Extraoral Imaging Market Size, Share & Industry Analysis, By Product Type (Panoramic Systems, Panoramic & Cephalometric Systems, and 3D CBCT Systems), By Application (Implantology, Orthodontics, Oral & Maxillofacial Surgery, and Others), By End-user (Imaging Centers, Dental Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

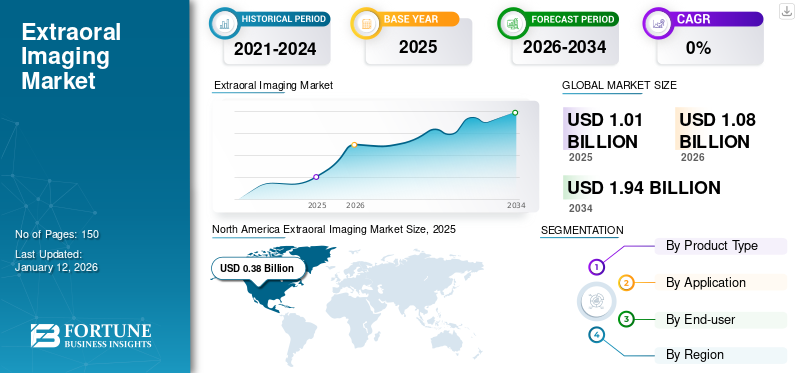

The global extraoral imaging market size was valued at USD 1.01 billion in 2025. The market is projected to grow from USD 1.08 billion in 2026 to USD 1.94 billion by 2034, exhibiting a CAGR of 7.60% during the forecast period. North America dominated the global extraoral imaging market with a market share of 37.30% in 2025.

Extraoral imaging encompasses techniques where the X-ray film or the detector is positioned outside the patient's mouth. It includes panoramic radiography, which captures a wide view of the entire dentition and the surrounding structures in a single image, aiding in the diagnosis of the impacted teeth, jaw disorders, and overall dental health. In addition, cephalometric radiography provides a lateral view of the skull, which is crucial for orthodontic treatment planning as it is used for the assessment of skeletal relationships and growth patterns. These imaging modalities minimize the radiation exposure and offer comprehensive insights into dental and craniofacial conditions, enhancing diagnostic accuracy and treatment outcomes in dentistry. 3D CBCT (cone beam computed tomography) is an advanced imaging technique used in dentistry and maxillofacial surgery, providing detailed three-dimensional views of dental structures, bones, and soft tissues with minimal radiation exposure compared to traditional CT scans.

The global market growth is attributed to the advancements in imaging technologies, such as digital sensors and panoramic systems, which enhance image quality and diagnostic accuracy. In addition, the increasing prevalence of dental disorders and the need for a comprehensive imaging platform to plan the treatment contribute significantly to the growth of the market. Furthermore, the benefits of reduced radiation exposure and quicker image acquisition times have increased the adoption of these systems among dentists. Moreover, the expanding healthcare infrastructure and investments in the dental imaging industry across the world further stimulate the adoption of these imaging technologies.

The COVID-19 pandemic significantly disrupted the market as dental practices were closed, and there was a lower number of patient visits, leading to a decreased demand for imaging equipment. Furthermore, disruptions in the supply chain also caused a decline in the adoption of this equipment. However, in the post-pandemic years, there has been a growing emphasis on advanced imaging solutions that enhance diagnostic accuracy and patient safety, driving market innovation and expansion.

Global Extraoral Imaging Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.01 billion

- 2026 Market Size: USD 1.08 billion

- 2034 Forecast Market Size: USD 1.94 billion

- CAGR: 7.60% from 2026–2034

Market Share:

- North America dominated the global extraoral imaging market with a 37.30% share in 2025, driven by the strong presence of dental imaging centers, early adoption of advanced imaging diagnostics, and continuous innovations from key industry players.

- By product type, 3D CBCT Systems held the largest market share in 2024, owing to their precision, versatility in implantology and orthodontics, and increasing applications in cosmetic dentistry and maxillofacial surgeries.

