Cosmetic Dentistry Market Size, Share & Industry Analysis, By Type (Equipment {Dental Imaging, CAD/CAM, Dental Handpiece, Dental Lasers, and Others}, and Consumables {Dental Implants, Dental Prosthetics [Crowns, Bridges, Abutments, Dentures, and Others], Orthodontics [Clear Aligners, Orthodontic Braces, Teeth Whitening, and Others], and Others}), By End-user (Solo Practices, DSO/ Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

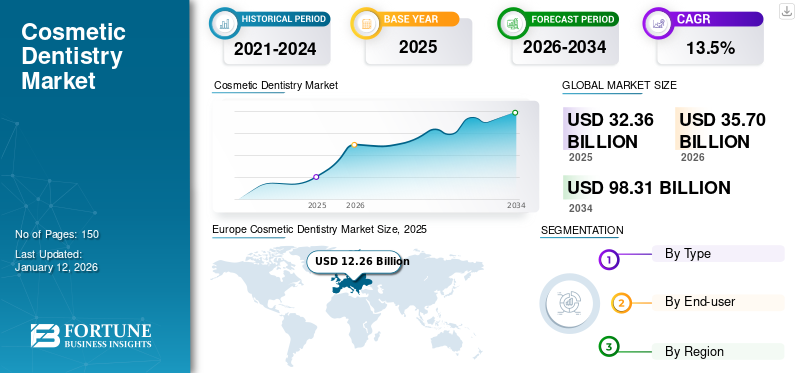

The global cosmetic dentistry market size was valued at USD 32.36 billion in 2025. The market is projected to grow from USD 35.7 billion in 2026 to USD 98.31 billion by 2034, exhibiting a CAGR of 13.5% during the forecast period. Europe dominated the cosmetic dentistry market with a market share of 41.43% in 2025.

Cosmetic dentistry refers to all types of dental procedures which are performed to improve the aesthetics of teeth. Cosmetic dentistry procedures include dental implants, dental prosthetics, teeth whitening, inlay & onlay, and teeth bonding. These treatments are focused to improve the misaligned and crowded teeth, malocclusions, alignment of jaws, and others. The cosmetic market includes equipment such as dental imaging equipment, dental lasers, handpieces, curing light equipment, and consumables used in these mentioned cosmetic dental procedures.

The market for cosmetic dentistry is expected to grow significantly in the coming years, driven by factors such as the increasing prevalence of dental malocclusion and edentulism, coupled with the growing focus on aesthetics amongst the population. This trend is contributing to an increasing number of implants, prosthetics, orthodontics, and teeth whitening procedures. In addition, the advancements such as the introduction of advanced products are driving market growth.

Additionally, new product launches and the rising number of distribution acquisitions and collaborations in the industry are likely to propel market growth.

- For instance, in May 2022, Osstem Implant introduced the Key Solution (KS) implant systems in Europe. Similarly, in March 2022, bredent GmbH & Co.KG launched a new generation of whiteSKY zirconia implants. The implant is designed for various indications, including short-span bridges in the premolar and molar regions and single restorations in the aesthetic zone.

During the COVID-19 pandemic, the dental market experienced a decline in revenue in 2020, as many dental offices either shut down or operated with limited services. This resulted in lower need for dental products. Travel restrictions and global lockdowns further contributed to the decline. Nonetheless, in 2021, the cosmetic dentistry market started to bounce back as dental practices resumed operations and there was a rise in the utilization of tele-dentistry and digital tools. The resurgence in demand for cosmetic dental procedures in 2021 contributed to significant growth and this trend of growth is projected to continue in the upcoming years.

Global Cosmetic Dentistry Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 32.36 billion

- 2026 Market Size: USD 35.7 billion

- 2034 Forecast Market Size: USD 98.31 billion

- CAGR: 13.5% from 2026–2034

Market Share:

- Region: Europe dominated the market with a 41.43% share in 2025. This is attributed to the widespread availability of advanced dental services, increased awareness of oral health, the rising adoption of products for dental aesthetics, and the strong presence of major industry players.

- By Type: Within the consumables segment, dental prosthetics held the largest share in 2024. This dominance is due to their cost-effectiveness, widespread availability, and advancements in materials and CAD/CAM technology that enhance the functionality and aesthetics of the devices.

Key Country Highlights:

- Japan: Demand is driven by rising awareness about dental procedures, a growing geriatric population that requires dental implants and prosthetics, and an increasing number of dental practices offering cosmetic services.

