen Group announced plans to utilize sensor and image data from its vehicles to enhance driver assistance systems and automated driving functions. Initially launching in Germany in Q4, the initiative began with Volkswagen and Audi models before expanding to other brands within the group.

- October 2024: CenturyArks Co., Ltd. officially unveiled the BothView C-mount model, which is a variant of the SilkyEvCam event-based vision camera product.

- September 2024: Sony and Raspberry Pi launched an AI camera. The Raspberry Pi AI Camera, well-suited with Raspberry Pi’s single-board computers, will be available at a retail price of USD 70.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market presents significant investment opportunities driven by increasing demand for high-speed, low-latency vision solutions across various industries. Investors are expected to benefit from the rising adoption of event-based vision technologies in emerging applications such as autonomous vehicles and smart factories, which require real-time data processing. Additionally, developments in sensor resolution and AI integration are expected to unlock new growth opportunities, making the market highly attractive for strategic investments and partnerships.

REPORT COVERAGE

The global market report covers an overview of the market and centers on central characteristics such as leading players, product types, supply chain, and their use cases in the market. Besides, the report offers insights into the market trends and highlights current market-related improvements. In addition, the report covers the competitive landscape of the overall market. Further, the report also comprises several factors that backed the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Resolution

By Application

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 24.98 billion by 2034.

In 2025, the global market was valued at USD 8.04 billion.

The market is projected to grow at a CAGR of 13.40% during the forecast period.

By application, the industrial automation & robotics segment led the market in 2026.

Increasing demand for high-speed imaging applications across various sectors, including robotics, automotive, and industrial automation, is driving the adoption of event camera modules in the market.

Samsung, Sony Corporation, Prophesee.ai, and iniVation AG are the top players in the market.

North America dominated the global market with a share of 35.30% in 2025.

By type, the Event-Based Vision Sensors (EVS) are expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us