Key Country Highlights:

- United States: Growth is driven by a large network of dental clinics and imaging centers adopting cutting-edge extraoral imaging systems, supported by strong investments in dental technology advancements.

- Europe: The market is expanding due to increasing awareness of oral health, rising adoption of advanced dental imaging equipment, and a well-established healthcare infrastructure fostering equipment installation in clinical settings.

- China: High demand for advanced dental diagnostics, growing dental tourism, and increasing healthcare investments are accelerating the adoption of extraoral imaging technologies in the country.

- Japan: The market is driven by the rising geriatric population requiring dental care, along with a strong focus on technological innovations in imaging solutions for precision diagnostics and treatment planning.

Extraoral Imaging Market Trends

Increased Transition From 2D to 3D Extraoral Imaging to Generate Broader Treatment Alternatives

Traditional 2D imaging methods such as panoramic radiography have long been utilized for dental diagnostics, providing valuable insights but with limitations in terms of spatial resolution and anatomical details. In contrast, 3D extraoral imaging, such as cone beam computed tomography (CBCT), offers volumetric data acquisition that allows for the detailed three-dimensional visualization of dental structures, bone morphology, and soft tissues.

Dental practitioners are increasingly favoring this shift due to their several key advantages. CBCT provides enhanced diagnostic accuracy, enabling the precise assessment of complex anatomical relationships. In addition, it facilitates more accurate treatment planning for procedures such as implant placements, orthodontics, and surgical interventions.

- For instance, according to the survey published by NCBI in April 2024, in the surveyed hospital, the dental CBCT was used mainly for the assessment of dental implants, accounting for 1,148 (78.85%) of the total 1,456 irradiation scans.

The ability to view dental structures from multiple angles and planes in 3D imaging reduces errors and ensures a comprehensive evaluation of the patient's condition. Moreover, the growing emphasis on patient-centric care and the demand for minimally invasive treatments have bolstered the adoption of 3D imaging technologies.

Download Free sample to learn more about this report.

Extraoral Imaging Market Growth Factors

Technological Advancements in Extraoral Imaging to Offer Wide Treatment Options

Technological innovations such as digital sensors and advanced panoramic systems have led to the development of a novel way for dental professionals to diagnose and treat patients. Digital sensors offer an enhanced resolution, higher image quality, and immediate image availability compared to traditional film-based systems. These sensors improve diagnostic accuracy and streamline workflow efficiencies in dental practices.

Furthermore, the advancements in software and image processing techniques have further augmented the utility of extraoral imaging techniques. These technologies have enabled dentists to manipulate and analyze the images more effectively, leading to better treatment outcomes and patient care.

- For instance, Dental Imaging Technologies Corporation’s extraoral equipment ORTHOPANTOMOGRAPH OP 3D LX unit exemplifies the technological advancements in extraoral imaging. The imaging equipment offers flexible FOV options from 5x5 cm to 15x20 cm, catering to diverse dental specialties, from endodontics to complex surgeries. Its non-stitched scans and shorter scan times enhance efficiency, capturing comprehensive maxillofacial details in one seamless process.

Moreover, the advancements in the CBCT enable the detailed three-dimensional visualization of the anatomical structures with minimal radiation exposure, which appeals to dental professionals for its efficiency and comprehensive insights. The growing adoption of CBCT for various complex procedures and its role in guiding precise interventions are driving the global extraoral imaging market growth.

Growing Demand for Non-Invasive Diagnostics to Support Market Growth

In recent years, there has been a growing demand for non-invasive diagnostics, which contributes to the adoption of dental extraoral imaging technologies. Nowadays, patients prefer diagnostic tools that minimize discomfort and reduce the need for invasive procedures. These imaging techniques such as panoramic radiography and cone beam computed tomography (CBCT) fulfill this need by providing comprehensive views of the oral and maxillofacial regions without the need for intraoral placement of sensors or films.

- For instance, as per the survey published by NCBI in April 2024, in the surveyed hospital in Taiwan, the number of patients’ visits for the diagnosis using dental CBCT increased from 355 in 2020 to 449 in 2021 and further to 488 in 2022.