- United States: The market is fueled by the high adoption of orthodontic and other cosmetic dental procedures. The presence of a large number of dental professionals and continuous advanced product launches, such as ZimVie's Next Generation TSX endosteal dental implants, also drive growth.

- China: As part of the fastest-growing Asia Pacific region, the market is propelled by increasing awareness of dental aesthetics and a rising number of dental practices. The introduction of new technologies, like Straumann's launch of the AlliedStar intraoral scanner, further boosts the market.

- Europe: Market growth is supported by a strong focus on dental aesthetics, the availability of advanced dental services, and the launch of new products from key regional players, such as bredent GmbH & Co.KG introducing its new generation of whiteSKY zirconia implants.

Cosmetic Dentistry Market Trends

Higher Adoption of Digital Tools for the Cosmetic Dental Applications

Increasing consumer focus on dental aesthetics is fueling the demand for cosmetic dental procedures. Use of digital tools such as intraoral scanners, CAD/CAM devices, 3D printers, coupled with artificial intelligence is currently trending in the industry. The use of digital tools has revolutionized the industry, allowing for more precise and efficient treatment options. Intraoral scanners, and other digital devices are increasingly being adopted to design custom dental restoration such as crowns, veneers, and bridges with enhanced accuracy.

- For instance, according to a survey published in January 2023 in Cureus, 40.9% of respondents in India used CAD/CAM.

On the other hand, 3D printing and the resins for 3D printers are also gaining popularity in the market. 3D printing enables dentists to provide same-day restorations to patients, reducing the number of appointments needed and improving overall patient satisfaction. Artificial intelligence is another emerging trend in the field of cosmetic dentistry, with AI algorithms being used to analyze patient data and predict the outcomes of various cosmetic treatments. These digital technologies are increasing the adoption of cosmetic dental procedures across the globe, making this a major trend in the global cosmetic dentistry market.

Download Free sample to learn more about this report.

Cosmetic Dentistry Market Growth Factors

Growing Focus on Dental Aesthetics to Boost the Market Growth

In recent years, there has been a notable increase in the number of people seeking orthodontic treatments, dental veneers, dental crowns, inlays and onlays, and bonding agents. This trend can be attributed to an increased awareness of the significance of dental aesthetics, dental care, and oral health, leading more individuals to opt for treatments to correct malocclusions and improve their aesthetics.

Additionally, the number of adults seeking orthodontic and other cosmetic treatments is notably increasing across the globe which is expected to drive cosmetic dentistry market growth.

- For instance, a survey article published in the Dentistry Journal in January 2022 stated that there had been a rise in the number of adults seeking teeth-aligning treatment in recent years. Similarly, in August 2023, the British Orthodontic Society survey reported that there was a 76% rise in adults seeking tooth-aligning treatment after the outbreak.

Such increased demand among adults due to increased awareness about cosmetic dental procedures and rising focus on aesthetics is expected to fuel the global cosmetic dentistry market growth.

Dental Tourism for Cosmetic Procedures to Boost Market Growth

The demand for cosmetic dental procedures such as teeth whitening, veneers, and clear aligners has been steadily increasing in recent years. Factors such as advancements in technologies and increased awareness of dental aesthetics are boosting the demand for these procedures.

Dental tourism, or traveling to another country for dental procedures, has become an increasingly popular trend. This trend is expected to boost the market in countries such as Mexico, Thailand, UAE, and Hungary, which are popular destinations for dental tourism. These countries offer a wide range of cosmetic dental procedures at a fraction of the cost compared to other countries, which increases the number of cosmetic dental procedures, thereby boosting market growth. Additionally, advancements in dental technology are further boosting tourism for cosmetic dentistry, which is expected to grow significantly in the coming years.

RESTRAINING FACTORS

High Cost and Limited Reimbursements to Restrain the Market Growth

Globally, the demand for dental cosmetic procedures is witnessing a significant growth. However, high costs associated with these treatments are expected to impede market growth in the forecast period. The expensive nature of cosmetic dentistry procedures can deter many patients from undergoing such treatments.

- For instance, as per a ValuePenguin report in 2023, the average cost of braces in the U.S. is around USD 6,000 for full mouth, while lingual braces can range from USD 6,500 to USD 11,500. Similarly, according to Arlington Dental Excellence, a single tooth implant can cost between USD 3,100 – USD 5,800, a multi-tooth implant can cost between USD 6,000 – USD 10,000, and full mouth implants can cost around USD 60,000 – USD 90,000. Such high expenses involved in these procedures are hindering their adoption among the general population.