Panoramic radiography, for instance, offers a wide-angle view of the entire dentition, supporting the diagnosis of conditions such as impacted teeth, jaw disorders, and temporomandibular joint (TMJ) problems. CBCT, on the other hand, provides detailed three-dimensional images that aid in complex treatment planning, such as dental implants and orthodontic interventions, while minimizing radiation exposure compared to traditional CT scans.

In addition, regulatory bodies and healthcare organizations advocate for the eradication of unnecessary radiation exposure, which further promotes the adoption of this type of imaging solution in dental practices across the world. Such clinical benefits are expected to increase the adoption of advanced these imaging technologies to improve dental care outcomes and patient satisfaction.

RESTRAINING FACTORS

High Cost of Extraoral Imaging Equipment May Hamper Market Growth

The high cost of extraoral imaging equipment represents a significant barrier to its widespread adoption in various dental practices. Equipment such as panoramic radiography systems and cone beam computed tomography (CBCT) machines often require a substantial initial investment, depending on the system's complexity and capabilities.

- For instance, according to the article published by Renew Digital, LLC, a new small to mid-sized dental CBCT machine costs between USD 50,000.0 and USD 100,000.0. Such high costs of these imaging systems limit their adoption in dental clinics, especially in the ones located in developing countries.

The potential financial burden that may be incurred by the dental clinics established in developing countries may cause them not to invest in these imaging equipment. This will lead them to opt for more affordable alternatives or to refer patients to external imaging centers. Furthermore, the reimbursement policies and insurance coverage for these imaging procedures vary, which can affect the financial feasibility for both dentists and patients. Limited reimbursement rates or lack of coverage for certain imaging modalities may discourage dentists from investing in these technologies, thereby hampering the market growth.

Extraoral Imaging Market Segmentation Analysis

By Product Type Analysis

3D CBCT Systems Segment Held Largest Share Owing to Strong Adoption of These Systems

Based on product type, the market is segmented into panoramic systems, panoramic & cephalometric systems, and 3D CBCT systems.

In 2024, the 3D CBCT systems segment secured the largest market share of 55.79% in 2026, owing to its precision, versatility, and minimal invasiveness with respect to oral disease diagnosis and treatment plans for orthodontics and implantology. Furthermore, its superior imaging capabilities and growing applications due to the demand for cosmetic dentistry and maxillofacial surgery are also contributing to its growth in the market. In addition, the technological advancements in these systems and the increasing awareness amongst dentists regarding the benefits of 3D CBCT further drive their adoption. The growing adoption of CBCT systems has resulted in a substantial installed base and ongoing replacement units, establishing CBCT as the primary factor contributing to the market growth.

The panoramic systems segment held a substantial share in 2024 due to its versatility and widespread applications in dental diagnostics. This equipment is important for routine dental examinations, implant treatment planning, and orthodontic evaluations, driving its demand amongst dental clinics and imaging centers globally.

The panoramic & cephalometric systems segment accounts for a significant share of the market due to the growing number of routine examination visits to clinics, which increases the requirement for imaging equipment among dentists. These systems offer detailed views of dental and facial structures, aiding in precise treatment planning and assessment of oral surgery. Their ability to capture wide-ranging anatomical details efficiently contributes to their growing adoption in the market.

By Application Analysis

Implantology Segment Dominated Owing to High Number of Cases of Implant Procedures

By application, the market is segmented into implantology, orthodontics, oral & maxillofacial surgery, and others.

The implantology segment registered the largest share of 38.41% in 2026 and is expected to grow at a substantial CAGR during the forecast period. The segmental expansion is attributed to the growing cases of tooth decay, which further stimulates the demand for implant procedures. These procedures require extraoral imaging equipment to provide detailed 3D views of the jawbone, facilitating the precise treatment planning and placement of dental implants. Furthermore, as the utilization of dental implants is growing as a preferred treatment for tooth replacement, the demand for advanced imaging units in implant procedures is also increasing, which is expected to drive segmental growth.

The oral & maxillofacial surgery segment held a substantial share of the market in 2024 due to technological advancements that enhance diagnostic capabilities for complex dental conditions. In addition, the rise in preventive care and early detection of oral and maxillofacial disorders further drives the segment growth.

In 2026, the orthodontics segment accounted for a moderate global extraoral imaging market share of 51.07%, and is projected to register a moderate CAGR during the forecast period. The segmental growth is due to the growing cases of orthodontic procedures, which require imaging techniques such as panoramic radiography and CBCT scans to assess the dental and skeletal structures for the treatment. Furthermore, advancements in imaging technology, including the adoption of 3D CBCT for orthodontic treatment, have further propelled its installation in dental facilities. The increasing installation is expected to result in segmental growth during the forecast period.

- For instance, according to the article published in BMC Oral Health in May 2021, in the U.S., more than 9.0 billion population of the country opt for orthodontic treatment every year. Such a large number of orthodontic procedures are expected to boost the segment's growth.

The others segment includes pedodontics, periodontics, and endodontics, which held a significant share in 2024. The segmental growth is due to the growing adoption of imaging units in dental facilities to diagnose and plan the treatment for pedodontics, periodontics, and endodontics.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Dental Clinics Segment Occupied the Largest Share Due to Increasing Patient Visits

By end-user, the market is divided into imaging centers, dental clinics, and others.

In 2024, the dental clinics segment witnessed the largest share and is poised to capture a substantial CAGR during the forecast timeframe, 2025-2032. This expansion is driven by the presence of a large number of specialty dentists adopting these practices. Furthermore, the growing number of various dental disorders that require minimally invasive diagnosis, coupled with the surge in patient visits to these practices for examinations, is expected to propel segmental growth during the forecast period. Moreover, the rising installation of advanced imaging units, such as cone beam computed tomography (CBCT) systems, which enhances diagnostic capabilities and patient care in dental clinics, is propelling segmental growth.

The imaging centers segment is set to observe the highest CAGR during the forecast period. These facilities provide high-quality, specialized imaging services efficiently and cost-effectively, which attracts a wide range of patients and contributes significantly to their share in the market. Furthermore, the presence of high-cost equipment, including the CBCT systems, in these facilities provides better diagnosis compared to other facilities, propelling patient visits to these centers. Such a large number of visits is expected to increase the installation of imaging equipment in these facilities.

The others segment includes academic research institutes and dental hospitals. The segment is expected to grow at a moderate CAGR during the forecast period. The others segment is expanding in the market as more facilities adopt advanced imaging technologies, such as panoramic X-rays and CBCT, to improve patient outcomes and integrate dental imaging with comprehensive dental services.

REGIONAL INSIGHTS

In terms of the region, the global market is segmented into Asia Pacific, the Middle East & Africa, North America, Europe, and Latin America.

North America Extraoral Imaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.38 billion in 2025 and USD 0.4 billion in 2026, and is expected to continue its dominance during the forecast timeframe. The growth of the region is due to the presence of a large number of dental imaging centers and dental clinics, which continuously focus on the adoption of superior dental imaging diagnostics, thereby driving the installed base of imaging equipment in the region. Hence, the region has a strong dental imaging market. Moreover, the presence of key market players and innovators in the region contributes to the continuous advancements and the adoption of extraoral imaging equipment. The U.S. market is projected to reach USD 0.37 billion by 2026.

Europe secured the second-highest share in 2024. The region has a well-established healthcare infrastructure and high adoption rates of advanced medical technologies, including dental imaging equipment. Moreover, the increasing awareness about oral health and rising investments in advanced dental equipment contribute to the market's growth in the region, propelling its position in the market. In addition, the growing cases of oral diseases, especially in pediatrics, are expected to increase the visits to clinics for the diagnosis of disease, thereby boosting the adoption of these imaging equipment. The UK market is projected to reach USD 0.05 billion by 2026, while the Germany market is projected to reach USD 0.09 billion by 2026.