Additionally, cosmetic dental procedures such as orthodontics, prosthetics, and other dental cosmetic procedures are not reimbursed in several countries. Moreover, prolonged orthodontics treatments are linked to various complications, such as increased dental cavities, decalcification, root resorption, and allergic reactions, which can further impede market growth. For instance, an article published in Applied Sciences in March 2023 stated that gingival mucosa and root resorption are common periodontal problems associated with orthodontic treatment. These limitations associated with cosmetic dental procedures are expected to hinder market growth in the coming years.

Cosmetic Dentistry Market Segmentation Analysis

By Type Analysis

Increase in the Orthodontic Procedures to Boost Consumables Segment Dominance

Based on type, the market is segmented into equipment and consumables.

The consumables segment dominated the global cosmetic dentistry market share in 2024. The consumables segment is divided into dental implants, dental prosthetics, orthodontics, teeth whitening, and others. The prosthetics segment can be further categorized into crowns, bridges, dentures, abutments, and others. The orthodontics segment is further divided into clear aligners, orthodontic braces, and others. The consumables segment is anticipated to hold a dominant market share of 89.46% in 2026.

In terms of the consumables segment, the dental prosthetics segment dominated the market in 2024. The growth of the prosthetics market segment can be attributed to its widespread availability and cost-effectiveness, which increase the adoption amongst the patients of various demographics. Furthermore, advancements in materials and the integration of advanced technologies such as CAD/CAM for designing prosthetics are expected to drive growth in this segment in the coming years. These developments enhance the functionality, customization ability, and aesthetics of these prosthetic devices, which further increases the demand.

On the other hand, the orthodontics segment is expected to grow at the highest CAGR during the forecast period. The factors influencing the segment growth include new product launches and high rate of clear aligners’ adoption. Furthermore, the demand for clear aligners is set to grow as healthcare providers and manufacturers teamed up to introduce cutting-edge products to the market.

- For instance, in November 2022, Envista introduced Spark Clear Aligners with advanced clinical features, supporting the segment growth.

In addition, the segments such as teeth whitening and others are expected to grow due to rising demand for aesthetics and advanced product launches across the globe.

The equipment segment held considerable revenue in 2024. The segment is divided into dental imaging, CAD/CAM, dental handpiece, dental lasers and others. The rising prevalence of oral diseases, an increase in tooth decay cases, and the growing popularity of prosthodontics are key factors driving the growth of the equipment segment. Additionally, the advantages offered by these equipment, including enhanced safety and efficacy in dental procedures, treatment of dental trauma, improved ergonomics, and simple sterilization methods, are anticipated to propel demand for these products worldwide.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Segment Dominated Due to Access to Large Patient Pool in These Settings

Based on end-user, the market is classified into solo practices, DSO/ group practices, and others.

The solo practice model remained the preferred choice for many patients, leading to its dominance in the market in 2024. This is fueled by the presence of numerous dental clinics with solo practitioners and the growing demand for cosmetic dental treatments such as clear aligners, dental veneers, and teeth whitening, in these settings globally. In 2026, the solo practices segment is projected to lead the market with a 62.44% share.

On the contrary, the DSO/group practices segment is anticipated to grow at the highest CAGR, driven by a shift toward the DSO affiliation in developed countries. The strategic acquisitions and new affiliated clinic openings by the DSO companies are expected to expand the segment, leading to an increase in procedural volume and overall market growth.

Additionally, the others segment, which includes hospitals and research institutes, is also projected to witness substantial growth. This growth is primarily attributed to the rising number of cosmetic procedures being performed in these settings, driving the demand for cosmetic dental services in such institutions.

REGIONAL INSIGHTS

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa.

Europe

Europe Cosmetic Dentistry Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2024, Europe cosmetic dentistry market accounted for the largest share, with a revenue of USD 11.35 billion. The market growth in the region is driven by the availability of advanced dental services and the presence of major players in the region. Additionally, increased awareness of oral health and the rising adoption of advanced dental products for oral aesthetics is expected to drive market growth. The UK market is anticipated to reach USD 1.26 billion by 2026, while the Germany market is estimated to reach USD 2.13 billion by 2026.

North America

The North America market holds the second largest share of the market. The market growth is attributed to the high adoption of orthodontic and other cosmetic dental procedures, and an increasing prevalence of dental disorders. Additionally, the presence of a higher number of dental professionals increases the utilization of these products in the region. Moreover, advanced product launches are expected to drive market growth in the region. For instance, in November 2022, ZimVie introduced the Next Generation TSX endosteal dental implants to the U.S. market. These implants are specifically designed for easy extraction and provide strong stability in soft and dense bone types. The U.S. market is expected to reach USD 11.59 billion by 2026.