- For example, as per the article published by American Hospital of Paris in April 2021, 50% of children under 15 have gingivitis in France. Such incidences of dental disorders will contribute to the growing demand for dental imaging, including extraoral imaging.

The Asia Pacific market is slated to observe the highest CAGR during the assessment period. The installed base of this imaging equipment in the region is growing due to rising demand for advanced diagnostics, healthcare spending, rising dental tourism, and increasing awareness of dental health. In addition, technological advancements in the extraoral imaging systems and a growing elderly population with dental care needs further drive market growth in the region. The Japan market is projected to reach USD 0.06 billion by 2026, the China market is projected to reach USD 0.07 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

Latin America and the Middle East & Africa markets are expected to grow at a significant CAGR during the forecast period. The growth is due to government initiatives to improve healthcare access and the growing prevalence of dental disorders. Furthermore, urbanization and rising disposable incomes are boosting the adoption of extraoral imaging equipment in these regions.

KEY INDUSTRY PLAYERS

Planmeca Secures a Leading Position Due to Strong Geographical Presence

The competitive structure of the market reflects a consolidated structure with the presence of a few market players with substantial market shares. Planmeca, VATECH, Dentsply Sirona, and Carestream Dental held a significant market share in 2024. Planmeca is in a prominent market position on account of its robust geographical presence, strong and diversified portfolio for these products, and large customer base across the globe. Furthermore, Carestream Dental's intense focus is on innovation, continuous research, and development in order to offer superior imaging capabilities for accurate diagnostics and treatment planning.

Other companies operational in the market include Dental Imaging Technologies Corporation, DÜRR DENTAL SE, Trident, and other small & medium-sized players. These players have advanced panoramic X-ray imaging equipment in their product portfolio. They are constantly involved in different strategic activities, such as the introduction of advanced solutions for dental professionals, ensuring their prominence in the industry.

List of Top Extraoral Imaging Companies:

- Acteon (U.K.)

- VATECH (South Korea)

- Trident (Italy)

- PLANMECA OY (Finland)

- Dentsply Sirona (U.S.)

- Dental Imaging Technologies Corporation (Australia)

- DÜRR DENTAL SE (Germany)

- Owandy Radiology (France)

- Carestream Dental (Germany)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Align Technology, Inc. has introduced a new cone beam computed tomography (CBCT) integration feature for its ClinCheck digital treatment planning software. This user-friendly tool seamlessly integrates roots, bone, and crowns for enhanced treatment planning.

- February 2024 - Carestream Dental introduced the CS 8200 3D Access, an advanced four-in-one CBCT system, which is built on user-friendly imaging technology.

- October 2023 - Denti.AI has obtained FDA 510(k) clearance for Denti.AI Detect, an innovative AI-powered imaging solution that enhances disease detection in panoramic X-rays as well as other types of X-rays

- May 2022: Planmeca and FCAI collaborated to understand machine learning for oral and maxillofacial imaging. The study included mandibular nerve canal and marking of cephalometric points in 3D images.

- November 2020 - JSS Academy of Higher Education and Research, Mysuru, India, introduced cone beam computed tomography (CBCT) in its facility.

REPORT COVERAGE

The global extraoral imaging market report provides a detailed competitive landscape. It focuses on key aspects such as key industry developments such as mergers, partnerships, and acquisitions. Furthermore, the market report provides strategic initiatives by the key companies, such as technological advancement of the products. Moreover, it provides an analysis of the different segments in various regions and the impact of COVID-19 on the market. The report also encompasses qualitative and quantitative insights that contribute to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.60% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1.01 billion in 2025 and is projected to reach USD 1.94 billion by 2034.

In 2025, the North America market stood at USD 1.01 billion.

The market is expected to exhibit a CAGR of 7.60% during the forecast period.

By product type, the 3D CBCT systems segment led in 2025.

The increasing demand for cosmetic dentistry coupled with growing cases of periodontal disease are the key factors driving the market growth.

Planmeca, VATECH, Dentsply Sirona, and Carestream Dental are the top players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us