Asia Pacific

The Asia Pacific market is expected to grow exponentially, with the highest CAGR during the forecast period. Factors such as rising awareness about dental procedures among the population, increasing prevalence of dental malocclusion, a growing geriatric population that requires dental implants, and growing number of dental practices in the region are expected to drive market growth. The Japan market is forecast to reach USD 1.28 billion by 2026, the China market is expected to reach USD 2.01 billion by 2026, and the India market is anticipated to reach USD 0.77 billion by 2026.

- For instance, in March 2024, Nair dental Hospital was opened with state-of-the-art dental systems and equipment, contributing to market growth.

Latin America

In Latin America, the market is also projected to rise due to increasing awareness of dental problems and growing medical tourism in countries such as Brazil and Mexico.

Middle East & Africa

The Middle East & Africa region’s market growth can be attributed to the development of healthcare infrastructure, the growing prevalence of dental disorders, and medical tourism.

KEY INDUSTRY PLAYERS

Strong Portfolio of Institut Straumann AG, Envista, ZimVie Inc, and Dentsply Sirona to Enable Their Market Dominance

The market is partially consolidated due to the large shares accounted by major players. Institut Straumann AG, Envista, ZimVie Inc, and Dentsply Sirona are key players in terms of revenue shares in the market due to their strong product portfolio of dental implants and orthodontic products. Additionally, there is a rising emphasis on developing strategies, acquiring, and merging with other companies in order to expand their market presence. The ongoing emphasis of major companies on launching new products is anticipated to further enhance their market share in the coming years.

- For instance, in May 2023, Envista launched Ultima Hook to correct malocclusion. Such product launches are supporting the growth of these companies.

Other companies such as 3M, Temrex Corp., and other small and medium-sized market are constantly focusing on geographical expansions and new product launches with advanced features. Moreover, the rising number of collaborations, new product launches and product approvals by these companies is expected to fuel market growth in the coming years.

LIST OF TOP COSMETIC DENTISTRY COMPANIES:

- Institut Straumann AG (Switzerland)

- Envista (U.S.)

- ZimVie Inc (U.S)

- Dentsply Sirona (U.S.)

- Henry Schein, Inc. (U.S.)

- Temrex Corp. (U.S.)

- Align Technology, Inc. (U.S.)

- 3M (U.S.)

- Hu-Friedy Mfg. Co., LLC. (U.S.)

- BioHorizons (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2024 – Launch of iEXCEL Premium Implant System in North America

Straumann introduced its new premium implant system, iEXCEL, in North America, aiming to enhance implantology solutions. Additionally, the company launched the AlliedStar intraoral scanner in China, expanding its digital dentistry portfolio.

- June 2024 – 18 Millionth Invisalign Patient Milestone

Align Technology reached a significant milestone, treating its 18 millionth Invisalign patient, reflecting the global adoption of its clear aligner system. - April 2025 – Introduction of Invisalign System with Mandibular Advancement

Align announced the commercial availability of the Invisalign System featuring mandibular advancement with occlusal blocks, designed for Class II skeletal and dental correction in the U.S. and Canada. - 2024 – Launch of Nupro Freedom Cordless Prophy System

Dentsply Sirona introduced the Nupro Freedom Cordless with SmartMode Technology, offering dental professionals enhanced control and ergonomics during hygiene procedures. - 2024 – Release of SureSmile Software 7.6

The company released SureSmile Software 7.6, providing dental professionals with improved tools for aligner treatment planning and in-practice aligner production capabilities.

REPORT COVERAGE

The global market report provides an in-depth global market analysis. It focuses on market segmentation, such as by type, end-user, and region. Besides, it offers the market forecast in relation to the current market dynamics, the impact of COVID-19, and the latest market statistics. Additionally, the report consists the market share by various segments and the factors driving the market and the growth. The report also provides the key players operating in the market & their SWOT analysis, and competitive landscape of the market at global level. Moreover, the report provides the key insights on technological advancements in cosmetic dentistry, prevalence of dental disorders, and key industry developments, and key product launches.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.5% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End-user

|

|

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 32.36 billion in 2025 and is projected to reach USD 98.31 billion by 2034.

The market will exhibit a steady CAGR of 13.5% during the forecast period.

Currently, the consumables segment is leading the market by product type.

The growing focus on dental aesthetics and dental tourism are the key factors driving market growth.

Institut Straumann AG, Envista, ZimVie Inc, and Dentsply Sirona are the key player in the market.

Europe dominated the market with a share of 41.43% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us